Amundi MSCI World Catholic Principles UCITS ETF Acc: A Guide To Net Asset Value (NAV)

Table of Contents

How NAV is Calculated for the Amundi MSCI World Catholic Principles UCITS ETF Acc

The Net Asset Value (NAV) of the Amundi MSCI World Catholic Principles UCITS ETF Acc represents the net value of its underlying assets per share. This calculation is a vital indicator of the ETF's performance and value.

Asset Valuation

Determining the NAV begins with valuing the ETF's underlying assets. The Amundi MSCI World Catholic Principles UCITS ETF Acc invests in a globally diversified portfolio of stocks, adhering to specific Catholic Principles. This screening process might slightly influence the valuation compared to a standard world equity index. The valuation process typically involves:

- Equity Valuation: Market prices of individual stocks are used, reflecting real-time trading activity.

- Fixed Income Valuation: Bonds and other fixed-income securities are valued using pricing models considering factors like maturity, yield, and credit risk.

- Other Assets (if applicable): Any other asset classes held by the ETF are valued using appropriate methodologies.

Market prices are generally used, but adjustments might be necessary for illiquid assets or specific circumstances.

Liabilities and Expenses

After totaling the asset values, the ETF's liabilities and expenses are subtracted. This includes:

- Management Fees: The expense ratio charged for managing the ETF (check the Amundi MSCI World Catholic Principles UCITS ETF Acc fact sheet for the precise figure).

- Other Expenses: Any other operational or administrative costs incurred by the ETF.

These deductions are crucial as they reflect the true net value available to investors.

Calculation Frequency

The NAV for the Amundi MSCI World Catholic Principles UCITS ETF Acc is typically calculated daily, usually at the end of the trading day. Investors can find the most up-to-date NAV information on the Amundi website, major financial news platforms, and through their brokerage accounts.

The Importance of NAV for Amundi MSCI World Catholic Principles UCITS ETF Acc Investors

Understanding NAV is paramount for various aspects of investing in the Amundi MSCI World Catholic Principles UCITS ETF Acc.

Monitoring Performance

Tracking NAV changes over time allows investors to monitor the ETF's performance. By comparing NAV changes across different periods, investors can calculate returns and compare the ETF's performance against benchmarks or other investments.

Buying and Selling

NAV is critical when buying or selling ETF shares. Investors often use NAV as a reference point when placing orders. A market order buys or sells at the prevailing market price, while a limit order specifies a specific price (often related to the NAV) at which the trade should execute.

Risk Management

Fluctuations in NAV directly reflect the risk associated with investing in the Amundi MSCI World Catholic Principles UCITS ETF Acc. Significant NAV drops can indicate increased risk, highlighting the importance of monitoring market trends and adjusting investment strategies accordingly.

Factors Affecting the NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc

Several factors influence the NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc, impacting investor returns.

Market Fluctuations

Broader market conditions significantly impact the NAV. A bull market generally leads to NAV increases, while a bear market often results in declines. Specific events such as:

- Global Economic Events: Recessions, economic growth spurts, etc.

- Interest Rate Changes: Impacts on bond valuations and company earnings.

- Geopolitical Risks: International conflicts, political instability, and other unforeseen events.

Currency Fluctuations

Since the Amundi MSCI World Catholic Principles UCITS ETF Acc holds internationally diversified assets, currency fluctuations affect the NAV. Exchange rate movements between the base currency (likely EUR) and the currencies of the underlying assets can either increase or decrease the overall NAV. Currency hedging strategies employed by the ETF manager can mitigate some of this risk.

Underlying Asset Performance

The performance of individual companies within the ETF's portfolio directly impacts the overall NAV. A strong performance by several holdings boosts the NAV, while underperformance negatively affects it. The inherent Catholic Principles screening might lead to a slightly different performance profile compared to a non-screened world equity index ETF.

Conclusion: Mastering Net Asset Value (NAV) in your Amundi MSCI World Catholic Principles UCITS ETF Acc Strategy

Understanding Net Asset Value (NAV) is fundamental to successful investing in the Amundi MSCI World Catholic Principles UCITS ETF Acc. By monitoring NAV changes, understanding its calculation, and recognizing the factors that influence it, you can make more informed decisions, manage risk effectively, and ultimately optimize your investment strategy. Actively monitor the NAV of your Amundi MSCI World Catholic Principles UCITS ETF Acc holdings and use this knowledge to refine your investment approach. For more detailed information, visit the Amundi website [link to Amundi website].

