Analysis Of April's U.S. Jobs Report: 177,000 Jobs, 4.2% Unemployment

Table of Contents

Job Growth Analysis: Dissecting the 177,000 Figure

The creation of 177,000 jobs in April represents a moderate increase in employment. However, a deeper dive into the data reveals important nuances within the overall job growth figure.

Sectoral Breakdown: A Closer Look at Industry Growth

Analyzing job creation across different sectors provides a more granular understanding of the U.S. employment landscape.

- Leisure and Hospitality: This sector continued its strong recovery, adding a significant number of jobs. The continued easing of pandemic restrictions likely fueled this growth.

- Professional and Business Services: This sector also saw healthy job growth, reflecting ongoing expansion in various professional fields.

- Manufacturing: Job growth in manufacturing remained relatively modest, indicating continued challenges in this sector.

- Construction: The construction sector exhibited moderate job growth, reflecting ongoing investment in infrastructure projects.

The relatively slow growth in some sectors, compared to the robust growth seen in others, suggests a complex and uneven recovery across different industries. This sectoral analysis is crucial for understanding the nuances of the U.S. employment situation and identifying potential areas of concern. Keywords like "sectoral employment," "industry growth," and "job creation by sector" highlight the importance of this granular analysis.

Wage Growth and Inflation: The Balancing Act

Average hourly earnings provide insight into the relationship between job growth and wage increases. While wage growth has been observed, it remains crucial to consider its impact on inflation. Rapid wage growth can fuel inflationary pressures, potentially eroding purchasing power. Conversely, stagnant wage growth can hinder consumer spending and economic expansion. Therefore, closely monitoring the interplay between wage growth and inflation is vital for assessing the overall health of the economy. Keywords like "wage growth," "inflation rate," "real wages," and "purchasing power" highlight the importance of this balance.

