Analysts Predict Trump-Era 30% China Tariffs To Last Until 2025

Table of Contents

The lingering shadow of the Trump administration's trade war continues to loom large. Analysts now predict that the 30% tariffs imposed on Chinese goods during that era will remain in place until at least 2025, significantly impacting global trade and the US-China economic relationship. This article delves into the reasons behind this prediction and its potential consequences for businesses and consumers alike. The implications of these extended China tariffs are far-reaching and demand careful consideration.

<h2>Reasons for the Extended Tariffs</h2>

The continued imposition of the 30% tariffs on Chinese goods is a complex issue with multiple contributing factors. Understanding these reasons is crucial to anticipating future economic trends and adapting business strategies accordingly.

<h3>Lack of Significant Trade Deal Progress</h3>

Stalled negotiations and the absence of a comprehensive trade agreement between the US and China are primary reasons for the continued tariffs. Despite numerous rounds of talks, significant sticking points remain.

- Intellectual Property Rights: The US continues to express concerns about China's inadequate protection of intellectual property, hindering innovation and American competitiveness.

- Technology Transfer: Forced technology transfer, where US companies are pressured to share their technology with Chinese partners, remains a major point of contention.

- Market Access: China's restrictive market access policies, limiting the ability of US companies to compete fairly in the Chinese market, are another obstacle.

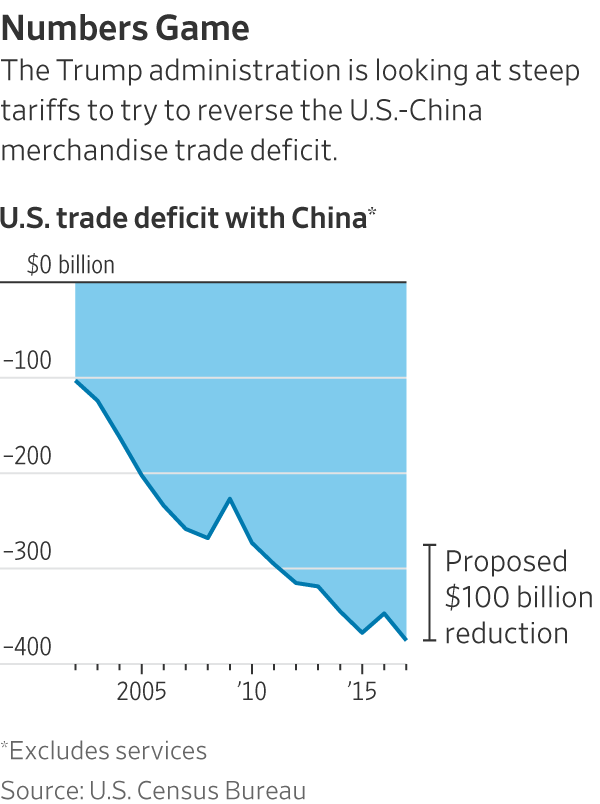

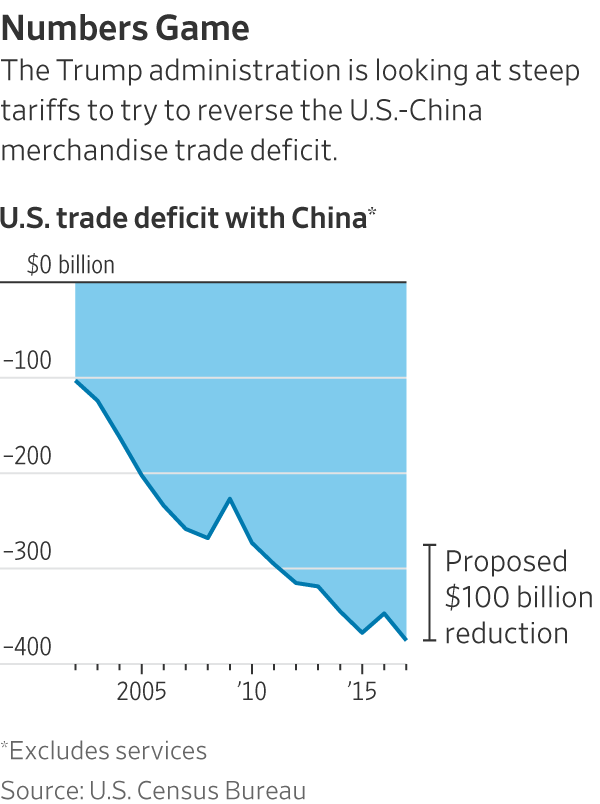

- Trade Deficit: The US-China trade deficit, while fluctuating, remains substantial, fueling arguments for maintaining tariffs as a means of correcting the imbalance. Recent data shows a persistent deficit, highlighting the ongoing challenges in achieving trade equilibrium.

