Amundi MSCI World II UCITS ETF Dist: A Guide To Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the value of a single share or unit in an investment fund, like the Amundi MSCI World II UCITS ETF Dist. It's essentially the net asset value per share. In simple terms, it's calculated by taking the total value of all the assets held within the ETF, subtracting liabilities, and then dividing by the total number of outstanding shares.

-

How NAV is Calculated: The calculation for ETFs, including the Amundi MSCI World II UCITS ETF Dist, is relatively straightforward. A simplified formula is:

(Total Asset Value - Total Liabilities) / Number of Outstanding Shares = NAV -

Factors Influencing NAV: Several factors influence the daily NAV calculation:

- Market Prices of Underlying Assets: The primary driver is the fluctuating market prices of the stocks, bonds, or other assets held within the ETF's portfolio, mirroring the performance of the MSCI World Index.

- Currency Fluctuations: As the Amundi MSCI World II UCITS ETF Dist invests globally, changes in exchange rates between currencies can impact the NAV.

- Expenses: Management fees and other operating expenses of the ETF reduce the overall asset value and therefore the NAV.

-

Importance of Monitoring NAV: Regularly monitoring the NAV is vital for tracking the performance of your investment. Changes in NAV reflect the overall growth or decline of the ETF's underlying assets.

-

NAV vs. Market Price: While NAV is the intrinsic value of the ETF, the market price is the price at which the ETF is currently trading on the exchange. These values may differ slightly due to market supply and demand.

The Amundi MSCI World II UCITS ETF Dist and its NAV

The Amundi MSCI World II UCITS ETF Dist is an exchange-traded fund that aims to track the performance of the MSCI World Index, providing exposure to a diversified portfolio of large and mid-cap companies across developed markets globally.

-

Investment Objective and Strategy: The ETF's objective is to replicate the MSCI World Index, offering investors broad global market exposure. Its strategy involves passively tracking the index's composition.

-

Underlying Index Tracking (MSCI World Index): The MSCI World Index is a widely recognized benchmark that includes a broad range of global equities, offering significant diversification across geographies and sectors.

-

Geographic and Sector Diversification: The ETF benefits from the diversification inherent in the MSCI World Index, reducing risk by spreading investments across various countries and industries.

-

How to Find the Daily NAV: You can find the daily NAV for the Amundi MSCI World II UCITS ETF Dist from several sources:

- Official Sources: Amundi's official website is the primary source, usually providing daily NAV data. Financial data providers like Bloomberg or Refinitiv also offer this information.

- Reliable Online Resources: Many reputable financial websites and brokerage platforms display real-time or near real-time NAV information for ETFs.

-

Impact of Dividend Distributions on NAV: The Amundi MSCI World II UCITS ETF Dist distributes dividends, which are paid out from the underlying holdings' dividends.

- Ex-Dividend Date: On the ex-dividend date, the NAV typically reflects a reduction to account for the upcoming dividend payment.

- Reinvestment of Dividends: Many investors opt to reinvest dividends, which can contribute to long-term growth and potentially increase the NAV over time.

Using NAV to Make Informed Investment Decisions

Understanding the NAV is a key element of informed investment decision-making.

-

NAV and Buy/Sell Decisions: While not the sole determinant, NAV can be considered alongside market price and other factors when deciding whether to buy or sell shares of the Amundi MSCI World II UCITS ETF Dist.

-

Comparing NAV to Other Investment Options: Compare the NAV performance of this ETF with other investment options to assess its relative value and potential returns.

