Amundi MSCI World (ex-US) UCITS ETF: A Deep Dive Into Net Asset Value

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated for the Amundi MSCI World (ex-US) UCITS ETF?

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, per share. Simply put, it's the value of what the ETF owns, less what it owes, divided by the number of outstanding shares. For the Amundi MSCI World (ex-US) UCITS ETF, this calculation involves several key components:

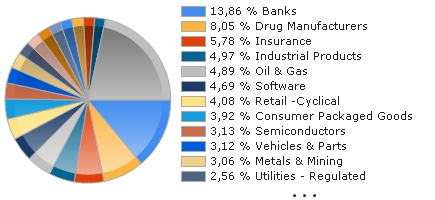

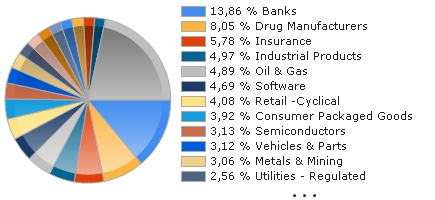

- Market Value of Underlying Assets: This is the primary driver of the NAV. It represents the total market value of all the global equities (excluding US equities) held within the ETF's portfolio. This value fluctuates constantly based on the performance of these individual stocks. Accurate asset valuation is critical.

- Liabilities: These include expenses such as management fees, administrative costs, and any other outstanding debts the ETF may have. These liabilities reduce the overall net asset value.

- Number of Outstanding Shares: The total number of ETF shares currently held by investors. Dividing the net asset value (assets minus liabilities) by this number gives the NAV per share.

The NAV differs from the market price, which is the price at which the ETF shares are traded on the exchange. While they are usually close, differences can arise due to market supply and demand. The Amundi MSCI World (ex-US) UCITS ETF's NAV is typically calculated and published daily, reflecting the closing market prices of its underlying assets. Understanding this daily NAV calculation provides insight into the ETF's valuation.

Factors Affecting the Amundi MSCI World (ex-US) UCITS ETF's NAV

Several factors significantly impact the Amundi MSCI World (ex-US) UCITS ETF's NAV:

- Global Market Fluctuations: Changes in the overall global equity markets (excluding the US) directly affect the value of the underlying assets and, consequently, the ETF's NAV. Market volatility can lead to significant NAV swings.

- Currency Exchange Rates: Because the ETF holds international equities, fluctuations in exchange rates between different currencies can impact the NAV. A strengthening of the Euro, for instance, could positively influence the NAV if a large portion of the holdings are denominated in Euros.

- Dividend Payments: When the underlying companies in the ETF's portfolio pay dividends, this increases the ETF's cash holdings, ultimately contributing positively to the NAV (before these are subsequently reinvested). The dividend yield is a crucial factor for long-term investors.

- Management Fees and Expenses: These ongoing costs reduce the NAV. The expense ratio, representing the annual management fee as a percentage of assets, directly affects the NAV over time.

How to Access the Amundi MSCI World (ex-US) UCITS ETF's NAV

Investors can typically find the daily NAV of the Amundi MSCI World (ex-US) UCITS ETF through several channels:

- ETF Provider's Website: Amundi's official website is the most reliable source for the latest NAV information.

- Financial News Sources: Many reputable financial news websites and data providers display real-time ETF data, including NAV.

- Brokerage Platforms: Most brokerage accounts will show the current NAV alongside the market price of the ETF.

There might be a slight delay in reporting the NAV, typically a few hours after market close, allowing for the accurate valuation of all underlying assets. Regular monitoring of NAV changes is essential for effective portfolio management.

Using NAV for Investment Decisions in the Amundi MSCI World (ex-US) UCITS ETF

The NAV plays a crucial role in investment decision-making:

- Performance Assessment: Tracking NAV changes over time helps assess the ETF's performance. Comparing the NAV against its past values helps investors evaluate growth or loss.

- Comparison with Other Investments: NAV allows for a direct comparison of the Amundi MSCI World (ex-US) UCITS ETF's performance against other investment options with similar exposure.

- Limitations: While NAV is a crucial metric, it shouldn't be the sole factor determining investment decisions. Other factors like expense ratios, risk tolerance, and investment goals must be carefully considered.

Conclusion: Investing Wisely with Amundi MSCI World (ex-US) UCITS ETF NAV Knowledge

Mastering Amundi MSCI World (ex-US) UCITS ETF NAV is crucial for making informed investment choices. Understanding how NAV is calculated, the factors affecting it, and how to access this crucial data empowers investors to monitor performance, compare investment options, and build a robust portfolio. Stay informed about the Amundi MSCI World (ex-US) UCITS ETF NAV to make smart investment decisions. For more detailed information, visit the Amundi website. (Insert link to Amundi's relevant webpage here)

