Amsterdam Stock Exchange: 7% Fall As Trade War Fears Rise

Table of Contents

Trade War Fears as the Catalyst for the AEX Decline

The recent AEX decline is inextricably linked to intensifying global trade tensions. The ongoing US-China trade war, coupled with simmering disputes within the European Union itself, has created a climate of profound uncertainty. This uncertainty fuels investor anxiety, triggering widespread sell-offs as investors seek to protect their portfolios from potential losses.

The impact is not uniform across sectors. Specific industries are disproportionately affected by these trade tensions:

- Technology companies listed on the AEX experienced disproportionately higher losses due to disrupted supply chains and reduced consumer demand stemming from tariffs and trade restrictions. Stock prices in this sector reflected significant drops, with some companies seeing double-digit percentage declines.

- Export-oriented businesses faced decreased demand and profit margins as international trade slows and tariffs increase the cost of their goods. This is particularly true for Dutch companies heavily reliant on exports to China and the US.

- Increased trading volume in the AEX reflects the heightened anxiety among investors, who are actively adjusting their portfolios in response to the changing geopolitical landscape.

Preliminary data suggests a significant increase in trading volume during the period of the AEX decline, indicating substantial investor activity and heightened risk aversion. Specific stock price drops varied depending on sector exposure to global trade, with technology and export-heavy businesses suffering the most significant losses.

Impact on Key Sectors of the Dutch Economy

The ripple effects of the AEX decline extend far beyond the stock market itself, impacting various sectors of the Dutch economy. The vulnerability of different sectors to global trade uncertainties varies significantly.

- The decline impacted the financial services sector, leading to decreased investor confidence and tighter lending conditions. Financial institutions are directly exposed to market volatility and the potential for loan defaults.

- The energy sector saw decreased investment due to uncertainty about future energy policies and potential disruptions to global energy markets. Energy companies are particularly vulnerable to trade disputes impacting the supply of raw materials.

- The agricultural sector also faces challenges, with trade restrictions impacting the export of Dutch agricultural products.

These economic shocks threaten employment and could significantly hinder economic growth if the current situation persists. The Dutch government is closely monitoring the situation and considering possible interventions to mitigate the potential damage.

Investor Sentiment and Market Volatility

The recent market downturn in the Amsterdam Stock Exchange has been characterized by heightened volatility and shifting investor sentiment. Investor behavior reflects a clear trend towards risk aversion.

- Increased trading volume suggests heightened anxiety and active trading strategies as investors attempt to limit their exposure to risk.

- A surge in safe-haven assets like gold demonstrates investor risk aversion, reflecting a flight to quality in uncertain times.

Market psychology played a significant role in exacerbating the decline. News reports and media coverage of trade war developments amplified investor anxieties, creating a self-reinforcing cycle of sell-offs. Expert analyses from leading financial institutions support the conclusion that trade war fears were the primary driver behind the AEX decline.

Potential Long-Term Consequences and Recovery Scenarios

The long-term consequences of the AEX fall remain uncertain, depending heavily on the resolution of global trade tensions.

- A prolonged trade war could lead to sustained economic slowdown in the Netherlands, impacting employment and investment.

- Resolution of trade disputes could trigger a quick market rebound, restoring investor confidence and spurring economic growth.

Government intervention, such as fiscal stimulus measures or targeted support for affected industries, could influence the market's recovery. Policy changes related to trade and investment could also play a significant role in shaping the future trajectory of the AEX.

Conclusion: Navigating the Uncertainties of the Amsterdam Stock Exchange

The significant 7% drop in the Amsterdam Stock Exchange, driven primarily by escalating trade war fears, has exposed the vulnerability of the Dutch economy to global geopolitical risks. The impact on key sectors, from technology to finance, underscores the interconnectedness of global markets. The AEX’s volatility highlights the need for continuous monitoring of trade developments and their potential impact on investment decisions.

For investors and businesses alike, staying informed about Amsterdam Stock Exchange updates is crucial. By following reputable financial news sources and conducting thorough AEX market analysis, you can better navigate the uncertainties and make informed decisions. Monitoring the AEX closely, coupled with a diversified investment strategy, is key to managing risk during these volatile times.

