Analysis: Chinese Stocks Recover Following Trading Suspension – Implications Of US Discussions And Recent Data

Table of Contents

The Role of US-China Discussions in the Market Rebound

The thawing of US-China relations has played a significant role in the recent recovery of Chinese stocks. Concerns over a protracted trade war and the potential delisting of Chinese companies from US exchanges had previously weighed heavily on investor sentiment. However, recent diplomatic talks have yielded some positive signals, easing some of these anxieties and contributing to increased investor confidence.

- Easing Tensions: Recent high-level diplomatic engagements between the US and China have resulted in a de-escalation of tensions, particularly regarding trade and technology. This improved communication has reduced the perceived risk of further escalation.

- Reduced Delisting Risk: While the threat of delisting remains a concern for some investors, the recent diplomatic overtures have somewhat lessened the immediate pressure, leading to a more optimistic outlook. The ongoing discussions offer hope for a more stable regulatory environment.

- Trade Negotiation Signals: Positive signals from trade negotiations, even if incremental, have helped to alleviate uncertainty surrounding future regulatory hurdles for Chinese companies operating in the US and globally. This improved clarity is a key factor driving the market recovery.

- Specific Agreements: While details of specific agreements reached during recent US-China discussions are often kept confidential, the mere act of engaging in productive dialogue has a considerable positive impact on investor confidence. This willingness to communicate and find common ground signals a potential path toward reduced trade friction.

- Lingering Uncertainties: Despite the positive developments, significant uncertainties remain. The long-term trajectory of US-China relations is still unpredictable, and potential future obstacles could easily impact investor sentiment. This underscores the need for continuous monitoring of the evolving geopolitical landscape.

Impact of Recent Chinese Economic Data on Stock Performance

Alongside the improved geopolitical climate, positive Chinese economic data has provided further impetus for the market rebound. Better-than-expected performance in several key indicators has boosted investor confidence in the country's economic resilience and future growth potential.

- Stronger-than-Expected GDP Growth: Recent GDP growth figures, exceeding analyst expectations, signaled a robust recovery from previous economic slowdowns, driving investor enthusiasm. This positive economic indicator offers assurance of sustained growth.

- Key Economic Indicators: A closer look at indicators like consumer spending, industrial production, and inflation rates reveals a positive trend, further bolstering the market's upward momentum. Analyzing these interconnected metrics offers a more holistic picture of the Chinese economy.

- Sustaining the Upward Trend: The potential for future economic growth to sustain the upward trend in Chinese stocks depends largely on the continued implementation of effective economic policies and the maintenance of stable domestic and international relations.

- Data Discrepancies: It's crucial to acknowledge that inconsistencies or discrepancies in reported economic data can occur. Investors need to approach economic reports with a critical eye, considering potential biases and limitations in data collection methods.

- Historical Comparisons: Comparing the current economic performance with previous years and predictions allows for a more informed assessment of the recovery's strength and sustainability. This historical perspective allows for a nuanced understanding of the current economic climate.

Sector-Specific Analysis of the Recovery

The recovery in Chinese stocks hasn't been uniform across all sectors. While some sectors have seen significant gains, others have lagged behind. Understanding these sector-specific trends is vital for informed investment decisions.

- Tech Stocks: The tech sector has generally experienced strong growth, driven by the continued expansion of the digital economy and government support for technological innovation. Market capitalization in this sector has significantly increased.

- Real Estate: The real estate sector, while facing ongoing regulatory scrutiny, has shown signs of recovery, driven partly by government policies aimed at stabilizing the market. However, it remains a sector with inherent risks and volatility.

- Energy and Consumer Goods: The energy and consumer goods sectors have demonstrated varied performance, influenced by factors such as global commodity prices and changing consumer spending habits. These sectors demonstrate the interconnected nature of the Chinese economy with global markets.

- Sector-Specific Trends: Identifying the specific factors driving performance within each sector—regulatory changes, policy shifts, technological advancements—is crucial for effective investment strategy. This detailed analysis allows for a more targeted approach.

- Market Capitalization Changes: Tracking changes in market capitalization within each sector provides a quantitative measure of the recovery's impact and allows for comparative analysis. Visualizing these changes through charts and graphs facilitates a clearer understanding of the sector-specific trends.

