Amundi Dow Jones Industrial Average UCITS ETF (Dist): NAV Calculation And Implications

Table of Contents

Understanding Net Asset Value (NAV) in ETFs

Definition and Importance of NAV

Net Asset Value (NAV) represents the market value of an ETF's underlying assets minus its liabilities, calculated per share. It's a fundamental metric for evaluating an ETF's performance and is essential for determining its price. The NAV differs from the market price, which can fluctuate throughout the trading day due to supply and demand.

- NAV as a Measure of Intrinsic Value: The NAV reflects the actual value of the ETF's holdings.

- Pricing ETFs: The NAV serves as a benchmark for the ETF's fair market value.

- Assessing Investment Returns: Comparing the change in NAV over time allows investors to track their returns.

Components of NAV Calculation for the Amundi DJIA UCITS ETF

The NAV calculation for the Amundi Dow Jones Industrial Average UCITS ETF (Dist) involves several key components:

- Underlying Assets: The primary component is the market value of the 30 constituent stocks of the Dow Jones Industrial Average, weighted according to their representation in the index.

- Transaction Costs: Expenses incurred from buying and selling securities to maintain the ETF's index tracking are deducted.

- Management Fees: The ETF's management fees, which cover administrative and operational expenses, are also deducted from the total asset value.

- Other Liabilities: Any other minor liabilities, such as accrued expenses, are subtracted to arrive at the net asset value.

The weighting of each holding in the DJIA directly influences its contribution to the overall NAV. A higher-weighted stock will have a more significant impact on the ETF's NAV fluctuations.

Frequency of NAV Calculation

The NAV of the Amundi DJIA UCITS ETF (Dist) is calculated and published daily, typically at the close of the market. This information is readily available on the official Amundi website and through various financial data providers, such as Bloomberg and Refinitiv.

- Daily Calculation: Provides investors with up-to-date information on the ETF's value.

- Amundi Website: The primary source for official NAV data.

- Financial Data Providers: Offer convenient access to historical and real-time NAV information.

Implications of NAV Fluctuations for Investors

Impact on Investment Returns

Changes in the NAV directly influence investor returns. An increase in NAV results in a profit, while a decrease leads to a loss. These changes are affected by both capital gains (or losses) from the underlying assets and dividend distributions.

- NAV Increase = Profit: Investors benefit from the appreciation of the underlying DJIA components.

- NAV Decrease = Loss: Investors experience a reduction in the value of their investment.

- Dividend Distributions: These add to the overall return, although they typically cause a slight decrease in NAV on the ex-dividend date.

NAV and Market Price Discrepancies

The market price of the Amundi DJIA UCITS ETF (Dist) may sometimes deviate slightly from its NAV. This is due to several factors:

- Bid-Ask Spreads: The difference between the buying and selling prices can create temporary discrepancies.

- Trading Volume: Lower trading volume may lead to wider price fluctuations relative to the NAV.

- Market Sentiment: Investor sentiment and market conditions can influence the market price independently of the NAV.

- Arbitrage Opportunities: These discrepancies can create opportunities for arbitrageurs to profit by buying low and selling high.

NAV and Dividend Distribution

The Amundi DJIA UCITS ETF (Dist) distributes dividends received from its underlying holdings. These distributions impact the NAV:

- Ex-Dividend Date: On the ex-dividend date, the NAV is typically reduced by the amount of the dividend per share, as the ETF no longer holds the dividend payment.

- Dividend Reinvestment: Many investors choose to reinvest their dividends, which leads to an increase in the number of ETF shares held, rather than receiving cash.

Accessing and Interpreting NAV Data for the Amundi DJIA UCITS ETF (Dist)

Reliable Sources for NAV Information

Accurate and up-to-date NAV data for the Amundi DJIA UCITS ETF (Dist) can be obtained from:

- Amundi Website: The official source for NAV information. [Insert link to Amundi website here]

- Financial News Sources: Reputable financial news websites and portals (e.g., Bloomberg, Yahoo Finance, Google Finance) often provide this data.

