Analyst Predicts Bitcoin Rally: Key Chart Levels To Watch (May 6th)

Table of Contents

Bitcoin's price action has been the subject of intense scrutiny lately, with many speculating about its next major move. Today, a prominent analyst is predicting a Bitcoin rally, highlighting specific chart levels that traders should be watching closely. This article delves into their analysis, exploring the key support and resistance levels that could determine the trajectory of Bitcoin's price in the coming days and weeks.

Analyst's Bitcoin Price Prediction and Rationale

Renowned cryptocurrency analyst, Michael van de Poppe (replace with actual analyst and credentials if different), known for his accurate predictions and insightful commentary on various crypto publications and trading platforms, is forecasting a significant Bitcoin rally. His prediction stems from a confluence of technical indicators, on-chain data, and macroeconomic factors.

-

Specific technical indicators used: Van de Poppe cites the recent bullish crossover of the 50-day and 200-day moving averages, coupled with a strengthening Relative Strength Index (RSI) above 50, as key signals supporting his bullish outlook. He also points to a positive divergence between the price and the MACD, suggesting a potential price reversal.

-

Key on-chain metrics supporting the prediction: The analyst highlights a growing accumulation trend among long-term Bitcoin holders, indicated by decreasing exchange balances and increasing activity on the Bitcoin network. This accumulation pattern suggests strong conviction from seasoned investors.

-

Macroeconomic events impacting Bitcoin's price: Van de Poppe acknowledges the impact of easing inflation concerns and a potential shift in monetary policy as positive factors that could fuel a Bitcoin rally. He also notes that regulatory clarity in certain jurisdictions might boost investor confidence.

Key Bitcoin Chart Levels to Watch

Van de Poppe has identified several crucial support and resistance levels that will be pivotal in determining the strength and sustainability of the predicted Bitcoin rally.

-

Support level 1: $28,000: A breach below this level could signal a temporary setback, but a strong bounce from this support would confirm the bullish momentum. This level represents a significant psychological barrier and historical support zone.

-

Support level 2: $26,500: This level represents a stronger support area, a break below which could indicate a more significant correction. However, a rebound from this level would suggest a robust underlying bullish trend.

-

Resistance level 1: $30,000: Breaking through this resistance level would be a major bullish signal, potentially triggering further upward price movement. It's a key psychological barrier and a previous price high.

-

Resistance level 2: $32,000: Overcoming this resistance would confirm the strength of the rally and could open the door to even higher price targets. This level aligns with previous resistance levels and significant trading volume.

Potential Risks and Considerations for Bitcoin Investors

While the analyst's prediction is compelling, it's crucial to acknowledge potential risks and factors that could invalidate the rally.

-

Market volatility and potential price corrections: The cryptocurrency market is inherently volatile, and even with a bullish prediction, short-term price corrections are expected. Investors should prepare for potential dips and not panic sell.

-

Regulatory uncertainty and its impact on Bitcoin price: Regulatory developments, both positive and negative, can significantly impact Bitcoin's price. Uncertainty around regulations could cause price fluctuations.

-

Geopolitical events that could affect the cryptocurrency market: Global geopolitical events, such as wars or economic crises, can influence investor sentiment and cause market volatility, impacting Bitcoin's price negatively.

Risk Management Strategies for Bitcoin Trading

To mitigate the inherent risks associated with Bitcoin trading, investors should implement robust risk management strategies.

-

Importance of diversification: Diversifying your investment portfolio across different asset classes, not just cryptocurrencies, is crucial to reduce risk.

-

Using stop-loss orders: Employing stop-loss orders helps limit potential losses by automatically selling your Bitcoin if the price drops to a predetermined level.

-

Dollar-cost averaging strategies: Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of price fluctuations, mitigating the risk of investing a large sum at a market peak.

-

Only investing what you can afford to lose: This is paramount. Never invest money you can't afford to lose completely.

Conclusion

This article analyzed a prominent analyst's prediction of an upcoming Bitcoin rally. The prediction is supported by a confluence of technical indicators, on-chain data, and macroeconomic considerations. Key support and resistance levels have been identified, offering potential entry and exit points for traders. However, it’s crucial to remember the inherent risks in the volatile cryptocurrency market. While this analysis suggests a potential Bitcoin rally, thorough research and careful risk management are paramount. Stay informed on the latest Bitcoin price action and chart levels to make well-informed decisions. Continue monitoring this crucial Bitcoin prediction and learn more about potential Bitcoin opportunities. Don't miss out on the potential Bitcoin rally – stay tuned for further updates!

