Analysis: SSE's £3 Billion Spending Reduction And Its Implications

Table of Contents

Reasons Behind SSE's £3 Billion Spending Reduction

Several intertwined factors contributed to SSE's decision to slash its spending by £3 billion. The macroeconomic environment plays a significant role. Rising inflation, coupled with aggressive interest rate hikes by the Bank of England, has created a challenging financial landscape for businesses across all sectors, including energy. The threat of a recession further exacerbates the situation, making large-scale investments riskier. SSE's £3 billion spending reduction is, in part, a direct response to this economic uncertainty.

Internally, SSE is also undertaking strategic shifts. This might involve reassessing the profitability of certain projects or identifying areas of operational inefficiency. The company might be prioritizing certain investments over others, focusing resources on projects deemed more likely to deliver strong returns in the current climate. This could lead to the postponement or cancellation of less-profitable initiatives.

Specific cost-cutting measures likely include:

- Reduced capital expenditure on new projects: Deferring or cancelling large-scale investments in new renewable energy infrastructure.

- Operational efficiency improvements: Streamlining internal processes to reduce operational costs.

- Staffing reductions or restructuring: A potential restructuring of the workforce to improve efficiency.

- Renegotiation of supplier contracts: Securing more favorable terms with suppliers to reduce input costs.

Impact on SSE's Operations and Future Investments

SSE's £3 billion spending reduction will undoubtedly impact its operations and future investments. The most immediate consequence will be felt in the renewable energy sector. Potential delays or cancellations of wind, solar, and other renewable energy projects are likely, impacting the company's ability to meet its long-term sustainability goals and potentially slowing the UK's transition to renewable energy sources.

The planned upgrades to network infrastructure might also face delays. Deferring grid modernization and enhancement projects could compromise the reliability and efficiency of the energy supply, leading to potential disruptions and challenges in meeting future energy demands. Moreover, cuts in investment in customer-facing technologies might compromise customer service levels, potentially impacting customer satisfaction and loyalty.

The short-term implications of SSE's £3 billion spending reduction are likely to include improved profitability ratios and cost savings. However, the long-term consequences could be more severe. Reduced investment in renewable energy could hinder SSE's growth potential, lead to missed opportunities in a rapidly expanding market, and potentially result in a loss of competitive advantage in the long run.

Implications for Stakeholders: Investors, Employees, and Customers

SSE's £3 billion spending reduction has significant implications for its stakeholders. Investors may react negatively, leading to share price fluctuations and a shift in investor sentiment. The uncertainty surrounding the company's future investment plans could erode investor confidence.

For employees, job security concerns are paramount. Staff reductions, restructuring, and potential layoffs are realistic possibilities, negatively impacting employee morale and potentially leading to a loss of valuable expertise.

Customers may also feel the impact. While the immediate effect on energy prices might be limited, potential delays in network upgrades or reduced investment in customer service could affect energy reliability and service quality in the long term.

- Investors: Potential share price volatility, reduced dividend payouts.

- Employees: Job security concerns, potential layoffs, reduced morale.

- Customers: Potential impact on service quality, reliability, and responsiveness.

Comparison with Industry Peers: SSE's Spending Reduction in Context

To understand the significance of SSE's £3 billion spending reduction, it's essential to compare its approach with that of its industry peers. While many energy companies are facing similar economic headwinds, the extent and nature of their cost-cutting measures may vary. Analyzing the spending strategies of competitors will reveal whether SSE's approach is a unique response or a reflection of a broader industry trend of cost reduction.

Diverging strategies among energy companies could have profound implications for market share and competitive advantage. Companies that continue to invest heavily in renewable energy and infrastructure upgrades may gain a significant advantage in the long run, even if it means incurring higher short-term costs. SSE's decision to prioritize cost reduction could leave them at a disadvantage if their competitors aggressively pursue growth opportunities in the renewable energy sector.

Conclusion: Assessing the Long-Term Effects of SSE's £3 Billion Spending Reduction

SSE's £3 billion spending reduction is a complex issue with both short-term benefits and potential long-term risks. The decision was driven by a combination of macroeconomic factors and internal strategic shifts. While the move might yield short-term cost savings and improved profitability, it carries the risk of hindering growth, impacting stakeholder confidence, and potentially compromising the company's long-term competitiveness in the evolving energy landscape. The impact on renewable energy investments and grid modernization will be crucial to observe in the coming years.

What are your thoughts on SSE's £3 billion spending reduction and its implications for the future of the energy sector? Share your analysis in the comments below.