<h3>Political Considerations and Bipartisan Support (or Lack Thereof)</h3>

The political landscape in the US plays a significant role in the tariff situation. While some bipartisan support exists for addressing trade imbalances, consensus on the best approach remains elusive.

- Political Polarization: The issue has become highly politicized, with differing viewpoints within both the Republican and Democratic parties. Some argue that the tariffs are necessary for national security and economic protection, while others contend they harm consumers and businesses.

- Electoral Impacts: The tariffs have become a key issue in US elections, influencing voters' decisions and shaping the political debate. The economic consequences of the tariffs are consistently raised during election campaigns.

<h3>Domestic Industry Protectionism</h3>

Intense lobbying efforts by specific US industries have significantly contributed to the maintenance of these protective measures. These industries argue that the tariffs are essential for their survival and competitiveness.

- Steel and Aluminum: These industries have benefitted significantly from the tariffs, citing increased domestic production and job creation as a result.

- Agriculture: While some agricultural sectors have been negatively impacted, others have received government support to offset the effects of retaliatory tariffs imposed by China.

<h2>Economic Impacts of Extended Tariffs</h2>

The extended tariffs have far-reaching economic consequences, impacting consumers, businesses, and the global economy.

<h3>Impact on US Consumers</h3>

The 30% tariffs on Chinese goods directly translate to increased prices for US consumers. This has a broad impact on household budgets and contributes to inflation.

- Increased Prices: Consumers pay more for a wide range of goods, from electronics and clothing to furniture and toys.

- Inflationary Pressures: The tariffs contribute to overall inflation, eroding purchasing power and reducing consumer spending.

- Examples: Increased prices on electronics, clothing, furniture, and other consumer goods directly imported from China are readily observable.

<h3>Impact on US Businesses</h3>

American businesses face numerous challenges due to the tariffs, including supply chain disruptions and increased production costs.

- Supply Chain Disruptions: Businesses relying on Chinese imports face delays and increased costs due to tariffs and trade restrictions.

- Increased Production Costs: Companies may be forced to raise prices or reduce profits due to increased import costs.

- Reduced Competitiveness: US businesses exporting to China may face retaliatory tariffs, reducing their competitiveness in the global market.

<h3>Global Economic Implications</h3>

The continued tariffs have broad global economic consequences, impacting international trade relationships and supply chains.

- Global Supply Chain Disruptions: The tariffs contribute to global supply chain instability, increasing uncertainty for businesses worldwide.

- Inflationary Pressures: The increased costs are not limited to the US; they ripple throughout the global economy, contributing to inflation in other countries.

- Geopolitical Tensions: The tariffs further strain US-China relations and create uncertainty in the global trade environment.

<h2>Potential Future Scenarios and Mitigation Strategies</h2>

While the prediction is for the tariffs to remain until 2025, several factors could alter this trajectory. Businesses can also take proactive steps to mitigate the negative impacts.

<h3>Possibility of Tariff Removal or Reduction</h3>

The possibility of tariff removal or reduction before 2025 depends on several factors, including political shifts and economic changes.

- Shifting Political Landscape: Changes in the US administration or Congress could lead to a reevaluation of tariff policy.

- Economic Conditions: A significant economic downturn could prompt a reassessment of the tariffs' impact.

- Negotiated Settlement: A negotiated trade agreement between the US and China could result in the removal or reduction of tariffs.

<h3>Strategies for Businesses to Adapt</h3>

Businesses can employ several strategies to mitigate the effects of the continued tariffs.

- Diversify Supply Chains: Reducing reliance on Chinese suppliers by sourcing goods from alternative markets is crucial.

- Cost-Cutting Measures: Implementing cost-cutting measures to offset increased input costs is essential for maintaining profitability.

- Explore Alternative Markets: Businesses should actively seek opportunities in other markets to reduce their dependence on the US-China trade relationship.

