Analyzing CoreWeave Stock: A Look At Current Trends And Predictions

Table of Contents

CoreWeave's Business Model and Competitive Landscape

CoreWeave's business model centers around providing cloud-based GPU computing solutions, primarily targeting organizations with heavy computational needs. Their revenue streams are generated through subscriptions and pay-as-you-go models, offering flexible access to a vast pool of GPU resources. This contrasts with traditional cloud providers who often offer a more general-purpose cloud infrastructure.

The competitive landscape is fierce, with major players like AWS, Google Cloud, and Microsoft Azure offering competing services. However, CoreWeave differentiates itself through:

- Specialized GPU infrastructure: CoreWeave focuses exclusively on GPU-accelerated computing, offering a level of expertise and optimization unmatched by general-purpose cloud providers.

- Sustainable practices: Their commitment to environmentally friendly data centers is attracting environmentally conscious clients.

- Scalability and flexibility: Their infrastructure allows for rapid scaling, accommodating fluctuating computational demands.

Analyzing market share is challenging due to the fragmented nature of the GPU cloud computing market. However, CoreWeave's rapid growth suggests a significant, and potentially increasing, market share. While facing competition from established giants, CoreWeave's specialization and agility provide considerable competitive advantages. Their potential for future expansion lies in extending their services to new industries and further specializing in niche HPC applications. The high-performance computing market is vast, with plenty of room for growth for specialized providers.

Current Financial Performance and Key Metrics

Analyzing CoreWeave's financial performance requires a thorough examination of its recent reports. While specific numbers are subject to change and require consultation of up-to-date financial statements, focusing on key performance indicators (KPIs) is crucial.

Key areas to consider include:

- Revenue growth rate: A consistent high revenue growth rate signifies strong market demand and successful business strategy.

- Profit margins: Analyzing profit margins helps determine the efficiency of CoreWeave's operations and pricing strategies.

- Customer acquisition cost: A low customer acquisition cost points to effective marketing and sales strategies.

- Debt-to-equity ratio: A balanced debt-to-equity ratio indicates financial stability and a responsible approach to funding growth.

By assessing these CoreWeave financials and understanding the CoreWeave revenue streams, investors can gain valuable insight into the company’s overall health and potential for future growth. The CoreWeave profitability and its trajectory are key factors in predicting future CoreWeave stock price movements.

Impact of Macroeconomic Factors and Industry Trends

CoreWeave's stock price, like any other, is subject to the influence of macroeconomic factors. Inflation, for example, can increase operating costs, potentially squeezing profit margins. Similarly, interest rate hikes can impact investment decisions, potentially affecting CoreWeave's access to capital.

Furthermore, industry trends play a significant role:

- The rise of AI: The increasing demand for AI solutions directly fuels the need for powerful GPU-accelerated computing, benefiting CoreWeave.

- Metaverse development: The growth of the metaverse demands substantial computing power, presenting a substantial opportunity for CoreWeave's services.

- Potential risks: Technological disruptions and shifts in cloud computing preferences could pose risks to CoreWeave's growth.

Understanding these macroeconomic factors and industry trends is essential for accurately predicting CoreWeave's future performance and assessing the investment risks and rewards.

CoreWeave Stock Price Prediction and Investment Outlook

Predicting CoreWeave's stock price is inherently challenging, involving inherent uncertainties. However, based on the previous analysis, we can outline potential scenarios:

- Bullish Scenario: Continued strong revenue growth, successful expansion into new markets, and favorable macroeconomic conditions could drive significant stock price appreciation. Short-term target: (Insert estimated price). Long-term target: (Insert estimated price).

- Bearish Scenario: Economic downturn, increased competition, or unexpected technological disruptions could negatively impact the stock price.

- Neutral Scenario: Moderate growth, reflecting a stable market environment.

Risk assessment is paramount. Investing in CoreWeave involves risks associated with the technology sector, competition, and macroeconomic conditions. Given (Insert current market conditions and analysis), a (Buy/Hold/Sell) recommendation is currently suggested. This is, however, purely speculative and should not be interpreted as financial advice.

