Analysis: Trump Tariffs' Impact On Affirm Holdings' (AFRM) IPO And The Fintech Sector

Table of Contents

The Macroeconomic Impact of Trump Tariffs on the Fintech Sector

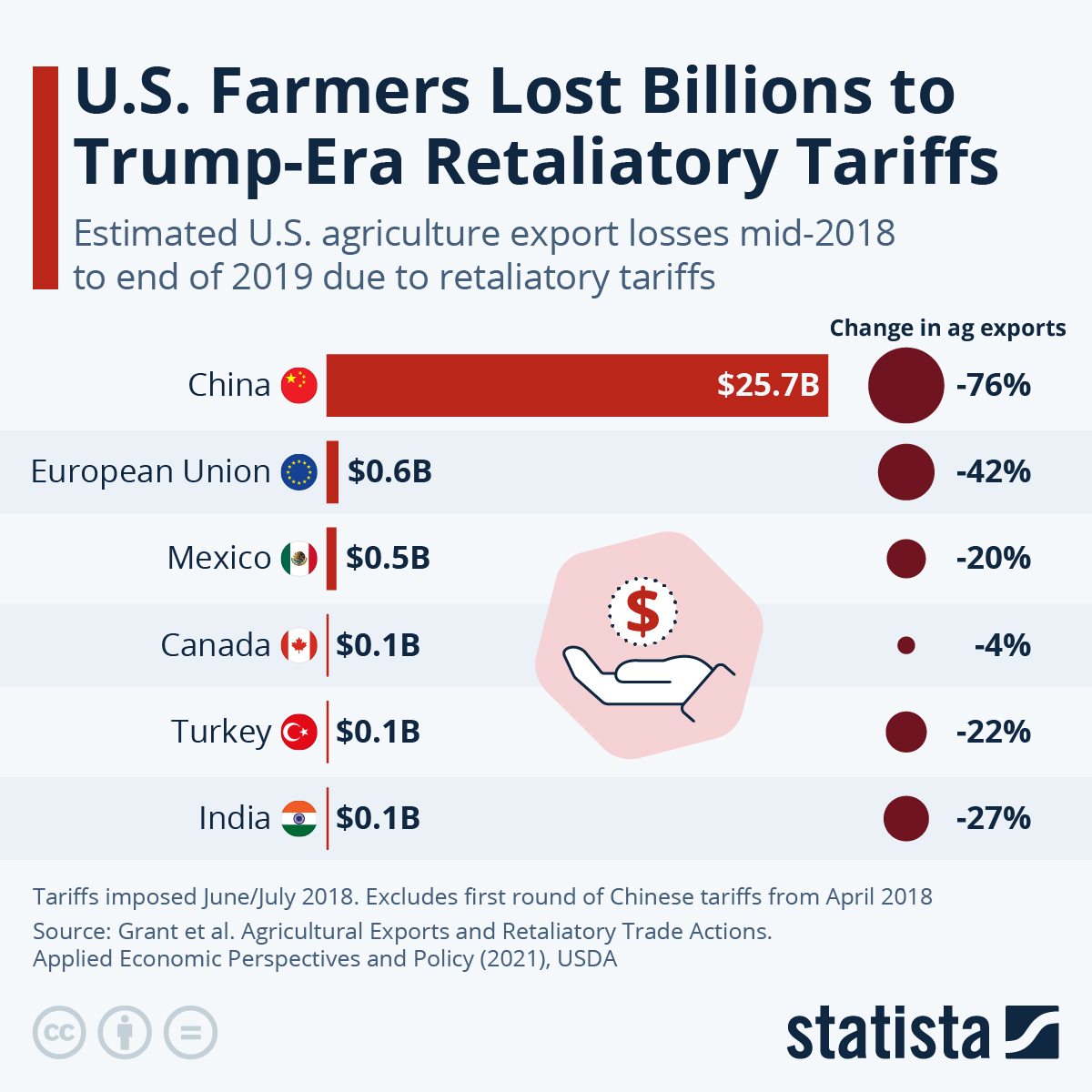

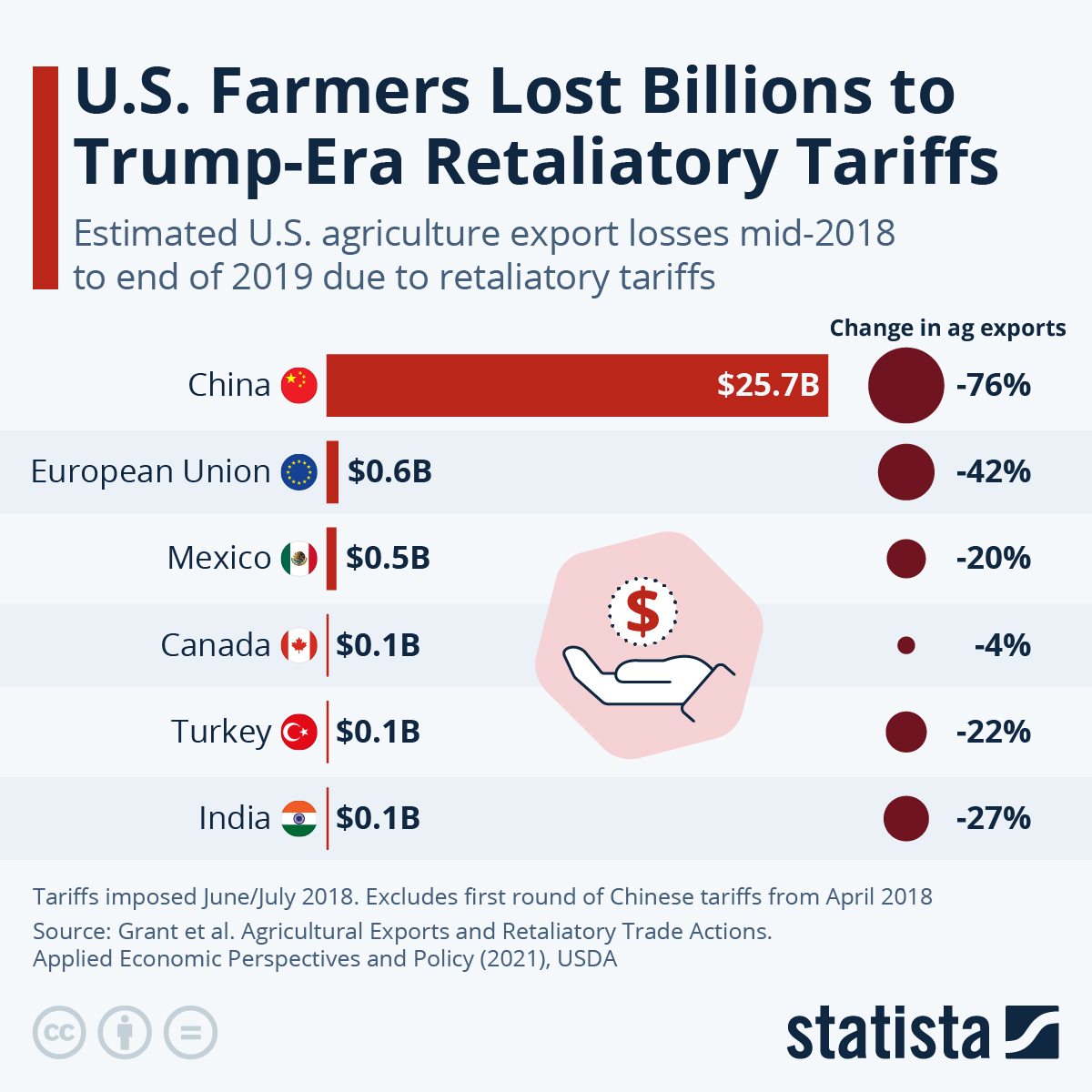

The Trump tariffs triggered a series of macroeconomic consequences that directly impacted the fintech sector. Increased inflation, stemming from higher import costs, squeezed consumer spending power, particularly impacting discretionary purchases. Simultaneously, supply chain disruptions led to shortages and increased prices for various goods and services. This uncertainty had a chilling effect on investor confidence, impacting the valuations of numerous fintech startups, including those relying on consumer borrowing and spending.

- Increased inflation: Reduced consumer discretionary spending, impacting the revenue streams of fintech companies reliant on consumer transactions.

- Supply chain disruptions: Created shortages and price hikes, impacting consumer affordability and influencing borrowing decisions.

- Investor uncertainty: Led to decreased investments and lower valuations for many fintech companies, including those in the BNPL space.

