Analysis: How Trump's Tariffs Are Affecting Auto Manufacturers

Table of Contents

Increased Costs of Imported Parts and Materials

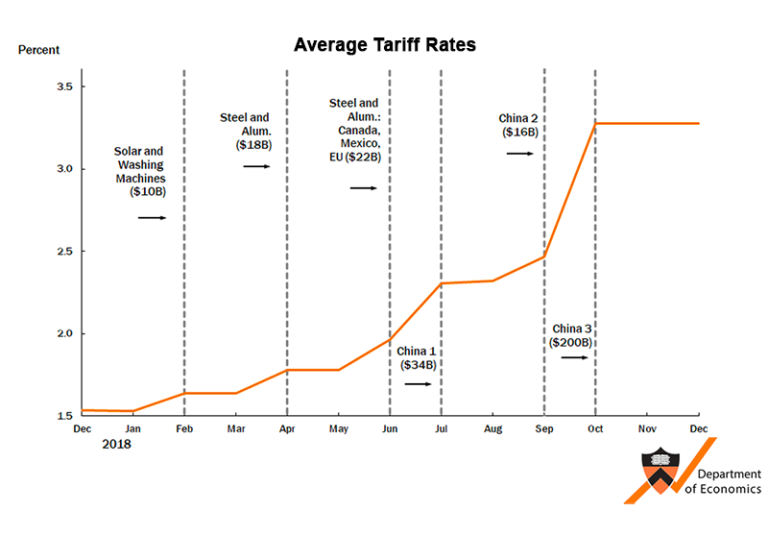

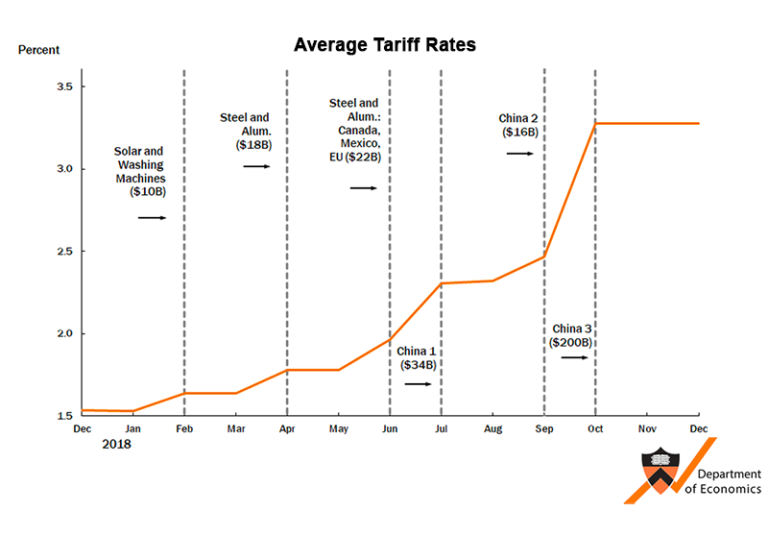

Trump's tariffs, particularly those targeting steel and aluminum, directly increased production costs for auto manufacturers. These levies, imposed under the guise of national security, significantly impacted the cost of essential imported materials.

- Higher prices for steel and aluminum components: The tariffs led to a substantial increase in the price of steel and aluminum, key components in vehicle manufacturing. This translated to higher manufacturing costs per vehicle. For example, the price of steel increased by approximately 25%, directly impacting the bottom line of automakers.

- Increased costs for imported tires, electronics, and other parts: The ripple effect extended beyond steel and aluminum. Tariffs on other imported parts, including tires, electronic components, and various other specialized parts, further escalated production costs. This added complexity to the already intricate supply chains of the automotive industry.

- Reduced profit margins for automakers: The increased costs of materials squeezed profit margins for automakers. Companies faced the difficult choice of absorbing these increased costs, reducing profits, or passing them on to consumers through higher vehicle prices.

- Pressure to raise vehicle prices to maintain profitability: Many automakers were forced to raise vehicle prices to offset the increased production costs stemming from the tariffs, potentially impacting consumer demand and market share. Data from the Bureau of Labor Statistics showed a clear correlation between the implementation of tariffs and the subsequent rise in vehicle prices.

Reduced Competitiveness in the Global Market

The tariffs imposed by the Trump administration made US-manufactured vehicles more expensive in international markets, significantly impacting export sales and the overall competitiveness of American automakers.

- Decreased export volume to countries impacted by retaliatory tariffs: Countries targeted by US tariffs responded with their own retaliatory tariffs on US goods, including vehicles. This resulted in a significant decrease in the export volume of US-made cars to these markets. The EU, for example, imposed retaliatory tariffs on several US goods, impacting US auto exports considerably.

