Amundi MSCI World II UCITS ETF USD Hedged Dist: A Deep Dive Into NAV Performance

Table of Contents

Understanding the Amundi MSCI World II UCITS ETF USD Hedged Dist

What is a UCITS ETF?

UCITS stands for Undertakings for Collective Investment in Transferable Securities. UCITS ETFs are regulated investment funds compliant with EU regulations, offering a high level of investor protection. This regulatory framework ensures transparency, standardized risk management, and investor safeguards. The Amundi MSCI World II UCITS ETF provides diversified exposure to a large number of global equities, simplifying the process of building a globally diversified portfolio. The UCITS structure is particularly attractive to international investors due to its regulatory clarity and portability across EU member states.

- Regulatory Benefits: Strict regulatory oversight ensures transparency and investor protection.

- Diversification: Access to a broad range of global equities, reducing overall portfolio risk.

- Accessibility: Easy to buy and sell on major exchanges, offering liquidity for investors.

The Significance of USD Hedging

Currency hedging aims to mitigate the risk associated with fluctuations in exchange rates. The Amundi MSCI World II UCITS ETF USD Hedged Dist employs a hedging strategy to reduce the impact of USD/investor-base-currency exchange rate movements on returns. This is beneficial for investors who primarily want to preserve their purchasing power in their local currency.

- Risk Reduction: Hedging minimizes the impact of unfavorable currency movements on investment returns.

- Predictability: Provides more predictable returns in the investor's local currency.

- Drawbacks: Hedging can limit potential upside if the USD appreciates against the investor's currency.

Tracking the MSCI World Index

The Amundi MSCI World II UCITS ETF tracks the MSCI World Index, a widely recognized benchmark representing large and mid-cap equities across developed markets globally. The index offers broad diversification across various sectors and geographies. While the ETF aims to replicate the index, a small tracking error may exist due to factors like transaction costs and index reconstitution.

- Broad Diversification: Exposure to a vast range of companies across developed markets.

- Benchmarking: Provides a clear benchmark to measure performance against.

- Tracking Error: A small deviation from the index's performance is possible.

