Amundi DJIA UCITS ETF: A Guide To Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV) and how is it calculated for the Amundi DJIA UCITS ETF?

Net Asset Value (NAV) represents the net value of an ETF's underlying assets per share. For the Amundi DJIA UCITS ETF, this means the value of the holdings that mirror the Dow Jones Industrial Average (DJIA). The NAV is calculated daily by taking the total market value of all the ETF's assets (the stocks comprising the DJIA), subtracting any liabilities (expenses and fees), and then dividing by the total number of outstanding shares.

Market fluctuations directly impact the daily NAV. If the DJIA rises, so does the NAV of the Amundi DJIA UCITS ETF, and vice versa. This makes understanding daily NAV changes crucial for assessing performance.

- Simplified NAV Calculation Formula: (Total Asset Value - Liabilities) / Total Number of Shares Outstanding

- Factors Influencing NAV Changes: Market movements of the DJIA components, dividend payments from those companies, and any changes in the ETF's expense ratio.

- Frequency of NAV Calculation and Publication: The NAV is typically calculated and published daily, usually at the close of the market.

How to find the Amundi DJIA UCITS ETF NAV?

Finding the current NAV for the Amundi DJIA UCITS ETF is straightforward. Several reliable sources provide this information:

- Amundi Website: The official Amundi website is the primary source for accurate and up-to-date NAV data.

- Financial News Websites: Major financial news providers (like Bloomberg, Yahoo Finance, Google Finance) usually display ETF NAVs.

- Brokerage Platforms: If you hold the Amundi DJIA UCITS ETF through a brokerage account, the platform will typically display the current NAV.

It's important to note the difference between the bid/ask price and the NAV. The bid/ask price is the price at which you can buy or sell the ETF shares on the exchange, which may slightly deviate from the NAV due to market supply and demand.

- List of Reliable Sources to Check the NAV: Amundi Website, Bloomberg, Yahoo Finance, Google Finance, your brokerage platform.

- Steps to Access the NAV (Example for Yahoo Finance): Search for the ETF ticker symbol (e.g., [insert relevant ticker symbol]), and the NAV will be displayed on the quote page.

- Potential Delays in NAV Updates: There might be a slight delay (usually a few hours) between market close and the official NAV publication.

Using NAV to track Amundi DJIA UCITS ETF performance:

Tracking the Amundi DJIA UCITS ETF's performance over time involves analyzing its NAV. By comparing the NAV against historical data, you can assess the ETF's growth or decline. Furthermore, comparing the NAV to the ETF's share price helps identify any premiums or discounts. A premium indicates the market price is higher than the NAV, while a discount signifies the opposite.

- Methods for Comparing NAV to Historical Performance: Use charting tools on financial websites or your brokerage platform to visualize NAV trends.

- Using NAV for Buy/Sell Decisions (Disclaimer): While NAV is a key factor, it shouldn't be the sole determinant for buy/sell decisions. Market sentiment and other economic factors should also be considered. Consult with a financial advisor before making investment choices.

- Importance of Long-Term Perspective: Short-term NAV fluctuations are normal; focusing on long-term trends is crucial for evaluating the ETF's performance.

Understanding the Implications of NAV for Amundi DJIA UCITS ETF Investing

The NAV is fundamental to understanding your investment returns. The change in NAV over time, combined with any dividends received, determines your total return. Dividends paid by the companies within the DJIA are usually reinvested back into the ETF, affecting the NAV. Consistent monitoring of the NAV also allows assessment of the fund manager's performance in tracking the DJIA.

- Explanation of Total Return and its Connection to NAV: Total return considers both the change in NAV and dividend income.

- How Reinvestment of Dividends Affects NAV: Reinvestment increases the total asset value and indirectly influences the NAV.

- The Role of NAV in Evaluating Fund Manager Performance: Comparing the ETF's NAV performance against the DJIA's performance provides insight into the fund manager's efficiency in tracking the index.

Conclusion: Mastering Amundi DJIA UCITS ETF NAV for Informed Investment Decisions

Understanding the Amundi DJIA UCITS ETF NAV is vital for making informed investment decisions. By regularly monitoring the NAV, comparing it to historical data, and understanding its relationship to the ETF's share price and total return, you can effectively manage your investment in this index-tracking ETF. Actively utilize the resources outlined above to track performance and stay informed. Learn more about maximizing your investment returns by consistently monitoring the Amundi DJIA UCITS ETF NAV. Start tracking your Amundi DJIA UCITS ETF NAV today!

