Analyzing BigBear.ai Stock: A Practical Guide For Investors

Table of Contents

Understanding BigBear.ai's Business Model

BigBear.ai is a leading provider of artificial intelligence (AI)-powered solutions, primarily targeting the government and commercial sectors. Its business model centers around delivering advanced analytics, AI-driven decision support, and digital transformation services. They leverage cutting-edge technologies to tackle complex challenges in areas such as national security, defense, and commercial operations.

BigBear.ai's revenue streams are diverse, stemming from government contracts, commercial partnerships, and software licensing. Their business strategy focuses on building strong relationships with key clients and expanding their AI capabilities to address evolving market needs. While their strong government presence provides stability, it also introduces reliance on government contracts, a crucial element of BigBear.ai stock analysis.

Competitive Advantages: BigBear.ai boasts a deep understanding of the government sector's unique requirements. Their expertise in data analytics and AI solutions positions them favorably within this niche. However, competition is fierce, with larger tech companies and specialized AI firms vying for market share.

- Key Clients and Partnerships: BigBear.ai has secured contracts with numerous government agencies, and strategic partnerships with technology providers broaden their reach and capabilities.

- Current Market Share and Growth Potential: The company's market share is growing, fueled by increased demand for AI solutions in both government and commercial sectors. The potential for further expansion is substantial.

- Core Technologies: BigBear.ai's core technologies include advanced analytics, machine learning, and natural language processing (NLP). These are crucial elements in understanding the potential of BigBear.ai stock.

- Approach to AI Solutions for the Government Sector: BigBear.ai's tailored approach to the government sector, focusing on security and compliance, sets them apart from more generalized AI providers. This is a key factor for evaluating BigBear.ai stock.

Evaluating BigBear.ai's Financial Performance

Analyzing BigBear.ai's financial performance is paramount when assessing BigBear.ai stock. A thorough review of recent financial statements is necessary. This involves scrutinizing revenue growth, profitability (or lack thereof), and cash flow dynamics. Key financial ratios, such as profit margins, debt-to-equity ratio, and return on equity (ROE), provide valuable insights into the company's financial health and stability.

- Interpretation of Key Financial Metrics: Understanding the trends in revenue, earnings, and cash flow is vital for projecting the future performance of BigBear.ai stock.

- Comparison to Industry Benchmarks: Comparing BigBear.ai's financial performance to its competitors sheds light on its relative strength and weaknesses.

- Assessment of Financial Health and Stability: Analyzing BigBear.ai's financial ratios provides a comprehensive picture of its financial stability and long-term viability.

- Significant Financial Risks or Opportunities: Identifying any significant financial risks, such as high debt levels or dependence on a single customer, and potential opportunities are crucial for assessing BigBear.ai stock.

Assessing BigBear.ai's Risk Factors

Investing in BigBear.ai stock involves inherent risks. These risks encompass several factors that need careful consideration:

-

Market Risks: The overall market volatility can significantly impact BigBear.ai's stock price, regardless of the company's performance.

-

Competitive Risks: Intense competition in the AI sector presents a significant threat to BigBear.ai's market share and profitability.

-

Financial Risks: The company's financial health, debt levels, and reliance on government contracts all contribute to financial risks associated with BigBear.ai stock.

-

Geopolitical Events and Regulatory Changes: Geopolitical instability and changes in government regulations can drastically impact the company's operations and revenue streams.

-

Specific Risks Related to Government Contracts: Dependence on government contracts exposes BigBear.ai to potential delays, budget cuts, or changes in procurement policies.

-

Risks Associated with Technological Advancements: The rapid pace of technological advancements in AI poses risks, as BigBear.ai needs to continuously innovate to stay competitive.

-

Competitive Landscape and Potential Threats: Analyzing the competitive landscape and identifying potential threats to BigBear.ai's market position is essential.

-

Assessment of the Company's Risk Mitigation Strategies: Evaluating BigBear.ai's strategies to mitigate these risks is crucial for understanding the viability of a BigBear.ai investment.

