Analyzing Canadian Labour Data: Rosenberg's Insights On Interest Rates

Table of Contents

Rosenberg's Methodology: Deciphering the Labour Market Signals

David Rosenberg employs a rigorous and multifaceted approach to analyzing Canadian employment data. His methodology goes beyond simply looking at headline numbers; instead, he delves into a range of indicators to paint a comprehensive picture of the labour market's health and its implications for interest rates. He focuses on a combination of leading and lagging indicators, allowing him to anticipate future trends and refine his predictions.

- Specific indicators: Rosenberg closely monitors the unemployment rate, the labour force participation rate, average hourly earnings, job creation numbers across various sectors, and even quits rates as a signal of employee confidence.

- Economic models: His analysis draws upon various economic models, including those focusing on the Phillips Curve relationship between inflation and unemployment, and incorporates elements of Keynesian and Austrian economic thought.

- Leading vs. lagging indicators: Rosenberg skillfully integrates both leading and lagging indicators. Leading indicators, such as consumer confidence and business investment plans, provide early signals of future economic activity, while lagging indicators, like the unemployment rate, offer a more delayed, but often more reliable, picture.

- Unique aspects: A unique aspect of Rosenberg's approach is his emphasis on understanding the underlying dynamics of the labour market, considering factors such as technological advancements, demographic shifts, and global economic conditions. He doesn't just look at the numbers; he seeks to understand the why behind the numbers.

Key Canadian Labour Market Indicators and their Influence on Interest Rates

Several key indicators within Canadian labour data significantly influence Rosenberg's interest rate predictions. Let's examine the most crucial ones:

Employment Rate and Participation Rate

Changes in the Canadian employment and participation rates profoundly impact interest rate expectations. A high employment rate, nearing full employment, often indicates strong economic growth, potentially leading to inflationary pressures. Conversely, high unemployment signifies weak economic activity, often prompting the Bank of Canada to lower interest rates to stimulate growth.

- Low unemployment and inflation: Low unemployment often leads to increased wage demands, fueling inflationary pressures. This forces the Bank of Canada to consider raising interest rates to cool down the economy.

- Shrinking participation rate: A shrinking labour force participation rate can complicate the picture. While it might artificially lower the unemployment rate, it suggests potential underlying issues within the economy, such as discouraged workers or a skills mismatch.

- Historical examples: The periods leading up to previous interest rate hikes by the Bank of Canada often show a correlation with low unemployment rates and rising wage growth.

Wage Growth and Inflationary Pressures

The relationship between wage growth and inflation is central to Rosenberg's analysis. Rapid wage growth can quickly translate into increased consumer spending and inflationary pressures. The Bank of Canada closely monitors wage growth as a key indicator of inflationary risks.

- Rising wages fuel inflation: When wages rise faster than productivity, businesses often pass these increased costs onto consumers in the form of higher prices, contributing to inflation.

- Inflation targets: The Bank of Canada has an explicit inflation target, typically around 2%. Significant deviations from this target influence their monetary policy decisions, including adjustments to interest rates.

- Rosenberg's incorporation: Rosenberg meticulously incorporates wage growth data into his forecasts, considering its impact on inflation and the Bank of Canada's likely response.

Productivity and its Role in Interest Rate Forecasts

Productivity growth plays a vital, often overlooked, role in shaping interest rate predictions. Higher productivity allows businesses to produce more output with the same or fewer inputs, mitigating inflationary pressures from wage increases.

- Productivity and economic growth: Strong productivity growth is a key driver of sustainable economic growth without fueling excessive inflation.

- Productivity, inflation, and wages: When productivity growth outpaces wage growth, inflationary pressures are lessened, potentially allowing for lower interest rates.

- Rosenberg's approach: Rosenberg incorporates productivity data into his analysis to assess the sustainable pace of economic growth and the potential for inflationary pressures, ultimately informing his interest rate forecasts.

Rosenberg's Predictions and their Implications for the Canadian Economy

David Rosenberg's recent analyses of Canadian labour data have led him to specific predictions regarding interest rates. [Insert specific examples of Rosenberg's predictions with sources here. For example: "In his recent report on [Date], Rosenberg predicted that the Bank of Canada would raise interest rates by X% by [Date], citing concerns about rising wage growth and tight labour markets."].

These predictions have significant implications for various sectors of the Canadian economy:

- Housing market: Rising interest rates typically lead to a cooling of the housing market, impacting prices and affordability.

- Business investment: Higher borrowing costs can discourage business investment and expansion.

- Impact on different groups: Borrowers will feel the pinch of higher interest rates, while savers may benefit from increased returns.

Specific predictions and their potential consequences should be detailed here using real examples and cited sources to enhance credibility and SEO.

Conclusion

Analyzing Canadian labour data is crucial for understanding the complexities of interest rate movements. David Rosenberg's insights, based on his thorough analysis of key indicators like employment rates, wage growth, and productivity, provide a valuable framework for interpreting the signals from the labour market and anticipating changes in monetary policy. The interplay between these indicators, inflation, and the Bank of Canada's decisions is complex, yet understanding this dynamic is critical for navigating the Canadian economy.

Call to Action: Stay informed about crucial shifts in Canadian labour data and their impact on interest rates by regularly consulting reliable economic sources such as [list reputable sources like the Bank of Canada website, Statistics Canada, and financial news outlets] and following Rosenberg's insightful analyses. Understanding Canadian labour data is key to navigating the complexities of interest rate predictions and making informed financial decisions.