-

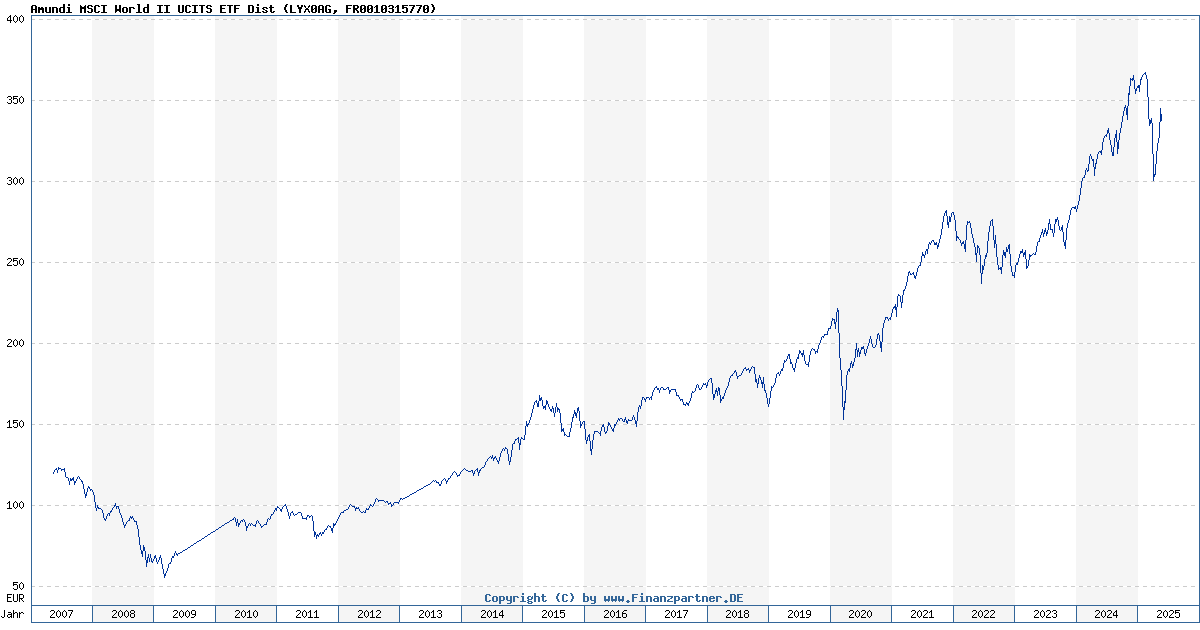

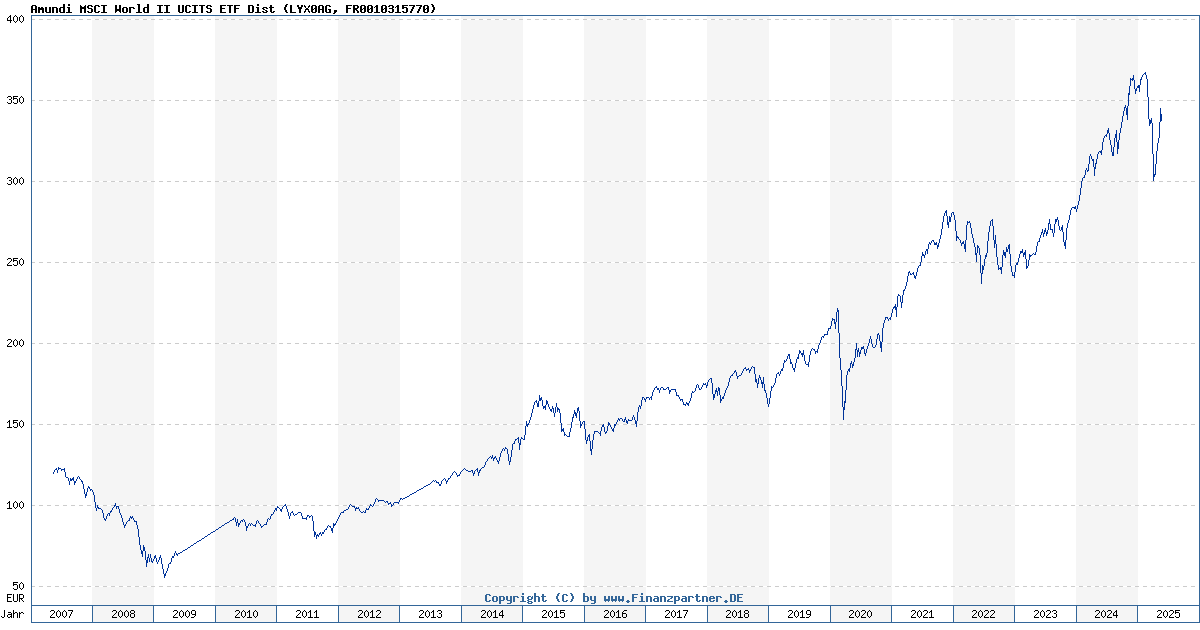

Analyzing NAV Trends: Tracking the NAV over time reveals the ETF's performance, highlighting periods of growth or decline. This analysis aids in understanding long-term trends and potential investment risks.

-

Expense Ratios and NAV Growth: Remember to consider the expense ratio of the ETF. High expense ratios can eat into potential NAV growth, impacting overall returns.

Calculating Potential Returns based on NAV

Historical NAV data can be used to illustrate potential returns. For example, comparing the NAV from a past date to the current NAV can show the percentage increase or decrease.

-

Illustrative Example: If the NAV a year ago was €100 and the current NAV is €105, this represents a 5% return (excluding dividend reinvestment).

-

Important Caveats: Past performance is not indicative of future results. Such calculations are simplified and don't account for all factors influencing actual returns (e.g., transaction costs, taxes).