- Loss of market share to competitors from countries with lower production costs: With increased production costs due to tariffs, US automakers found themselves at a disadvantage against competitors from countries with lower production costs and less restrictive trade policies. This led to a loss of market share in both domestic and international markets.

- Impact on foreign manufacturing plants owned by US automakers: The tariffs also affected the profitability and competitiveness of US automakers' foreign manufacturing plants. These plants, often located in countries with favorable production costs, faced increased challenges due to the altered global trade landscape.

- Reduced global sales revenue for affected companies: The combination of decreased export volume and loss of market share resulted in reduced global sales revenue for several major US auto manufacturers. Financial reports from leading companies clearly reflected this negative impact.

Shifting Production and Investment Strategies

In response to the tariffs, auto manufacturers adjusted their production and investment strategies, leading to significant shifts in the global automotive landscape.

- Increased investment in domestic steel and aluminum production: Some automakers increased their investment in domestic steel and aluminum production, seeking to reduce their reliance on imported materials and mitigate the impact of tariffs. This involved substantial capital investment and a renewed focus on domestic supply chains.

- Reshoring of some manufacturing processes to the US: Several companies considered or implemented reshoring initiatives, moving some manufacturing processes back to the US from overseas facilities. This decision, while potentially reducing reliance on imported parts, came with increased labor and production costs.

- Expansion of production facilities in countries with lower tariff barriers: Other automakers opted to expand their production facilities in countries with lower tariff barriers or more favorable trade agreements, allowing them to maintain competitiveness in global markets. This led to a geographic shift in automotive manufacturing.

- Long-term implications for the geographic distribution of automotive manufacturing: The tariffs spurred a significant reassessment of the geographic distribution of automotive manufacturing, with companies seeking to optimize their supply chains and production locations based on the evolving trade environment. The long-term implications of these shifts are still being analyzed.

Impact on Employment and the US Economy

The effects of Trump's tariffs on the US auto industry had a complex impact on employment and the broader US economy.

- Job losses in export-oriented sectors of the auto industry: The decline in exports due to retaliatory tariffs led to job losses in export-oriented sectors of the auto industry. The impact varied depending on the company and specific market.

- Potential job creation in domestic steel and aluminum industries: Increased investment in domestic steel and aluminum production could have potentially created jobs in these related sectors. However, the net effect on job creation compared to job losses in the auto industry is subject to ongoing debate.

- Overall impact on US GDP: The overall impact of Trump's tariffs on US GDP is a subject of ongoing economic analysis and debate. Estimates vary widely depending on the methodological approach and underlying assumptions.

- Long-term effects on the competitiveness of the US auto industry: The long-term effects of these trade policies on the competitiveness of the US auto industry are still unfolding. The restructuring of supply chains and the changes in production locations will have significant lasting consequences.

Conclusion

Trump's tariffs on imported goods significantly impacted the auto manufacturing industry, leading to increased production costs, reduced competitiveness, shifts in production strategies, and complex employment implications. The long-term consequences of these policies continue to unfold, affecting both the profitability of US automakers and the broader US economy.

Call to Action: Understanding the effects of Trump's tariffs on auto manufacturers is crucial for policymakers, investors, and industry professionals alike. Further research into the lasting impacts of these trade policies and the development of effective strategies for future trade negotiations is needed to safeguard the competitiveness of the US auto industry and ensure its continued prosperity. For more in-depth analysis of Trump's Tariffs Auto Manufacturers, continue exploring relevant economic data and industry reports.

Featured Posts

-

Fortnite Update 34 30 Release Date Downtime And Patch Notes For Sabrina Carpenter Skin

May 02, 2025

Fortnite Update 34 30 Release Date Downtime And Patch Notes For Sabrina Carpenter Skin