Investment Implications and Future Outlook for Chinese Stocks

Investing in Chinese stocks presents both significant opportunities and considerable risks. A well-defined investment strategy is essential for navigating the complexities of this market.

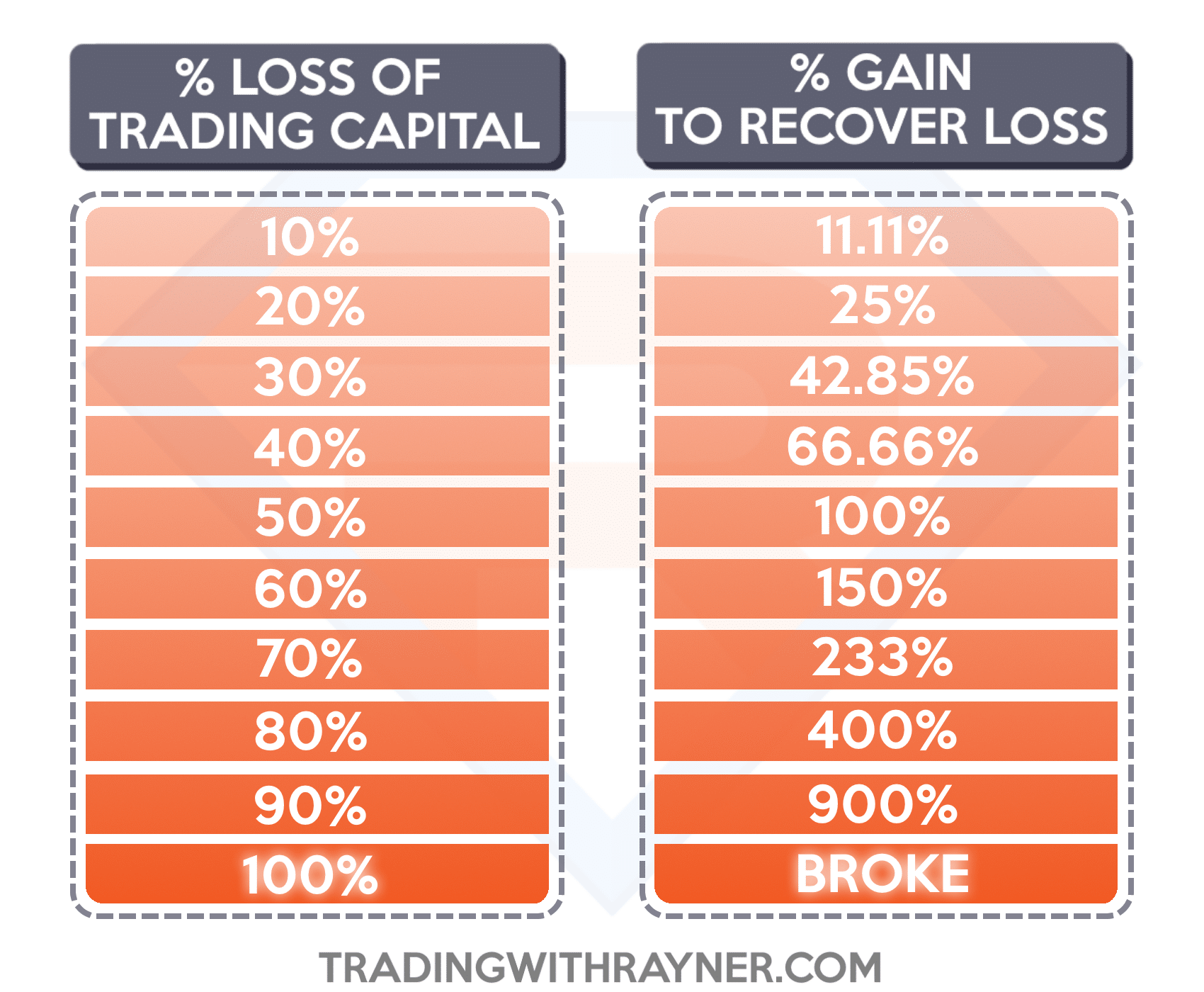

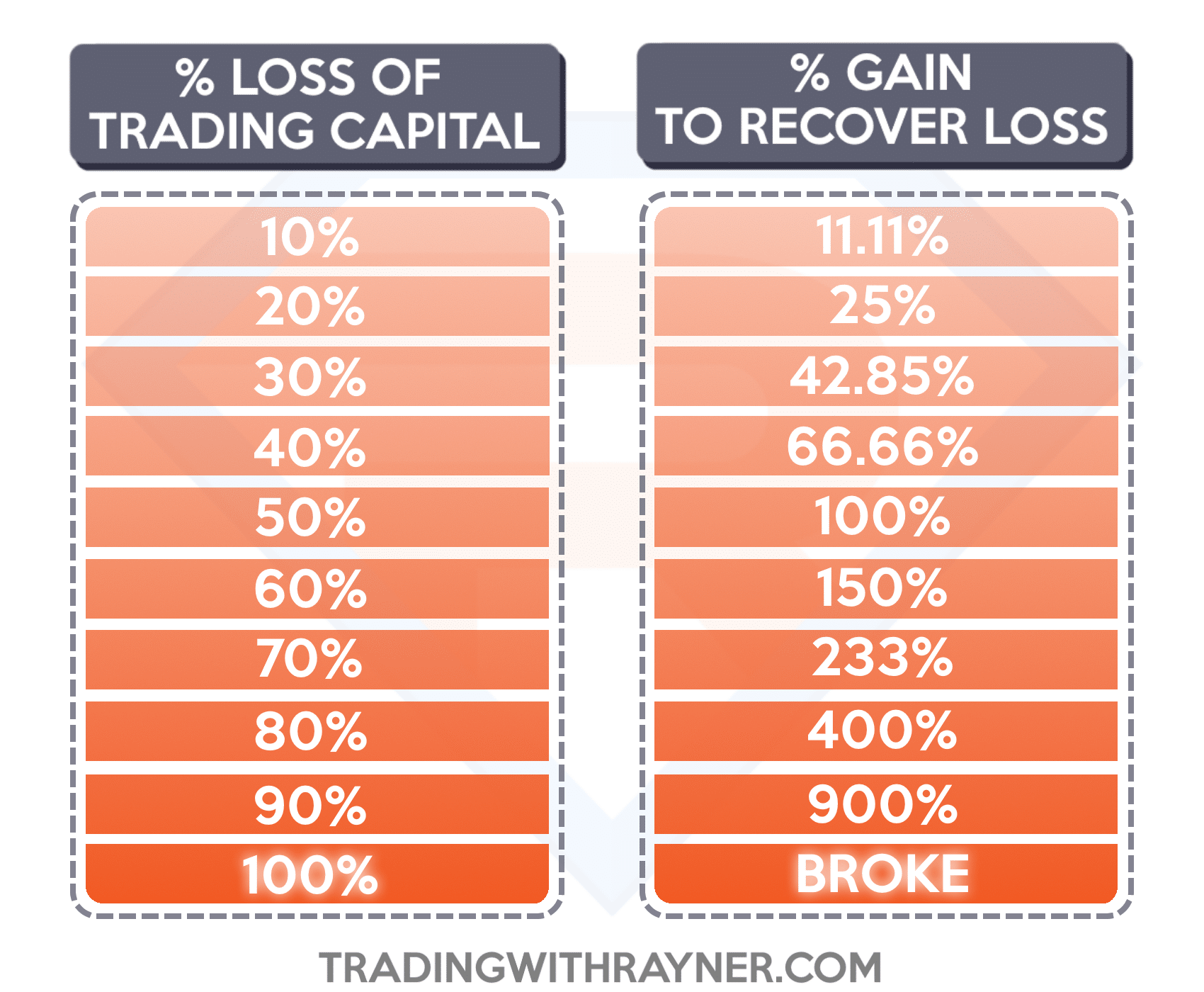

- Risk Assessment: Investors must carefully assess the inherent risks associated with investing in Chinese stocks, including geopolitical risks, regulatory uncertainty, and market volatility. A thorough understanding of these risks is crucial.

- Investment Strategies: Various investment strategies, ranging from long-term value investing to short-term trading, can be employed depending on individual risk tolerance and investment goals. Diversification is key.