<h2>Conclusion</h2>

The prediction of extended 30% China tariffs until 2025 presents significant challenges for businesses and consumers. The reasons behind this prediction are multifaceted, encompassing trade negotiations, political considerations, and domestic industry protectionism. The economic impacts are substantial, affecting US consumers through increased prices, US businesses through supply chain disruptions, and the global economy through broader inflationary pressures and geopolitical uncertainty. While the future is uncertain, understanding the potential scenarios and adopting proactive mitigation strategies is crucial for navigating this complex economic landscape. Stay informed about developments in US-China trade relations and the potential impact of the 30% China tariffs on your businesses and investments. Further research into the topic, using terms like "impact of China tariffs 2025," "mitigating China tariff risks," and "US-China trade negotiations," is highly recommended to proactively adapt to the changing global economic climate.

Featured Posts

-

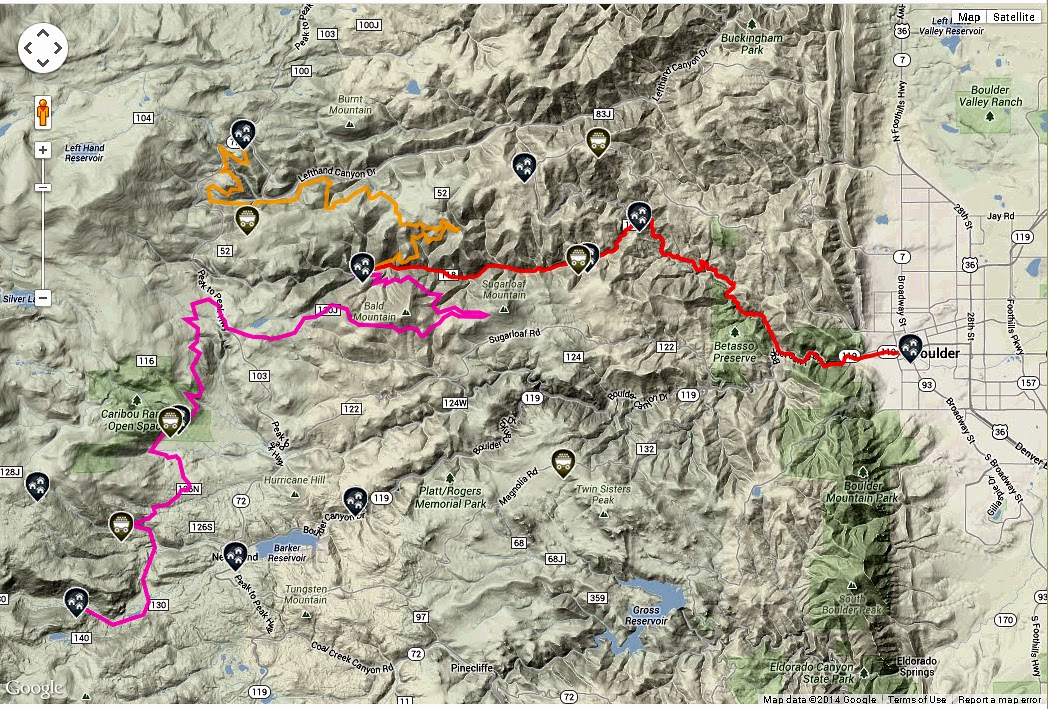

Switzerland Trail Boulder County A Journey Through Mining History

May 18, 2025

Switzerland Trail Boulder County A Journey Through Mining History

May 18, 2025 -

Michelle Williams On Marcello Hernandezs Clasp Comment In Dying For Sex

May 18, 2025

