Amundi MSCI World II UCITS ETF Dist: Net Asset Value (NAV) Explained

Table of Contents

What is Net Asset Value (NAV) and how is it calculated?

Net Asset Value (NAV) represents the intrinsic value of each share in an ETF. It’s calculated by subtracting the ETF's liabilities from its total assets and then dividing by the number of outstanding shares. In simpler terms: (Assets - Liabilities) / Number of Shares Outstanding = NAV.

The assets of the Amundi MSCI World II UCITS ETF Dist primarily consist of its holdings in a diverse range of global stocks, mirroring the MSCI World Index. It also includes any cash reserves. Liabilities encompass management fees, administrative expenses, and other operational costs associated with running the ETF.

The NAV is calculated daily, typically at the close of market trading, and is publicly available. This daily calculation reflects the ongoing changes in the value of the underlying assets within the ETF.

- NAV reflects the intrinsic value of the ETF, representing the net worth of its holdings.

- NAV is crucial for determining the fair market price, providing a benchmark for evaluating whether the ETF is trading at a premium or discount.

- Understanding NAV helps in performance evaluation by providing a clear picture of the ETF's growth over time.

NAV vs. Market Price of Amundi MSCI World II UCITS ETF Dist

While the NAV provides a measure of the ETF's underlying asset value, the market price is the price at which the ETF shares are actually trading on the exchange. These two values can, and often do, differ.

Discrepancies between NAV and market price arise due to market forces like supply and demand. High trading volume can lead to temporary deviations, while low trading volume may cause larger discrepancies. Market sentiment and investor expectations also play a role. A premium (market price higher than NAV) might suggest strong investor demand, while a discount (market price lower than NAV) could indicate less enthusiastic market sentiment.

- Market price fluctuates throughout the trading day, reflecting real-time market activity.

- NAV is a more stable indicator of the underlying asset value, providing a more consistent measure of the ETF's worth.

- Premium or discount to NAV can signal market sentiment and potentially represent buying or selling opportunities.

Impact of Distributions on NAV

The Amundi MSCI World II UCITS ETF Dist pays out distributions to its shareholders, typically representing dividends received from the underlying companies held within the ETF. These distributions directly impact the NAV.

On the ex-dividend date, the NAV decreases by the amount of the distribution per share. This is because the ETF no longer holds the cash that has been distributed. However, investors who held shares before the ex-dividend date are still entitled to receive the distribution. If the distributions are reinvested, the number of shares held increases, partially offsetting the reduction in NAV per share.

- Distributions reduce NAV on the ex-dividend date.

- Reinvested distributions increase the number of shares held, potentially impacting overall returns.

- Understanding distribution impact is vital for long-term investment strategies and accurate performance assessment.

Using NAV to Make Informed Investment Decisions

By tracking the NAV of the Amundi MSCI World II UCITS ETF Dist over time, investors can gain valuable insights into its performance. Comparing the NAV to relevant benchmark indices, like the MSCI World Index, allows for relative performance assessment. Analyzing NAV trends helps identify periods of growth and potential risks.

While NAV is not the sole determinant of buy/sell decisions, it provides crucial context. Consider using the NAV alongside other metrics, such as expense ratios, trading volume, and your overall investment objectives, to arrive at informed investment choices.

- Track NAV over time to assess growth and performance of your investment.

- Compare NAV against benchmark indices to evaluate relative performance.

- Use NAV in conjunction with other metrics for holistic investment analysis and better decision-making.

You can usually find the daily NAV for the Amundi MSCI World II UCITS ETF Dist on the ETF provider's website, major financial news sources, and through your brokerage account.

Conclusion: Mastering Amundi MSCI World II UCITS ETF Dist: Net Asset Value (NAV)

Understanding the Amundi MSCI World II UCITS ETF Dist: Net Asset Value (NAV) is essential for any investor seeking to maximize their returns. By regularly monitoring the NAV and understanding its relationship to market price and distributions, you gain a clearer picture of your investment's performance and can make more informed decisions. Remember that NAV is just one piece of the puzzle; consider it alongside other relevant information for a holistic view. We encourage you to actively engage in Amundi MSCI World II UCITS ETF Dist NAV tracking and utilize this knowledge to refine your investment strategy. For further information on ETFs and NAV calculations, refer to reputable financial education resources and your investment advisor.

