Amsterdam Stock Market Crash: Index Down Over 4 Percent

Table of Contents

Causes of the Amsterdam Stock Market Crash

Several interconnected factors contributed to this sharp decline in the Amsterdam Stock Market. Understanding these contributing elements is crucial to assessing the situation's severity and predicting future market behavior.

Geopolitical Uncertainty

Global geopolitical instability significantly impacts investor confidence and fuels market volatility. The current international landscape, characterized by ongoing conflicts and political uncertainty, creates a climate of fear and uncertainty, prompting investors to seek safer havens for their assets.

- Specific Events: The recent escalation of tensions in [mention specific geopolitical event, e.g., a region] directly impacted investor sentiment, leading to a sell-off in riskier assets, including those listed on the AEX.

- Historical Parallels: Similar geopolitical events in the past, such as [mention past examples], have resulted in comparable market downturns, highlighting the sensitive relationship between global politics and stock market performance. Experts widely agree that these factors play a crucial role.

- Expert Analysis: Leading economists and financial analysts attribute a significant portion of the AEX index's drop to this ongoing geopolitical uncertainty, predicting further volatility until the situation stabilizes.

Inflationary Pressures

Rising inflation and subsequent interest rate hikes by central banks worldwide significantly impact investor sentiment and depress stock prices. Increased inflation erodes purchasing power and raises business costs, leading to reduced profitability and lower stock valuations.

- Inflation Data: The current inflation rate in the Netherlands stands at [insert current data], significantly impacting businesses' operating costs and investor confidence.

- Interest Rate Impact: The European Central Bank's recent interest rate increases further exacerbate the situation by making borrowing more expensive for businesses, hindering investment and economic growth.

- Sectors Affected: Sectors particularly vulnerable to inflationary pressures, such as energy and consumer staples, have experienced disproportionately large declines within the AEX index.

Company-Specific Factors

While macroeconomic factors play a dominant role, company-specific events can also contribute to a market crash. Negative news or poor financial performance from influential companies listed on the AEX can trigger a domino effect, affecting investor sentiment and contributing to the overall market downturn.

- Corporate Announcements: [Mention any significant corporate announcements, e.g., profit warnings, restructuring plans] from major companies listed on the AEX directly impacted investor confidence and contributed to the sell-off.

- Financial Reports: Disappointing financial reports from key players in the Dutch economy have further exacerbated the situation, reinforcing negative market sentiment.

- Impact on AEX: These company-specific factors, while perhaps not solely responsible, significantly amplified the overall impact of the macroeconomic pressures on the AEX index.

Consequences of the Amsterdam Stock Market Crash

The Amsterdam stock market crash has far-reaching consequences, impacting investors, the broader economy, and international markets.

Impact on Investors

The sharp decline in the AEX index has resulted in significant financial losses for investors, potentially triggering panic selling and further market instability.

- Financial Losses: The 4%+ drop translates to billions of Euros in losses for Dutch and international investors holding AEX-listed stocks.

- Investor Psychology: Market crashes often lead to widespread fear and uncertainty, prompting investors to make irrational decisions based on emotion rather than reasoned analysis. This panic selling can further accelerate the downturn.

- Regulatory Response: Regulatory bodies are likely to respond to protect investors, potentially introducing measures to increase market transparency and investor protection.

Economic Ripple Effects

The Amsterdam stock market crash will undoubtedly have significant ripple effects on the Dutch economy and beyond, potentially leading to job losses, reduced consumer spending, and slower economic growth.

- Economic Slowdown: A sharp stock market decline can trigger a recession or significantly slow economic growth by reducing business investment and consumer confidence.

- Job Losses: Businesses facing reduced investment and declining sales may resort to layoffs, resulting in higher unemployment rates.

- Government Response: The Dutch government is likely to implement measures to mitigate the economic damage, potentially through fiscal stimulus or other economic policy interventions.

International Market Impact

The interconnectedness of global financial markets means that the Amsterdam stock market crash will likely have spillover effects on other European and global stock markets, potentially triggering a wider downturn.

- European Indices: The decline in the AEX index has already impacted other major European indices like the DAX and FTSE, indicating the contagious nature of market downturns.

- Global Contagion: The interconnectedness of global financial markets increases the risk of contagion, where the decline in one market triggers a domino effect across others.

