Amundi MSCI World II UCITS ETF Dist: Understanding Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the intrinsic value of a single share in an ETF like the Amundi MSCI World II UCITS ETF Dist. It's calculated by subtracting the ETF's total liabilities from its total assets. Think of it as the net worth of the ETF, divided by the number of outstanding shares. This calculation provides a snapshot of the underlying assets' value held within the fund.

It’s vital to understand the difference between NAV and market price.

- NAV represents the intrinsic value of the ETF. This is the actual value of the assets the ETF holds.

- Market price can fluctuate based on supply and demand. This means the price you buy or sell the ETF at might be slightly higher or lower than its NAV due to market forces.

- Understanding the relationship between NAV and market price helps assess investment opportunities. A significant deviation between the two could signal potential buying or selling opportunities.

How NAV Impacts Amundi MSCI World II UCITS ETF Dist Investors

The daily NAV changes directly affect your returns as an investor in the Amundi MSCI World II UCITS ETF Dist.

- NAV growth signifies positive performance. An increase in NAV means the value of the underlying assets has increased, resulting in a higher return on your investment.

- Tracking NAV helps monitor investment performance over time. By regularly reviewing the NAV, you can assess the long-term growth or decline of your investment.

- Regular NAV updates provide transparency to investors. This transparency allows investors to monitor their investments and make informed decisions. Furthermore, NAV is also a key factor in calculating dividend distributions. The fund's management uses the NAV to determine the amount distributed to shareholders.

Factors Affecting the NAV of Amundi MSCI World II UCITS ETF Dist

Several factors influence the NAV of the Amundi MSCI World II UCITS ETF Dist, primarily driven by the performance of its underlying assets, which track the MSCI World Index.

- Market performance of global equities: The performance of the global stock market, as represented by the MSCI World Index, is the dominant factor influencing the NAV. Positive market movements generally lead to NAV increases, while negative movements lead to decreases.

- Currency exchange rates: Because the Amundi MSCI World II UCITS ETF Dist invests globally, fluctuations in currency exchange rates can impact the NAV, particularly for investors holding the ETF in a currency different from the base currency of the fund.

- ETF operating expenses: Management fees and other operating expenses are deducted from the ETF's assets, impacting the final NAV calculation. These fees are usually relatively low for ETFs but still influence the overall NAV.

Where to Find the NAV of Amundi MSCI World II UCITS ETF Dist

Finding the daily NAV for the Amundi MSCI World II UCITS ETF Dist is straightforward.

- Amundi's official website: The most reliable source is the official Amundi website, where you will typically find a dedicated section for ETF information, including daily NAV updates.

- Major financial data providers: Many financial news websites and data providers (like Bloomberg, Yahoo Finance, Google Finance) display real-time or delayed NAV data for various ETFs, including the Amundi MSCI World II UCITS ETF Dist.

- Your brokerage account: Your brokerage account will also display the NAV of your Amundi MSCI World II UCITS ETF Dist holdings, often alongside other relevant investment information. The frequency of NAV updates is typically daily, reflecting the closing value of the underlying assets.

Conclusion

Understanding Net Asset Value (NAV) is fundamental to successful investing in the Amundi MSCI World II UCITS ETF Dist. By monitoring the NAV, you can track your investment's performance, assess its value, and make informed decisions about buying, selling, or holding your ETF shares. Regularly checking the NAV, understanding its relationship to market price, and recognizing the factors that influence it will enhance your investment strategy and improve your understanding of your portfolio's health. Mastering Net Asset Value (NAV) is key to successful Amundi MSCI World II UCITS ETF Dist investing. Stay informed about your Amundi MSCI World II UCITS ETF Dist investment by regularly monitoring its NAV.

Featured Posts

-

Sejarah Porsche 356 Pabrik Zuffenhausen Jerman

May 24, 2025

Sejarah Porsche 356 Pabrik Zuffenhausen Jerman

May 24, 2025 -

Memorial Day 2025 Air Travel Smartest Flight Dates To Book

May 24, 2025

Memorial Day 2025 Air Travel Smartest Flight Dates To Book

May 24, 2025 -

Lyudi Lyubyat Schekotat Nervy Refleksiya Fedora Lavrova O Pavle I I Zhanre Trillera

May 24, 2025

Lyudi Lyubyat Schekotat Nervy Refleksiya Fedora Lavrova O Pavle I I Zhanre Trillera

