Analysis: How China's Lithium Export Restrictions Benefit Eramet

Table of Contents

Increased Global Lithium Demand and Supply Constraints

The burgeoning electric vehicle (EV) market and the expanding renewable energy sector are driving unprecedented demand for lithium. This growing need surpasses current production capabilities, creating a significant supply-demand imbalance that is further exacerbated by China's export restrictions.

The Growing Need for Lithium-ion Batteries

- Increasing EV sales globally: The global transition to electric mobility is accelerating, leading to exponential growth in lithium-ion battery demand.

- Rising demand for energy storage solutions: The integration of renewable energy sources, such as solar and wind power, requires large-scale energy storage solutions, further boosting lithium demand.

- Limited geographical distribution of lithium resources: Lithium resources are not evenly distributed globally, concentrating production and processing in specific regions, creating vulnerabilities in the supply chain.

China's Role as a Dominant Player

China has historically been a major processor and exporter of lithium compounds, controlling a significant portion of the global refining capacity. The recent export restrictions aim to prioritize domestic needs and reduce reliance on foreign sources of raw materials, directly impacting the global availability of lithium.

- China's dominance in lithium refining: China's processing capabilities have been crucial for the global lithium supply chain. Its restrictions create a bottleneck in the market.

- Impact of export restrictions on global supply chains: The restrictions disrupt established supply chains, forcing companies to seek alternative sources of lithium and potentially increasing costs.

- Price volatility in the lithium market: The interplay of increased demand and constrained supply due to China's actions has led to significant price fluctuations in the lithium market, creating both risks and opportunities.