Featured Posts

-

Konchita Vurst O Evrovidenii 2025 Ee Prognoz Na Chetyrekh Pobediteley

May 24, 2025

Konchita Vurst O Evrovidenii 2025 Ee Prognoz Na Chetyrekh Pobediteley

May 24, 2025 -

Escape To The Country Building Your Dream Rural Property

May 24, 2025

Escape To The Country Building Your Dream Rural Property

May 24, 2025 -

Picture This 2023 The Full Soundtrack And Where To Find It

May 24, 2025

Picture This 2023 The Full Soundtrack And Where To Find It

May 24, 2025 -

Evrovidenie Pobediteli Poslednikh 10 Let Gde Oni Seychas

May 24, 2025

Evrovidenie Pobediteli Poslednikh 10 Let Gde Oni Seychas

May 24, 2025 -

Following Kyle Walkers Night Out Annie Kilners Solo Errands

May 24, 2025

Following Kyle Walkers Night Out Annie Kilners Solo Errands

May 24, 2025

Latest Posts

-

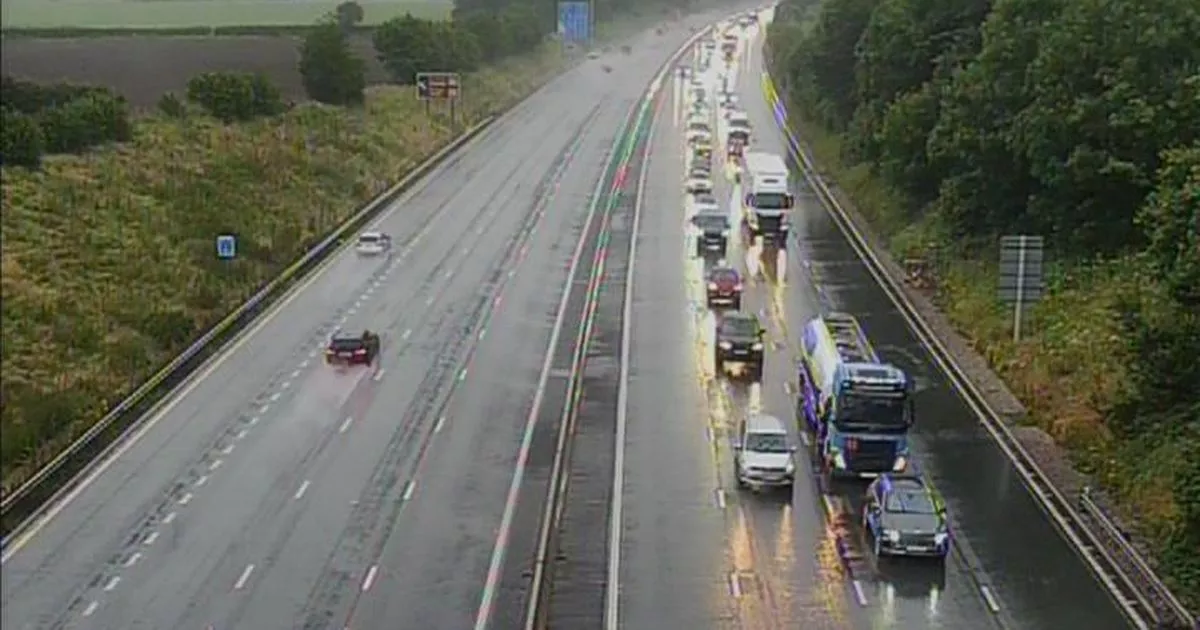

Serious M6 Crash Causes Major Traffic Disruption

May 24, 2025

Serious M6 Crash Causes Major Traffic Disruption

May 24, 2025 -

Live Updates Emergency Response Following Princess Road Accident

May 24, 2025

Live Updates Emergency Response Following Princess Road Accident

May 24, 2025 -

M62 Westbound Closure Manchester To Warrington Resurfacing Works

May 24, 2025

M62 Westbound Closure Manchester To Warrington Resurfacing Works

May 24, 2025 -

Live M56 Traffic Updates Motorway Closure After Serious Crash

May 24, 2025

Live M56 Traffic Updates Motorway Closure After Serious Crash

May 24, 2025 -

M56 Motorway Accident Live Traffic News And Delays

May 24, 2025

M56 Motorway Accident Live Traffic News And Delays

May 24, 2025