Analyst Sees Bitcoin Entering Rally Zone: Chart Analysis (May 6, 2024)

Table of Contents

The Analyst's Predictions and Methodology

A prominent cryptocurrency analyst has recently predicted a significant Bitcoin price rally, basing their forecast on a confluence of technical indicators and chart patterns. Their analysis suggests Bitcoin is breaking out of a period of consolidation and entering a new phase of growth.

Key Chart Patterns Identified

The analyst identified several key chart patterns indicating a potential Bitcoin rally:

-

A clear breakout from a descending triangle: This pattern, often viewed as a bullish continuation pattern, suggests accumulating buying pressure overcoming selling pressure.

-

A positive MACD crossover: The moving average convergence divergence (MACD) indicator recently showed a bullish crossover, signaling a potential shift in momentum.

-

RSI breaking above oversold levels: The Relative Strength Index (RSI) moved above the oversold threshold, suggesting the market may be nearing a bounce.

-

Specific technical indicators used: RSI, MACD, Bollinger Bands, and various moving averages (e.g., 20-day, 50-day, 200-day).

-

Price targets mentioned by the analyst: The analyst suggests price targets ranging from $35,000 to $50,000 in the short to mid-term.

-

Timeframes for the predicted rally: The predicted rally is expected to unfold over the next few months to a year, with the potential for further gains in the longer term.

Supporting Data: The analyst's predictions are further supported by increased trading volume during the breakout from the descending triangle and the strengthening of key support levels. Historical price comparisons with similar patterns in Bitcoin's past suggest a potential for substantial upside.

On-Chain Data Supporting the Rally Thesis

Beyond technical analysis, on-chain data also provides supporting evidence for the potential Bitcoin rally. Analyzing on-chain metrics offers valuable insights into the underlying strength and momentum of the Bitcoin network.

Analyzing On-Chain Metrics

Several key on-chain metrics point towards a positive outlook:

-

Decreased exchange inflows: A decline in the amount of Bitcoin flowing into exchanges indicates less selling pressure and potential accumulation by long-term holders.

-

Increased network activity: Growing transaction volume and hashrate suggest increased user engagement and network security, bolstering confidence in Bitcoin's long-term value.

-

Miner behavior: Consistent mining activity despite price fluctuations suggests belief in the long-term viability of Bitcoin.

-

Significance of each metric: These on-chain indicators collectively suggest a growing confidence in Bitcoin, reducing the likelihood of a significant price correction in the near future.

-

Reputable on-chain data sources: Glassnode, CoinMetrics, and similar platforms provide valuable insights into on-chain data.

Potential Risks and Challenges to a Bitcoin Rally

While the analysis suggests a potential Bitcoin rally, it's crucial to acknowledge the inherent risks and challenges.

Macroeconomic Factors

Several macroeconomic factors could impact Bitcoin's price:

- Inflationary pressures: High inflation could erode Bitcoin's purchasing power, potentially dampening investor enthusiasm.

- Interest rate hikes: Increased interest rates might shift investor capital away from riskier assets like Bitcoin toward safer investments.

- Regulatory uncertainty: Changes in regulatory landscapes worldwide could significantly influence Bitcoin's price volatility.

Market Sentiment and Volatility

Market sentiment plays a crucial role in Bitcoin's price movements. Sudden shifts in sentiment can lead to significant price volatility.

- Potential downside risks: Unexpected market events, regulatory changes, or a renewed bear market could lead to price corrections.

- Risk management strategies: Diversification, stop-loss orders, and dollar-cost averaging can help mitigate risks.

- Geopolitical events: Global geopolitical events can trigger uncertainty and impact Bitcoin's price.

Alternative Perspectives and Contrarian Views

It's important to consider alternative viewpoints. Not all analysts are bullish on Bitcoin's short-term prospects. Some argue that the current market conditions might not be conducive to a sustained rally.

- Summary of different opinions: Some analysts remain cautious, citing macroeconomic headwinds and potential regulatory hurdles.

- Reasoning behind contrarian views: These analysts point to the possibility of a prolonged period of consolidation or a further price correction before a significant rally.

- Links to relevant resources: [Link to article 1], [Link to article 2] (replace with actual links)

Bitcoin Rally Zone: Key Takeaways and Next Steps

This analysis suggests a potential Bitcoin rally based on compelling technical and on-chain data. However, the cryptocurrency market remains volatile, and risks associated with macroeconomic factors and market sentiment must be considered.

Summary of Findings: The analyst's prediction of a Bitcoin price rally is supported by several technical indicators, chart patterns, and positive on-chain data. However, this is not financial advice.

Recap of Risks and Opportunities: While the potential rewards are significant, investors need to carefully assess and manage the risks associated with Bitcoin's price volatility.

Call to Action: While this analysis suggests Bitcoin is entering a rally zone, diligent research and risk management remain crucial. Continue monitoring the Bitcoin price and relevant on-chain data, exploring Bitcoin investment strategies, and conducting thorough Bitcoin market analysis to make informed decisions about your Bitcoin investments. Stay informed, invest wisely, and don't miss out on the potential Bitcoin rally.

Featured Posts

-

Jayson Tatum Under Fire From Colin Cowherd After Celtics Game 1

May 08, 2025

Jayson Tatum Under Fire From Colin Cowherd After Celtics Game 1

May 08, 2025 -

Sony Ps 5 Pro Disassembly Examining The Liquid Metal Cooling Implementation

May 08, 2025

Sony Ps 5 Pro Disassembly Examining The Liquid Metal Cooling Implementation

May 08, 2025 -

Unscripted Moments In Saving Private Ryan Impact And Legacy

May 08, 2025

Unscripted Moments In Saving Private Ryan Impact And Legacy

May 08, 2025 -

Inter Milan Eliminate Feyenoord Secure Last Eight Spot

May 08, 2025

Inter Milan Eliminate Feyenoord Secure Last Eight Spot

May 08, 2025 -

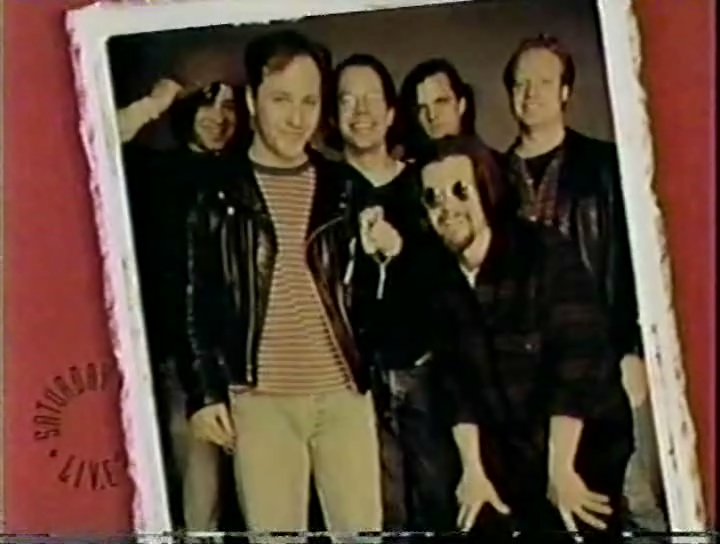

Counting Crows 1995 Snl Performance A Retrospective

May 08, 2025

Counting Crows 1995 Snl Performance A Retrospective

May 08, 2025