Analysis: New US Energy Policy And Its Effect On Energy Prices

Table of Contents

Impact on Fossil Fuel Prices

The new US energy policy's influence on fossil fuel prices is multifaceted and depends heavily on its specific provisions regarding oil, natural gas, and coal production. Key areas of impact include changes in drilling permits and leasing on federal lands, modifications to regulations on fossil fuel extraction and transportation, and the overall effect on domestic production versus reliance on imports. These factors collectively determine the nation's energy independence and its vulnerability to global price fluctuations.

- Drilling Permits and Leasing: A decrease in the issuance of drilling permits on federal lands could lead to reduced domestic oil and natural gas production, potentially increasing reliance on imports and driving up prices. Conversely, an increase in permits could stimulate domestic production, potentially lowering prices.

- Regulations on Extraction and Transportation: Stricter regulations on fossil fuel extraction and transportation could increase production costs, leading to higher energy prices for consumers and businesses. Conversely, relaxed regulations could lower production costs and prices.

- Domestic Production vs. Imports: Increased domestic production, facilitated by policy changes, could lessen dependence on foreign oil and natural gas, offering a buffer against global price volatility. However, a decrease in domestic production could make the US more vulnerable to international energy market fluctuations, leading to price spikes.

- Price at the Pump and for Businesses: The net effect on prices at the pump and for businesses will depend on the interplay of these factors. For example, increased domestic production could lead to a 5-10% decrease in gas prices, but this is highly dependent on other market factors. The impact on businesses will vary significantly depending on their energy consumption intensity.

Bullet Points:

- Increased domestic production could lead to a potential 5-10% decrease in oil and gas prices (depending on global market conditions).

- Reduced domestic production could result in increased reliance on imports, making the US more susceptible to global price shocks and potentially leading to a 10-20% price increase.

- Policy uncertainty itself can create price volatility, making it difficult for businesses to plan effectively.

Effect on Renewable Energy Development

The new policy's impact on renewable energy development hinges on its provisions regarding subsidies, tax credits, and overall support for green energy initiatives. This includes solar power, wind energy, geothermal energy, and other clean energy sources. The policy's success in fostering a transition to a cleaner energy future will depend on its effectiveness in attracting investment and stimulating innovation.

- Government Subsidies and Tax Incentives: Increased subsidies and tax credits can make renewable energy projects more economically viable, stimulating investment and accelerating the energy transition. Reductions in these incentives would have the opposite effect.

- Investment in Renewable Energy Infrastructure: Government policies that support the development of renewable energy infrastructure, such as transmission lines and storage facilities, are crucial for the long-term success of renewable energy sources.

- Job Creation in the Renewable Energy Sector: Investments in renewable energy can create substantial job opportunities in manufacturing, installation, maintenance, and research. This aspect plays a role in the overall economic impact of the policy.

- Accelerated or Decelerated Energy Transition: The policy's influence on the pace of the energy transition from fossil fuels to renewable energy sources is significant for both environmental and economic reasons.

Bullet Points:

- Increased investment in renewable energy could lead to a projected 15-20% growth in renewable energy production within 5 years.

- A reduction in subsidies could significantly slow down the growth of renewable energy, potentially delaying the energy transition by several years.

- Long-term effects on carbon emissions will be directly related to the success of renewable energy deployment.

Broader Economic Consequences

The economic implications of the new US energy policy extend far beyond energy prices themselves, impacting inflation, economic growth, energy security, and international relations. The policy's effect on job creation, consumer spending, and national security are all critical considerations.

- Impact on Inflation and Consumer Spending: Changes in energy prices directly affect inflation and consumer spending. Higher energy costs can reduce disposable income and dampen economic growth.

- Effect on Job Creation and the Overall Economy: The policy's effects on both the fossil fuel and renewable energy sectors will have significant consequences for job creation and the overall economy. A shift towards renewable energy could create new jobs in that sector, while potentially displacing jobs in the fossil fuel industry.

- Energy Independence and National Security: The policy's influence on domestic energy production and reliance on imports directly affects the US's energy security and its geopolitical standing. Increased energy independence can enhance national security.

- International Trade and Relations: The policy's impact on the global energy market and the US's trade relationships with other energy-producing nations will have significant international implications.

Bullet Points:

- The potential impact on GDP growth could range from a minor increase (with a focus on renewables) to a slight decrease (with a focus on restricting fossil fuel production).

- Job losses in the fossil fuel sector could be partially offset by job gains in the renewable energy sector, but the net effect is uncertain and depends on the policy's specifics.

- Long-term implications for US economic competitiveness will depend on the success of the transition to a more sustainable and secure energy system.