- Market Interdependence: This event highlights the crucial interdependence of global financial markets and the need for robust risk management strategies.

Potential Recovery and Future Outlook

While the situation is undoubtedly concerning, several factors could influence the market's recovery and long-term outlook.

Government Intervention

Government intervention through monetary or fiscal policies can play a crucial role in stabilizing the market and boosting investor confidence.

- Monetary Policy: The European Central Bank might adjust interest rates or implement other monetary policies to stimulate economic activity and improve investor sentiment.

- Fiscal Policy: The Dutch government may introduce fiscal stimulus measures, such as tax cuts or increased government spending, to boost economic growth.

- Past Interventions: Analyzing the effectiveness of past government interventions in similar situations can provide insights into potential strategies.

Investor Sentiment

Investor sentiment plays a critical role in market recovery. A shift towards optimism can trigger a market rebound, while continued pessimism can prolong the downturn.

- Factors Influencing Recovery: Factors such as geopolitical stability, inflation control, and positive corporate news can significantly impact investor sentiment and market recovery.

- Media Influence: Media coverage and expert opinions play a critical role in shaping investor confidence and perceptions.

- Market Predictions: While predictions are inherently uncertain, analyzing expert forecasts can help understand the potential trajectories of the AEX index.

Long-Term Implications

The Amsterdam stock market crash offers valuable lessons for investors and policymakers alike. It underscores the need for robust risk management strategies and highlights the inherent volatility of financial markets.

- Structural Changes: The crash might lead to structural changes in the market, potentially impacting regulations, investment strategies, and corporate governance.

- Risk Mitigation: Investors should diversify their portfolios, adopt long-term investment horizons, and consider hedging strategies to mitigate risks during periods of market volatility.

- Lessons Learned: This event serves as a stark reminder of the unpredictable nature of financial markets and the importance of careful planning and risk assessment.

Conclusion

The Amsterdam stock market crash, resulting in a dramatic over 4% plunge in the AEX index, is a significant event with wide-ranging consequences for the Dutch economy and European markets. The interplay of geopolitical uncertainty, inflationary pressures, and company-specific factors contributed to this downturn. The consequences include substantial investor losses, potential economic slowdown, and the risk of international market contagion. While government intervention and a shift in investor sentiment could lead to recovery, the long-term implications of this crash necessitate a cautious approach. Stay informed about the evolving situation in the Amsterdam stock market and the wider European markets. Monitor the AEX index closely and consider consulting with a financial advisor to manage your investments during periods of high market volatility. Understanding the factors contributing to this Amsterdam stock market crash is crucial for making informed investment decisions.