Eramet's Strategic Positioning and Diversification

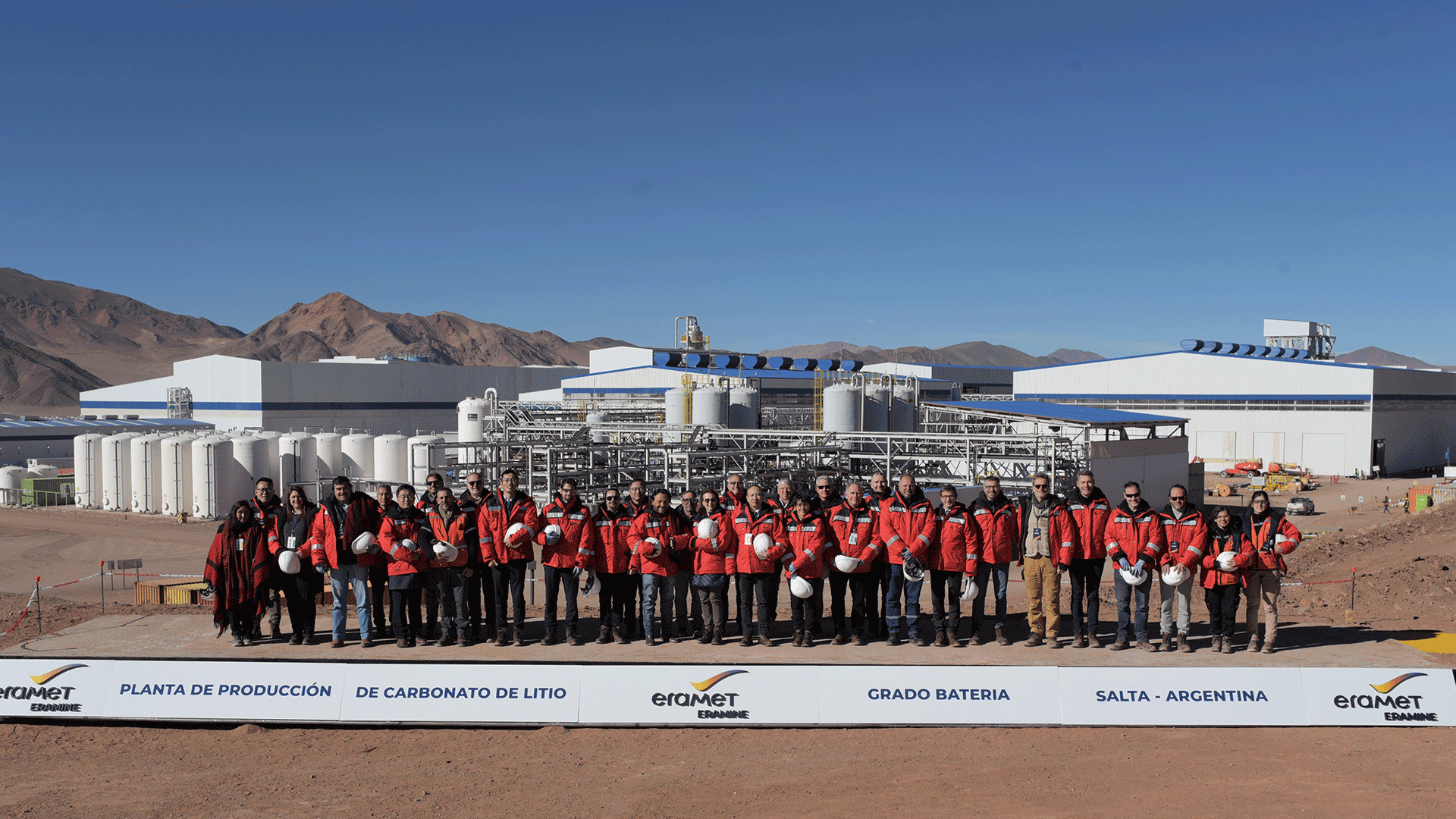

Eramet, a multinational mining and metallurgy group, is strategically positioned to benefit from China's lithium export restrictions. Its existing projects and vertical integration strategy provide resilience against supply chain disruptions.

Eramet's Lithium Projects and Investments

Eramet is actively involved in lithium projects worldwide, investing in both upstream mining and downstream processing. These initiatives are increasingly crucial given the tightening global lithium supply.

- List of Eramet's key lithium projects: Eramet's projects, located in various regions, reduce their reliance on any single source. Specific details on production capacity and geographic location can be found on their website.

- Investment in upstream and downstream operations: Eramet's vertical integration, controlling the entire value chain from mining to processing, allows it to manage costs and secure supply.

- Partnerships and collaborations: Eramet actively seeks partnerships and collaborations to accelerate project development and access new technologies.

Vertical Integration and Supply Chain Resilience

Eramet's vertical integration strategy—controlling raw material sourcing, processing, and refining—is a key advantage in the current market environment. This approach minimizes reliance on external suppliers and mitigates the risk of supply chain disruptions.

- Control over raw materials: Securing access to raw materials minimizes vulnerability to price volatility and supply chain bottlenecks.

- Processing capabilities: Eramet's own processing facilities offer greater control over the quality and availability of lithium products.

- Relationships with downstream battery manufacturers: Direct relationships with battery manufacturers provide a stable market for Eramet's lithium products.

Geopolitical Implications and Market Opportunities

China's actions have dramatically altered the geopolitical landscape of the lithium market, opening up new opportunities for companies like Eramet.

Shifting Geopolitical Landscape

The changing dynamics create a more diverse and potentially less China-centric lithium market.

- Diversification away from China: Companies are actively seeking alternative sources of lithium, reducing reliance on a single dominant player.

- Increased interest in sustainable and ethically sourced lithium: The focus on responsible sourcing and sustainable mining practices is growing, creating opportunities for companies with strong ESG credentials.

- Opportunities for new strategic partnerships: The reshaped market encourages new alliances and collaborations between mining companies, processors, and battery manufacturers.

Eramet's Competitive Advantage

Eramet's geographic diversification, sustainable mining practices, and technological capabilities give it a competitive edge.

- Sustainable mining practices: Eramet's commitment to sustainability resonates with environmentally conscious consumers and businesses.

- Technological innovation: Investment in advanced technologies optimizes production processes and reduces environmental impact.

- Proximity to key markets: Strategic locations of projects provide efficient access to major lithium consuming regions.

Conclusion

China's lithium export restrictions have created significant challenges but also unveiled new opportunities for Western mining and processing companies. Eramet, with its strategic investments, vertical integration, and geographic diversification, is well-positioned to capitalize on this shift in the global lithium market. The increased demand and limited supply are creating a favorable environment for players like Eramet to expand their market share and solidify their position as a key supplier of lithium materials. Understanding the impact of China's lithium export restrictions is crucial for navigating the evolving lithium market.

To learn more about how Eramet is adapting to the changing dynamics of the lithium market and the impact of China's export restrictions, visit [link to Eramet's website or relevant resource]. Stay informed about the evolving landscape of China's lithium export restrictions and their impact on global lithium market dynamics.

