Analysis: Japan's Steep Bond Yield Curve And Its Economic Consequences

Table of Contents

Factors Contributing to Japan's Steepening Bond Yield Curve

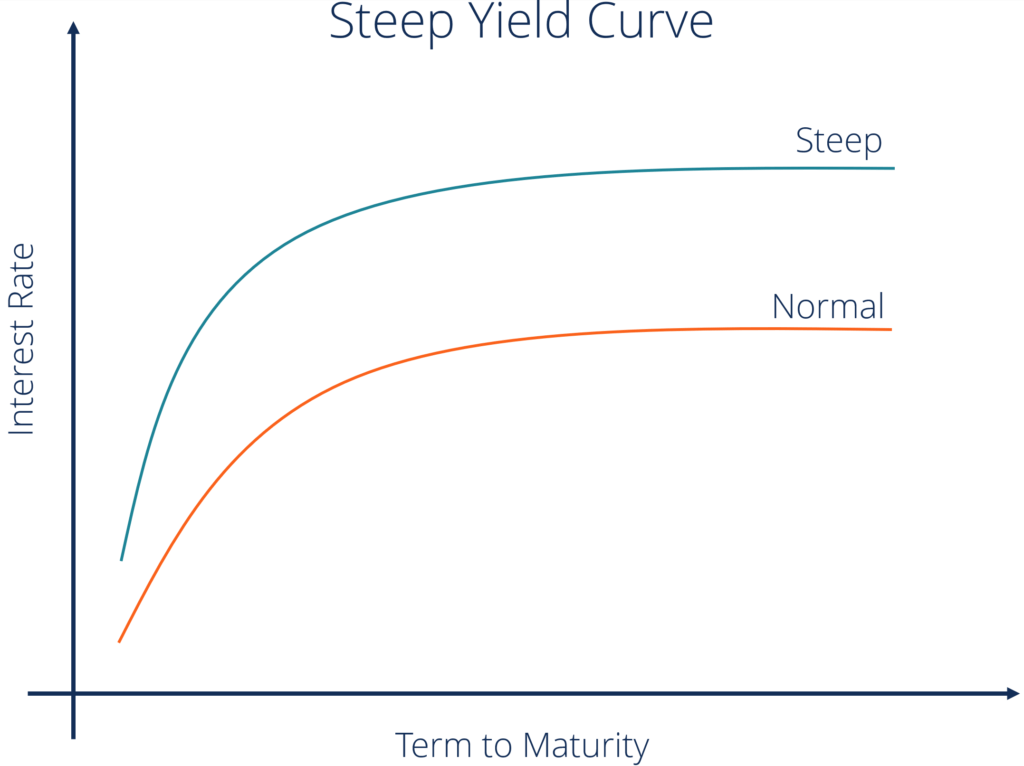

Several interconnected factors are driving the steepening of Japan's bond yield curve. These include the Bank of Japan's (BOJ) policy adjustments, rising inflationary pressures, and ongoing global economic uncertainty.

The Bank of Japan's (BOJ) Yield Curve Control (YCC) Policy

The BOJ's Yield Curve Control (YCC) policy, implemented to stimulate economic growth and combat deflation, has played a significant role in shaping the yield curve. YCC aimed to maintain short-term interest rates near zero while controlling longer-term yields. However, recent modifications and increased market speculation regarding future policy changes have contributed to the steepening trend. The BOJ's recent adjustments, while still maintaining a degree of control, have signaled a potential shift away from the extremely accommodative monetary policy of recent years.

- Increased market speculation regarding future policy changes: Markets are increasingly anticipating a complete abandonment or significant overhaul of YCC. This speculation itself pushes up longer-term yields.

- Impact of global interest rate hikes on the Japanese bond market: Global central banks raising interest rates have created pressure on the BOJ to follow suit, leading to increased expectations of higher future yields in Japan.

- Growing pressure on the BOJ to abandon YCC: Persistent, albeit moderate, inflation in Japan is putting pressure on the BOJ to adjust its monetary policy, potentially leading to a steepening of the yield curve.

Inflationary Pressures and Market Expectations

Rising inflation expectations are a key driver of the steepening yield curve. While inflation in Japan remains relatively low compared to other developed nations, it is increasing. This leads investors to demand higher yields on longer-term bonds to compensate for the erosion of purchasing power. The impact of global inflation, particularly rising energy and commodity prices, further exacerbates this effect.

- Rising import costs and their effect on domestic prices: Increased global commodity prices translate to higher import costs for Japan, contributing to inflationary pressures.

- Wage growth and its contribution to inflationary pressure: While modest, increasing wages in Japan are adding to inflationary pressures, affecting expectations for future inflation.