- Increased interest rates: A potential response to inflation, making borrowing more expensive and potentially decreasing demand for BNPL services. This could significantly impact Affirm's business model.

Direct and Indirect Effects of Tariffs on Affirm Holdings (AFRM) Specifically

Affirm Holdings, operating primarily in the Buy Now Pay Later (BNPL) sector, experienced both direct and indirect effects from the Trump tariffs. While AFRM's core operations weren't directly impacted by import tariffs on specific goods, the macroeconomic environment significantly influenced its performance.

- Supply chain analysis: Although AFRM’s business isn't directly tied to physical goods, the broader supply chain disruptions could have indirectly affected its merchant partners, leading to potential delays or reduced sales.

- Loan default rates: The economic uncertainty created by the tariffs might have increased loan default rates among AFRM's customer base, impacting the company's profitability. A correlation analysis between default rates and macroeconomic indicators related to the tariffs would be insightful.

- Investor response: Investor sentiment towards AFRM, during and after its IPO, could have been affected by the overall economic uncertainty resulting from the trade war.

Comparison to Other Fintech Companies Affected by the Trump Tariffs

Comparing AFRM's performance to other fintech companies affected by the Trump tariffs provides crucial context. Companies in similar sectors like online lending and payment processing faced varying degrees of impact. For instance, companies heavily reliant on international transactions might have been more severely affected by supply chain disruptions and increased transaction costs.

- Case studies: Analyzing the strategies and outcomes of other BNPL providers, online lenders, and payment processors would offer a comparative perspective on how various fintech business models navigated the tariff-induced economic headwinds.

- Comparative stock performance: Comparing AFRM's stock performance to its competitors, both before and after the imposition of tariffs, would reveal relative resilience and vulnerability within the sector.

- Business model vulnerability: Analyzing the differing business models reveals how their susceptibility to tariff-related challenges varied, highlighting the importance of diversification and adaptable strategies.

Long-Term Implications and Lessons Learned for the Fintech Industry

The Trump tariffs offered valuable lessons for the fintech industry, emphasizing the importance of proactive risk management in the face of global trade policies and economic uncertainty.

- Mitigating future impacts: Fintech companies can develop robust strategies to mitigate the effects of future trade wars or economic downturns, including hedging against inflation and diversifying revenue streams.

- Robust risk management: The experience underscored the importance of comprehensive risk management strategies that account for macroeconomic volatility and global trade uncertainties.

- Regulatory adaptability: Navigating the evolving regulatory landscape will be crucial for fintech companies. Adaptability and proactive compliance are key to sustained success.

Assessing the Lasting Influence of Trump Tariffs on Affirm Holdings (AFRM) and the Fintech Future

The Trump tariffs created a complex macroeconomic environment significantly affecting Affirm Holdings (AFRM) and the fintech sector. While AFRM's core BNPL business wasn't directly targeted, the resulting inflation, supply chain disruptions, and investor uncertainty had demonstrable impacts. The analysis highlights the importance of understanding the interconnectedness of global trade policies and the financial health of fintech companies. Further research into the lasting influence of these policies is crucial. Stay informed about the evolving regulatory landscape impacting Affirm Holdings (AFRM) and other fintech companies. Understanding how trade policies affect the fintech sector is vital for investors and industry players alike. Continuing to analyze the effects of trade wars on the fintech industry, particularly concerning Affirm Holdings (AFRM) and its BNPL model, is essential for navigating the future.

Featured Posts

-

Tommy Boy Sequel David Spades Pitch And What It Means For Fans

May 14, 2025

Tommy Boy Sequel David Spades Pitch And What It Means For Fans

May 14, 2025 -

Garcia Pimienta Deja El Sevilla Fc Caparros Su Sucesor

May 14, 2025

Garcia Pimienta Deja El Sevilla Fc Caparros Su Sucesor

May 14, 2025 -

Nonna A Heartwarming Old Fashioned Comedy

May 14, 2025

Nonna A Heartwarming Old Fashioned Comedy

May 14, 2025 -

Kenins Injury Ends Paolinis Dubai Reign

May 14, 2025

Kenins Injury Ends Paolinis Dubai Reign

May 14, 2025 -

Ai Enhanced Battery Life Apples I Os 19 Update

May 14, 2025

Ai Enhanced Battery Life Apples I Os 19 Update

May 14, 2025