BigBear.ai Stock Valuation and Investment Strategies

Valuing BigBear.ai stock requires employing various valuation methods. Discounted cash flow (DCF) analysis, which projects future cash flows and discounts them to their present value, provides a fundamental valuation. Comparable company analysis, comparing BigBear.ai to its peers, offers another perspective. These methods, along with understanding the current market price, allow for an assessment of the stock's intrinsic value.

- Analysis of Current Market Price and its Relationship to Intrinsic Value: Comparing the current market price to the estimated intrinsic value helps determine whether BigBear.ai stock is undervalued or overvalued.

- Different Investment Strategies and their Suitability for Various Investors: Investment strategies can range from long-term buy-and-hold to short-term trading, depending on the investor's risk tolerance and financial goals.

- Consideration of Diversification Within an Investment Portfolio: Diversification is crucial for mitigating risk, and BigBear.ai stock should be considered within the context of a broader investment portfolio.

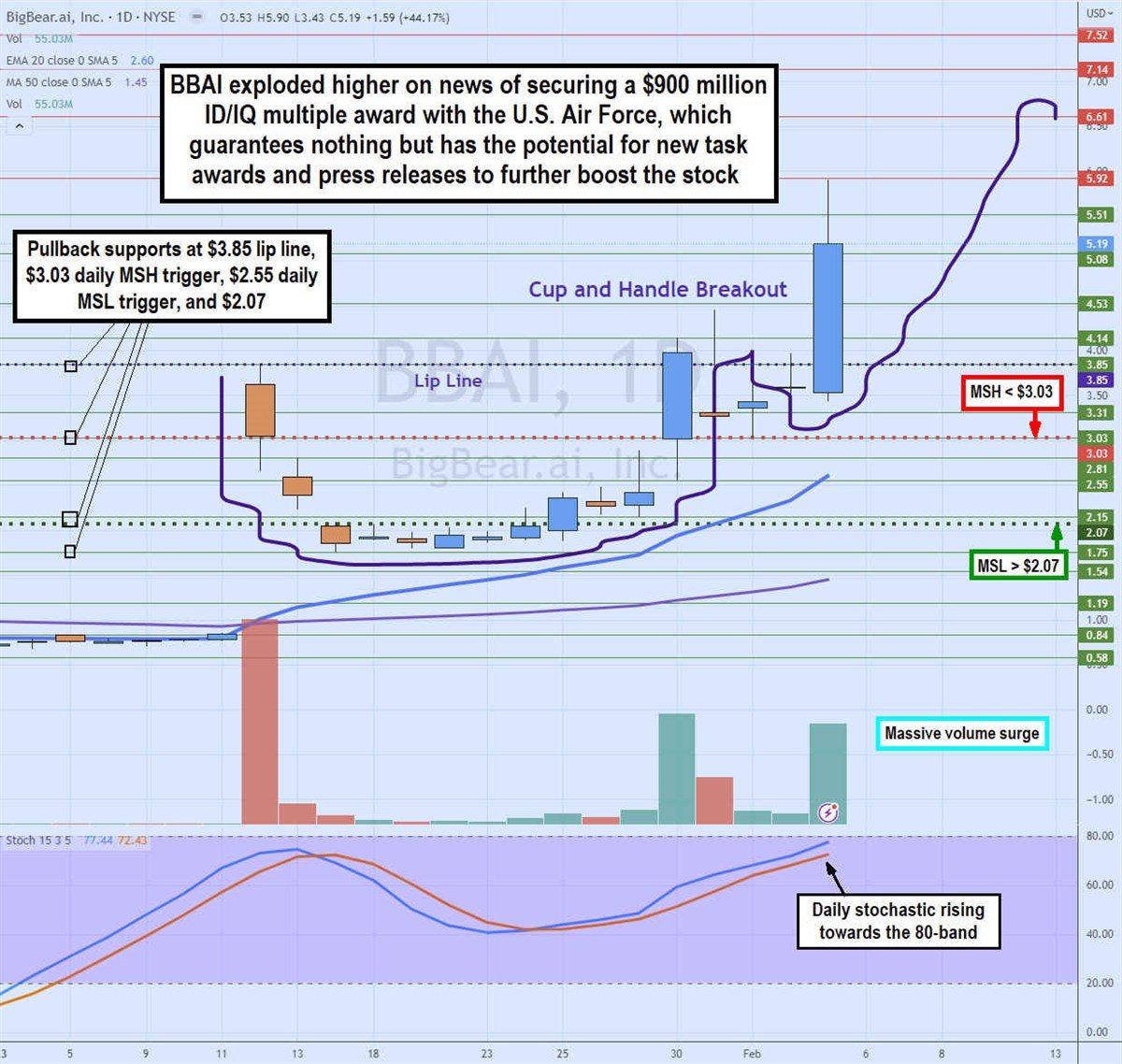

- Factors Influencing Stock Price Fluctuations: Understanding factors that drive stock price fluctuations, such as news events, earnings reports, and market sentiment, is essential for effective investment decision-making.

Conclusion: Making Informed Decisions about BigBear.ai Stock

Analyzing BigBear.ai stock requires a comprehensive understanding of its business model, financial performance, risk factors, and valuation. This guide has highlighted key aspects to consider before investing in BigBear.ai. Remember, thorough due diligence is crucial before making any investment decision. While BigBear.ai presents exciting opportunities in the rapidly expanding AI sector, significant risks are also present. The potential rewards of investing in BigBear.ai are substantial, but careful consideration of the outlined risks is paramount.

Conduct further research, consult with a financial advisor, and thoroughly analyze the information available before making any decisions regarding investing in BigBear.ai. By understanding the intricacies of BigBear.ai and employing a well-informed approach to analyzing BigBear.ai, you can increase your chances of success in this potentially lucrative but volatile market. Remember, successful investing in BigBear.ai relies heavily on informed decision-making.