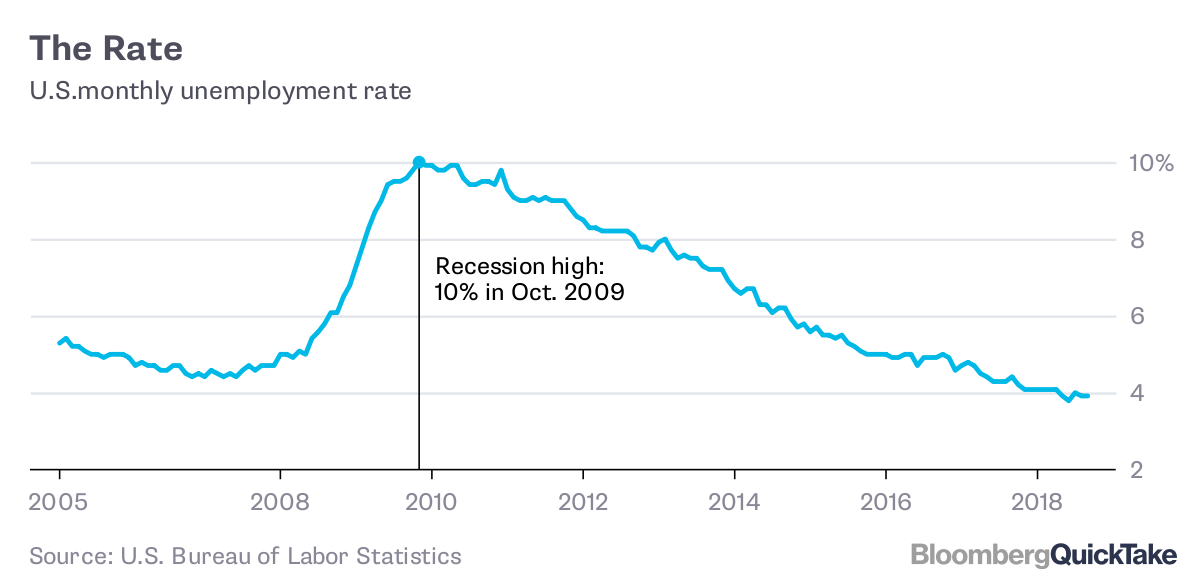

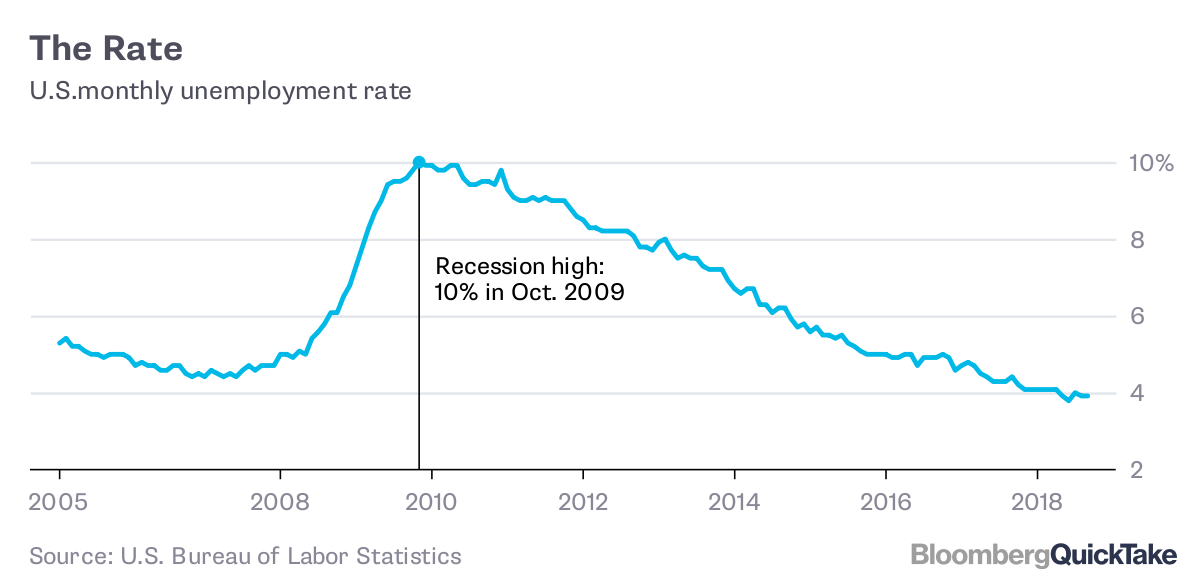

Unemployment Rate Deep Dive: Understanding the 4.2% Figure

The 4.2% unemployment rate, while relatively low, requires further analysis to fully understand its significance.

Labor Force Participation Rate: A Key Indicator

The labor force participation rate—the percentage of the working-age population actively employed or seeking employment—is a crucial factor influencing the unemployment rate. A rising participation rate can indicate a healthier labor market, while a declining rate might point to potential challenges in attracting and retaining workers. Factors such as demographics, retirement patterns, and educational attainment can influence this rate, requiring careful consideration for accurate interpretation of the unemployment figures. Keywords like "labor force participation," "employment-to-population ratio," and "potential workforce" are key to understanding this aspect of the report.

Types of Unemployment: Unpacking the Numbers

Unemployment isn't monolithic. It's essential to consider the different types:

- Frictional Unemployment: This represents short-term unemployment between jobs, a natural part of a healthy economy.

- Cyclical Unemployment: This is unemployment tied to economic downturns. A low cyclical unemployment rate generally indicates a robust economy.

- Structural Unemployment: This results from a mismatch between worker skills and available jobs, often requiring retraining or education to address.

Analyzing the dominant type of unemployment helps determine the underlying causes and potential solutions. This granular approach is important for understanding the true picture presented by the overall unemployment rate. Keywords like "frictional unemployment," "cyclical unemployment," and "structural unemployment" highlight the complexities of this seemingly simple statistic.

Interpreting the Data: Implications for the U.S. Economy

The April U.S. Jobs Report holds significant implications for both the Federal Reserve's monetary policy and the overall economic outlook.

