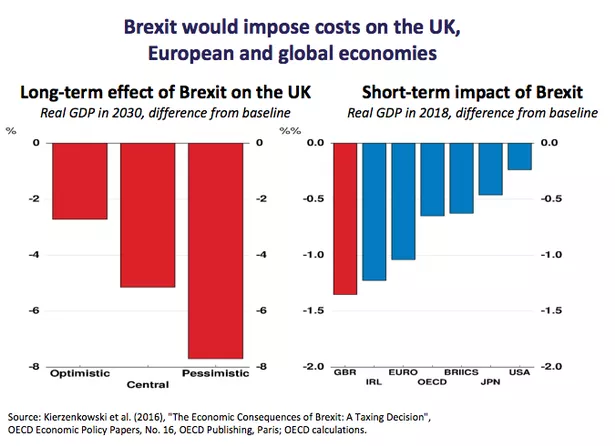

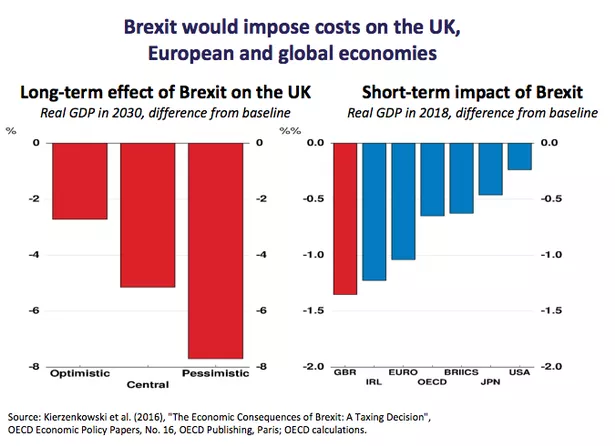

Analysis: Brexit's Negative Effect On UK Luxury Exports To The EU

Table of Contents

Increased Trade Barriers and Bureaucracy

Brexit has erected significant trade barriers between the UK and the EU, creating substantial hurdles for luxury goods exporters. The new customs checks, tariffs, and mountains of paperwork required have dramatically increased the complexity and cost of exporting.

- Increased shipping times and costs: Customs delays lead to longer transit times and increased transportation expenses, impacting profitability and potentially damaging perishable goods.

- Higher administrative costs: Compliance with new regulations necessitates employing specialized staff and investing in sophisticated software to manage customs declarations, significantly increasing administrative overheads.

- Risk of goods being held up or rejected: Even minor paperwork errors can result in delays, rejection of goods at the border, and substantial financial losses. This is particularly problematic for time-sensitive luxury goods deliveries.

- Specific examples: The impact is felt across various luxury sectors. Scotch whisky exports face increased tariffs and logistical challenges, while high-end car manufacturers grapple with complex customs procedures. Designer clothing brands also experience delays and added costs impacting their supply chains. These issues collectively hinder the efficient flow of luxury goods from the UK to the EU.

The Impact of the Strong Pound

Post-Brexit exchange rate fluctuations have further exacerbated the challenges faced by UK luxury exporters. The stronger pound, compared to the Euro in certain periods, has made UK luxury goods more expensive for EU consumers.

- Reduced price competitiveness: A stronger pound directly increases the price of UK luxury items in the EU market, reducing their attractiveness compared to competitors from other countries offering similar products at more competitive price points.

- Decreased demand and market share: As UK luxury goods become pricier, demand inevitably falls, leading to a decline in market share for UK brands within the EU. This loss of market share can be devastating for businesses reliant on EU sales.

- Competitive disadvantage: Competitors from countries with weaker currencies, such as Italy or France, gain a considerable advantage, offering comparable luxury goods at significantly lower prices for EU consumers.

Loss of Access to the Single Market

Before Brexit, UK businesses enjoyed seamless access to the EU's single market, a vast consumer base with streamlined trade. Leaving this market has had significant consequences.

- Reduced free movement of goods: The free flow of goods, a cornerstone of the single market, has been disrupted, leading to increased logistical complexities and higher costs for UK luxury exporters.

- Loss of preferential access: Brexit resulted in the loss of preferential access to the EU market, meaning UK luxury exporters now face tariffs and other trade barriers that did not previously exist. This severely impacts competitiveness.

