Analysis: Bank Of England's Potential Half-Point Interest Rate Cut

Table of Contents

Economic Indicators Pointing Towards a Rate Cut

Several key economic indicators suggest a rate cut might be on the horizon. However, the decision is far from straightforward, and the Bank of England's Monetary Policy Committee (MPC) will weigh these factors carefully.

Inflationary Pressures

The current UK inflation rate, as measured by the Consumer Price Index (CPI) and Retail Price Index (RPI), remains stubbornly high. While there are signs of cooling, it's unclear whether this deceleration is sufficient to justify a half-point cut. Contributing factors, such as persistently high energy prices and lingering supply chain issues, continue to exert upward pressure on UK inflation. Analyzing the inflation rate forecast is crucial to understanding the MPC's thinking.

- CPI and RPI: Monitoring the trends in both indices is vital for gauging the effectiveness of current monetary policy.

- Energy Prices: Fluctuations in global energy markets significantly impact inflation and could influence the Bank's decision.

- Supply Chain Disruptions: Ongoing supply chain bottlenecks add to inflationary pressures.

GDP Growth and Recession Risks

The UK's GDP growth has slowed considerably, raising concerns about a potential recession. A significant economic slowdown is a real possibility, impacting consumer spending and business investment. A rate cut could, in theory, stimulate economic growth by making borrowing cheaper and encouraging investment. However, the effectiveness of this approach depends on several other factors.

- Recession Probability: Economists are divided on the likelihood and depth of a potential UK recession.

- Consumer Confidence: Low consumer confidence further dampens spending and economic activity.

- Impact of Rate Cuts: Historically, rate cuts have helped stimulate economic growth, but their impact can be delayed and varied.

Unemployment Figures and Labour Market Dynamics

While unemployment rates in the UK remain relatively low, there are indications of a tightening labour market. This could impact consumer spending and economic growth. A rate cut might aim to prevent a sharp increase in unemployment by supporting businesses and encouraging job creation. However, this is a delicate balancing act, as excessive stimulus could exacerbate inflationary pressures.

- Unemployment Rate UK: Analyzing trends in unemployment offers insights into the health of the labor market.

- Job Market Dynamics: Changes in job creation and job losses are key indicators.

- Wage Growth: Rapid wage growth can contribute to a wage-price spiral, further complicating the decision.

Arguments Against a Half-Point Interest Rate Cut

Despite the economic headwinds, arguments against a half-point rate cut remain compelling. The MPC must consider the potential downsides of such a significant intervention.

Inflationary Concerns

A half-point cut risks reigniting inflationary pressures. Lower interest rates could encourage borrowing and spending, potentially leading to a wage-price spiral – a situation where rising wages fuel further price increases, creating a vicious cycle. The Bank of England's primary mandate is to control inflation, and a significant rate cut could jeopardize this goal. The BoE inflation report will offer crucial insights into their thinking.

- Inflation Target: The MPC is tasked with keeping inflation close to its target, typically around 2%.

- Wage-Price Spiral Risks: This is a significant concern that could make the MPC hesitant to cut rates aggressively.

- Monetary Policy Committee's independence: The committee operates independently from the government.

Impact on the Pound Sterling

A rate cut could weaken the Pound Sterling relative to other currencies. This would make imports more expensive, potentially exacerbating inflationary pressures. The impact on the exchange rate needs careful consideration. A weaker pound can also affect UK businesses reliant on exports, making them less competitive in international markets.

- Currency Market Volatility: Rate cuts can trigger volatility in the currency markets.

- Import Prices: A weaker pound increases the cost of imported goods.

- Export Competitiveness: The effects on export competitiveness are complex and depend on various factors.

International Economic Factors

Global economic conditions play a significant role in the Bank of England's decision-making. Interest rate differentials between the UK and other major economies, such as the US (US Federal Reserve), influence capital flows and exchange rates. The global economy's overall health significantly affects the UK's economic outlook and the MPC's choices.

Potential Consequences of a Half-Point Interest Rate Cut

A half-point rate cut would have wide-ranging consequences for the UK economy, affecting individuals, businesses, and the overall financial system.