Featured Posts

-

Gryozy Lyubvi Ili Ilicha Otsenka Publikatsii V Gazete Trud

May 24, 2025

Gryozy Lyubvi Ili Ilicha Otsenka Publikatsii V Gazete Trud

May 24, 2025 -

Bardellas Presidential Bid A Contender Emerges

May 24, 2025

Bardellas Presidential Bid A Contender Emerges

May 24, 2025 -

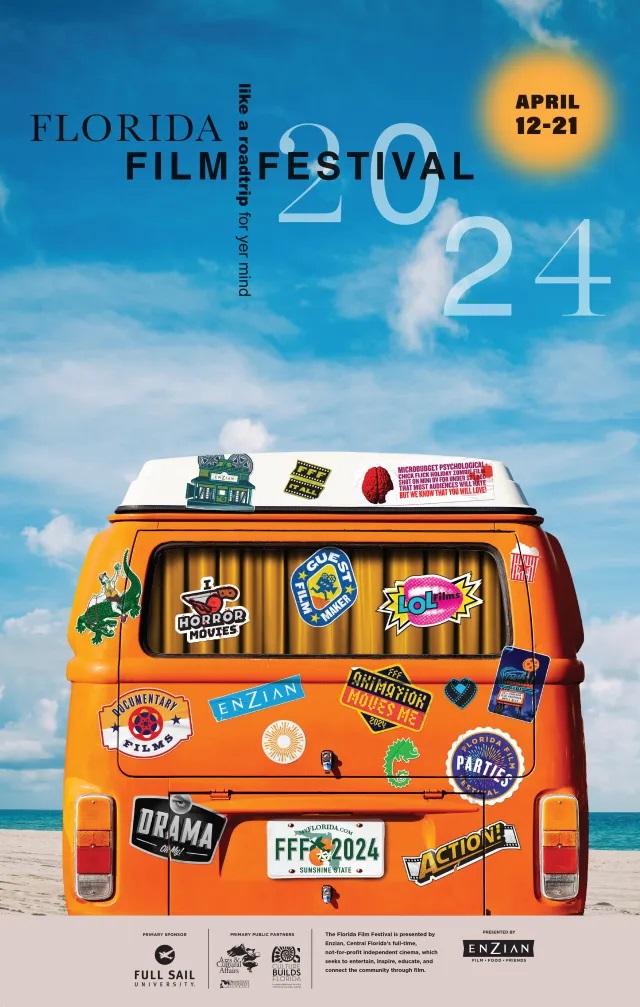

Florida Film Festival Past And Present Celebrity Appearances Featuring Mia Farrow And Christina Ricci

May 24, 2025

Florida Film Festival Past And Present Celebrity Appearances Featuring Mia Farrow And Christina Ricci

May 24, 2025 -

M6 Motorway Crash Current Traffic And Travel Disruption

May 24, 2025

M6 Motorway Crash Current Traffic And Travel Disruption

May 24, 2025 -

Glastonbury 2025 Lineup A Comprehensive Guide To Must See Artists

May 24, 2025

Glastonbury 2025 Lineup A Comprehensive Guide To Must See Artists

May 24, 2025

Latest Posts

-

Michael Caine Recalls Awkward Mia Farrow Sex Scene Encounter

May 24, 2025

Michael Caine Recalls Awkward Mia Farrow Sex Scene Encounter

May 24, 2025 -

Sean Penns Support Of Woody Allen A Me Too Blind Spot

May 24, 2025

Sean Penns Support Of Woody Allen A Me Too Blind Spot

May 24, 2025 -

Mia Farrows Career Revival The Influence Of Ronan Farrow

May 24, 2025

Mia Farrows Career Revival The Influence Of Ronan Farrow

May 24, 2025 -

Mia Farrows Comeback Is Ronan Farrow The Key

May 24, 2025

Mia Farrows Comeback Is Ronan Farrow The Key

May 24, 2025 -

Florida Film Festival Past And Present Celebrity Appearances Featuring Mia Farrow And Christina Ricci

May 24, 2025

Florida Film Festival Past And Present Celebrity Appearances Featuring Mia Farrow And Christina Ricci

May 24, 2025