Featured Posts

-

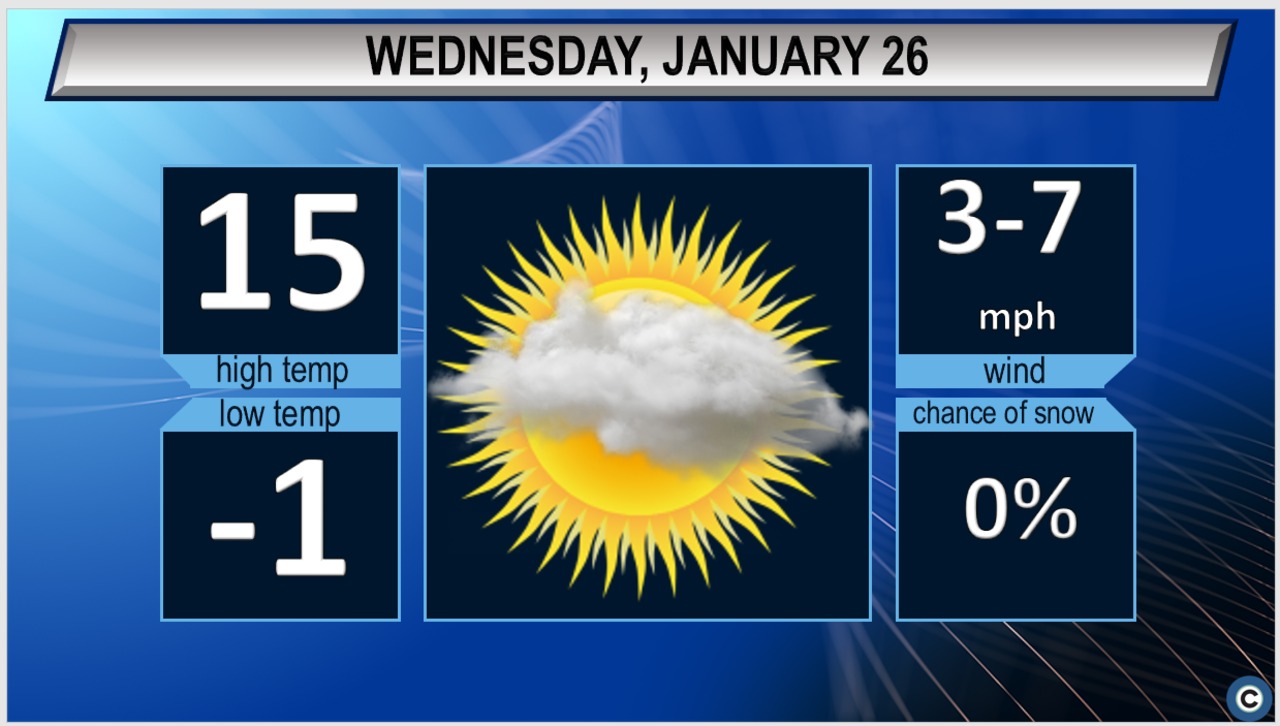

Clear Skies And Dry Weather Predicted For Northeast Ohio On Tuesday

May 31, 2025

Clear Skies And Dry Weather Predicted For Northeast Ohio On Tuesday

May 31, 2025 -

Navigating Veterinary Watchdog Reports What Vets Need To Know

May 31, 2025

Navigating Veterinary Watchdog Reports What Vets Need To Know

May 31, 2025 -

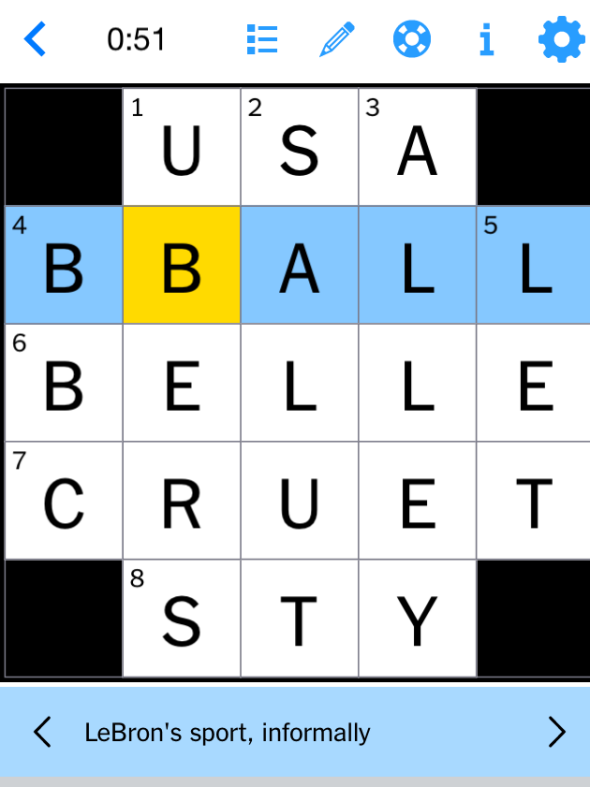

Nyt Mini Crossword Today March 31 2025 Complete Answers

May 31, 2025

Nyt Mini Crossword Today March 31 2025 Complete Answers

May 31, 2025 -

Rcn And Vet Nursing Collaboration A Plastic Glove Project Case Study

May 31, 2025

Rcn And Vet Nursing Collaboration A Plastic Glove Project Case Study

May 31, 2025 -

The Good Life What It Means And How To Get There

May 31, 2025

The Good Life What It Means And How To Get There

May 31, 2025