Amundi MSCI All Country World UCITS ETF USD Acc: A Comprehensive Guide To Net Asset Value

Table of Contents

What is the Amundi MSCI All Country World UCITS ETF USD Acc and Why is its NAV Important?

The Amundi MSCI All Country World UCITS ETF USD Acc is an ETF designed to track the MSCI All Country World Index. This index provides broad exposure to global equities, offering investors a diversified portfolio spanning developed and emerging markets. Understanding its Net Asset Value (NAV) is paramount because it directly reflects the value of the underlying assets held within the ETF.

The NAV is essential for several reasons:

- Investment Decisions: Knowing the NAV helps determine the appropriate buying and selling points for the ETF. A low NAV might present a buying opportunity, while a high NAV could signal a potential selling point.

- Performance Assessment: Tracking the NAV allows you to monitor the ETF's performance over time. Changes in NAV reflect the overall growth or decline of the underlying assets.

- Underlying Asset Reflection: The NAV accurately represents the net value of all the assets within the ETF, less any liabilities. This provides transparency into the ETF's holdings.

Here's why the Amundi MSCI All Country World UCITS ETF USD Acc is a compelling investment choice:

- Provides global market exposure, reducing geographic concentration risk.

- Offers low-cost diversification across a vast range of companies and sectors.

- Employs a transparent investment strategy, closely tracking the MSCI All Country World Index.

- Its NAV is crucial for calculating returns and understanding investment performance accurately.

How is the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc Calculated?

The NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is calculated daily, typically at the close of market hours. The process involves:

- Asset Valuation: The ETF's custodian bank determines the market value of all the underlying securities held within the ETF portfolio. This involves obtaining up-to-date prices for each asset.

- Liability Deduction: After valuing the assets, any liabilities, such as management fees and other expenses, are deducted.

- Net Asset Value Calculation: The NAV is then calculated by dividing the total net asset value (assets less liabilities) by the total number of outstanding ETF shares.

This process ensures accuracy and transparency:

- Daily valuation of underlying assets ensures the NAV reflects current market conditions.

- Deduction of ETF expenses provides a clear picture of the net value available to investors.

- Independent verification processes by the custodian bank guarantee the accuracy of the calculation.

- Transparent reporting methodologies ensure investors understand how the NAV is derived.

Where to Find the Amundi MSCI All Country World UCITS ETF USD Acc NAV?

Accessing the daily NAV for the Amundi MSCI All Country World UCITS ETF USD Acc is straightforward. Reliable sources include:

- Amundi's Official Website: The ETF provider's website usually publishes the latest NAV information.

- Major Financial Data Providers: Platforms like Bloomberg, Refinitiv, and others provide real-time and historical NAV data for various ETFs.

- Your Brokerage Account Platform: Most brokerage accounts display the current NAV of your held ETFs.

- Financial News Websites: Many reputable financial news sources include ETF NAV data in their market summaries.

Remember to consider the timing when checking the NAV:

- Before Market Close: Provides a snapshot of the NAV before significant price changes during trading.

- After Market Close: Represents the official closing NAV for the day, reflecting all trading activity.

Factors Affecting the Amundi MSCI All Country World UCITS ETF USD Acc NAV

Several factors impact the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc:

- Global Market Performance: The most significant factor is the overall performance of the global equity markets. Positive market movements generally lead to NAV increases, while negative movements cause decreases.

- Currency Exchange Rate Movements: As this is a USD-denominated ETF, fluctuations in exchange rates between the USD and other currencies affect the value of the underlying assets held in different currencies.

- Dividend Payouts: When underlying companies distribute dividends, this impacts the NAV, usually leading to a slight decrease immediately followed by an increase in the share price if reinvested.

- Management Fees and Other Expenses: The ETF's operating expenses, including management fees, are deducted from the assets, influencing the calculated NAV.

Conclusion: Mastering Amundi MSCI All Country World UCITS ETF USD Acc NAV

Understanding the Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc is crucial for successful ETF investing. By regularly monitoring the NAV from reliable sources and understanding the factors that influence it, investors can make informed decisions, track performance effectively, and maximize their investment returns. Stay informed about your Amundi MSCI All Country World UCITS ETF USD Acc investment by monitoring its Net Asset Value regularly. For more information on ETF investing and the Amundi MSCI All Country World UCITS ETF USD Acc, visit [link to Amundi's website].

Featured Posts

-

Hawaiis Keiki Artists Shine In Memorial Day Lei Poster Contest

May 24, 2025

Hawaiis Keiki Artists Shine In Memorial Day Lei Poster Contest

May 24, 2025 -

Bbc Big Weekend 2025 Sefton Park Ticket Information And Application

May 24, 2025

Bbc Big Weekend 2025 Sefton Park Ticket Information And Application

May 24, 2025 -

H Nonline Sk Nemecke Hospodarstvo V Krize Straty Pracovnych Miest Rastu

May 24, 2025

H Nonline Sk Nemecke Hospodarstvo V Krize Straty Pracovnych Miest Rastu

May 24, 2025 -

Porsche Cayenne Gts Coupe Szczegolowa Recenzja Po Jazdach Testowych

May 24, 2025

Porsche Cayenne Gts Coupe Szczegolowa Recenzja Po Jazdach Testowych

May 24, 2025 -

Ferrari Launches Flagship Facility In Bangkok Bangkok Post

May 24, 2025

Ferrari Launches Flagship Facility In Bangkok Bangkok Post

May 24, 2025

Latest Posts

-

Emergency Services Respond To M56 Crash Car Overturn And Casualty

May 24, 2025

Emergency Services Respond To M56 Crash Car Overturn And Casualty

May 24, 2025 -

M56 Motorway Crash Car Overturns Paramedics Treat Casualty

May 24, 2025

M56 Motorway Crash Car Overturns Paramedics Treat Casualty

May 24, 2025 -

M62 Westbound Planned Resurfacing Closure Manchester Warrington

May 24, 2025

M62 Westbound Planned Resurfacing Closure Manchester Warrington

May 24, 2025 -

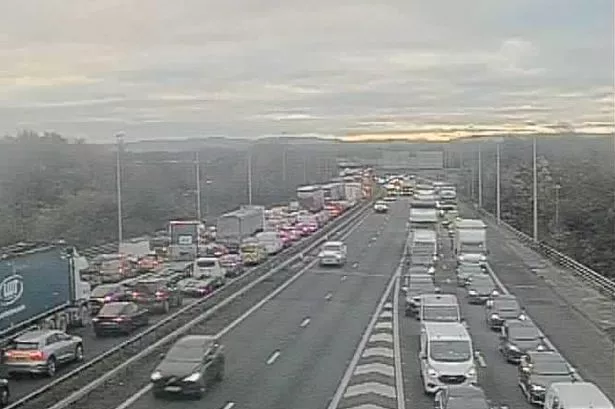

Live Updates M6 Crash Causes Significant Delays For Drivers

May 24, 2025

Live Updates M6 Crash Causes Significant Delays For Drivers

May 24, 2025 -

M62 Resurfacing Westbound Closure From Manchester To Warrington

May 24, 2025

M62 Resurfacing Westbound Closure From Manchester To Warrington

May 24, 2025