May 24, 2025 -

Experience Porsche At Indonesia Classic Art Week 2025

May 24, 2025

Experience Porsche At Indonesia Classic Art Week 2025

May 24, 2025 -

Joy Crookes New Song I Know You D Kill A Deep Dive

May 24, 2025

Joy Crookes New Song I Know You D Kill A Deep Dive

May 24, 2025

Latest Posts

-

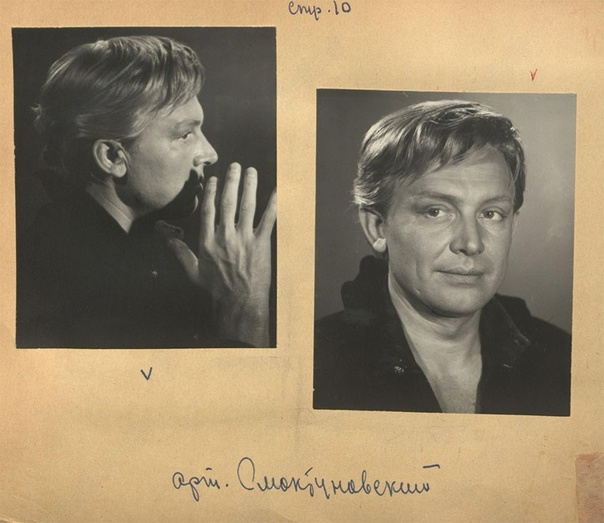

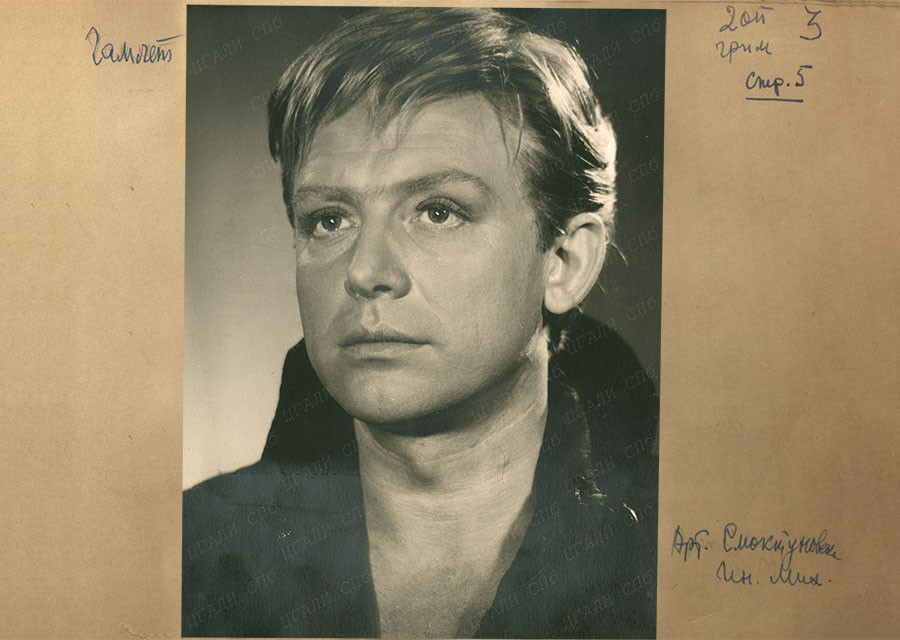

K 100 Letiyu Innokentiya Smoktunovskogo Istoriya Zhizni V Filme Menya Vela Kakaya To Sila

May 24, 2025

K 100 Letiyu Innokentiya Smoktunovskogo Istoriya Zhizni V Filme Menya Vela Kakaya To Sila

May 24, 2025 -

Analiz Proizvedeniya Gryozy Lyubvi Ili Ilicha Gazeta Trud

May 24, 2025

Analiz Proizvedeniya Gryozy Lyubvi Ili Ilicha Gazeta Trud

May 24, 2025 -

Lyudi Lyubyat Schekotat Nervy Refleksiya Fedora Lavrova O Pavle I I Zhanre Trillera

May 24, 2025

Lyudi Lyubyat Schekotat Nervy Refleksiya Fedora Lavrova O Pavle I I Zhanre Trillera

May 24, 2025 -

Teatr Mossoveta Vospominaniya O Sergee Yurskom

May 24, 2025

Teatr Mossoveta Vospominaniya O Sergee Yurskom

May 24, 2025 -

Dokumentalniy Film Menya Vela Kakaya To Sila Zhizn I Tvorchestvo Innokentiya Smoktunovskogo

May 24, 2025

Dokumentalniy Film Menya Vela Kakaya To Sila Zhizn I Tvorchestvo Innokentiya Smoktunovskogo

May 24, 2025