Conclusion

The new US energy policy's effects on energy prices and the broader economy are complex and far-reaching. While increased domestic fossil fuel production could potentially lower prices in the short term, the long-term impacts depend heavily on the balance between fossil fuel and renewable energy development. The policy's influence on inflation, job creation, and energy independence will shape the US economy for years to come. Understanding the intricacies of the new US energy policy and its ongoing effect on energy prices is crucial for both businesses and individuals. Stay informed and adapt your strategies accordingly. Consult government reports, industry analyses, and academic publications for ongoing updates on this dynamic issue.

Featured Posts

-

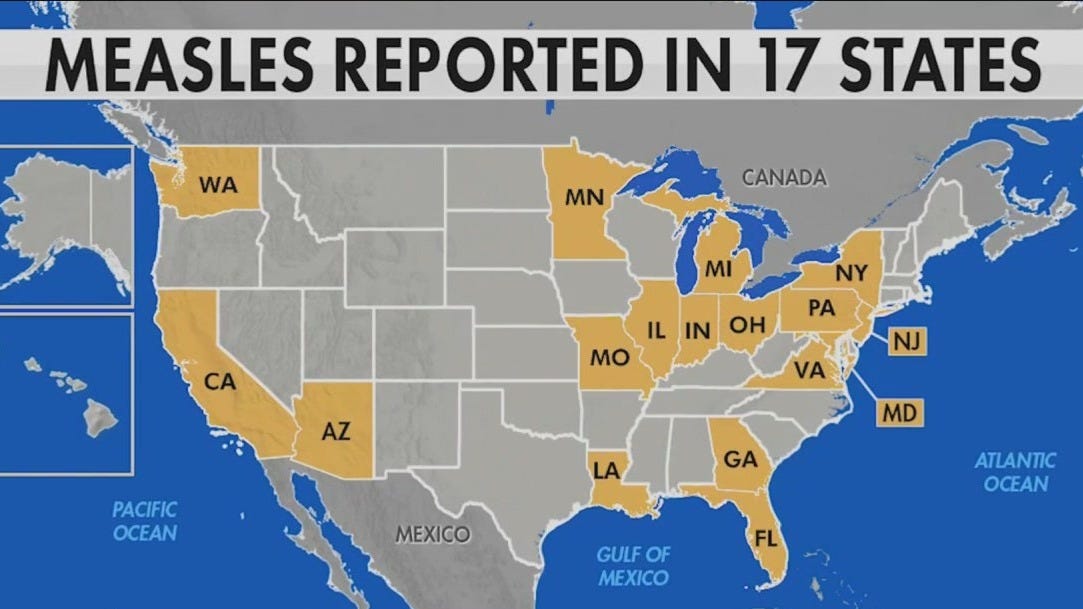

The Return Of Measles Examining The Kansas Outbreak

May 30, 2025

The Return Of Measles Examining The Kansas Outbreak

May 30, 2025 -

Retrouver Aurelien Veron Et Laurent Jacobelli Le Week End Sur Europe 1 Soir

May 30, 2025

Retrouver Aurelien Veron Et Laurent Jacobelli Le Week End Sur Europe 1 Soir

May 30, 2025 -

Ticketmaster Ofrece Detalles Sobre El Costo De Sus Entradas

May 30, 2025

Ticketmaster Ofrece Detalles Sobre El Costo De Sus Entradas

May 30, 2025 -

Analyse Kasper Dolbergs Vej Til 35 Mal Pa En Saeson

May 30, 2025

Analyse Kasper Dolbergs Vej Til 35 Mal Pa En Saeson

May 30, 2025 -

Understanding Angela Del Toros Role In Daredevil Born Again

May 30, 2025

Understanding Angela Del Toros Role In Daredevil Born Again

May 30, 2025

Latest Posts

-

Dragon Den Winners Lawsuit Puppy Toilet Idea Theft Alleged

May 31, 2025

Dragon Den Winners Lawsuit Puppy Toilet Idea Theft Alleged

May 31, 2025 -

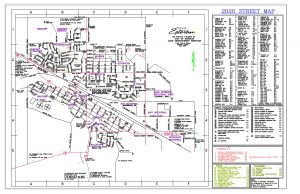

Estevans 2024 Road Sweeping Dates And Important Information

May 31, 2025

Estevans 2024 Road Sweeping Dates And Important Information

May 31, 2025 -

City Of Estevan Releases 2024 Street Sweeping Dates

May 31, 2025

City Of Estevan Releases 2024 Street Sweeping Dates

May 31, 2025 -

Duncan Bannatynes Charitable Contribution To Children In Morocco

May 31, 2025

Duncan Bannatynes Charitable Contribution To Children In Morocco

May 31, 2025 -

Bannatyne Ingleby Barwick Padel Court Development Underway

May 31, 2025

Bannatyne Ingleby Barwick Padel Court Development Underway

May 31, 2025