Featured Posts

-

Southern Vacation Hot Spot Disputes Safety Rating After Shooting Incident

May 26, 2025

Southern Vacation Hot Spot Disputes Safety Rating After Shooting Incident

May 26, 2025 -

2025s Top Nike Running Shoes Style Performance And Comfort

May 26, 2025

2025s Top Nike Running Shoes Style Performance And Comfort

May 26, 2025 -

George Russells Leadership Bringing Calm And Confidence To Mercedes

May 26, 2025

George Russells Leadership Bringing Calm And Confidence To Mercedes

May 26, 2025 -

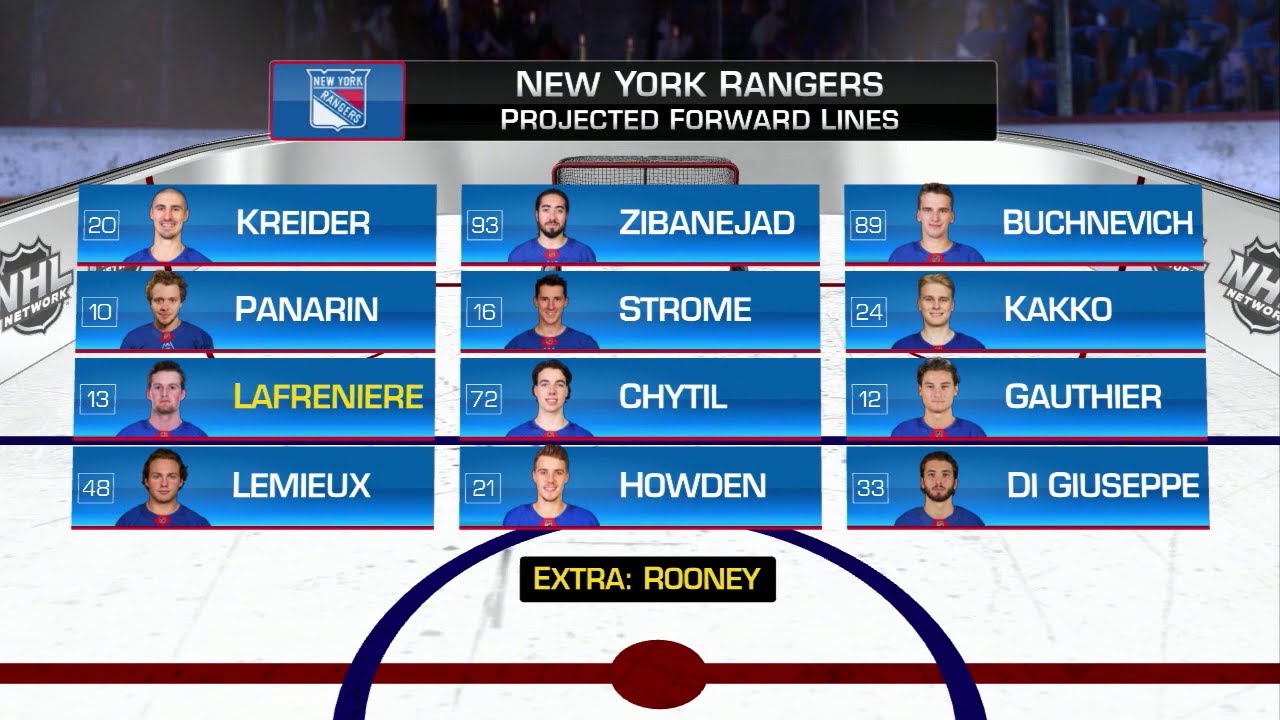

The New York Rangers Roster Overhaul Underway

May 26, 2025

The New York Rangers Roster Overhaul Underway

May 26, 2025 -

Ralph Fiennes In Talks For Coriolanus Snow In The Hunger Games Prequel Fans Favor Kiefer Sutherland

May 26, 2025

Ralph Fiennes In Talks For Coriolanus Snow In The Hunger Games Prequel Fans Favor Kiefer Sutherland

May 26, 2025

Latest Posts

-

Liverpool Transfer News Leagues Best Dribbler Eyed To Replace Departing Star

May 28, 2025

Liverpool Transfer News Leagues Best Dribbler Eyed To Replace Departing Star

May 28, 2025 -

Scouting Update Liverpool And The Pursuit Of Rayan Cherki

May 28, 2025

Scouting Update Liverpool And The Pursuit Of Rayan Cherki

May 28, 2025 -

Rayan Cherki Liverpools Potential Summer Acquisition

May 28, 2025

Rayan Cherki Liverpools Potential Summer Acquisition

May 28, 2025 -

Liverpools Interest In Rayan Cherki Intensifies

May 28, 2025

Liverpools Interest In Rayan Cherki Intensifies

May 28, 2025 -

Is Rayan Cherki Liverpools Next Signing

May 28, 2025

Is Rayan Cherki Liverpools Next Signing

May 28, 2025