Featured Posts

-

How To Get Bbc Radio 1s Big Weekend 2025 Tickets In Sefton Park

May 25, 2025

How To Get Bbc Radio 1s Big Weekend 2025 Tickets In Sefton Park

May 25, 2025 -

Memorial Day Poster Contest Celebrating Hawaii Keikis Artistic Skills

May 25, 2025

Memorial Day Poster Contest Celebrating Hawaii Keikis Artistic Skills

May 25, 2025 -

Porsche 956 Neden Ters Yuez Edilmis Olarak Sergileniyor

May 25, 2025

Porsche 956 Neden Ters Yuez Edilmis Olarak Sergileniyor

May 25, 2025 -

Joy Crookes Carmen A New Single For Your Playlist

May 25, 2025

Joy Crookes Carmen A New Single For Your Playlist

May 25, 2025 -

Hawaii Keikis Memorial Day Lei Making Poster Contest A Showcase Of Talent

May 25, 2025

Hawaii Keikis Memorial Day Lei Making Poster Contest A Showcase Of Talent

May 25, 2025

Latest Posts

-

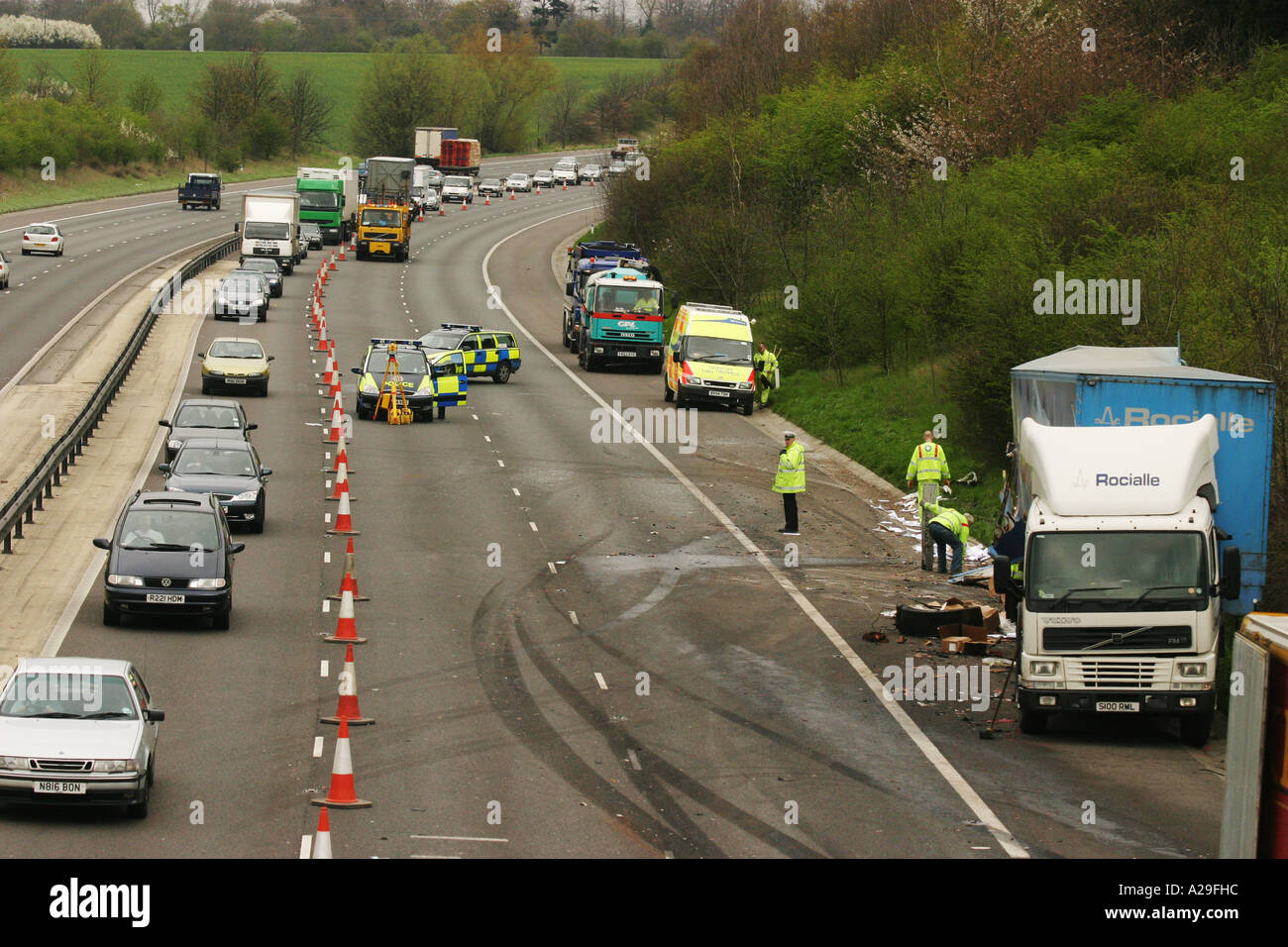

Princess Road Accident Emergency Response Underway Live Updates

May 25, 2025

Princess Road Accident Emergency Response Underway Live Updates

May 25, 2025 -

M62 Westbound Road Closure Resurfacing Between Manchester And Warrington

May 25, 2025

M62 Westbound Road Closure Resurfacing Between Manchester And Warrington

May 25, 2025 -

M56 Motorway Closure Latest Traffic Updates And Diversion Routes

May 25, 2025

M56 Motorway Closure Latest Traffic Updates And Diversion Routes

May 25, 2025 -

Planned M62 Westbound Closure Manchester To Warrington Resurfacing

May 25, 2025

Planned M62 Westbound Closure Manchester To Warrington Resurfacing

May 25, 2025 -

M56 Motorway Accident Real Time Traffic Information And Route Alternatives

May 25, 2025

M56 Motorway Accident Real Time Traffic Information And Route Alternatives

May 25, 2025