Amundi DJIA UCITS ETF: A Deep Dive Into Net Asset Value

Table of Contents

How the Amundi DJIA UCITS ETF's NAV is Calculated

The Net Asset Value (NAV) of the Amundi DJIA UCITS ETF represents the total value of its assets minus its liabilities, divided by the number of outstanding shares. This calculation reflects the intrinsic value of each ETF share. Understanding how this NAV is calculated is key to understanding the ETF's performance and your investment.

The process involves several key components:

- Market Value of Holdings: The primary driver is the current market price of each company within the Dow Jones Industrial Average (DJIA) that the ETF tracks. These are weighted according to their representation in the DJIA index.

- Accrued Income: This includes dividends received from the underlying DJIA stocks. This income is accumulated until it's distributed to ETF shareholders or reinvested.

- Expenses: These are the ETF's operational costs, including management fees, administrative expenses, and any other applicable charges. These expenses reduce the overall NAV.

- Currency Exchange Rates: If the ETF holds assets denominated in currencies other than the ETF's base currency (likely EUR for a UCITS ETF), fluctuations in exchange rates will impact the NAV.

The Amundi DJIA UCITS ETF's NAV is typically calculated daily, at the close of the relevant market. This information is usually available on the Amundi website, major financial news sources, and through your brokerage account. Keywords: NAV calculation, ETF holdings, market value, expenses, management fees, daily NAV.

Factors Affecting the Amundi DJIA UCITS ETF's NAV Fluctuation

Several factors cause the Amundi DJIA UCITS ETF's NAV to fluctuate. These fluctuations directly reflect the performance of the underlying Dow Jones Industrial Average and other market influences.

- DJIA Price Movements: The most significant factor is the daily movement of the Dow Jones Industrial Average. If the DJIA rises, the NAV of the Amundi DJIA UCITS ETF generally rises proportionally (though tracking error can exist). Conversely, a decline in the DJIA will typically lead to a decrease in the ETF's NAV.

- Currency Fluctuations: If the ETF holds assets in currencies other than the euro, changes in exchange rates can affect the NAV. For instance, a strengthening euro against the US dollar would reduce the NAV if the ETF holds significant US dollar-denominated assets.

- Dividend Impact: Dividends paid out by the underlying DJIA companies will initially increase the NAV of the Amundi DJIA UCITS ETF as the ETF receives these payments. However, after distribution to shareholders, the NAV will adjust accordingly.

- Tracking Error: While the Amundi DJIA UCITS ETF aims to track the DJIA, slight deviations (tracking error) can occur due to various factors including expenses and the timing of transactions. This difference can slightly impact the correlation between the DJIA's performance and the ETF's NAV.

Let's consider some scenarios:

- Market Upswing: A rising DJIA will generally lead to an increase in the ETF's NAV.

- Market Downturn: A falling DJIA results in a decrease in the ETF's NAV.

- Dividend Payouts: Dividends paid by underlying stocks initially increase the NAV before distribution to shareholders.

Keywords: NAV fluctuation, DJIA price movements, currency risk, dividend impact, ETF market price, tracking error.

Interpreting and Utilizing the Amundi DJIA UCITS ETF's NAV Information

Understanding and utilizing the Amundi DJIA UCITS ETF's NAV data is crucial for effective investment management. Investors can use this information in several ways:

- Tracking Investment Performance: Regularly monitoring the NAV allows you to track your investment's growth or loss over time. Comparing daily, weekly, or monthly NAVs provides a clear picture of performance.

- Comparing the ETF to other investments: You can use NAV data to compare the performance of the Amundi DJIA UCITS ETF against other investment options to evaluate relative returns.

- Understanding the ETF’s risk profile: Analyzing historical NAV fluctuations can offer insights into the ETF's volatility and risk profile, helping to assess its suitability for your risk tolerance.

The daily NAV for the Amundi DJIA UCITS ETF is accessible through various resources, including the Amundi website, reputable financial news websites, and your brokerage platform. The NAV is also a key factor in determining the price at which ETF shares are bought and sold throughout the trading day.

Keywords: NAV interpretation, investment decisions, performance evaluation, ETF trading, risk management.

Conclusion: Making Informed Decisions with Amundi DJIA UCITS ETF NAV Data

Understanding the Net Asset Value (NAV) of the Amundi DJIA UCITS ETF is fundamental for successful investing. The NAV, calculated daily, is significantly impacted by the performance of the Dow Jones Industrial Average, dividend payouts, currency fluctuations, and the ETF's operational expenses. Regular monitoring of the Amundi DJIA UCITS ETF NAV enables investors to effectively track performance, manage risk, and make informed investment decisions. Learn more about Amundi DJIA UCITS ETF NAV and monitor your Amundi DJIA UCITS ETF net asset value regularly to optimize your investment strategy. Conduct thorough research and consult with a financial advisor before making any investment decisions. Keywords: Amundi DJIA UCITS ETF NAV analysis.