Impact on Borrowing Costs

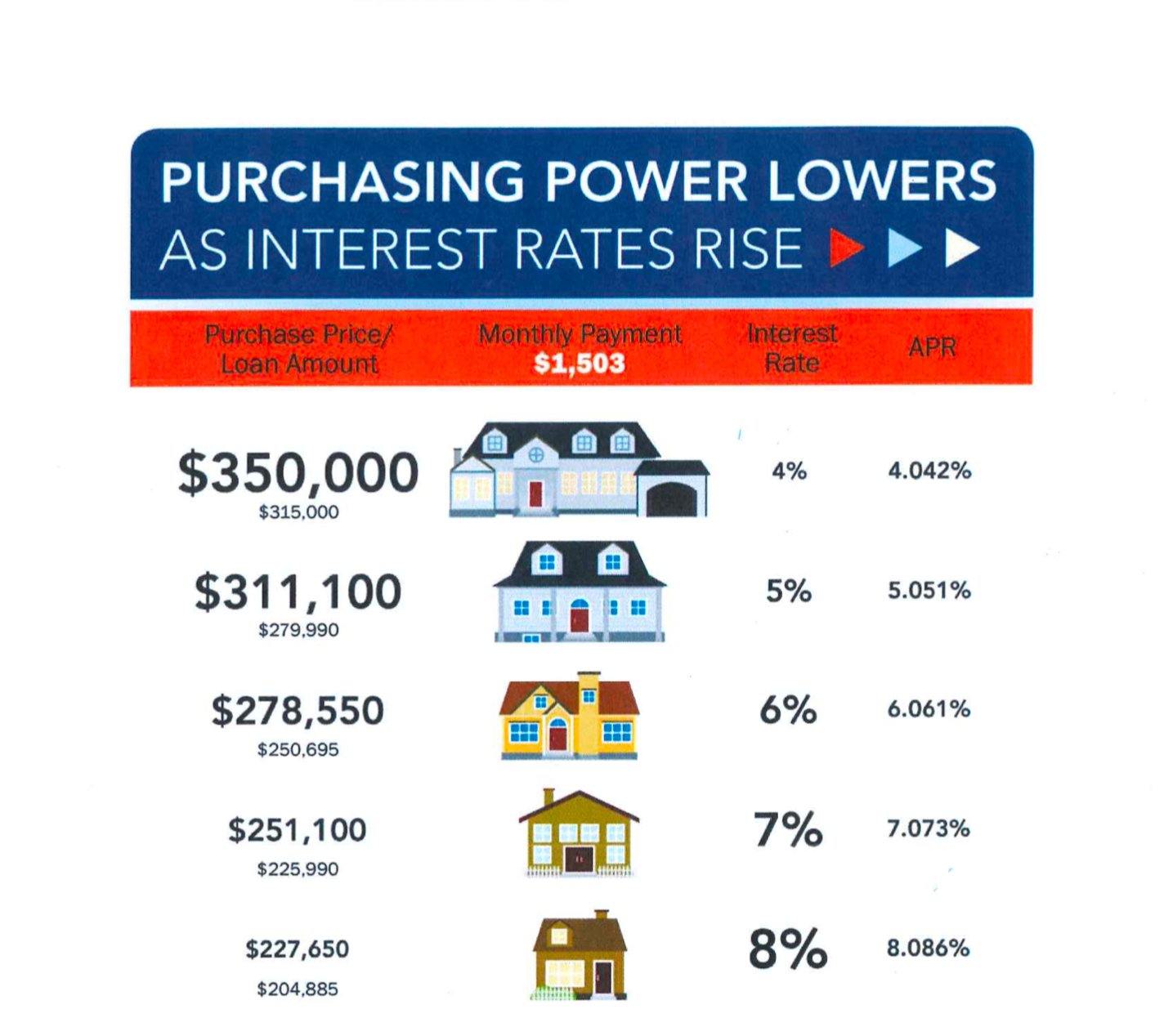

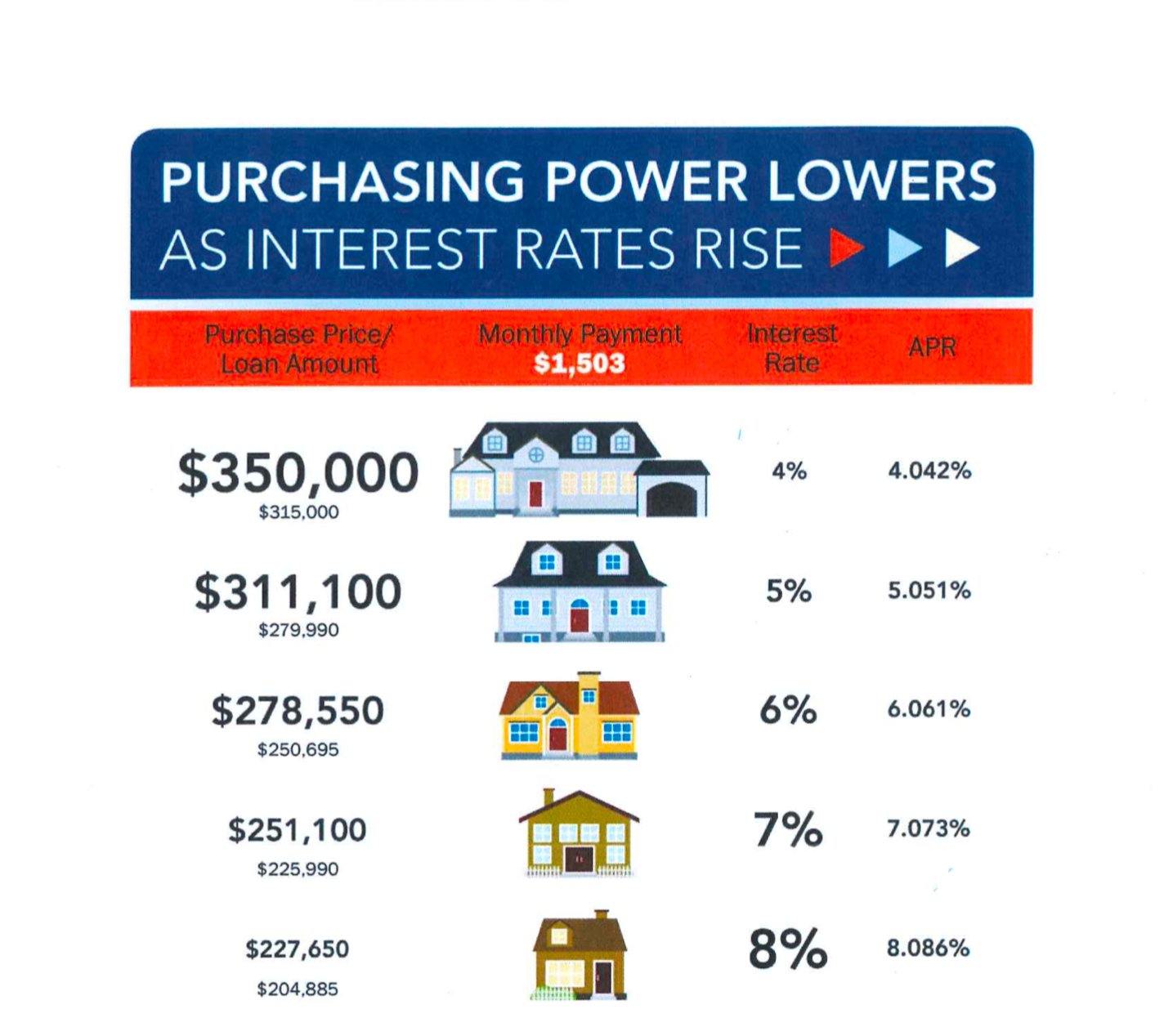

Lower interest rates would reduce borrowing costs for mortgages, loans, and other forms of borrowing. This could stimulate consumer spending and investment. However, it would also likely lead to lower returns on savings accounts.

- Mortgage Rates: A significant reduction in mortgage rates could boost the housing market.

- Business Investment: Lower borrowing costs might encourage businesses to invest more.

- Consumer Spending: Reduced borrowing costs could lead to increased consumer spending.

Impact on Savings

Lower interest rates would mean lower savings rates and returns on savings accounts and other investments. This could negatively impact household finances, especially for those relying on savings income.

- Return on Savings: Reduced interest rates lead to lower returns for savers.

- Household Finances: This could have significant implications for households relying on savings income.

- Pension Funds: Lower interest rates could impact the returns of pension funds.

Long-Term Economic Outlook

The long-term economic effects of a half-point rate cut are uncertain. While it could provide short-term stimulus, it could also exacerbate inflationary pressures or weaken the pound in the long run. The long-term economic outlook depends on many factors and the effectiveness of other government policies.

- Economic Growth: The impact on economic growth is likely to be varied and depend on other economic factors.

- Economic Stability: The potential impact on economic stability needs careful analysis.

- Risks and Opportunities: Weighing the potential risks and opportunities of a rate cut is crucial.

Analyzing the Bank of England's Potential Half-Point Interest Rate Cut – What's Next?

The decision regarding a Bank of England's potential half-point interest rate cut is complex and fraught with challenges. While a rate cut might offer some short-term economic benefits, the risks of fueling inflation and weakening the pound are significant. The MPC must carefully weigh these competing considerations. The likelihood of a cut remains uncertain, but monitoring key economic indicators and the Bank's pronouncements is crucial. Stay informed about future announcements regarding the Bank of England's interest rate policy. Share your thoughts and analysis on this crucial decision in the comments below! Let's continue the discussion on the Bank of England's potential half-point interest rate cut and its implications for the UK economy.

