Amundi Dow Jones Industrial Average UCITS ETF: Understanding Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the per-share value of an ETF's holdings. It's distinct from the market price, which can fluctuate throughout the trading day based on supply and demand. The NAV, however, is a more fundamental measure reflecting the true value of the ETF's underlying assets. It's calculated daily, providing a snapshot of the ETF's worth at the close of the market.

- NAV represents the per-share value of the ETF's holdings. This means it shows you how much each share of the ETF is theoretically worth based on the value of its assets.

- It's calculated by summing the market value of all assets, subtracting liabilities, and dividing by the number of outstanding shares. This process ensures a fair representation of the ETF's intrinsic worth.

- The NAV is usually published at the end of each trading day. This daily update allows investors to track the ETF's performance accurately.

How is the Amundi Dow Jones Industrial Average UCITS ETF NAV Calculated?

The Amundi Dow Jones Industrial Average UCITS ETF NAV calculation directly reflects the performance of the 30 constituent companies within the Dow Jones Industrial Average (DJIA). The process involves several steps:

- The NAV reflects the value of the 30 constituent companies of the DJIA. The ETF aims to track the DJIA's performance, so the NAV is heavily influenced by these companies' stock prices.

- It considers the weighted average of each company's market capitalization within the index. Larger companies within the DJIA will have a greater influence on the overall NAV.

- Any currency conversion from USD to EUR (or other applicable currency) is factored into the calculation. As the DJIA is a US-dollar-denominated index, any currency fluctuations will impact the NAV for investors holding the EUR-denominated UCITS ETF.

- Management fees are deducted from the total asset value before calculating the NAV per share. These fees are an important consideration as they directly reduce the NAV.

This meticulous calculation ensures the NAV accurately reflects the underlying value of the ETF, providing investors with a clear picture of their investment's performance.

The Importance of NAV for Amundi Dow Jones Industrial Average UCITS ETF Investors

Monitoring the Amundi Dow Jones Industrial Average UCITS ETF NAV is crucial for several reasons:

- Track the ETF's performance over time. By comparing the NAV over different periods, investors can assess the ETF's growth or decline.

- Compare the ETF's performance to its benchmark (DJIA). This helps determine how effectively the ETF tracks the index.

- Assess the fund manager's effectiveness in managing the portfolio. While the ETF aims for passive replication, slight deviations can indicate the fund manager's skill (or lack thereof).

- Determine whether to buy, sell, or hold the ETF based on NAV trends and market conditions. NAV trends, in conjunction with market analysis, can inform well-timed investment decisions.

Understanding the NAV allows for a data-driven approach to investment management, ensuring that investment strategies are informed and optimized.

Where to Find the Amundi Dow Jones Industrial Average UCITS ETF NAV?

Reliable and readily accessible sources provide daily Amundi Dow Jones Industrial Average UCITS ETF NAV data:

- Amundi's official website. The fund manager typically publishes this data prominently.

- Major financial news providers (e.g., Bloomberg, Yahoo Finance). Many reputable financial websites offer ETF data, including NAV.

- Your brokerage account's platform. Most brokerage platforms provide real-time or near real-time NAV information for your holdings.

Using reliable sources is crucial for accurate information and informed decision-making. Inaccurate NAV data can lead to poor investment choices.

Conclusion:

Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV is vital for any investor. By regularly monitoring the NAV and understanding its calculation, investors can effectively assess the value of their investment and adapt their strategies accordingly. Remember to always use reliable sources for accurate Amundi Dow Jones Industrial Average UCITS ETF NAV data. Stay informed about your Amundi Dow Jones Industrial Average UCITS ETF NAV and optimize your investment strategy.