Featured Posts

-

Where To Watch Sandylands U A Comprehensive Guide

May 20, 2025

Where To Watch Sandylands U A Comprehensive Guide

May 20, 2025 -

Balikatan Exercises A Super Bowl Of Military Drills Between Philippines And Us

May 20, 2025

Balikatan Exercises A Super Bowl Of Military Drills Between Philippines And Us

May 20, 2025 -

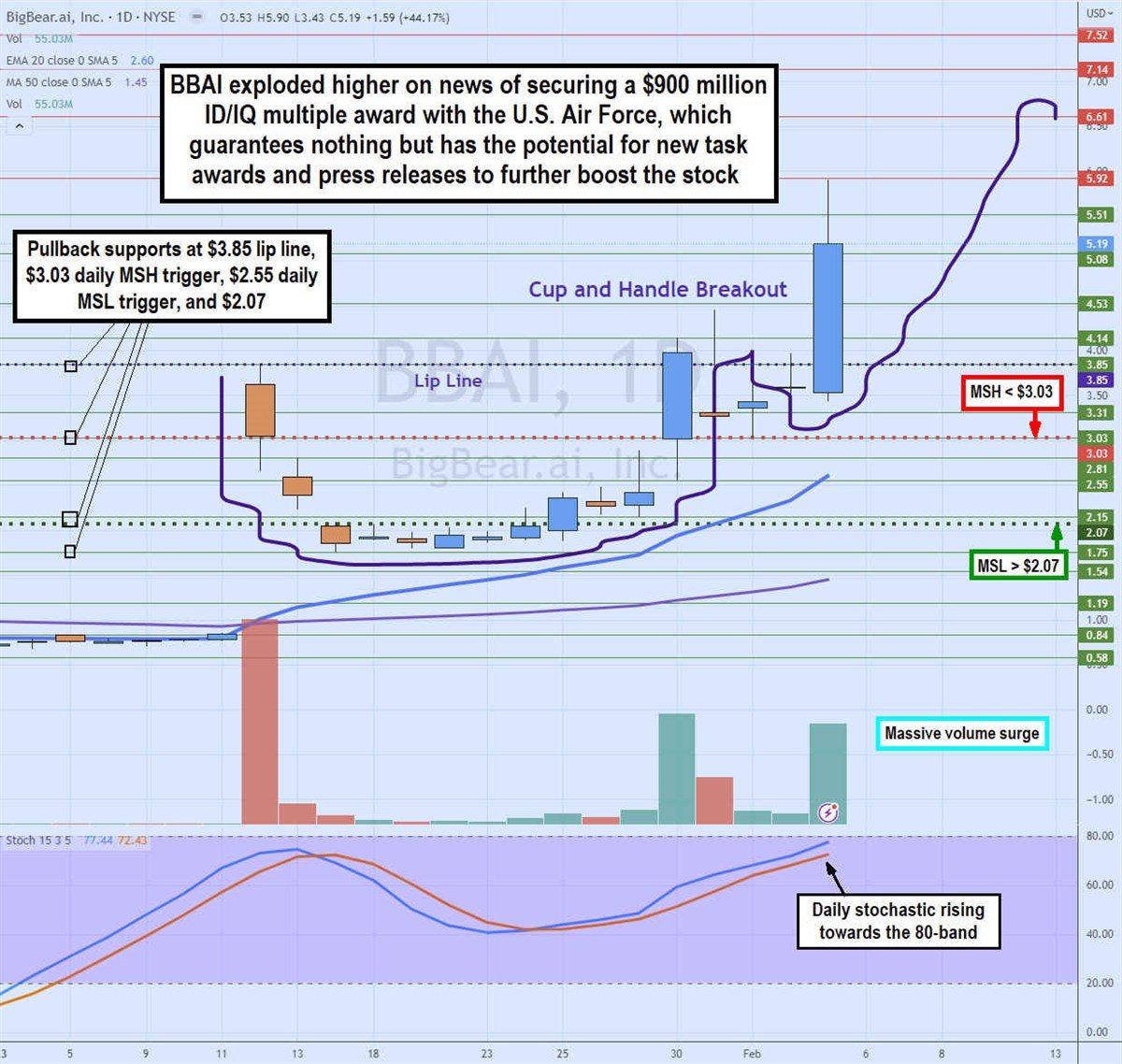

Nyt Crossword Answer Key April 25 2025

May 20, 2025

Nyt Crossword Answer Key April 25 2025

May 20, 2025 -

Turning Trash Into Treasure An Ai Powered Poop Podcast From Mundane Documents

