Amundi Dow Jones Industrial Average UCITS ETF: Monitoring Net Asset Value (NAV) For Informed Decisions

Table of Contents

The Amundi Dow Jones Industrial Average UCITS ETF is designed to track the performance of the Dow Jones Industrial Average, a leading index of 30 large, publicly-owned companies in the United States. A UCITS (Undertakings for Collective Investment in Transferable Securities) ETF is a type of investment fund regulated under European Union law, offering investors a standardized and regulated way to access a diversified portfolio.

Net Asset Value (NAV) represents the total value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. Simply put, it's the net worth of the ETF per share. For ETF investors, understanding the NAV is vital because it reflects the intrinsic value of the underlying assets. Regularly monitoring the NAV of the Amundi Dow Jones Industrial Average UCITS ETF allows investors to track the ETF's performance and make better-informed buy and sell decisions.

Factors Influencing the Amundi Dow Jones Industrial Average UCITS ETF NAV

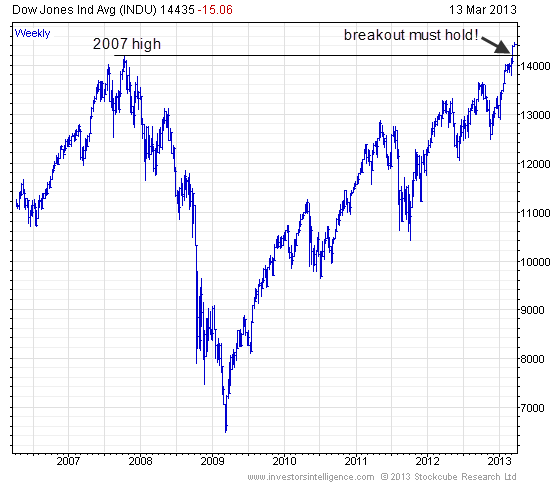

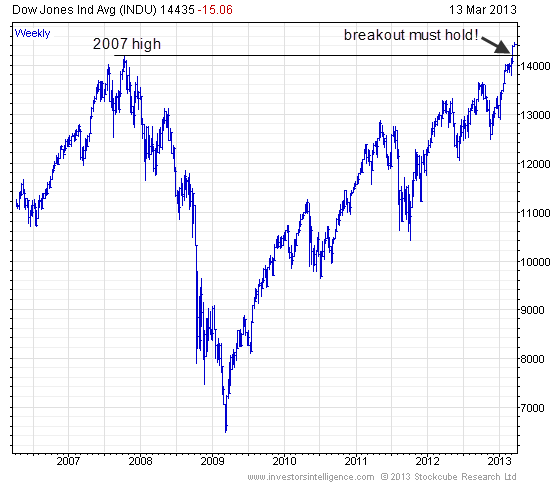

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF is directly influenced by the performance of the underlying Dow Jones Industrial Average index. A rise in the index generally leads to an increase in the ETF's NAV, while a fall in the index results in a decrease in the NAV.

Market movements significantly impact the NAV. During bull markets, characterized by rising prices, the NAV tends to increase. Conversely, bear markets, characterized by falling prices, typically lead to a decrease in the NAV.

While this ETF primarily tracks a US index, currency fluctuations between the Euro (or your local currency) and the US dollar can indirectly affect the NAV if you're not investing in USD. A strengthening dollar against the Euro would reduce the NAV (in Euro terms) even if the Dow Jones itself remained unchanged.

- Impact of individual company performance: The performance of each of the 30 companies within the Dow Jones index contributes to the overall NAV. Strong performance by one or more companies can boost the NAV, while poor performance can have the opposite effect.

- Influence of economic indicators: Macroeconomic factors like interest rate changes, inflation rates, and economic growth forecasts significantly influence the NAV. Positive economic news tends to support higher NAVs, while negative news can lead to declines.

- Effect of investor sentiment and trading volume: Investor sentiment and trading volume also play a role. High trading volume and positive sentiment can push the NAV upwards, while low volume and negative sentiment can lead to declines.

How to Access and Interpret the Amundi Dow Jones Industrial Average UCITS ETF NAV

Real-time and historical NAV data for the Amundi Dow Jones Industrial Average UCITS ETF can be accessed through several channels:

- Amundi's official website: The ETF provider's website is the most reliable source for accurate and up-to-date NAV information.

- Financial news websites: Major financial news sources and investment platforms often provide real-time and historical ETF NAV data.

- Brokerage platforms: If you hold the ETF through a brokerage account, the platform will usually display the current NAV.

The NAV is typically presented as a value per share. You can also calculate the total value of your investment by multiplying the NAV per share by the number of shares you own.

Example: If the NAV is €100 per share, and you own 10 shares, your total investment value is €1000. A rise in NAV to €105 indicates a 5% increase in your investment value.

