Analysis: House Passes Revised Trump Tax Legislation

Table of Contents

Key Changes in the Revised Trump Tax Legislation

The revised Trump tax legislation introduced several key modifications compared to the original proposal. These alterations aimed to address criticisms and potentially improve the bill's overall impact. Understanding these changes is crucial to grasping the full scope of the legislation.

- Individual Tax Rate Adjustments: [Explain specific changes to individual tax brackets and rates. For example: "The revised bill slightly lowered the top individual income tax rate from 37% to 35%, while increasing the standard deduction for married couples filing jointly."]

- Changes to Corporate Tax Rates: [Explain modifications to corporate tax rates. For example: "The corporate tax rate, initially set at 21%, remained unchanged in the revised legislation."]

- Modifications to Deductions: [Detail changes to deductions like SALT (State and Local Taxes) and standard deductions. For example: "The revised bill maintained the limitations on SALT deductions, a point of contention during the original bill's passage. The standard deduction remained largely unchanged."]

- Alterations to Tax Credits: [Discuss any changes to specific tax credits, such as child tax credits or earned income tax credits. For example: "The child tax credit was expanded to include more families with lower incomes."]

- Impact on Specific Income Brackets: [Analyze how different income brackets are affected. For example: "Lower-income families saw a minimal increase in their tax burden due to the expanded child tax credit, while high-income earners experienced a slight reduction in their overall tax liability."]

Political Ramifications of the Revised Bill's Passage

The passage of the revised Trump tax bill had significant political ramifications. The voting breakdown largely followed party lines, with [Insert Percentage]% of Republicans voting in favor and [Insert Percentage]% of Democrats voting against. This partisan divide underscores the deep ideological differences surrounding tax policy in the US.

- Impact on the President's Legacy: The revised bill's passage contributed significantly to the President's legislative agenda. [Discuss the positive and/or negative implications for the president's image and legacy.]

- Shifting Power Dynamics within Congress: [Analyze how the bill's passage affected the balance of power within Congress. Did it strengthen or weaken certain factions?]

- Potential Future Legislative Battles Related to Tax Policy: The revised bill is likely to trigger further debates on tax reform, potentially leading to future legislative battles. [Discuss potential areas of future conflict regarding tax policy.]

Economic Implications of the Revised Trump Tax Legislation

The economic implications of the revised Trump tax legislation are complex and multifaceted. While proponents argued it would stimulate economic growth, critics raised concerns about its potential to exacerbate income inequality and increase the national debt.

- Impact on National Debt: The tax cuts are projected to [Increase/Decrease] the national debt by [Amount]. [Explain the impact of this change.]

- Effects on Income Inequality: [Discuss the bill's potential effect on the gap between rich and poor. Consider providing data or projections.]

- Potential for Job Creation or Loss: [Analyze the bill's potential effects on job creation and job losses across various sectors. Provide evidence or forecasts to support the analysis.]

- Long-Term Economic Consequences: The long-term consequences of the revised Trump tax legislation are difficult to predict with certainty, but they will likely have a significant influence on future economic policies. [Discuss potential long-term effects.]

Analysis of the Revised Bill's Long-Term Effects

Predicting the long-term effects of the revised Trump tax legislation requires careful consideration of various factors, including economic fluctuations and potential unintended consequences.

- Potential Need for Future Tax Reform: [Explain the likelihood of future tax reforms based on the revised bill's impact.]

- Adaptability to Changing Economic Conditions: [Discuss the bill's adaptability to changing economic circumstances.]

- Long-Term Impact on Government Revenue: [Analyze the projected impact on government revenue over the long term.]

- Potential for Legal Challenges: [Discuss the potential for legal challenges to various aspects of the revised bill.]

