Analysis: Westpac (WBC) Profitability Hit By Margin Compression

Table of Contents

Declining Net Interest Margin (NIM): A Key Driver of Reduced Profitability

The net interest margin (NIM) is a crucial indicator of a bank's profitability. It represents the difference between the interest income a bank earns on its loans and the interest it pays on its deposits and other borrowings, expressed as a percentage of earning assets. A shrinking NIM directly translates to lower profitability. Westpac's falling NIM is primarily due to several interconnected factors:

- Increased Competition: The Australian banking sector is highly competitive. New entrants and established players are vying for market share, leading to pressure on lending rates and a consequent squeeze on margins.

- Pressure on Lending Rates: Regulatory changes implemented by the Australian Prudential Regulation Authority (APRA) and broader economic conditions, including lower inflation expectations, have put downward pressure on the interest rates Westpac can charge on loans.

- Higher Funding Costs: The cost of funds for Westpac, including deposits and wholesale borrowing, has increased, further compressing the NIM. This is partly due to global interest rate hikes and increased competition for deposits.

- Shift in Customer Behavior: Customers are increasingly opting for lower-margin products, such as savings accounts with lower interest rates, impacting the overall NIM.

Data Visualization: (Insert a chart or graph here illustrating the decline in Westpac's NIM over a specified period, clearly labeled with data sources.) This visual representation would strengthen the analysis and enhance reader engagement.

Increased Operating Expenses Impacting Westpac's Bottom Line

Beyond the compression of the net interest margin, Westpac's profitability has also been affected by a rise in operating expenses. This increase stems from several sources:

- Increased Regulatory Compliance Costs: Stringent regulations and increased scrutiny following the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry have significantly increased compliance costs for Westpac.

- Investments in Technology and Digital Transformation: Westpac, like other banks, is investing heavily in technology and digital transformation to enhance customer experience and operational efficiency. These investments represent substantial upfront costs.

- Higher Staff Costs: Increased salaries, benefits, and bonuses contribute to the rise in overall operating expenses.

The impact of these increased expenses is a significant reduction in profit margins, further compounding the challenges posed by margin compression.

Impact of Economic Factors on Westpac's Profitability

Macroeconomic conditions significantly influence Westpac's profitability and contribute to margin compression. Key factors include:

- Interest Rate Changes by the Reserve Bank of Australia (RBA): The RBA's monetary policy decisions directly affect interest rates, influencing both the interest income Westpac earns on loans and the interest it pays on deposits. Changes in the cash rate significantly impact NIM.

- Economic Slowdown or Growth: Economic slowdown reduces loan demand, impacting interest income. Conversely, rapid growth can lead to increased competition and pressure on margins.

- Inflation and its Effect on Consumer Spending and Borrowing: High inflation impacts consumer spending and borrowing habits, affecting loan demand and potentially leading to higher loan defaults, which can also indirectly impact profitability.

Westpac's Strategies to Mitigate Margin Compression

Westpac is actively implementing strategies to mitigate the effects of margin compression and improve profitability. These include:

- Cost-Cutting Measures: The bank is focusing on streamlining operations and reducing expenses across various departments to improve efficiency.

- Focus on Higher-Margin Products/Services: Westpac is shifting its focus towards higher-margin products and services to improve its overall profitability. This might include wealth management services or specialized lending products.

- Expansion into New Markets or Product Offerings: Exploring new market segments and expanding product offerings can diversify revenue streams and reduce reliance on lower-margin businesses.

- Improving Operational Efficiency: Investing in technology and process improvements aims to enhance operational efficiency and reduce costs.

Conclusion: Understanding Westpac's (WBC) Profitability Challenges

Westpac's (WBC) reduced profitability is a complex issue stemming from a confluence of factors. The decline in the net interest margin (NIM), driven by increased competition, pressure on lending rates, higher funding costs, and shifts in customer behavior, is a primary concern. Furthermore, rising operating expenses related to regulatory compliance, technology investments, and staff costs are also impacting the bottom line. Macroeconomic factors, such as RBA interest rate decisions and economic growth, further exacerbate these challenges. While Westpac is implementing strategies to mitigate margin compression, the ongoing impact of these factors necessitates careful monitoring of the bank’s financial performance. To gain a deeper understanding, keep monitoring Westpac's (WBC) profitability and the impact of margin compression by analyzing their quarterly reports and following relevant financial news articles. For a deeper dive into Westpac's (WBC) financial health, consider analyzing their quarterly reports regarding margin compression.