Featured Posts

-

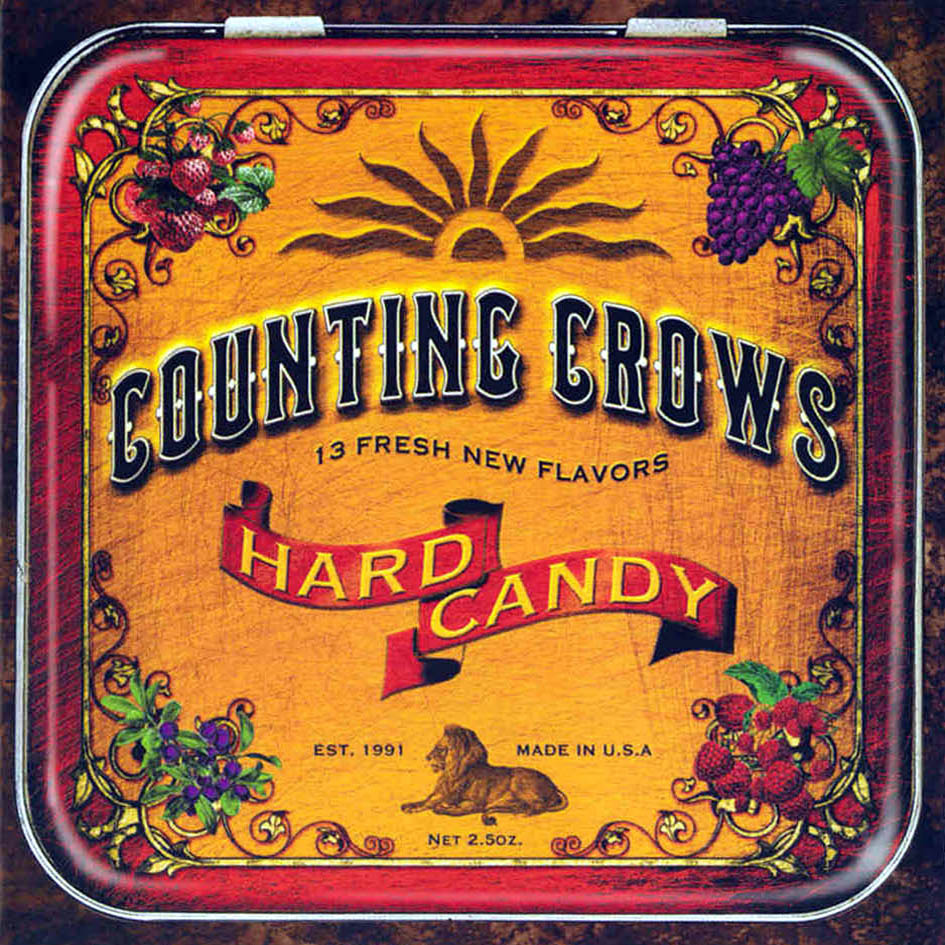

Saturday Night Live And Counting Crows A Career Changing Partnership

May 08, 2025

Saturday Night Live And Counting Crows A Career Changing Partnership

May 08, 2025 -

Istoriya Matchiv Ps Zh Ta Aston Villi V Yevrokubkakh

May 08, 2025

Istoriya Matchiv Ps Zh Ta Aston Villi V Yevrokubkakh

May 08, 2025 -

The Overvalued Loonie Economic Implications And Necessary Reforms

May 08, 2025

The Overvalued Loonie Economic Implications And Necessary Reforms

May 08, 2025 -

March 7th Nba Thunder Vs Trail Blazers Game Time Tv And Live Stream Details

May 08, 2025

March 7th Nba Thunder Vs Trail Blazers Game Time Tv And Live Stream Details

May 08, 2025 -

Xrp Trading Volume Tops Solana Amidst Etf Speculation

May 08, 2025

Xrp Trading Volume Tops Solana Amidst Etf Speculation

May 08, 2025