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF Dist is essential for successful investing. By monitoring the NAV and considering other factors like expense ratios and dividend distributions, investors can make informed decisions and track the performance of their investment in this globally diversified ETF. Learn more about the Amundi MSCI World II UCITS ETF Dist and its NAV to optimize your investment strategy. Regularly check the NAV to stay informed about your investment's performance. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

2025 Porsche Cayenne See The New Interior And Exterior Design In Pictures

May 24, 2025

2025 Porsche Cayenne See The New Interior And Exterior Design In Pictures

May 24, 2025 -

Serious M56 Motorway Accident Car Overturns Paramedic Response

May 24, 2025

Serious M56 Motorway Accident Car Overturns Paramedic Response

May 24, 2025 -

Public And Private Sector Convergence Brbs Banco Master Acquisition

May 24, 2025

Public And Private Sector Convergence Brbs Banco Master Acquisition

May 24, 2025 -

Joy Crookes New Song I Know You D Kill A Deep Dive

May 24, 2025

Joy Crookes New Song I Know You D Kill A Deep Dive

May 24, 2025 -

Forbes 2025 La Classifica Degli Uomini Piu Ricchi Sorpassi E Novita

May 24, 2025

Forbes 2025 La Classifica Degli Uomini Piu Ricchi Sorpassi E Novita

May 24, 2025

Latest Posts

-

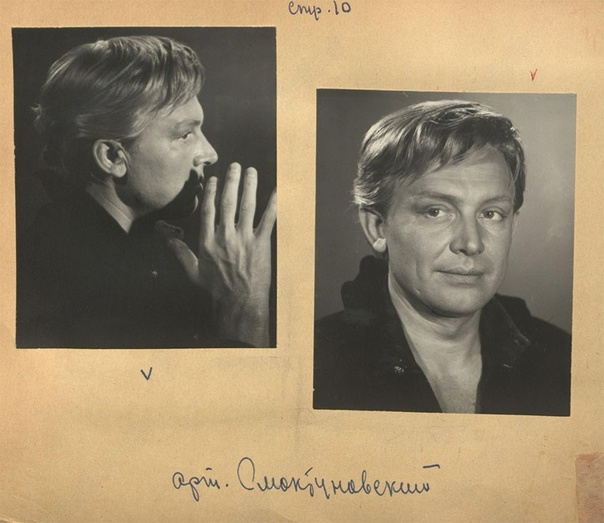

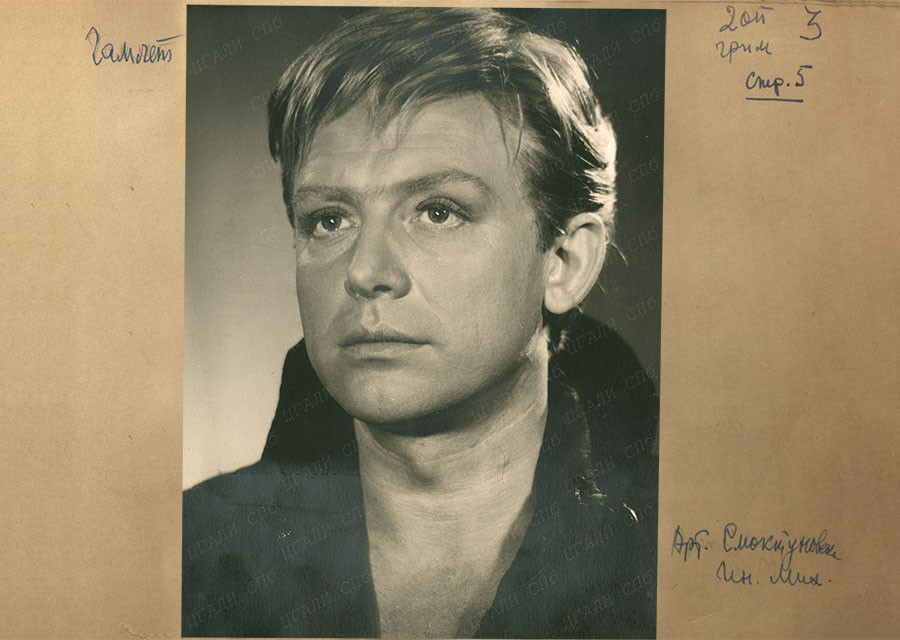

K 100 Letiyu Innokentiya Smoktunovskogo Istoriya Zhizni V Filme Menya Vela Kakaya To Sila

May 24, 2025

K 100 Letiyu Innokentiya Smoktunovskogo Istoriya Zhizni V Filme Menya Vela Kakaya To Sila

May 24, 2025 -

Analiz Proizvedeniya Gryozy Lyubvi Ili Ilicha Gazeta Trud

May 24, 2025

Analiz Proizvedeniya Gryozy Lyubvi Ili Ilicha Gazeta Trud

May 24, 2025 -

Lyudi Lyubyat Schekotat Nervy Refleksiya Fedora Lavrova O Pavle I I Zhanre Trillera

May 24, 2025

Lyudi Lyubyat Schekotat Nervy Refleksiya Fedora Lavrova O Pavle I I Zhanre Trillera

May 24, 2025 -

Teatr Mossoveta Vospominaniya O Sergee Yurskom

May 24, 2025

Teatr Mossoveta Vospominaniya O Sergee Yurskom

May 24, 2025 -

Dokumentalniy Film Menya Vela Kakaya To Sila Zhizn I Tvorchestvo Innokentiya Smoktunovskogo

May 24, 2025

Dokumentalniy Film Menya Vela Kakaya To Sila Zhizn I Tvorchestvo Innokentiya Smoktunovskogo

May 24, 2025