Featured Posts

-

Demna At Gucci Analyzing The Creative Direction Change

May 24, 2025

Demna At Gucci Analyzing The Creative Direction Change

May 24, 2025 -

M6 Southbound Traffic 1 Hour Delays After Collision

May 24, 2025

M6 Southbound Traffic 1 Hour Delays After Collision

May 24, 2025 -

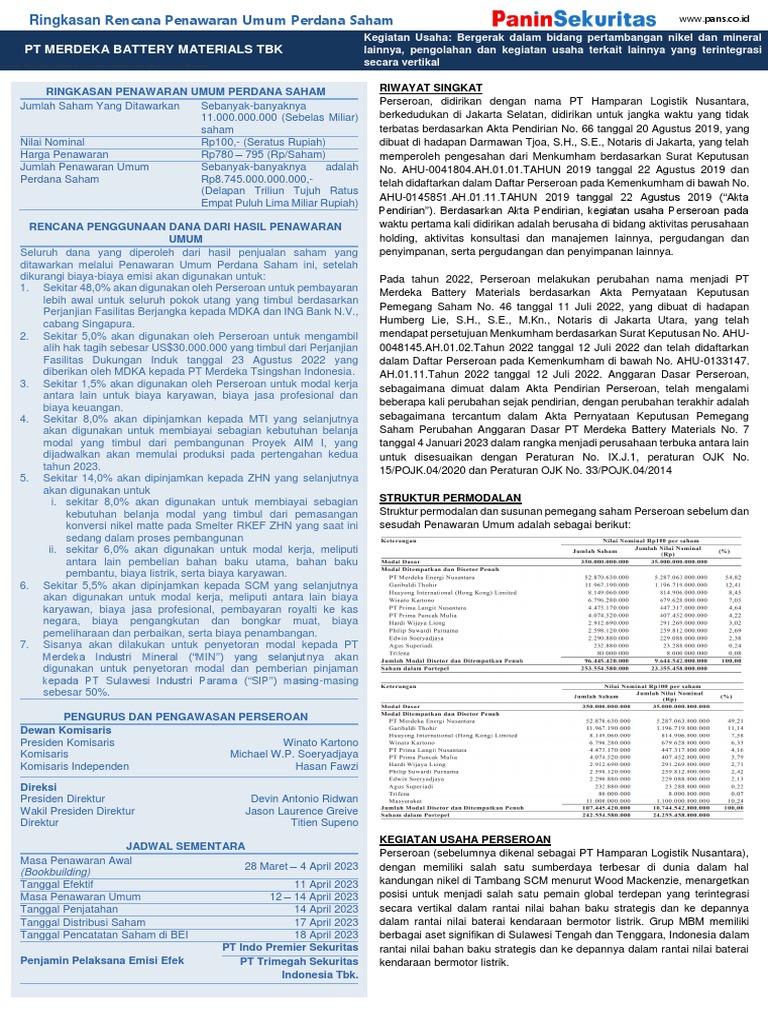

Dayamitra Telekomunikasi Mtel Dan Merdeka Battery Mbma Prospek Investasi Usai Pencatatan Msci

May 24, 2025

Dayamitra Telekomunikasi Mtel Dan Merdeka Battery Mbma Prospek Investasi Usai Pencatatan Msci

