Analysis Of CMA CGM's $440 Million Turkish Logistics Acquisition

Table of Contents

Strategic Rationale Behind the Acquisition

CMA CGM's decision to invest $440 million in the Turkish logistics market isn't arbitrary. It's a calculated move driven by several key strategic factors aimed at solidifying their position as a global leader.

Expanding Market Access in a Key Region

Turkey's strategic geopolitical location, situated at the crossroads of Europe and Asia, makes it a crucial hub for global trade. This acquisition grants CMA CGM unparalleled direct access to this vital market, unlocking significant growth potential.

- Enhanced access to Black Sea and Caspian Sea trade routes: This opens up new avenues for transporting goods to and from Central Asia and Eastern Europe, significantly expanding CMA CGM's network and reach.

- Increased market share in the rapidly growing Turkish logistics sector: The Turkish logistics market is experiencing robust growth, driven by increasing e-commerce and international trade. CMA CGM’s acquisition positions them to capture a larger slice of this expanding pie.

- Diversification of CMA CGM's geographical footprint, reducing reliance on specific regions: By expanding into Turkey, CMA CGM diversifies its operational base, mitigating risks associated with over-reliance on any single region. This strategic diversification enhances resilience in the face of geopolitical instability or economic downturns in other markets.

Strengthening CMA CGM's Global Supply Chain Network

The acquisition doesn't just provide market access; it integrates a new network of logistics capabilities into CMA CGM's existing infrastructure, enhancing its end-to-end supply chain solutions.

- Improved inland transportation capabilities within Turkey: This acquisition strengthens CMA CGM's ability to efficiently manage the movement of goods within Turkey, from ports to inland distribution centers and ultimately to the final customer.

- Access to a wider range of logistics services, including warehousing, distribution, and last-mile delivery: This expansion of service offerings allows CMA CGM to offer comprehensive, integrated logistics solutions to its clients, increasing their value proposition.

- Potential for synergies and operational efficiencies across the combined network: By integrating the acquired company's operations, CMA CGM can streamline processes, reduce redundancies, and improve overall efficiency, leading to cost savings and increased profitability.

Gaining a Competitive Advantage

This $440 million Turkish logistics acquisition significantly boosts CMA CGM's competitive edge in the global shipping and logistics arena.

- Increased competitiveness in securing contracts with major Turkish exporters and importers: Having a strong on-the-ground presence gives CMA CGM a considerable advantage in bidding for and securing lucrative contracts.

- Potential for offering bundled logistics solutions to clients, improving value proposition: The ability to offer a comprehensive suite of services—from ocean freight to inland transportation and last-mile delivery—makes CMA CGM a more attractive partner for clients.

- Consolidation of market share, potentially leading to price optimization and profitability improvements: Increased market share can provide CMA CGM with greater bargaining power, leading to improved pricing and profitability.

Financial Implications and Market Analysis

The $440 million investment in this Turkish logistics acquisition demands a thorough financial assessment.

Valuation and ROI

Analyzing the $440 million investment requires careful consideration of several factors to determine potential return on investment (ROI).

- Evaluation of the target company's financials and growth trajectory: A detailed due diligence process must have been undertaken to assess the financial health and future growth prospects of the acquired company.

- Assessment of potential synergies and cost savings from integration: Identifying and quantifying the potential cost savings from integration is critical to projecting the overall ROI.

- Forecasting future revenue streams and profitability based on market projections: Accurate forecasting of future revenue streams, taking into account market growth and CMA CGM's expanded market share, is essential.