- Step-by-step guide to finding NAV on the Amundi website: Visit the Amundi website, locate the ETF's page, and look for the section displaying current and historical NAV data. Usually this is prominently displayed.

- Explanation of common data sources: Bloomberg, Refinitiv, Google Finance, and Yahoo Finance are common sources for ETF NAV information.

- Tips for comparing NAV with other similar ETFs: When comparing ETFs, consider the tracking error (difference between the ETF’s performance and the index's performance) and the expense ratio in addition to the NAV.

Using NAV to Make Informed Investment Decisions with the Amundi Dow Jones Industrial Average UCITS ETF

Monitoring the NAV helps determine potential buy and sell points. A consistently falling NAV might suggest a sell signal, while a consistently rising NAV could indicate a buy opportunity. However, this requires a longer-term perspective and shouldn't be the sole factor in your decision.

Comparing the ETF's performance against the benchmark (the Dow Jones Industrial Average) helps evaluate its tracking ability. A significant deviation between the ETF’s NAV and the index's value might indicate tracking issues.

The NAV can provide insights into the ETF's overall investment strategy and whether it's aligned with your investment goals.

- Strategies for using NAV to time market entries and exits: Use NAV in conjunction with technical analysis, fundamental analysis, and your risk tolerance to time market entries and exits, avoiding impulsive decisions based solely on short-term fluctuations.

- Importance of considering NAV alongside other key performance indicators (KPIs): Expense ratios, trading volume, and management fees should also be considered for a holistic view.

- Risk management strategies based on NAV fluctuations: Set stop-loss orders based on predefined NAV thresholds to limit potential losses.

Potential Risks and Limitations of Relying Solely on NAV

While NAV is a crucial indicator, it shouldn't be the sole determinant of investment decisions. Other factors such as expense ratios, trading volume, and market liquidity are also important considerations. Remember there might be a slight lag between the calculation of the NAV and the actual market price of the ETF.

- Importance of diversification beyond a single ETF: Diversifying your portfolio across various asset classes reduces risk. Don’t put all your eggs in one basket!

- The role of professional financial advice: Seek advice from a qualified financial advisor to create a personalized investment strategy.

- Understanding the limitations of relying solely on NAV data: NAV is just one piece of the puzzle. Consider the broader market context and other relevant factors before making any investment decisions.

Conclusion: Mastering the Amundi Dow Jones Industrial Average UCITS ETF through NAV Monitoring

Monitoring the NAV of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for informed investment decisions. However, it’s vital to remember that NAV is just one factor to consider. A holistic approach incorporating other key performance indicators and professional financial advice is essential for long-term success. Start monitoring the Amundi Dow Jones Industrial Average UCITS ETF's NAV today to gain a deeper understanding of your investment and make informed choices. Regular NAV checks empower you to optimize your investment strategy.

Featured Posts

-

Joy Crookes New Single Carmen Is Here

May 25, 2025

Joy Crookes New Single Carmen Is Here

May 25, 2025 -

A Step By Step Guide To Getting Bbc Radio 1 Big Weekend 2025 Tickets Sefton Park

May 25, 2025

A Step By Step Guide To Getting Bbc Radio 1 Big Weekend 2025 Tickets Sefton Park

May 25, 2025 -

Euronext Amsterdam Stock Market Rally 8 Increase After Trumps Tariff Pause

May 25, 2025

Euronext Amsterdam Stock Market Rally 8 Increase After Trumps Tariff Pause

May 25, 2025 -

Annie Kilners Social Media Posts After Kyle Walkers Night Out Spark Controversy

May 25, 2025

Annie Kilners Social Media Posts After Kyle Walkers Night Out Spark Controversy

May 25, 2025 -

M56 Crash Overturned Car And Paramedic Response

May 25, 2025

M56 Crash Overturned Car And Paramedic Response

May 25, 2025

Latest Posts

-

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 25, 2025

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 25, 2025 -

Woody Allen And Dylan Farrow Sean Penn Weighs In On The Allegations

May 25, 2025

Woody Allen And Dylan Farrow Sean Penn Weighs In On The Allegations

May 25, 2025 -

The Woody Allen Dylan Farrow Case Sean Penns Doubts

May 25, 2025

The Woody Allen Dylan Farrow Case Sean Penns Doubts

May 25, 2025 -

Woody Allen Sexual Assault Case Sean Penn Expresses Doubts

May 25, 2025

Woody Allen Sexual Assault Case Sean Penn Expresses Doubts

May 25, 2025 -

Sean Penns Skepticism Regarding Woody Allen And Dylan Farrows Allegations

May 25, 2025

Sean Penns Skepticism Regarding Woody Allen And Dylan Farrows Allegations

May 25, 2025