May 02, 2025 -

La Laport 3 20

May 02, 2025

La Laport 3 20

May 02, 2025 -

Fortnite Item Shop Free Captain America Items For A Limited Time

May 02, 2025

Fortnite Item Shop Free Captain America Items For A Limited Time

May 02, 2025 -

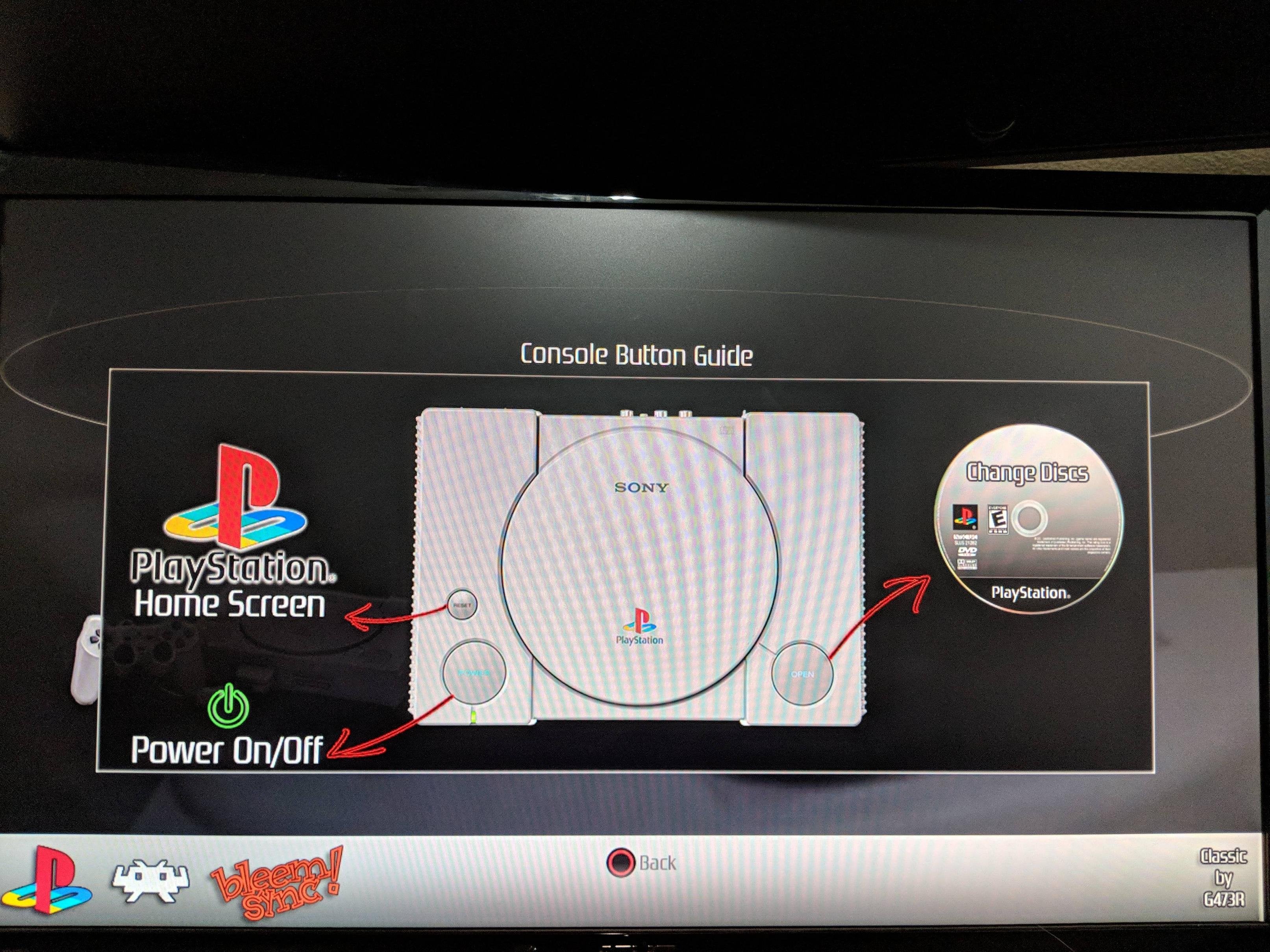

Sony Revives Classic Play Station Console Themes On Ps 5

May 02, 2025

Sony Revives Classic Play Station Console Themes On Ps 5

May 02, 2025 -

Lotto And Lotto Plus Winning Numbers Saturday April 12 2025

May 02, 2025

Lotto And Lotto Plus Winning Numbers Saturday April 12 2025

May 02, 2025

Latest Posts

-

Fatherhood Glastonbury And The New Loyle Carner Album An Overview

May 02, 2025

Fatherhood Glastonbury And The New Loyle Carner Album An Overview

May 02, 2025 -

Loyle Carners Glastonbury Set And Reflections On Fatherhood And New Album

May 02, 2025

Loyle Carners Glastonbury Set And Reflections On Fatherhood And New Album

May 02, 2025 -

Loyle Carners Fatherhood Journey New Album And Glastonbury Performance

May 02, 2025

Loyle Carners Fatherhood Journey New Album And Glastonbury Performance

May 02, 2025 -

Loyle Carner 3 Arena Concert Date Tickets And More

May 02, 2025

Loyle Carner 3 Arena Concert Date Tickets And More

May 02, 2025 -

Loyle Carner Dublin 3 Arena Gig Announced

May 02, 2025

Loyle Carner Dublin 3 Arena Gig Announced

May 02, 2025