Featured Posts

-

Cryptocurrencys Resilience Navigating The Trade War

May 08, 2025

Cryptocurrencys Resilience Navigating The Trade War

May 08, 2025 -

Former Uber Ceo Kalanick Reveals Regret Over Project Name Cancellation

May 08, 2025

Former Uber Ceo Kalanick Reveals Regret Over Project Name Cancellation

May 08, 2025 -

Xrp News 3 Reasons For A Potential Xrp Price Surge And Remittix Ico Success

May 08, 2025

Xrp News 3 Reasons For A Potential Xrp Price Surge And Remittix Ico Success

May 08, 2025 -

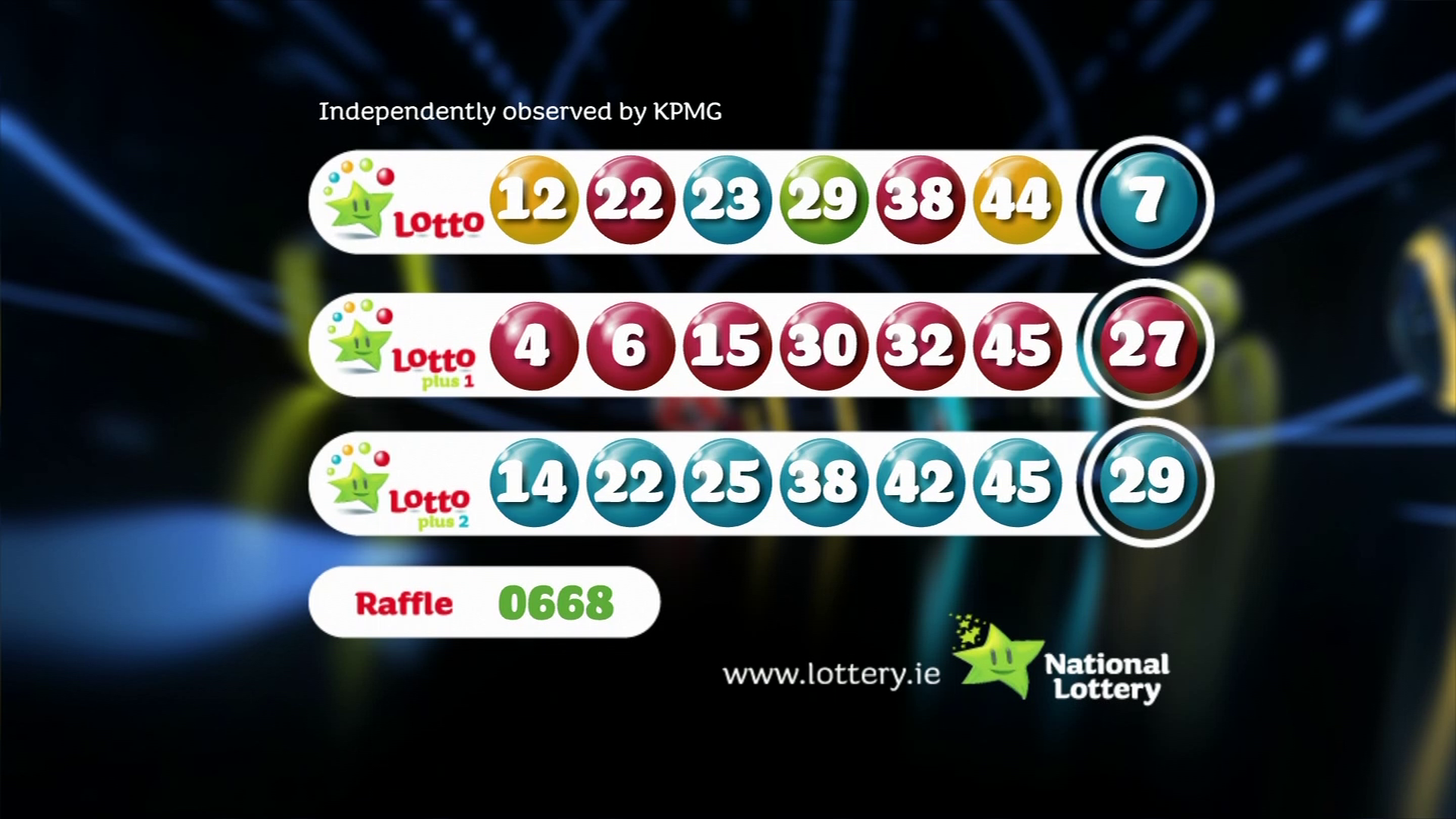

Saturday April 12th Lotto Draw Winning Numbers And Prizes

May 08, 2025

Saturday April 12th Lotto Draw Winning Numbers And Prizes

May 08, 2025 -

Owen Hargreaves Champions League Final Prediction Arsenal Vs Psg

May 08, 2025

Owen Hargreaves Champions League Final Prediction Arsenal Vs Psg

May 08, 2025