Federal Reserve Policy: Interest Rate Expectations

The jobs report heavily influences the Federal Reserve's decisions regarding monetary policy, particularly interest rate adjustments. Strong job growth and rising inflation might lead the Fed to consider further interest rate hikes to cool down the economy. Conversely, weaker-than-expected data might lead to a more cautious approach. Understanding the Fed's response is crucial for investors and businesses as interest rate changes impact borrowing costs and overall economic activity. Keywords like "monetary policy," "interest rates," "Federal Reserve," and "quantitative easing" are important for understanding the report's impact on financial markets.

Economic Outlook: Navigating the Future

The April U.S. Jobs Report contributes to a broader assessment of the U.S. economy. While the report showcases positive employment trends, potential risks remain. Global economic uncertainties, supply chain disruptions, and geopolitical factors can all impact future economic growth. A comprehensive analysis considers these external factors to provide a more nuanced economic forecast. Keywords like "economic growth," "GDP growth," "recession risk," and "economic forecast" reflect the broader implications of the jobs report.

The April U.S. Jobs Report: A Summary and Next Steps

The April U.S. Jobs Report indicates a moderate increase in employment, with 177,000 new jobs added and an unemployment rate of 4.2%. While this suggests a generally healthy labor market, a deeper dive reveals complexities within specific sectors and a need to carefully monitor wage growth and inflation. The report will significantly influence the Federal Reserve's monetary policy decisions and inform future economic forecasts. To maintain a comprehensive understanding of the evolving U.S. employment landscape, stay tuned for our next analysis of the U.S. Jobs Report and follow us for continued updates on the U.S. employment situation.

Featured Posts

-

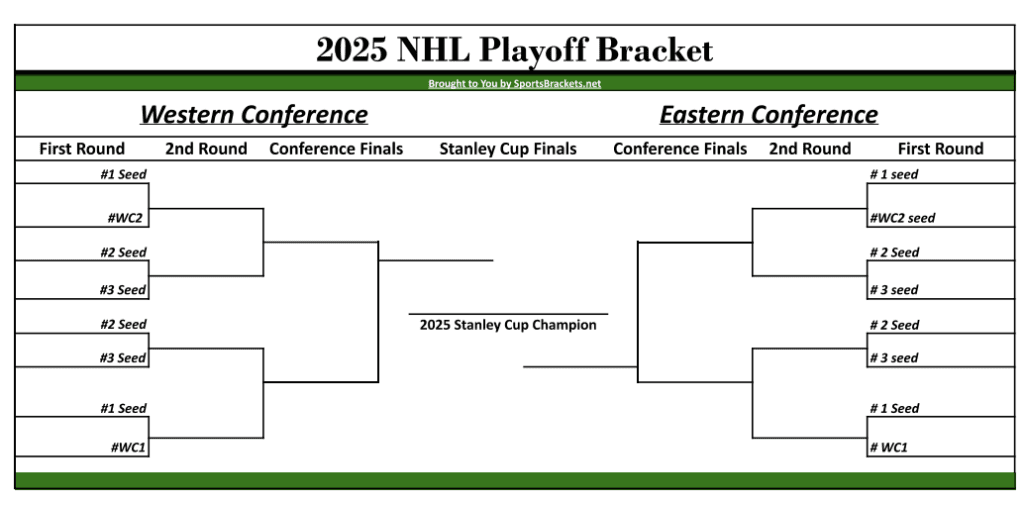

First Round Nhl Stanley Cup Playoffs What You Need To Know

May 04, 2025

First Round Nhl Stanley Cup Playoffs What You Need To Know

May 04, 2025 -

The Value Proposition Of Middle Managers A Key To Business Success And Employee Retention

May 04, 2025

The Value Proposition Of Middle Managers A Key To Business Success And Employee Retention