- Short-Term Gains vs. Long-Term Growth: The potential for both short-term gains and long-term growth exists in the Chinese stock market. However, the timing of these gains is unpredictable and depends on various factors.

- Due Diligence: Thorough due diligence is critical before investing in any Chinese company. Understanding a company's financials, business model, and regulatory compliance is essential. Independent research and analysis are imperative.

- Macroeconomic and Geopolitical Factors: Macroeconomic factors and geopolitical risks must be considered when formulating an investment strategy. Staying informed about developments in US-China relations is vital.

Conclusion

The recent recovery of Chinese stocks is a multifaceted phenomenon driven by a combination of improved US-China relations and positive economic data. This market rebound presents opportunities, but investors must carefully assess the risks and conduct thorough due diligence before making investment decisions. The interplay of US-China relations and the performance of key economic indicators creates a dynamic investment landscape. Understanding these factors is crucial for success in navigating the complexities of this ever-evolving market. Stay informed on the latest developments in US-China relations and Chinese economic data to make informed decisions regarding your investment in Chinese stocks. Successfully investing in Chinese equities requires continuous monitoring and a nuanced understanding of the market's intricate dynamics.

Featured Posts

-

Oscar 2024 Mick Jagger E O Medo Brasileiro De Pe Frio

May 07, 2025

Oscar 2024 Mick Jagger E O Medo Brasileiro De Pe Frio

May 07, 2025 -

Find The Daily Lotto Results For Wednesday April 16th 2025

May 07, 2025

Find The Daily Lotto Results For Wednesday April 16th 2025

May 07, 2025 -

Anthony Edwards And Mike Conley Lead Jazz Gobert Out Against Rockets

May 07, 2025

Anthony Edwards And Mike Conley Lead Jazz Gobert Out Against Rockets

May 07, 2025 -

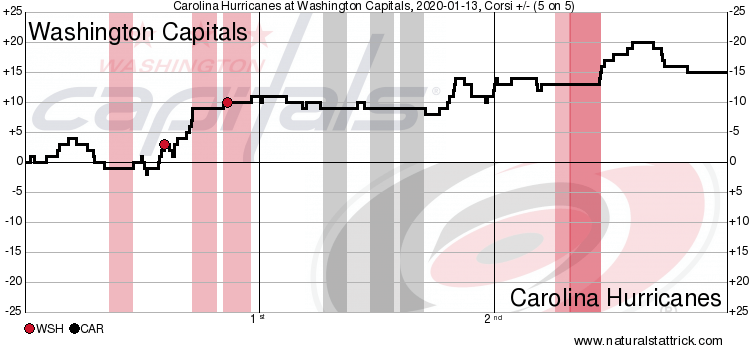

Ilya Samsonov And Alex Ovechkin A Defining Moment In Hockey History

May 07, 2025

Ilya Samsonov And Alex Ovechkin A Defining Moment In Hockey History

May 07, 2025 -

Alkhtwt Almlkyt Almghrbyt Tkhtt Lzyadt Edd Rhlatha Ila Saw Bawlw

May 07, 2025

Alkhtwt Almlkyt Almghrbyt Tkhtt Lzyadt Edd Rhlatha Ila Saw Bawlw

May 07, 2025

Latest Posts

-

Feds Charge Individual With Millions In Office365 Executive Account Theft

May 08, 2025

Feds Charge Individual With Millions In Office365 Executive Account Theft

May 08, 2025 -

16 Million Penalty T Mobiles Three Year Data Breach Settlement

May 08, 2025

16 Million Penalty T Mobiles Three Year Data Breach Settlement

May 08, 2025 -

Cybercriminal Makes Millions From Executive Office365 Account Hacks

May 08, 2025

Cybercriminal Makes Millions From Executive Office365 Account Hacks

May 08, 2025 -

T Mobile Hit With 16 Million Fine For Data Breaches Spanning Three Years

May 08, 2025

T Mobile Hit With 16 Million Fine For Data Breaches Spanning Three Years

May 08, 2025 -

Millions Stolen Inside Job Reveals Office365 Executive Account Vulnerability

May 08, 2025

Millions Stolen Inside Job Reveals Office365 Executive Account Vulnerability

May 08, 2025