Amundi MSCI World II UCITS ETF USD Hedged Dist: A Guide To NAV And Performance

Table of Contents

Understanding the Amundi MSCI World II UCITS ETF USD Hedged Dist

The Amundi MSCI World II UCITS ETF USD Hedged Dist is an exchange-traded fund (ETF) that aims to track the performance of the MSCI World Index, while hedging currency risk against the US dollar. Let's break down the key terms:

- UCITS (Undertakings for Collective Investment in Transferable Securities): This signifies that the ETF complies with EU regulations, ensuring investor protection and harmonized standards.

- ETF (Exchange-Traded Fund): This is an investment fund that trades on stock exchanges like a regular stock, offering liquidity and transparency.

- USD Hedged: This crucial feature aims to minimize the impact of currency fluctuations between your base currency and the US dollar. This is beneficial for investors whose primary currency isn't the USD, protecting them from losses due to currency exchange rate movements.

The benefits of a USD-hedged strategy are significant, particularly in times of currency volatility. By mitigating currency risk, the ETF aims to provide a more stable return in the investor's base currency.

- Target market: This ETF is suitable for long-term investors seeking broad global diversification, particularly those who want to minimize currency risk associated with international investments.

- Underlying assets: The ETF tracks the MSCI World Index, a widely recognized benchmark that represents large and mid-cap equities across developed markets globally. Its composition covers a diverse range of sectors and geographies.

- Expense ratio: The expense ratio represents the annual cost of managing the ETF. It's important to compare this to similar ETFs to ensure competitive pricing. (Note: Always check the current expense ratio on the provider's website as it can change).

Deciphering Net Asset Value (NAV)

The Net Asset Value (NAV) represents the value of the ETF's underlying assets per share. For the Amundi MSCI World II UCITS ETF USD Hedged Dist, the NAV is calculated daily by summing the market values of all the securities held within the ETF, subtracting any liabilities, and then dividing by the total number of outstanding shares.

Several factors influence daily NAV fluctuations, including:

- Changes in the market value of the underlying assets: The performance of the companies whose shares are included in the MSCI World Index directly affects the NAV.

- Currency fluctuations: Despite the USD hedge, minor fluctuations can still impact the NAV.

- Dividends received: Dividend payments from the underlying companies will affect the NAV.

The NAV is crucial because it reflects the true intrinsic value of the ETF's holdings. While the market price of the ETF can deviate slightly from the NAV due to supply and demand, the NAV provides a more accurate representation of the underlying assets' value.

- Where to find the daily NAV: The Amundi website, major financial news sources, and your brokerage account typically provide daily NAV information.

- Importance of monitoring NAV: Tracking the NAV allows you to monitor the ETF's performance over time, ensuring alignment with your investment goals.

- Difference between NAV and bid/ask price: The bid price is what buyers are willing to pay, and the ask price is what sellers are willing to accept. The market price fluctuates around the NAV.

Analyzing Performance Metrics of the Amundi MSCI World II UCITS ETF USD Hedged Dist

Evaluating the performance of the Amundi MSCI World II UCITS ETF USD Hedged Dist requires analyzing several key performance indicators (KPIs):

-

Total Return: This reflects the overall return including capital appreciation and dividend distributions.

-

Annualized Return: This expresses the average annual growth rate over a specified period, facilitating comparisons across different timeframes.

-

Benchmark Comparison: The ETF’s performance should be compared to its benchmark, the MSCI World Index, to assess its tracking ability.

-

Volatility and Risk: Volatility, measured by standard deviation, quantifies the price fluctuations of the ETF, reflecting the inherent risk.

-

Where to find historical performance data: Amundi's website, financial data providers (e.g., Bloomberg, Refinitiv), and brokerage platforms provide historical performance data.

-

Importance of considering time horizons: Performance should be evaluated over appropriate time horizons, aligning with your investment strategy (e.g., long-term vs. short-term).

-

Interpreting performance charts and graphs: Familiarize yourself with common chart types (line graphs, bar charts) to understand performance trends.