- Brokerage Platforms: Most brokerage accounts will display the NAV alongside other relevant information for the ETF.

Interpreting NAV Data in Investment Decisions

While NAV is crucial, it's essential to consider other factors when making investment decisions:

- Market Price: Compare the NAV with the market price to identify potential arbitrage opportunities or to gauge market sentiment.

- Expense Ratio: Assess the ETF's expense ratio to understand the ongoing costs of holding the investment.

- Historical Performance: Examine the ETF's historical NAV performance to assess its long-term growth potential.

- Broader Investment Context: Don't rely solely on NAV; consider your overall investment strategy and risk tolerance.

Conclusion

Understanding the Net Asset Value (NAV) calculation for the Amundi Dow Jones Industrial Average UCITS ETF (Dist) is vital for informed investment management. This article has highlighted the key components of NAV, its fluctuations, the impact on investor returns, and how to access and interpret this crucial data. By considering the NAV alongside other relevant metrics, investors can make more confident decisions regarding this ETF and similar index-tracking products. Learn more about Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV and master Amundi Dow Jones Industrial Average UCITS ETF (Dist) NAV calculations today by visiting the Amundi website for detailed information.

Featured Posts

-

Prepustanie V Nemecku Najvaecsie Spolocnosti Reaguju Na Krizu H Nonline Sk

May 24, 2025

Prepustanie V Nemecku Najvaecsie Spolocnosti Reaguju Na Krizu H Nonline Sk

May 24, 2025 -

Finding Tranquility Your Escape To The Country

May 24, 2025

Finding Tranquility Your Escape To The Country

May 24, 2025 -

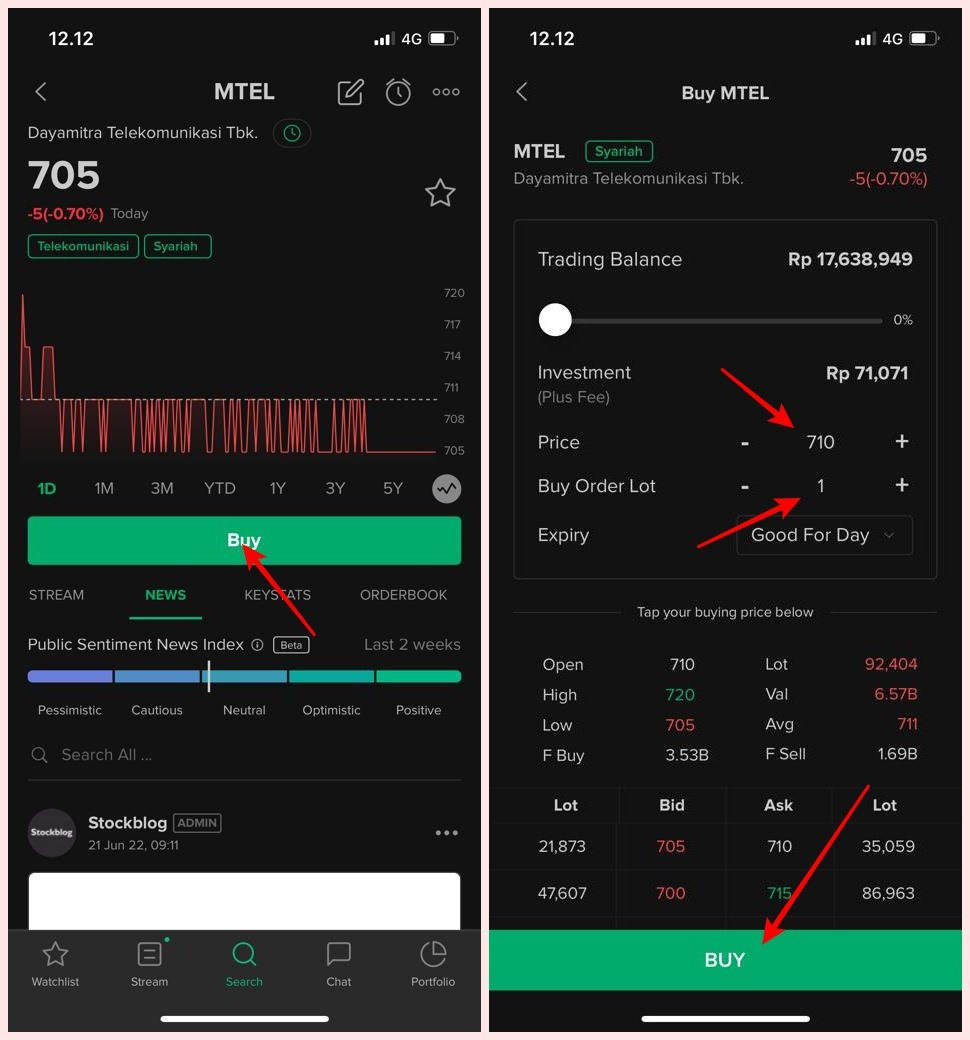

Analisis Saham Mtel And Mbma Setelah Masuk Msci Small Cap

May 24, 2025

Analisis Saham Mtel And Mbma Setelah Masuk Msci Small Cap

May 24, 2025 -

Dazi Stati Uniti Effetti Sui Prezzi Del Settore Moda

May 24, 2025

Dazi Stati Uniti Effetti Sui Prezzi Del Settore Moda