Featured Posts

-

Escape To The Country Top Destinations For A Relaxing Getaway

May 24, 2025

Escape To The Country Top Destinations For A Relaxing Getaway

May 24, 2025 -

Mwshr Daks Alalmany Tjawz Qmt Mars W Ahmyt Hdha Alhdth Fy Alaswaq Alawrwbyt

May 24, 2025

Mwshr Daks Alalmany Tjawz Qmt Mars W Ahmyt Hdha Alhdth Fy Alaswaq Alawrwbyt

May 24, 2025 -

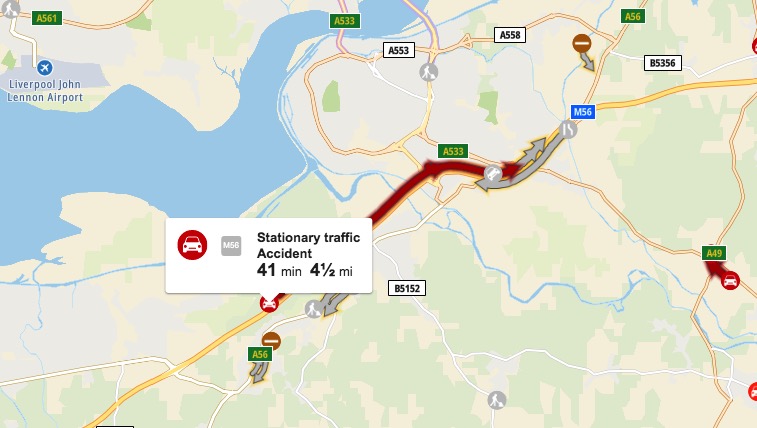

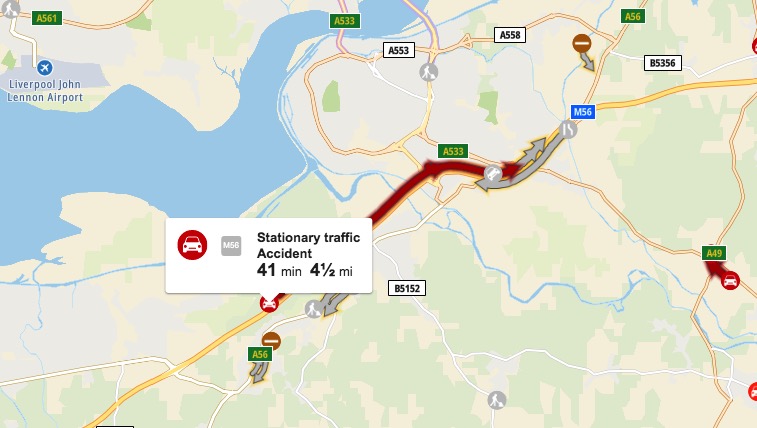

Accident On M56 Causes Major Delays Near Cheshire Deeside Border

May 24, 2025

Accident On M56 Causes Major Delays Near Cheshire Deeside Border

May 24, 2025 -

Nemecke Spolocnosti A Vlna Prepustania Analyza Situacie

May 24, 2025

Nemecke Spolocnosti A Vlna Prepustania Analyza Situacie

May 24, 2025 -

Kyle Walker Peters To Leeds Latest Transfer News

May 24, 2025

Kyle Walker Peters To Leeds Latest Transfer News

May 24, 2025

Latest Posts

-

M62 Resurfacing Westbound Closure From Manchester To Warrington

May 24, 2025

M62 Resurfacing Westbound Closure From Manchester To Warrington

May 24, 2025 -

M6 Motorway Crash Current Traffic And Travel Disruption

May 24, 2025

M6 Motorway Crash Current Traffic And Travel Disruption

May 24, 2025 -

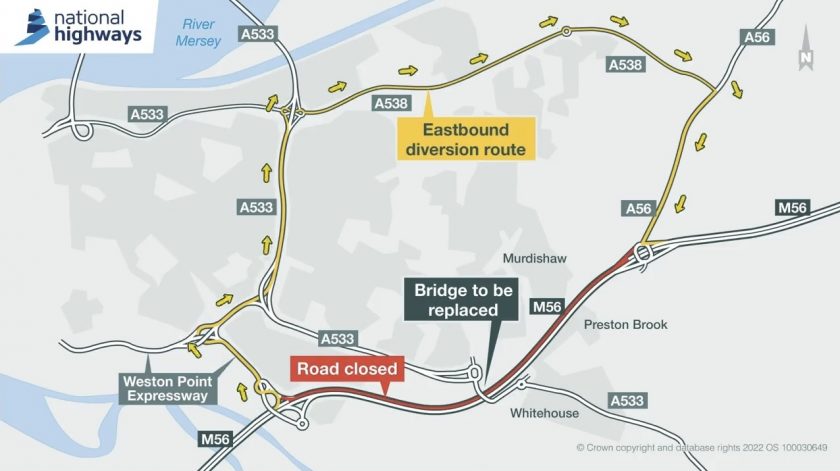

M56 Motorway Closed Cheshire Deeside Area Experiencing Long Delays

May 24, 2025

M56 Motorway Closed Cheshire Deeside Area Experiencing Long Delays

May 24, 2025 -

M6 Crash Live Updates And Traffic Delays

May 24, 2025

M6 Crash Live Updates And Traffic Delays

May 24, 2025 -

Accident On M56 Causes Major Delays Near Cheshire Deeside Border

May 24, 2025

Accident On M56 Causes Major Delays Near Cheshire Deeside Border

May 24, 2025