Conclusion: Understanding the Implications of the Revised Trump Tax Legislation

The revised Trump tax legislation represents a significant shift in US tax policy. This article examined its core changes, political ramifications, economic implications, and long-term effects. The bill's passage has created a complex interplay of political and economic factors, whose long-term consequences remain to be seen. Understanding the intricacies of this legislation is crucial for navigating the evolving economic and political landscape. Stay informed about the ongoing impact of this landmark legislation by following our updates on the Trump Tax Legislation and its ongoing effects. [Insert Link to Further Resources]

Featured Posts

-

Partial Evacuation Ordered In Swiss Municipality Due To Landslide Risk

May 23, 2025

Partial Evacuation Ordered In Swiss Municipality Due To Landslide Risk

May 23, 2025 -

What Businesses Are Open On Memorial Day 2025 In Michigan

May 23, 2025

What Businesses Are Open On Memorial Day 2025 In Michigan

May 23, 2025 -

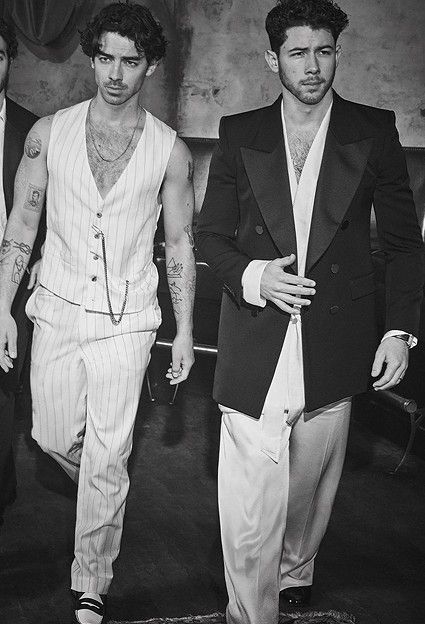

A Couples Fight Joe Jonass Classy Response

May 23, 2025

A Couples Fight Joe Jonass Classy Response

May 23, 2025 -

Babalarin En Cok Yaktigi Erkek Burclari Guevenilir Calkantili Ve Sadik Midirlar

May 23, 2025

Babalarin En Cok Yaktigi Erkek Burclari Guevenilir Calkantili Ve Sadik Midirlar

May 23, 2025 -

Joe Jonass Mature Response To A Couples Fight

May 23, 2025

Joe Jonass Mature Response To A Couples Fight

May 23, 2025

Latest Posts

-

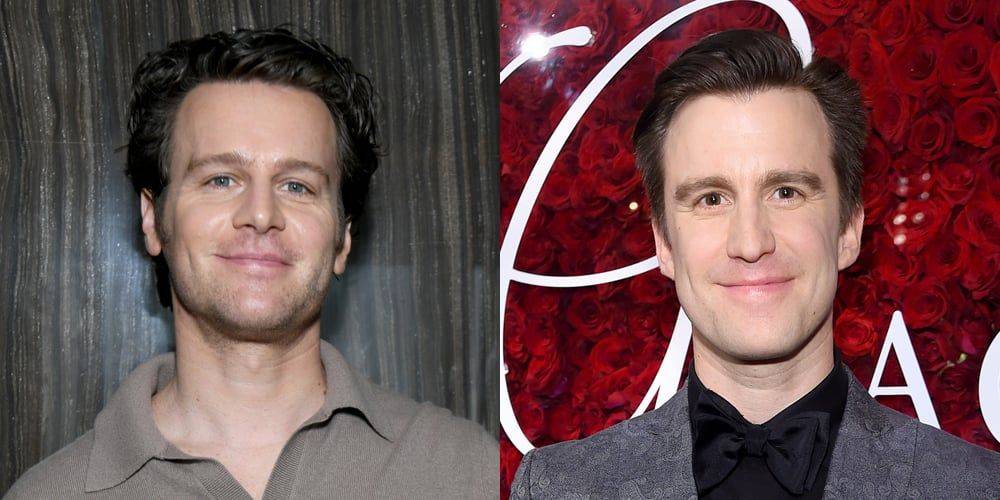

Review Jonathan Groffs Just In Time Captures The Spirit Of Bobby Darin

May 23, 2025

Review Jonathan Groffs Just In Time Captures The Spirit Of Bobby Darin

May 23, 2025 -

Just In Time Musical Review Groffs Performance Makes This Show A Hit

May 23, 2025

Just In Time Musical Review Groffs Performance Makes This Show A Hit

May 23, 2025 -

Jonathan Groff And The Asexual Community

May 23, 2025

Jonathan Groff And The Asexual Community

May 23, 2025 -

Asexual Identity Jonathan Groff Shares His Story

May 23, 2025

Asexual Identity Jonathan Groff Shares His Story

May 23, 2025 -

Jonathan Groff The Just In Time Performance And His Intense Drive To Perform

May 23, 2025

Jonathan Groff The Just In Time Performance And His Intense Drive To Perform

May 23, 2025