May 04, 2025 -

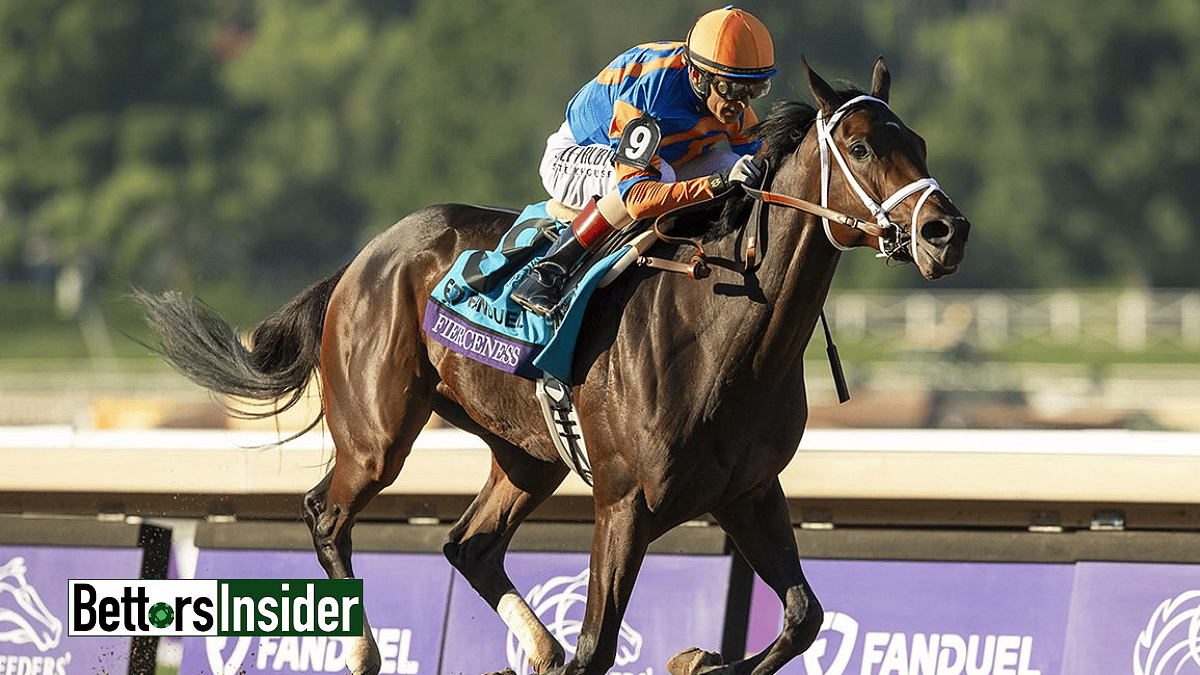

Betting On The 2025 Kentucky Derby A Guide To Odds And Favorites

May 04, 2025

Betting On The 2025 Kentucky Derby A Guide To Odds And Favorites

May 04, 2025 -

The Reform Party Needs New Leadership The Case For Rupert Lowe

May 04, 2025

The Reform Party Needs New Leadership The Case For Rupert Lowe

May 04, 2025 -

Predicting The 2025 Louisiana Derby Odds Field Analysis And Kentucky Derby Path

May 04, 2025

Predicting The 2025 Louisiana Derby Odds Field Analysis And Kentucky Derby Path

May 04, 2025

Latest Posts

-

Sydney Sweeneys Wedding Plans With Jonathan Davino Reportedly Cancelled

May 04, 2025

Sydney Sweeneys Wedding Plans With Jonathan Davino Reportedly Cancelled

May 04, 2025 -

Update Sydney Sweeney And Fiance Jonathan Davino Delay Wedding Plans

May 04, 2025

Update Sydney Sweeney And Fiance Jonathan Davino Delay Wedding Plans

May 04, 2025 -

Sydney Sweeneys Wedding To Jonathan Davino A Postponement Announcement

May 04, 2025

Sydney Sweeneys Wedding To Jonathan Davino A Postponement Announcement

May 04, 2025 -

Post Split Sydney Sweeney Enjoys African Safari With Friends

May 04, 2025

Post Split Sydney Sweeney Enjoys African Safari With Friends

May 04, 2025 -

Sydney Sweeney On Safari Friends Fun And A Break From The Headlines

May 04, 2025

Sydney Sweeney On Safari Friends Fun And A Break From The Headlines

May 04, 2025