Analyzing NAV Performance

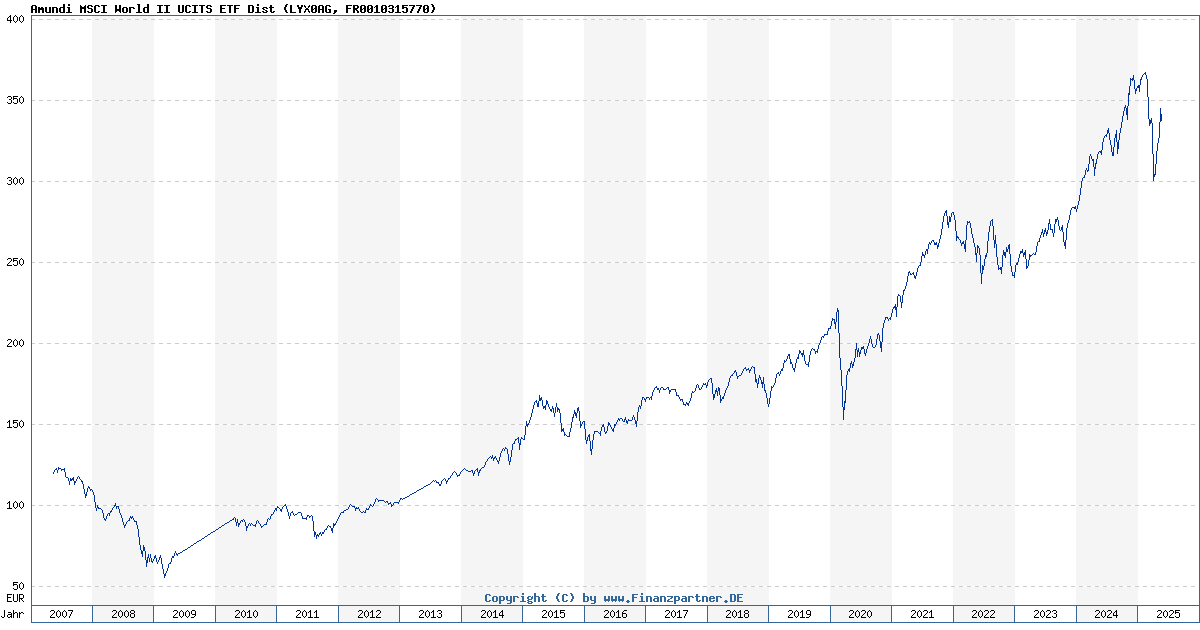

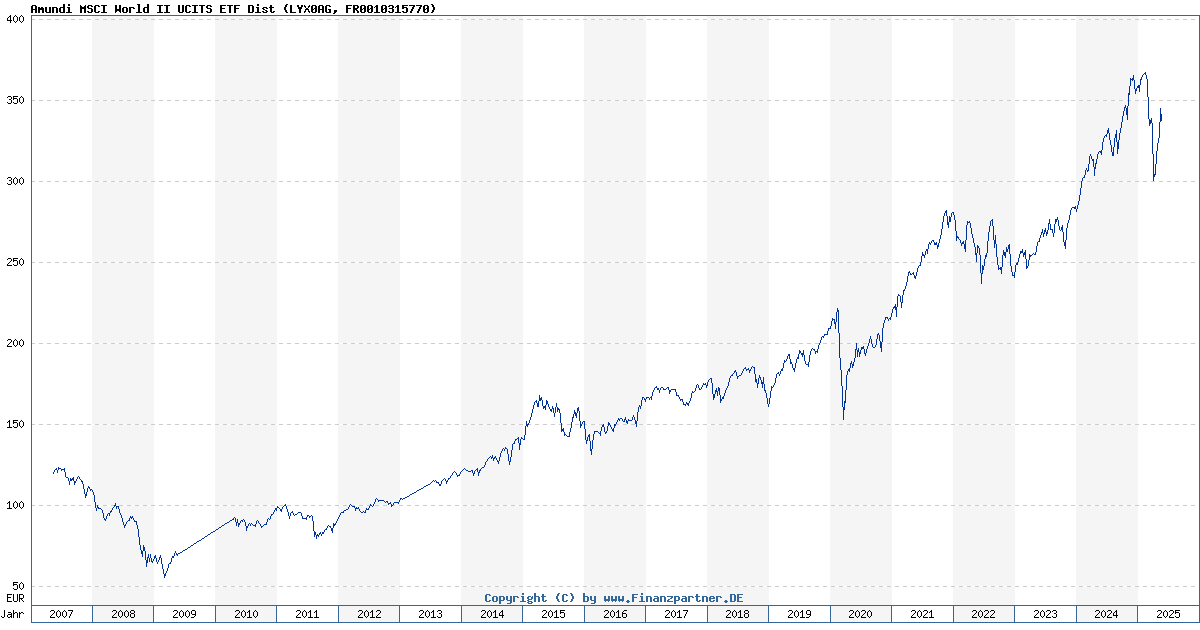

Historical NAV Performance Data

(This section would ideally include charts and graphs displaying historical NAV performance data. Key performance indicators like annualized return, standard deviation (volatility), Sharpe ratio, and maximum drawdown should be presented numerically and visually. A comparison to the unhedged MSCI World Index performance would also be valuable.)

Analyzing historical NAV data reveals [insert specific data points and interpretations here, for example: "a positive annualized return of X% over the past Y years, demonstrating consistent growth despite market fluctuations. The Sharpe ratio indicates [insert value], suggesting [interpretation of risk-adjusted return]. A comparison to the unhedged MSCI World Index highlights the impact of the currency hedging strategy, showing [comparison of performance]."]

Factors Affecting NAV Performance

Several factors influence the ETF's NAV performance:

- Global Economic Conditions: Economic growth, recessions, and market sentiment significantly impact equity markets.

- Interest Rates: Changes in interest rates affect company valuations and investor behavior.