Conclusion: Final Thoughts on Analyzing CoreWeave Stock

Analyzing CoreWeave stock requires careful consideration of its unique business model, its position in a competitive market, and the impact of broader economic and industry trends. While the potential rewards associated with CoreWeave's growth are significant, investors must also be aware of the inherent risks. Thorough due diligence is crucial before making any investment decisions. Remember to consult with a financial advisor before making any investment. Start your own in-depth analysis of CoreWeave stock today! Learn more about investing in CoreWeave stock and other cloud computing opportunities and make informed decisions based on your risk tolerance and investment goals.

Featured Posts

-

De Kwetsbaarheid Van De Voedingssector Abn Amro Over Arbeidsmigratie

May 22, 2025

De Kwetsbaarheid Van De Voedingssector Abn Amro Over Arbeidsmigratie

May 22, 2025 -

Cassis Blackcurrant Jam And Preserves Homemade Recipes

May 22, 2025

Cassis Blackcurrant Jam And Preserves Homemade Recipes

May 22, 2025 -

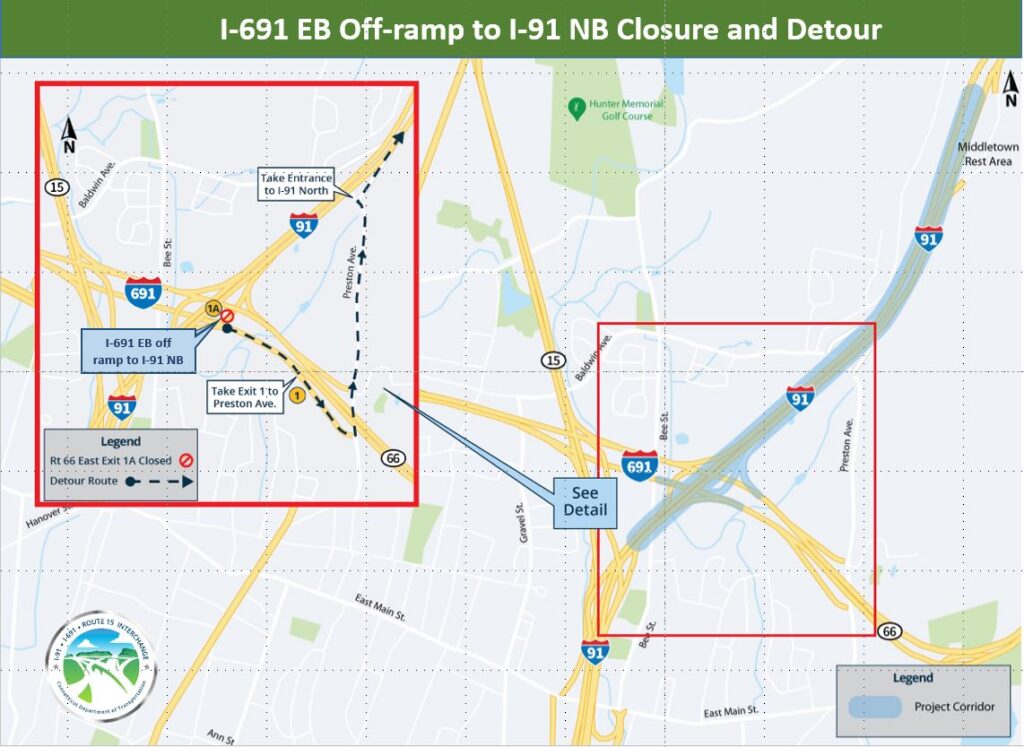

Location Route 15 On Ramp Closure Traffic Advisory