Michelle Williams On Marcello Hernandezs Clasp Comment In Dying For Sex

May 18, 2025 -

Moodys Credit Rating Downgrade Sparks White House Outrage

May 18, 2025

Moodys Credit Rating Downgrade Sparks White House Outrage

May 18, 2025 -

Canadian Tire Acquisition Of Hudsons Bay Potential Benefits And Risks

May 18, 2025

Canadian Tire Acquisition Of Hudsons Bay Potential Benefits And Risks

May 18, 2025 -

Quebec Labour Tribunal Hears Amazon Union Case Over Warehouse Shutdowns

May 18, 2025

Quebec Labour Tribunal Hears Amazon Union Case Over Warehouse Shutdowns

May 18, 2025

Latest Posts

-

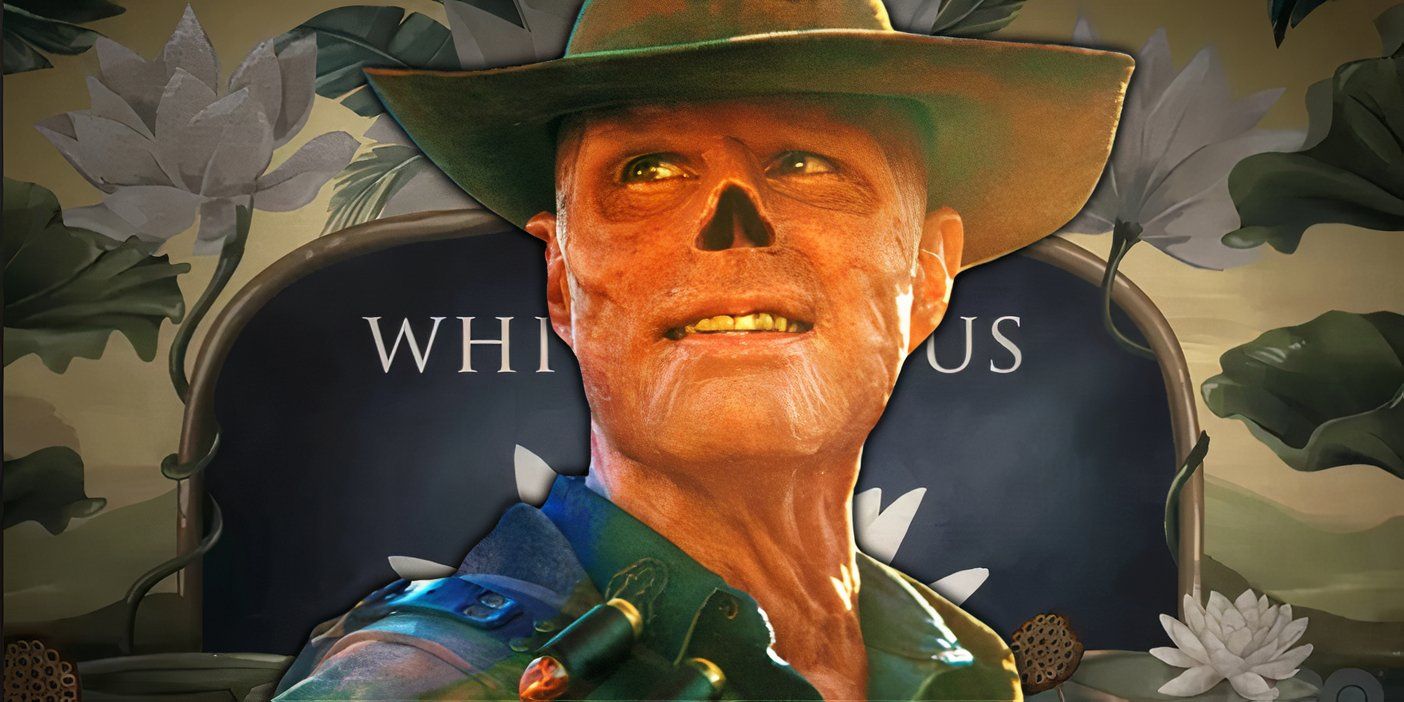

Goggins Prepares For Snl A Look At His White Lotus Fan Theory Jabs

May 18, 2025

Goggins Prepares For Snl A Look At His White Lotus Fan Theory Jabs

May 18, 2025 -

Taylor Swift Kendrick Lamar And Simone Biles Win Big At The Webby Awards

May 18, 2025

Taylor Swift Kendrick Lamar And Simone Biles Win Big At The Webby Awards

May 18, 2025 -

Snl Host Walton Goggins Takes Aim At White Lotus Fan Theories

May 18, 2025

Snl Host Walton Goggins Takes Aim At White Lotus Fan Theories

May 18, 2025 -

White Lotus Fan Theories Walton Goggins Snl Monologue

May 18, 2025

White Lotus Fan Theories Walton Goggins Snl Monologue

May 18, 2025 -

Walton Goggins Pokes Fun At White Lotus Fan Theories Before Snl

May 18, 2025

Walton Goggins Pokes Fun At White Lotus Fan Theories Before Snl

May 18, 2025