Featured Posts

-

Prezzi Moda Dopo I Dazi Usa Analisi E Prospettive

May 24, 2025

Prezzi Moda Dopo I Dazi Usa Analisi E Prospettive

May 24, 2025 -

Hihetetlenuel Draga Porsche 911 80 Millio Forint Az Extrakban

May 24, 2025

Hihetetlenuel Draga Porsche 911 80 Millio Forint Az Extrakban

May 24, 2025 -

Top 10 Fastest Standard Production Ferraris On Their Home Track

May 24, 2025

Top 10 Fastest Standard Production Ferraris On Their Home Track

May 24, 2025 -

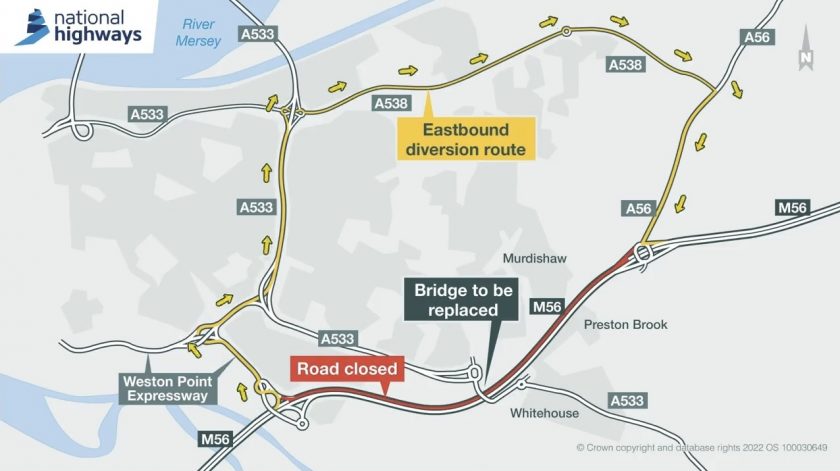

M56 Motorway Closed Cheshire Deeside Area Experiencing Long Delays

May 24, 2025

M56 Motorway Closed Cheshire Deeside Area Experiencing Long Delays

May 24, 2025 -

M56 Closed Live Traffic Updates And Road Closures Following Serious Accident

May 24, 2025

M56 Closed Live Traffic Updates And Road Closures Following Serious Accident

May 24, 2025

Latest Posts

-

Mia Farrows Career Revival The Influence Of Ronan Farrow

May 24, 2025

Mia Farrows Career Revival The Influence Of Ronan Farrow

May 24, 2025 -

Mia Farrows Comeback Is Ronan Farrow The Key

May 24, 2025

Mia Farrows Comeback Is Ronan Farrow The Key

May 24, 2025 -

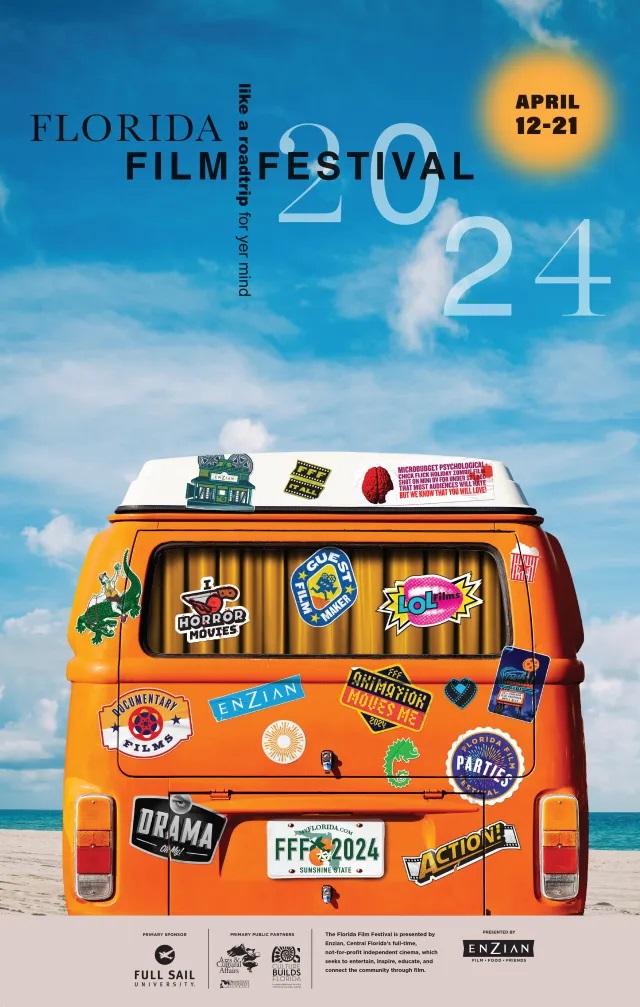

Florida Film Festival Past And Present Celebrity Appearances Featuring Mia Farrow And Christina Ricci

May 24, 2025

Florida Film Festival Past And Present Celebrity Appearances Featuring Mia Farrow And Christina Ricci

May 24, 2025 -

Ronan Farrows Role In Mia Farrows Potential Comeback

May 24, 2025

Ronan Farrows Role In Mia Farrows Potential Comeback

May 24, 2025 -

Celebrities At The Florida Film Festival Mia Farrow Christina Ricci And More

May 24, 2025

Celebrities At The Florida Film Festival Mia Farrow Christina Ricci And More

May 24, 2025