- Geopolitical Events: Uncertainties stemming from global events can cause market volatility.

- Currency Fluctuations: While hedged, residual currency movements can still have a minor impact.

- Expense Ratios: The ETF's expense ratio directly impacts overall returns.

Amundi MSCI World II UCITS ETF USD Hedged Dist: Investment Strategies and Considerations

Suitable Investor Profiles

This ETF is well-suited for:

- Long-term investors: The ETF is designed for investors with a long-term investment horizon.

- Risk-averse investors: The currency hedging reduces some risk compared to unhedged alternatives.

- Investors seeking global diversification: The ETF offers broad exposure to global equities.

However, investors with a short-term investment horizon or a high-risk tolerance might find other investment options more suitable.

Diversification and Portfolio Allocation

The Amundi MSCI World II UCITS ETF USD Hedged Dist can be a core holding in a diversified portfolio. It provides exposure to global equities, a key asset class. Investors should consider other asset classes like bonds, real estate, and alternative investments to further diversify and manage risk effectively.

Comparing to Alternatives

(This section requires a comparison to other similar ETFs. Key differentiators should be highlighted, such as expense ratios, tracking accuracy, and hedging strategies.) For example, [mention competitor ETFs and discuss comparative expense ratios, tracking differences, and the nuances of their hedging strategies.]

Conclusion

The Amundi MSCI World II UCITS ETF USD Hedged Dist offers diversified exposure to global equities with the added benefit of currency hedging, aiming to reduce currency risk for investors. Analyzing historical NAV performance data provides insights into its risk-adjusted return and potential for long-term growth. However, potential investors should carefully consider their investment timeline, risk tolerance, and portfolio allocation strategy. Further research and consultation with a financial advisor are recommended before making any investment decisions related to the Amundi MSCI World II UCITS ETF USD Hedged Dist or any similar hedged ETF.

Featured Posts

-

Porsche Cayenne Gts Coupe Recenzja Po Jazdzie Pronej

May 25, 2025

Porsche Cayenne Gts Coupe Recenzja Po Jazdzie Pronej

May 25, 2025 -

Nemecky Pracovny Trh V Krize Rozsiahle Prepustanie V Najvaecsich Firmach

May 25, 2025

Nemecky Pracovny Trh V Krize Rozsiahle Prepustanie V Najvaecsich Firmach

May 25, 2025 -

Lauryn Goodmans Italy Move The Truth Behind The Kyle Walker Transfer Story

May 25, 2025

Lauryn Goodmans Italy Move The Truth Behind The Kyle Walker Transfer Story

May 25, 2025 -

Alnmw Alqyasy Ldaks Tjawz Mstwa Mars Wtathyrh Ela Alaswaq Alawrwbyt

May 25, 2025

Alnmw Alqyasy Ldaks Tjawz Mstwa Mars Wtathyrh Ela Alaswaq Alawrwbyt

May 25, 2025 -

Losses On Frankfurt Stock Exchange Dax Closes Below 24 000

May 25, 2025

Losses On Frankfurt Stock Exchange Dax Closes Below 24 000

May 25, 2025

Latest Posts

-

M6 Closure Real Time Updates On Crash And Associated Delays

May 25, 2025

M6 Closure Real Time Updates On Crash And Associated Delays

May 25, 2025 -

M6 Motorway Crash Current Traffic Conditions And Delays

May 25, 2025

M6 Motorway Crash Current Traffic Conditions And Delays

May 25, 2025 -

Severe Delays On M56 Cheshire And Deeside Motorway Traffic Disrupted

May 25, 2025

Severe Delays On M56 Cheshire And Deeside Motorway Traffic Disrupted

May 25, 2025 -

M56 Collision Near Cheshire Deeside Border Current Traffic Updates

May 25, 2025

M56 Collision Near Cheshire Deeside Border Current Traffic Updates

May 25, 2025 -

Cheshire Deeside M56 Traffic Major Delays After Collision

May 25, 2025

Cheshire Deeside M56 Traffic Major Delays After Collision

May 25, 2025