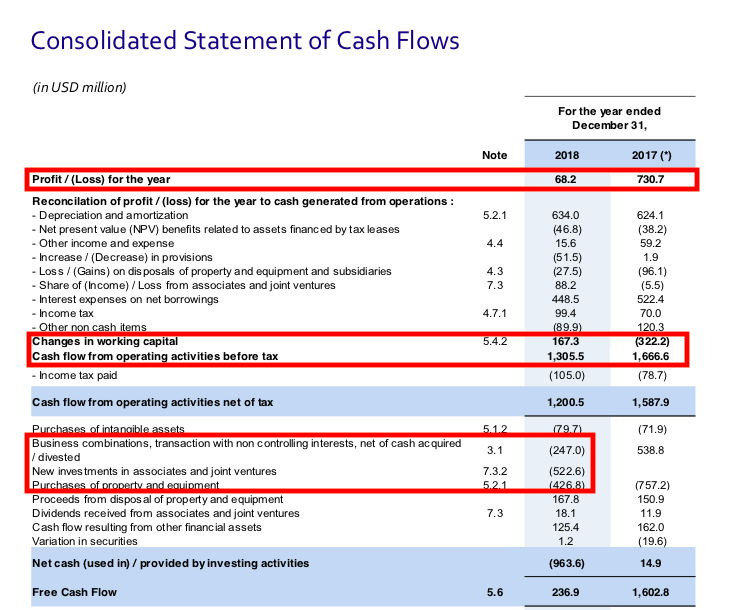

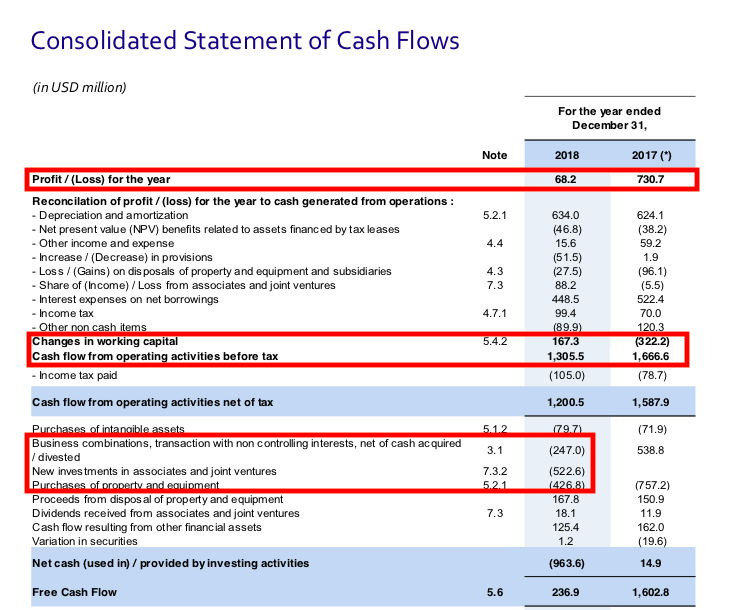

Impact on CMA CGM's Overall Financial Performance

The acquisition's impact on CMA CGM's financial statements will be closely scrutinized.

- Potential impact on revenue, profit margins, and earnings per share: The acquisition is expected to contribute positively to CMA CGM's top and bottom lines in the medium to long term.

- Analysis of debt levels and capital expenditure related to the acquisition: The financing of the acquisition and its impact on CMA CGM's overall debt levels need to be evaluated.

- Long-term growth projections for CMA CGM, taking into account the Turkish acquisition: The acquisition should contribute positively to CMA CGM's overall long-term growth trajectory.

Potential Challenges and Risks

Despite the potential benefits, CMA CGM must address several challenges and mitigate potential risks.

Integration Challenges

Integrating a new company into a large multinational corporation always presents complexities.

- Cultural differences and management styles: Harmonizing different corporate cultures and management styles can be challenging and time-consuming.

- Technological compatibility and system integration: Integrating different IT systems and technologies can lead to delays and disruptions.

- Potential employee attrition and retention issues: Integrating two different workforces can lead to employee uncertainty and potential attrition.

Geopolitical and Economic Risks

The Turkish market is subject to various geopolitical and economic risks.

- Currency fluctuations and inflation: Fluctuations in the Turkish lira and inflation can impact profitability.

- Political instability and regulatory changes: Political instability and regulatory changes can disrupt operations.

- Potential disruptions to supply chains due to unforeseen circumstances: Geopolitical events or natural disasters can negatively affect supply chains.

Conclusion

CMA CGM's $440 million Turkish logistics acquisition represents a significant strategic investment with the potential to substantially enhance the company's global reach and competitive positioning. While challenges related to integration and geopolitical factors are unavoidable, the strategic rationale behind the acquisition—accessing a key growth market and strengthening its supply chain network—remains compelling. The acquisition's success hinges on effective integration, proactive risk management, and the ability to leverage synergies to deliver the projected ROI. Continued monitoring of CMA CGM's post-acquisition performance is crucial to fully assess the long-term impact of this substantial investment in the global shipping and Turkish logistics landscape. Stay informed about future developments in this significant CMA CGM acquisition.

Featured Posts

-

Thueringen Artenvielfalt Von Eidechsen Und Molchen Im Neuen Atlas

Apr 27, 2025

Thueringen Artenvielfalt Von Eidechsen Und Molchen Im Neuen Atlas

Apr 27, 2025 -

Us Open 2024 Svitolinas Strong Start Against Kalinskaya

Apr 27, 2025

Us Open 2024 Svitolinas Strong Start Against Kalinskaya

Apr 27, 2025 -

Your Guide To The Grand National 2025 Runners At Aintree

Apr 27, 2025

Your Guide To The Grand National 2025 Runners At Aintree

Apr 27, 2025 -

Get Professional Help Ariana Grandes Bold Hair And Tattoo Choices

Apr 27, 2025

Get Professional Help Ariana Grandes Bold Hair And Tattoo Choices

Apr 27, 2025 -

Canadas Trade Strategy Waiting For A Favorable Us Deal

Apr 27, 2025

Canadas Trade Strategy Waiting For A Favorable Us Deal

Apr 27, 2025

Latest Posts

-

Pirates Steal Victory Over Yankees With Walk Off In Extra Innings Game

Apr 28, 2025

Pirates Steal Victory Over Yankees With Walk Off In Extra Innings Game

Apr 28, 2025 -

Pirates Walk Off Win Against Yankees In Extras

Apr 28, 2025

Pirates Walk Off Win Against Yankees In Extras

Apr 28, 2025 -

Watch Blue Jays Vs Yankees Live Free Mlb Spring Training Stream March 7 2025

Apr 28, 2025

Watch Blue Jays Vs Yankees Live Free Mlb Spring Training Stream March 7 2025

Apr 28, 2025 -

Mlb Spring Training Blue Jays Vs Yankees Live Stream Free Options And Tv Schedule March 7 2025

Apr 28, 2025

Mlb Spring Training Blue Jays Vs Yankees Live Stream Free Options And Tv Schedule March 7 2025

Apr 28, 2025 -

Where To Watch Blue Jays Vs Yankees Mlb Spring Training Game March 7 2025

Apr 28, 2025

Where To Watch Blue Jays Vs Yankees Mlb Spring Training Game March 7 2025

Apr 28, 2025