Featured Posts

-

Analyse Snelle Koerswijziging Europese Aandelen Vergeleken Met Wall Street

May 24, 2025

Analyse Snelle Koerswijziging Europese Aandelen Vergeleken Met Wall Street

May 24, 2025 -

Escape To The Country Finding Your Perfect Rural Home

May 24, 2025

Escape To The Country Finding Your Perfect Rural Home

May 24, 2025 -

Kharkovschina 600 Svadeb Za Mesyats Prichiny I Prognozy

May 24, 2025

Kharkovschina 600 Svadeb Za Mesyats Prichiny I Prognozy

May 24, 2025 -

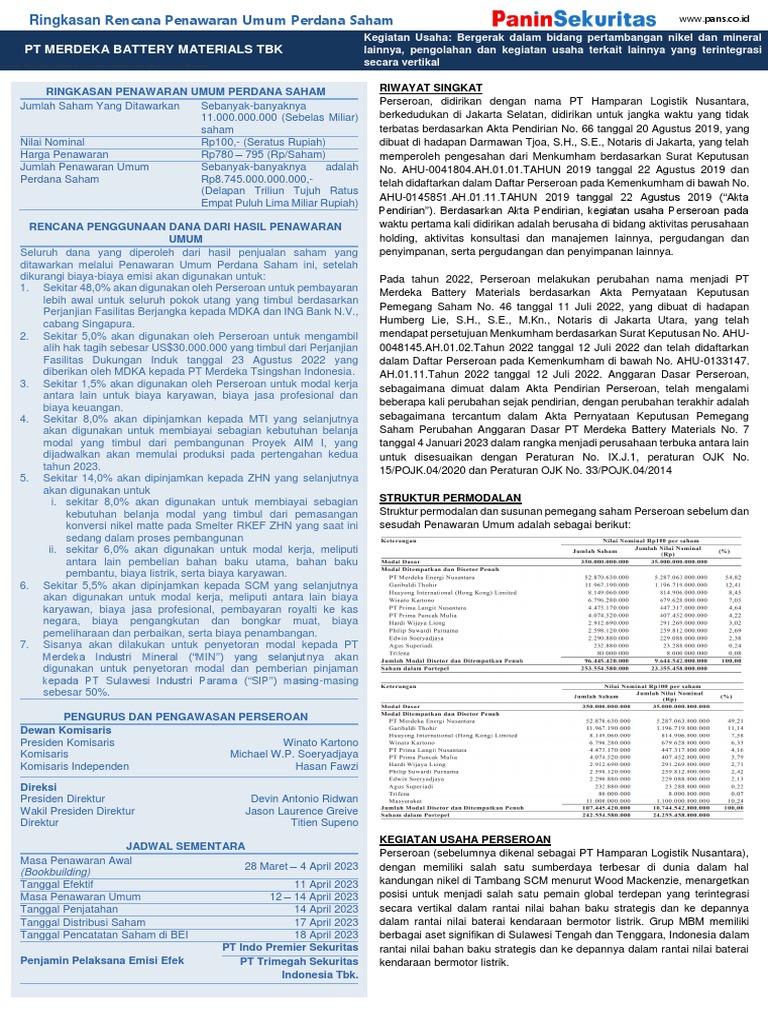

Dayamitra Telekomunikasi Mtel Dan Merdeka Battery Mbma Prospek Investasi Usai Pencatatan Msci

May 24, 2025

Dayamitra Telekomunikasi Mtel Dan Merdeka Battery Mbma Prospek Investasi Usai Pencatatan Msci

May 24, 2025 -

The Demna Gvasalia Gucci Era Expectations And Predictions

May 24, 2025

The Demna Gvasalia Gucci Era Expectations And Predictions

May 24, 2025

Latest Posts

-

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Mia Farrow Demands Trump Be Jailed For Deporting Venezuelan Gang Members

May 24, 2025

Mia Farrow Demands Trump Be Jailed For Deporting Venezuelan Gang Members

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportation Policy

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportation Policy

May 24, 2025 -

Reputation Wreckage 17 Celebrities Whose Careers Ended Abruptly

May 24, 2025

Reputation Wreckage 17 Celebrities Whose Careers Ended Abruptly

May 24, 2025 -

Understanding Frank Sinatras Four Marriages

May 24, 2025

Understanding Frank Sinatras Four Marriages

May 24, 2025