Featured Posts

-

Federer Se Vra A Iz Ava O Zhelji Za Punim Stadionima I Publikom

May 14, 2025

Federer Se Vra A Iz Ava O Zhelji Za Punim Stadionima I Publikom

May 14, 2025 -

Viimeisimmaet Eurojackpot Tulokset Ilta Sanomat

May 14, 2025

Viimeisimmaet Eurojackpot Tulokset Ilta Sanomat

May 14, 2025 -

Tom Cruises Death Defying Stunt 8000 Feet 140 Mph Winds In Mission Impossible Dead Reckoning Sneak Peek

May 14, 2025

Tom Cruises Death Defying Stunt 8000 Feet 140 Mph Winds In Mission Impossible Dead Reckoning Sneak Peek

May 14, 2025 -

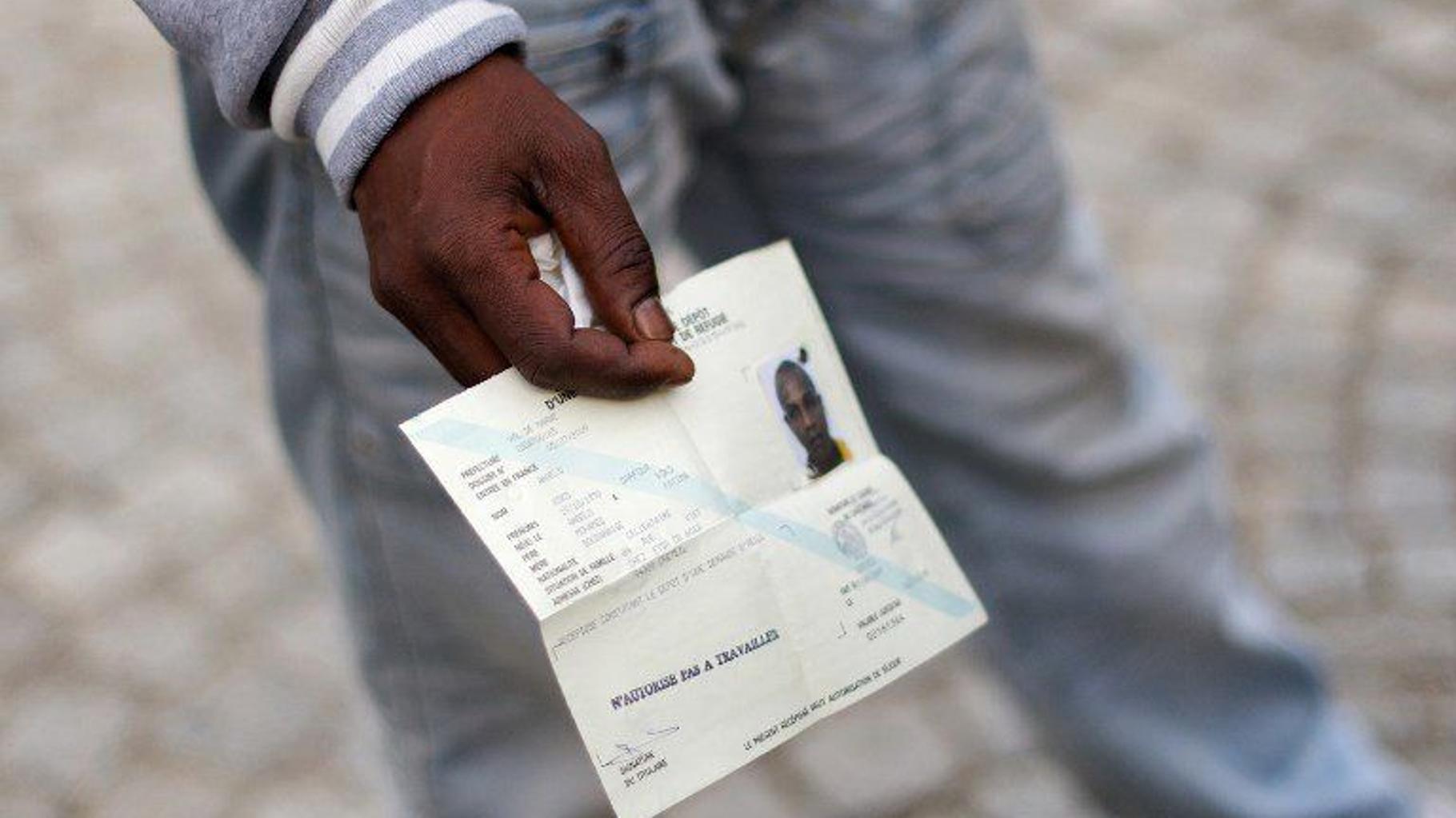

Aide Et Solidarite Accrues Pour Les Demandeurs D Asile A Bourg En Bresse

May 14, 2025

Aide Et Solidarite Accrues Pour Les Demandeurs D Asile A Bourg En Bresse

May 14, 2025 -

Dean Huijsen Transfer Arsenal And Chelsea Face Stiff Competition

May 14, 2025

Dean Huijsen Transfer Arsenal And Chelsea Face Stiff Competition

May 14, 2025