May 24, 2025 -

Escape To The Countryside Top Locations And Considerations

May 24, 2025

Escape To The Countryside Top Locations And Considerations

May 24, 2025 -

Live M56 Traffic Updates Motorway Closure After Serious Crash

May 24, 2025

Live M56 Traffic Updates Motorway Closure After Serious Crash

May 24, 2025

Latest Posts

-

Gryozy Lyubvi Ili Ilicha Otsenka Publikatsii V Gazete Trud

May 24, 2025

Gryozy Lyubvi Ili Ilicha Otsenka Publikatsii V Gazete Trud

May 24, 2025 -

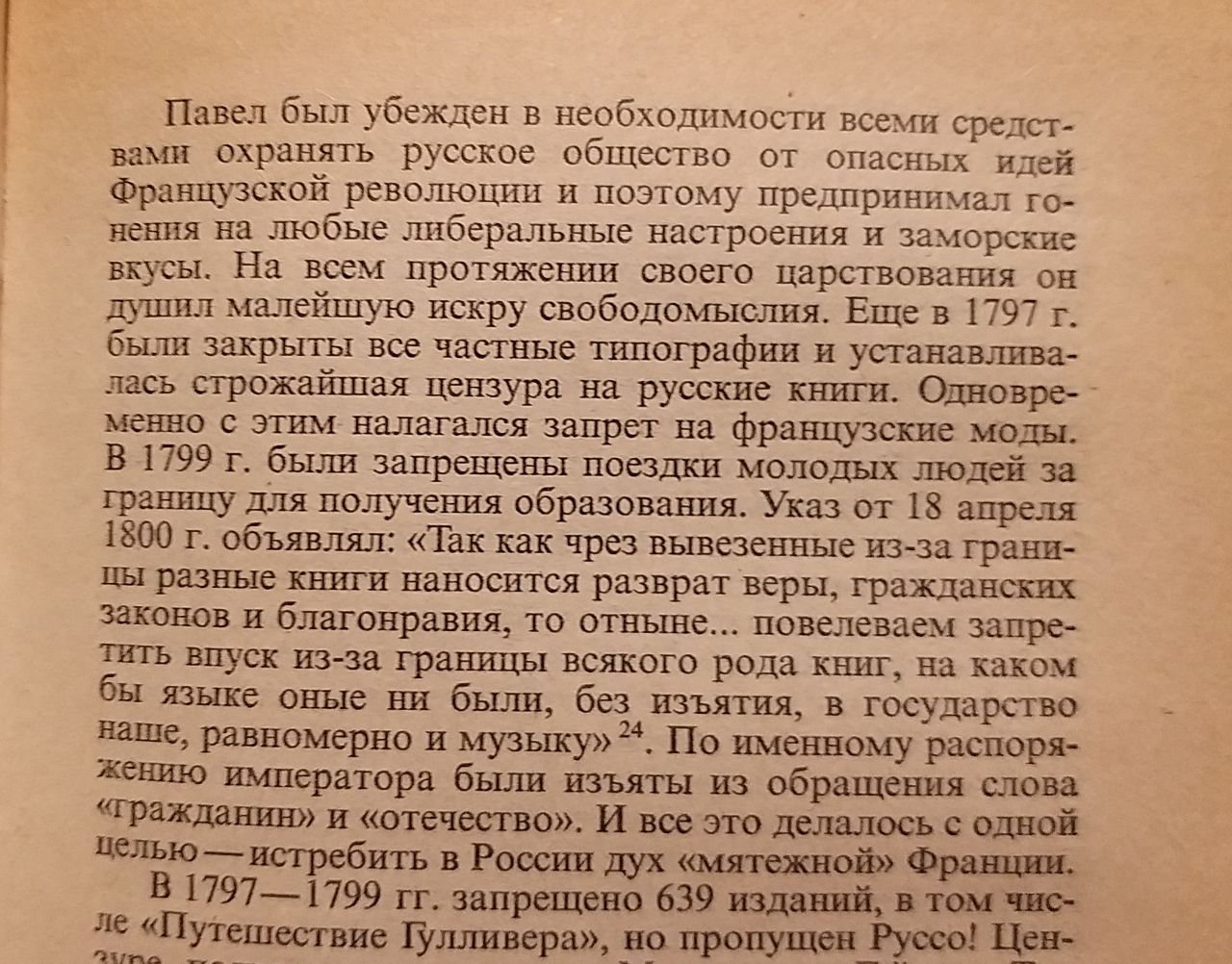

Fedor Lavrov O Trillerakh I Imperatore Pavle I O Prirode Chelovecheskogo Interesa K Opasnosti

May 24, 2025

Fedor Lavrov O Trillerakh I Imperatore Pavle I O Prirode Chelovecheskogo Interesa K Opasnosti

May 24, 2025 -

Gryozy Lyubvi Ili Ilicha Gazeta Trud Kratkiy Analiz

May 24, 2025

Gryozy Lyubvi Ili Ilicha Gazeta Trud Kratkiy Analiz

May 24, 2025 -

Pavel I I Trillery Pochemu Lyudi Lyubyat Schekotat Nervy Vzglyad Fedora Lavrova

May 24, 2025

Pavel I I Trillery Pochemu Lyudi Lyubyat Schekotat Nervy Vzglyad Fedora Lavrova

May 24, 2025 -

Innokentiy Smoktunovskiy 100 Let Film Menya Vela Kakaya To Sila

May 24, 2025

Innokentiy Smoktunovskiy 100 Let Film Menya Vela Kakaya To Sila

May 24, 2025