- Market anticipation of future interest rate adjustments: Markets are anticipating that the BOJ might eventually raise interest rates, which pushes up longer-term bond yields in anticipation.

Global Economic Uncertainty and Safe-Haven Demand

Global economic uncertainty plays a significant role. Periods of global instability often increase the demand for safe-haven assets, such as Japanese government bonds (JGBs). This increased demand for JGBs can push down short-term yields while leaving longer-term yields relatively unaffected, further contributing to a steeper curve.

- Geopolitical risks and their impact on bond yields: Geopolitical tensions and global conflicts often lead investors to seek the safety of JGBs, impacting the yield curve.

- Fluctuations in the global currency market and their influence: Volatility in the global currency market can impact investor confidence and increase the demand for safe-haven assets like JGBs.

- Increased demand for JGBs during periods of uncertainty: During times of uncertainty, investors tend to flock to JGBs, further influencing the shape of the yield curve.

Economic Consequences of a Steepening Yield Curve in Japan

The steepening of Japan's bond yield curve carries significant economic consequences for various sectors of the Japanese economy.

Impact on Government Borrowing Costs

A steeper yield curve increases the Japanese government's cost of borrowing. Higher long-term yields translate to increased interest payments on government bonds (JGBs), putting a strain on public finances.

- Increased interest payments on JGBs: The government will need to pay more to service its existing debt.

- Potential strain on public finances: Higher borrowing costs could necessitate fiscal adjustments, potentially impacting social programs or infrastructure investments.

- Need for fiscal adjustments to manage higher debt servicing costs: The government might need to implement austerity measures or increase taxes to manage the increased debt burden.

Effects on the Japanese Yen

The steepening yield curve can influence the Japanese Yen's exchange rate. Higher yields on Japanese government bonds can attract foreign investment, potentially leading to an appreciation of the Yen.

- Attraction of foreign investment due to higher yields: Increased yields make JGBs more attractive to foreign investors, leading to capital inflows and Yen appreciation.

- Potential appreciation of the Yen: A stronger Yen can impact Japan's export competitiveness, making Japanese goods more expensive in foreign markets.

- Implications for Japanese businesses involved in international trade: Yen appreciation can negatively impact the profitability of Japanese exporters.

Consequences for Businesses and Consumers

A steeper yield curve also affects businesses and consumers through higher borrowing costs. Increased interest rates translate to higher lending rates for businesses, potentially reducing investment and economic growth. Consumers might also reduce spending due to higher interest rates on loans and mortgages.

- Increased borrowing costs for businesses: Higher borrowing costs can deter businesses from investing in expansion or new projects.

- Reduced consumer spending due to higher interest rates: Higher interest rates on loans and mortgages can lead to decreased consumer spending.

- Potential slowdown in economic growth: Reduced business investment and consumer spending can contribute to a slowdown in overall economic growth.

Conclusion

The steepening of Japan's bond yield curve presents a complex interplay of factors, primarily driven by the BOJ's policy adjustments, inflationary pressures, and global economic uncertainties. This shift has significant implications for government borrowing costs, the Japanese Yen, and the broader economy. Understanding the dynamics of Japan's bond yield curve is critical for investors, policymakers, and businesses operating within the Japanese market. Continued monitoring of the situation and analysis of potential future shifts in Japan's bond yield curve are crucial for informed decision-making. Stay informed about changes in Japan's monetary policy and global economic conditions to effectively navigate the evolving landscape of Japan's bond yield curve and its consequences.

Featured Posts

-

Razvitie Infrastruktury Industrialnykh Parkov Otvet Na Rastuschiy Spros

May 17, 2025

Razvitie Infrastruktury Industrialnykh Parkov Otvet Na Rastuschiy Spros

May 17, 2025 -

Descongelaran Cuentas De Koriun Recuperacion De Capital Para Inversionistas

May 17, 2025

Descongelaran Cuentas De Koriun Recuperacion De Capital Para Inversionistas

May 17, 2025 -

Extreme Price Hike For V Mware At And T Sounds Alarm On Broadcoms Proposal

May 17, 2025

Extreme Price Hike For V Mware At And T Sounds Alarm On Broadcoms Proposal

May 17, 2025 -

Ftcs Appeal Will The Microsoft Activision Deal Be Blocked

May 17, 2025

Ftcs Appeal Will The Microsoft Activision Deal Be Blocked

May 17, 2025 -

Liverpool Transfer News Schlotterbeck And Stiller On The Reds Radar

May 17, 2025

Liverpool Transfer News Schlotterbeck And Stiller On The Reds Radar

May 17, 2025