Featured Posts

-

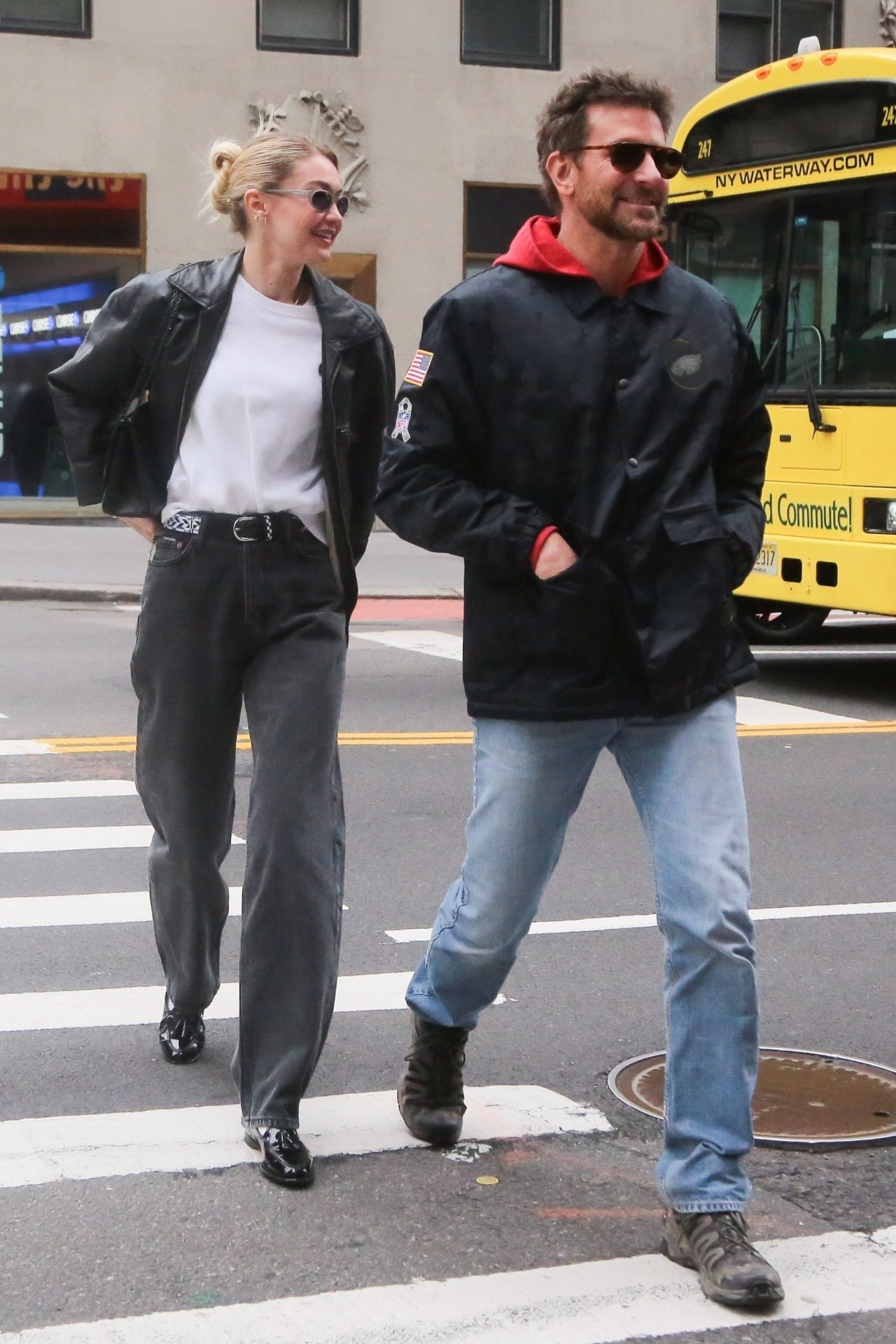

Gigi Hadid The Reason Behind Bradley Cooper And Leonardo Di Caprios Falling Out

May 05, 2025

Gigi Hadid The Reason Behind Bradley Cooper And Leonardo Di Caprios Falling Out

May 05, 2025 -

Tampa Bay Derby Odds 2025 Predicting The Field And Kentucky Derby Prospects

May 05, 2025

Tampa Bay Derby Odds 2025 Predicting The Field And Kentucky Derby Prospects

May 05, 2025 -

Nhl Showdown Saturday A Look At The Updated Playoff Standings

May 05, 2025

Nhl Showdown Saturday A Look At The Updated Playoff Standings

May 05, 2025 -

Alvarez Remains Focused On Plant Postpones Crawford Discussion

May 05, 2025

Alvarez Remains Focused On Plant Postpones Crawford Discussion

May 05, 2025 -

Sydney Sweeneys Sparkling Pink Barbiecore Gown At The Vanity Fair Oscars After Party

May 05, 2025

Sydney Sweeneys Sparkling Pink Barbiecore Gown At The Vanity Fair Oscars After Party

May 05, 2025

Latest Posts

-

Nba Playoffs Game 1 Knicks Vs Celtics Prediction And Best Betting Options

May 06, 2025

Nba Playoffs Game 1 Knicks Vs Celtics Prediction And Best Betting Options

May 06, 2025 -

Celtics Vs Knicks Game 1 Playoff Prediction Betting Analysis And Picks

May 06, 2025

Celtics Vs Knicks Game 1 Playoff Prediction Betting Analysis And Picks

May 06, 2025 -

Nba Playoffs Knicks Vs Celtics Prediction Picks And Best Bets For Game 1

May 06, 2025

Nba Playoffs Knicks Vs Celtics Prediction Picks And Best Bets For Game 1

May 06, 2025 -

April 4th Celtics Vs Suns Game Time Tv Broadcast And Streaming Options

May 06, 2025

April 4th Celtics Vs Suns Game Time Tv Broadcast And Streaming Options

May 06, 2025 -

Knicks Vs Celtics 2025 Nba Playoffs Live Stream And Tv Schedule

May 06, 2025

Knicks Vs Celtics 2025 Nba Playoffs Live Stream And Tv Schedule

May 06, 2025