May 22, 2025

Location Route 15 On Ramp Closure Traffic Advisory

May 22, 2025 -

7 Du An Ket Noi Giao Thong Tp Hcm Long An Tiem Nang Dau Tu

May 22, 2025

7 Du An Ket Noi Giao Thong Tp Hcm Long An Tiem Nang Dau Tu

May 22, 2025 -

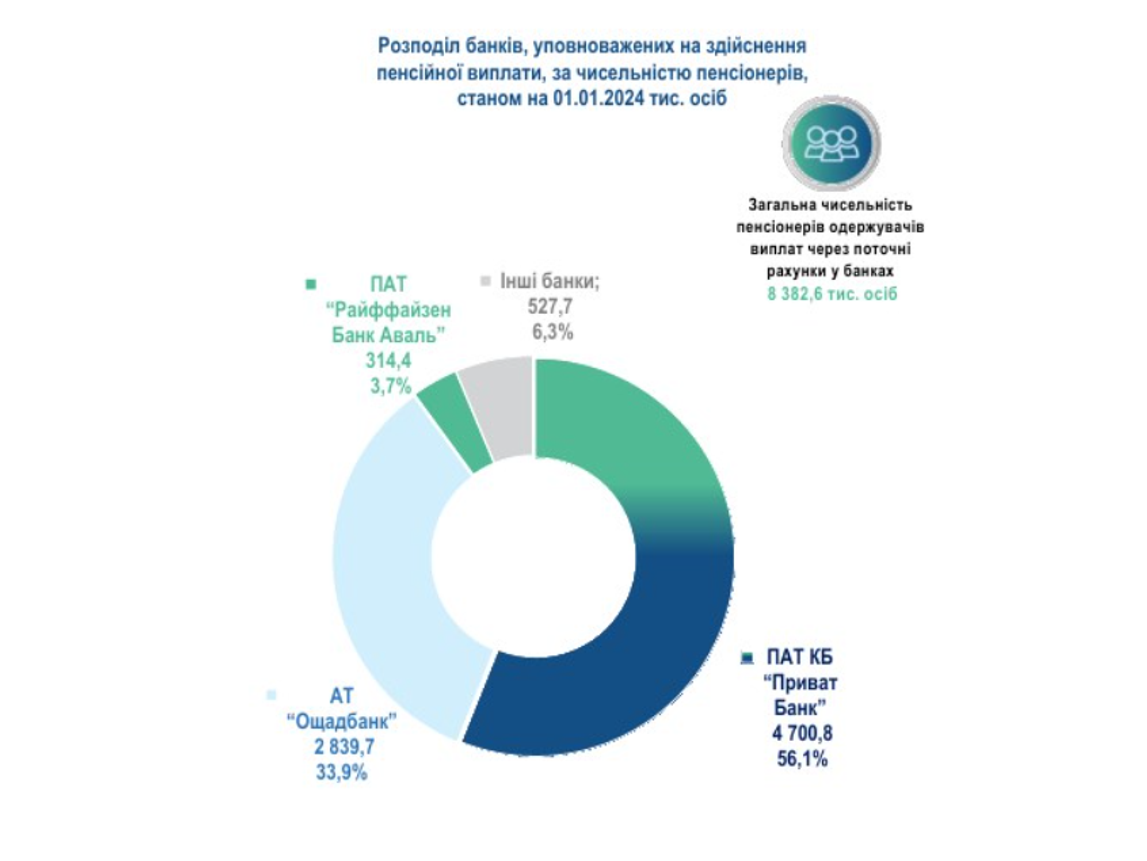

Top 5 Finansovikh Kompaniy Ukrayini Za Dokhodami U 2024 Rotsi

May 22, 2025

Top 5 Finansovikh Kompaniy Ukrayini Za Dokhodami U 2024 Rotsi

May 22, 2025

Latest Posts

-

Wordle 370 March 20 Hints Clues To Help You Solve Todays Puzzle

May 22, 2025

Wordle 370 March 20 Hints Clues To Help You Solve Todays Puzzle

May 22, 2025 -

Wordle 370 Solution Hints And Clues For March 20th Game

May 22, 2025

Wordle 370 Solution Hints And Clues For March 20th Game

May 22, 2025 -

Thursdays Wordle 370 March 20th Hints Clues And Answer

May 22, 2025

Thursdays Wordle 370 March 20th Hints Clues And Answer

May 22, 2025 -

Saturday Wordle March 8th Puzzle 1358 Hints And Answer

May 22, 2025

Saturday Wordle March 8th Puzzle 1358 Hints And Answer

May 22, 2025 -

Wordle Game 370 March 20th Hints Clues And Solution

May 22, 2025

Wordle Game 370 March 20th Hints Clues And Solution

May 22, 2025