Featured Posts

-

Prepustanie V Nemecku H Nonline Sk Prinasa Komplexny Prehlad Situacie

May 25, 2025

Prepustanie V Nemecku H Nonline Sk Prinasa Komplexny Prehlad Situacie

May 25, 2025 -

Kyle Walker Night Out Fallout Annie Kilners Posts And Poisoning Claims

May 25, 2025

Kyle Walker Night Out Fallout Annie Kilners Posts And Poisoning Claims

May 25, 2025 -

Kyle Walker And Mystery Women The Full Story Following Annie Kilners Return

May 25, 2025

Kyle Walker And Mystery Women The Full Story Following Annie Kilners Return

May 25, 2025 -

Camunda Con 2025 Unlocking The Power Of Orchestration In Ai And Automation

May 25, 2025

Camunda Con 2025 Unlocking The Power Of Orchestration In Ai And Automation

May 25, 2025 -

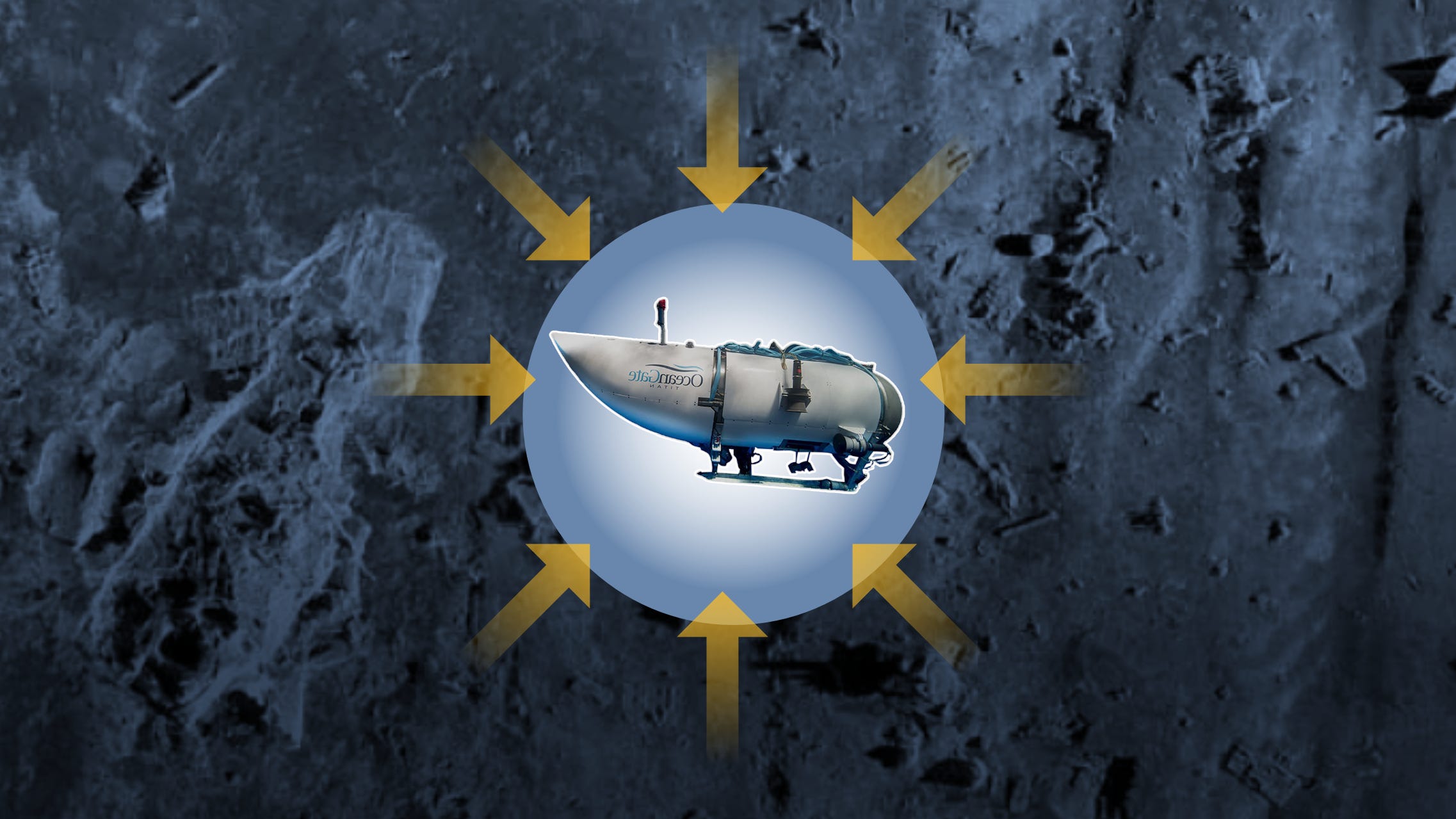

Titan Sub Implosion Footage Reveals The Devastating Sound

May 25, 2025

Titan Sub Implosion Footage Reveals The Devastating Sound

May 25, 2025

Latest Posts

-

Elon Musk And Dogecoin Whats The Latest

May 25, 2025

Elon Musk And Dogecoin Whats The Latest

May 25, 2025 -

Fujifilm X Half Whimsical Refreshing And Fun To Use

May 25, 2025

Fujifilm X Half Whimsical Refreshing And Fun To Use

May 25, 2025 -

The Cost Of Power Presidential Seals Expensive Watches And High End Events

May 25, 2025

The Cost Of Power Presidential Seals Expensive Watches And High End Events

May 25, 2025 -

Their Journey To Dc A Love And Loss Story

May 25, 2025

Their Journey To Dc A Love And Loss Story

May 25, 2025 -

I O Vs Io The Ongoing Tech War Between Google And Open Ai

May 25, 2025

I O Vs Io The Ongoing Tech War Between Google And Open Ai

May 25, 2025