May 20, 2025

Turning Trash Into Treasure An Ai Powered Poop Podcast From Mundane Documents

May 20, 2025 -

Drier Weather Ahead Tips For Water Conservation And Drought Preparedness

May 20, 2025

Drier Weather Ahead Tips For Water Conservation And Drought Preparedness

May 20, 2025

Latest Posts

-

David Walliams Scathing Simon Cowell Takedown A Britains Got Talent Feud

May 20, 2025

David Walliams Scathing Simon Cowell Takedown A Britains Got Talent Feud

May 20, 2025 -

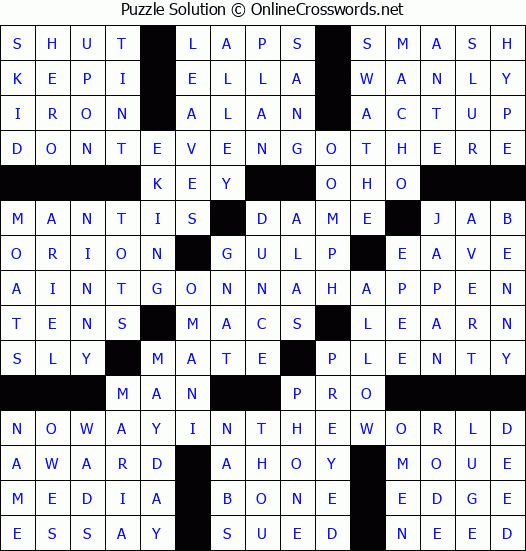

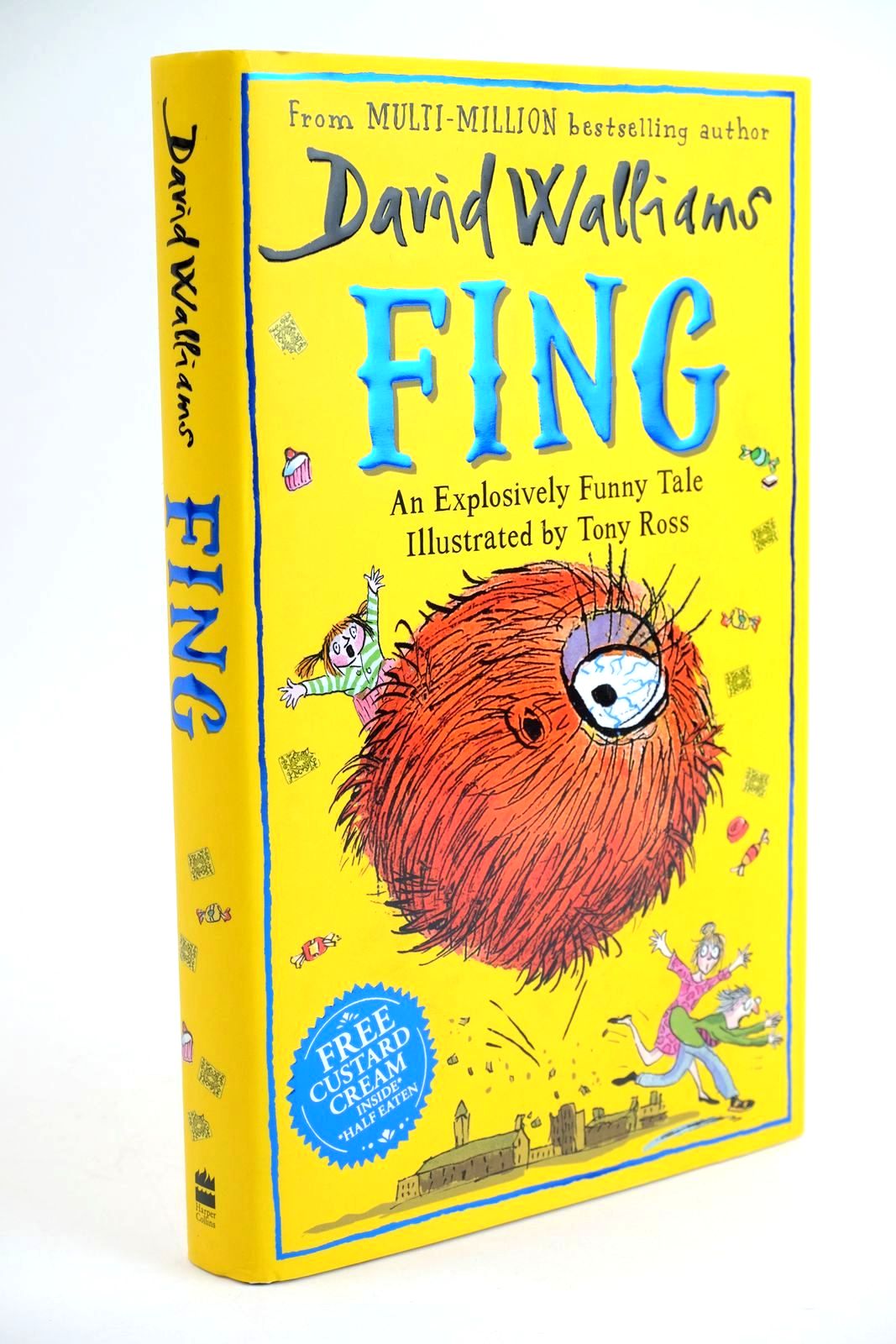

David Walliams Fing Production Greenlit By Stan

May 20, 2025

David Walliams Fing Production Greenlit By Stan

May 20, 2025 -

Fing A New David Walliams Fantasy Film Coming Soon Thanks To Stan

May 20, 2025

Fing A New David Walliams Fantasy Film Coming Soon Thanks To Stan

May 20, 2025 -

Mia Wasikowska Joins Taika Waititis New Family Film

May 20, 2025

Mia Wasikowska Joins Taika Waititis New Family Film

May 20, 2025 -

Stan Gives The Go Ahead To David Walliams Fing Fantasy Adaptation

May 20, 2025

Stan Gives The Go Ahead To David Walliams Fing Fantasy Adaptation

May 20, 2025