May 24, 2025 -

Porsche Di Indonesia Classic Art Week 2025 Perpaduan Seni And Mobil Klasik

May 24, 2025

Porsche Di Indonesia Classic Art Week 2025 Perpaduan Seni And Mobil Klasik

May 24, 2025

Latest Posts

-

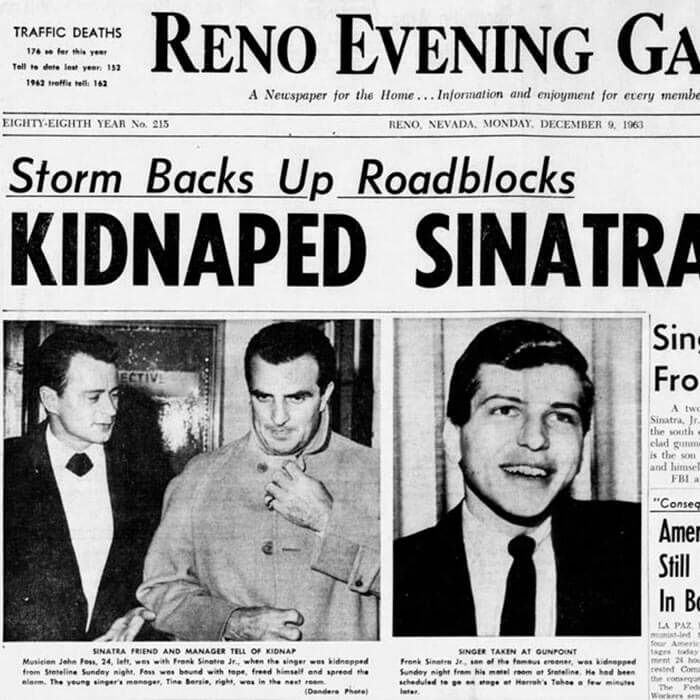

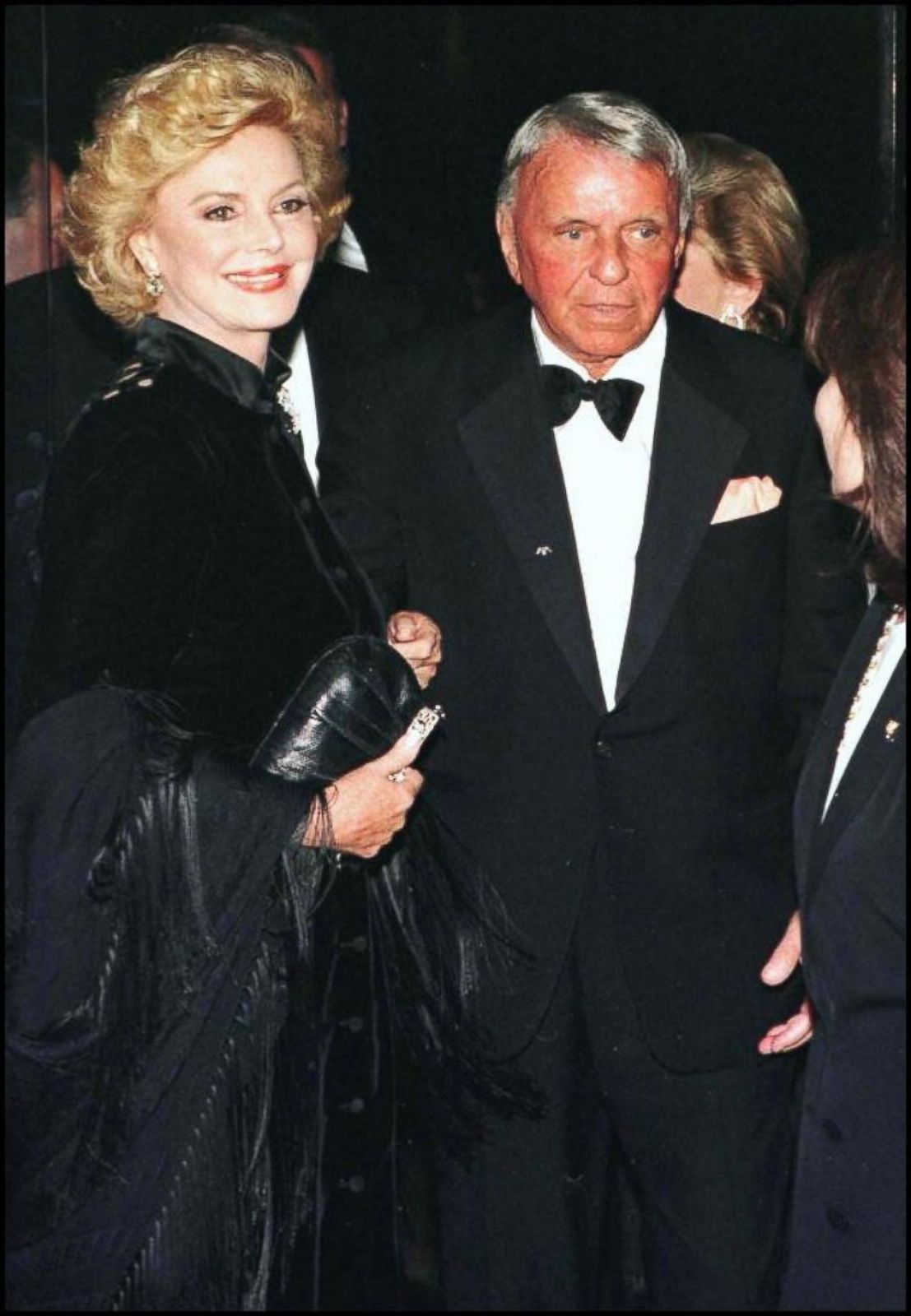

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025

The Four Women Who Married Frank Sinatra Their Stories And Impact

May 24, 2025 -

From Grace To Disaster 17 Celebrities Whose Reputations Imploded

May 24, 2025

From Grace To Disaster 17 Celebrities Whose Reputations Imploded

May 24, 2025 -

Frank Sinatra And His Four Wives Exploring His Love Life

May 24, 2025

Frank Sinatra And His Four Wives Exploring His Love Life

May 24, 2025 -

17 Celebrities Who Destroyed Their Careers Overnight

May 24, 2025

17 Celebrities Who Destroyed Their Careers Overnight

May 24, 2025 -

Frank Sinatras Four Marriages A Look At His Wives And Relationships

May 24, 2025

Frank Sinatras Four Marriages A Look At His Wives And Relationships

May 24, 2025