- Difficulty accessing EU distribution networks: Establishing and maintaining efficient distribution networks within the EU is now significantly more challenging, adding further complexity and cost to the export process. This hinders reaching key retail channels.

The Decline in Consumer Confidence and Demand

Brexit uncertainty has negatively impacted consumer confidence both in the UK and within the EU. This uncertainty has directly affected demand for UK luxury goods.

- Decreased consumer confidence: Post-Brexit economic volatility and uncertainty have led to decreased consumer confidence in the UK, impacting domestic demand and potentially reducing the overall perceived value of UK luxury brands.

- Reduced willingness to purchase: EU consumers may be less willing to purchase UK luxury goods due to concerns about economic instability and potential supply chain disruptions. This hesitation further reduces demand.

- Long-term damage to brand reputation: The negative publicity surrounding Brexit and its economic consequences could potentially damage the long-term reputation of UK luxury brands in the EU market, making it harder to regain lost market share.

Potential Solutions and Mitigation Strategies

While the challenges are considerable, UK luxury exporters can employ several strategies to mitigate the negative impacts of Brexit.

- Invest in streamlined customs processes: Investing in efficient customs processes and compliance systems can minimize delays and reduce administrative costs associated with exporting to the EU.

- Diversify export markets: Reducing reliance on the EU market by actively exploring and developing new export markets globally can lessen the impact of Brexit-related trade barriers.

- Adapt pricing strategies: Carefully adjusting pricing strategies to remain competitive within the EU market while maintaining profitability is crucial. This might involve absorbing some costs or finding efficiencies elsewhere in the business.

- Strengthen relationships with EU distributors: Maintaining strong relationships with established EU distributors and retailers can help navigate logistical challenges and ensure continued access to key distribution channels.

Navigating the Post-Brexit Landscape for UK Luxury Exports to the EU

Brexit has undeniably created significant challenges for UK luxury exports to the EU. Increased trade barriers, currency fluctuations, loss of single market access, and decreased consumer confidence have all contributed to a decline in exports. Understanding these challenges is crucial for survival and growth. Investing in efficient customs processes, diversifying export markets, adapting pricing strategies, and strengthening relationships with EU distributors are vital steps for UK luxury businesses to navigate this new trade environment and secure their future in the European market. Take proactive steps to mitigate these challenges and secure your future in the European market. The future of UK luxury exports to the EU hinges on adapting and innovating in the face of these new realities.

Featured Posts

-

Breaking The Trans Australia Run Record The Current Landscape

May 21, 2025

Breaking The Trans Australia Run Record The Current Landscape

May 21, 2025 -

Transparency And Trumps Aerospace Legacy A Review Of Publicly Available Information

May 21, 2025

Transparency And Trumps Aerospace Legacy A Review Of Publicly Available Information

May 21, 2025 -

Couple Arrested Following Antiques Roadshow Appraisal Of National Treasure

May 21, 2025

Couple Arrested Following Antiques Roadshow Appraisal Of National Treasure

May 21, 2025 -

Combate Las Enfermedades Cronicas El Superalimento Que Te Ayudara A Envejecer Bien

May 21, 2025

Combate Las Enfermedades Cronicas El Superalimento Que Te Ayudara A Envejecer Bien

May 21, 2025 -

Sell America Moodys 30 Year Yield Hike To 5 And Its Market Impact

May 21, 2025

Sell America Moodys 30 Year Yield Hike To 5 And Its Market Impact

May 21, 2025

Latest Posts

-

How To Dress For Breezy And Mild Weather

May 21, 2025

How To Dress For Breezy And Mild Weather

May 21, 2025 -

Overnight Storm Potential Severe Weather Risk On Monday

May 21, 2025

Overnight Storm Potential Severe Weather Risk On Monday

May 21, 2025 -

Finding Comfort In Breezy And Mild Conditions

May 21, 2025

Finding Comfort In Breezy And Mild Conditions

May 21, 2025 -

Watch 10 Minnesota Twins Games On Kcrg Tv 9

May 21, 2025

Watch 10 Minnesota Twins Games On Kcrg Tv 9

May 21, 2025 -

Breezy And Mild Your Guide To Optimal Outdoor Comfort

May 21, 2025

Breezy And Mild Your Guide To Optimal Outdoor Comfort

May 21, 2025