Investment Strategies and Considerations

The Amundi MSCI World II UCITS ETF USD Hedged Dist can be incorporated into various investment strategies:

- Regular investment (dollar-cost averaging): Investing a fixed amount at regular intervals helps mitigate market timing risk.

- Lump sum investment: Investing a large amount at once, suitable for those with a higher risk tolerance and a longer time horizon.

Before investing, consider:

- Risk tolerance: Assess your comfort level with potential price fluctuations.

- Investment goals: Define your objectives (e.g., retirement, education) and the timeframe for achieving them.

Compared to other global equity ETFs, this ETF offers the advantage of currency hedging, which can be beneficial for investors concerned about currency exchange rate risks. However, it might have slightly higher expense ratios or slightly lower returns compared to unhedged counterparts depending on the market conditions.

- Tax implications: Be aware of any tax implications associated with your investment in the ETF.

Conclusion

Understanding the NAV and performance metrics of the Amundi MSCI World II UCITS ETF USD Hedged Dist is crucial for making well-informed investment decisions. Diligent research, monitoring of the NAV and performance against its benchmark, and consideration of your risk tolerance and investment goals are essential before investing. Remember to check the latest NAV and performance figures on the Amundi website and other reliable financial sources before committing your capital. Consider the Amundi MSCI World II UCITS ETF USD Hedged Dist as part of a well-diversified portfolio if its characteristics align with your investment strategy.

Featured Posts

-

Joy Crookes Unveils Carmen Her Latest Single

May 25, 2025

Joy Crookes Unveils Carmen Her Latest Single

May 25, 2025 -

Interview Matt Maltese On Intimacy Growth And His Sixth Album Her In Deep

May 25, 2025

Interview Matt Maltese On Intimacy Growth And His Sixth Album Her In Deep

May 25, 2025 -

Konchita Vurst Predskazyvaet Pobediteley Evrovideniya 2025 Chetverka Favoritov

May 25, 2025

Konchita Vurst Predskazyvaet Pobediteley Evrovideniya 2025 Chetverka Favoritov

May 25, 2025 -

Menelusuri Sejarah Porsche 356 Di Zuffenhausen Jerman

May 25, 2025

Menelusuri Sejarah Porsche 356 Di Zuffenhausen Jerman

May 25, 2025 -

Memorial Day 2025 Flight Bookings Tips For Avoiding Peak Travel

May 25, 2025

Memorial Day 2025 Flight Bookings Tips For Avoiding Peak Travel

May 25, 2025

Latest Posts

-

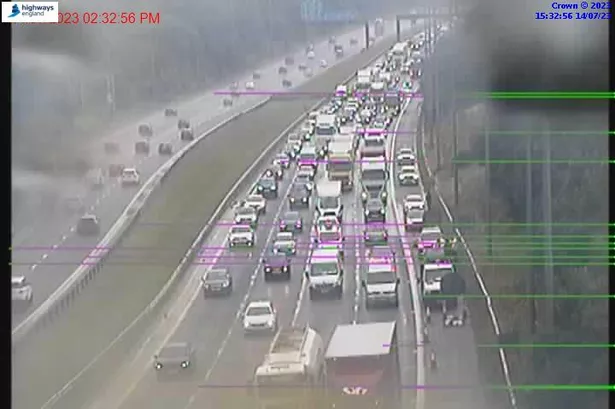

Car Overturns On M56 Motorway Crash Causes Casualties

May 25, 2025

Car Overturns On M56 Motorway Crash Causes Casualties

May 25, 2025 -

Sixty Minute Delays On M6 Southbound Due To Accident

May 25, 2025

Sixty Minute Delays On M6 Southbound Due To Accident

May 25, 2025 -

Traffic Alert M62 Westbound Closure For Resurfacing Manchester To Warrington

May 25, 2025

Traffic Alert M62 Westbound Closure For Resurfacing Manchester To Warrington

May 25, 2025 -

Serious M6 Crash Live Traffic News And Route Diversions

May 25, 2025

Serious M6 Crash Live Traffic News And Route Diversions

May 25, 2025 -

M6 Southbound Crash Causes 60 Minute Delays For Drivers

May 25, 2025

M6 Southbound Crash Causes 60 Minute Delays For Drivers

May 25, 2025