Analyzing ETF Investments In Uber's Autonomous Driving Technology

Table of Contents

Understanding Uber's Autonomous Vehicle Strategy

Uber's Advanced Technologies Group (ATG) is at the forefront of the company's ambitious autonomous vehicle strategy. Their goal is to develop and deploy a fully self-driving ride-hailing service, revolutionizing personal transportation. This involves significant investment in research and development, sophisticated sensor technology, and advanced AI algorithms for navigation and decision-making.

Uber's ATG isn't operating in a vacuum. They've forged key partnerships and collaborations, notably with Volvo, to leverage existing automotive expertise and manufacturing capabilities. This collaborative approach allows Uber to focus on software development and AI while benefiting from established automotive infrastructure.

However, the path to autonomous vehicle dominance is paved with challenges. Regulatory hurdles vary significantly across different jurisdictions, creating complexities in deployment and testing. Safety concerns, both real and perceived, remain a significant hurdle, requiring robust testing and fail-safe mechanisms to build public trust. Despite these obstacles, Uber's potential market share in the autonomous ride-hailing sector is substantial, making it an attractive target for investors.

- Focus: Uber's self-driving technology development is centered around a robust software platform capable of handling complex driving scenarios.

- Partnerships: Key partnerships, like the one with Volvo, provide access to vehicle platforms and manufacturing expertise.

- Challenges: Regulatory uncertainty and public safety concerns represent major obstacles to widespread adoption.

- Market Potential: Uber's established ride-hailing network positions it well to capitalize on the autonomous vehicle market.

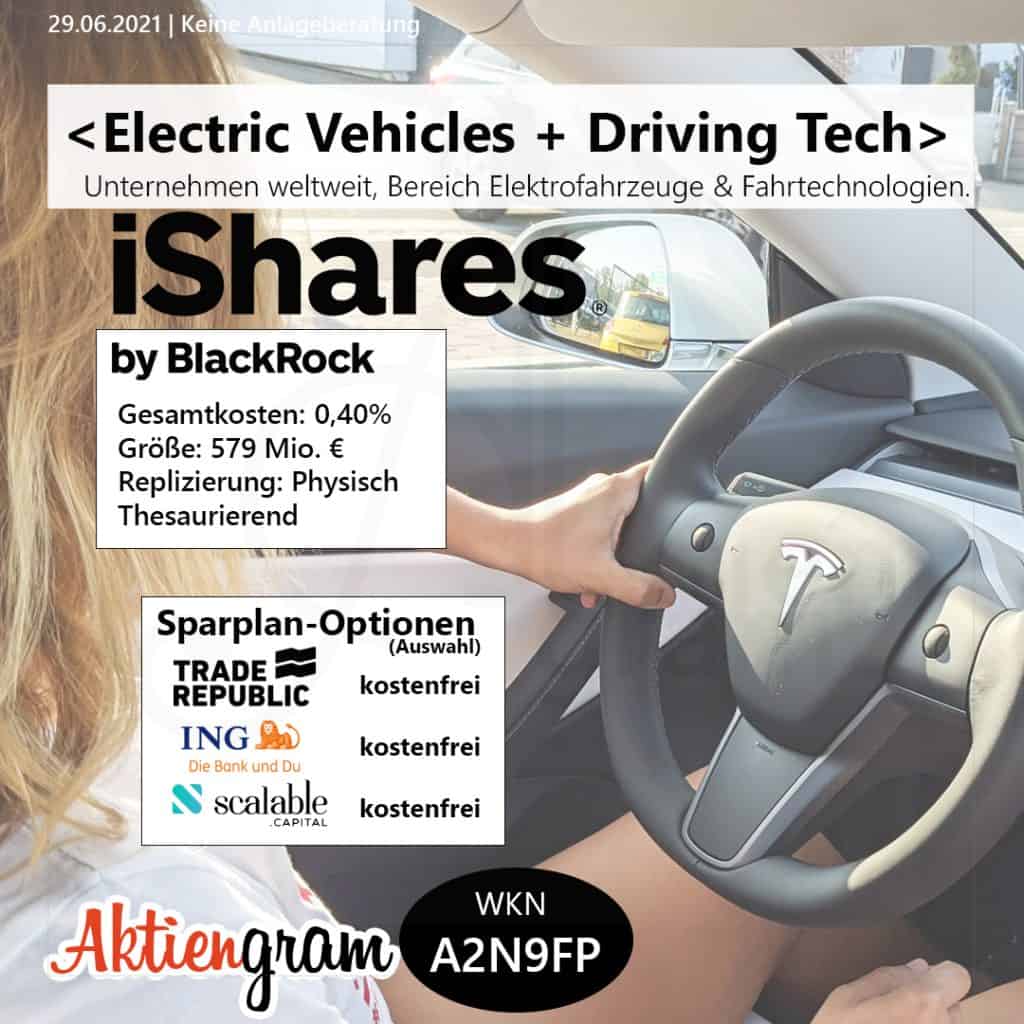

Identifying Relevant ETFs

Investing in Uber's autonomous driving technology indirectly, through ETFs, offers diversification and potentially lower risk compared to directly investing in Uber stock. Several types of ETFs can offer exposure to this sector. Sector-specific ETFs focus solely on companies involved in autonomous vehicles, robotics, or artificial intelligence. Broader technology ETFs provide a more diversified approach, including companies involved in autonomous driving alongside other tech sectors.

Choosing the right ETFs requires careful consideration. Below are examples – remember to conduct thorough research before investing. Expense ratios and geographical focus should be key factors in your decision.

- Example 1: [ETF Ticker Symbol 1] - Focus: Robotics and AI, Expense Ratio: [Ratio], Geographic Focus: [Global/US-centric]

- Example 2: [ETF Ticker Symbol 2] - Focus: Transportation and Logistics, Expense Ratio: [Ratio], Geographic Focus: [Global/US-centric]

- Example 3: [ETF Ticker Symbol 3] - Focus: Global Technology, Expense Ratio: [Ratio], Geographic Focus: [Global/US-centric]

- Example 4: [ETF Ticker Symbol 4] - Focus: Autonomous Vehicle Technology, Expense Ratio: [Ratio], Geographic Focus: [Global/US-centric]

- Example 5: [ETF Ticker Symbol 5] - Focus: Artificial Intelligence, Expense Ratio: [Ratio], Geographic Focus: [Global/US-centric]

(Note: Replace bracketed information with actual ETF data)

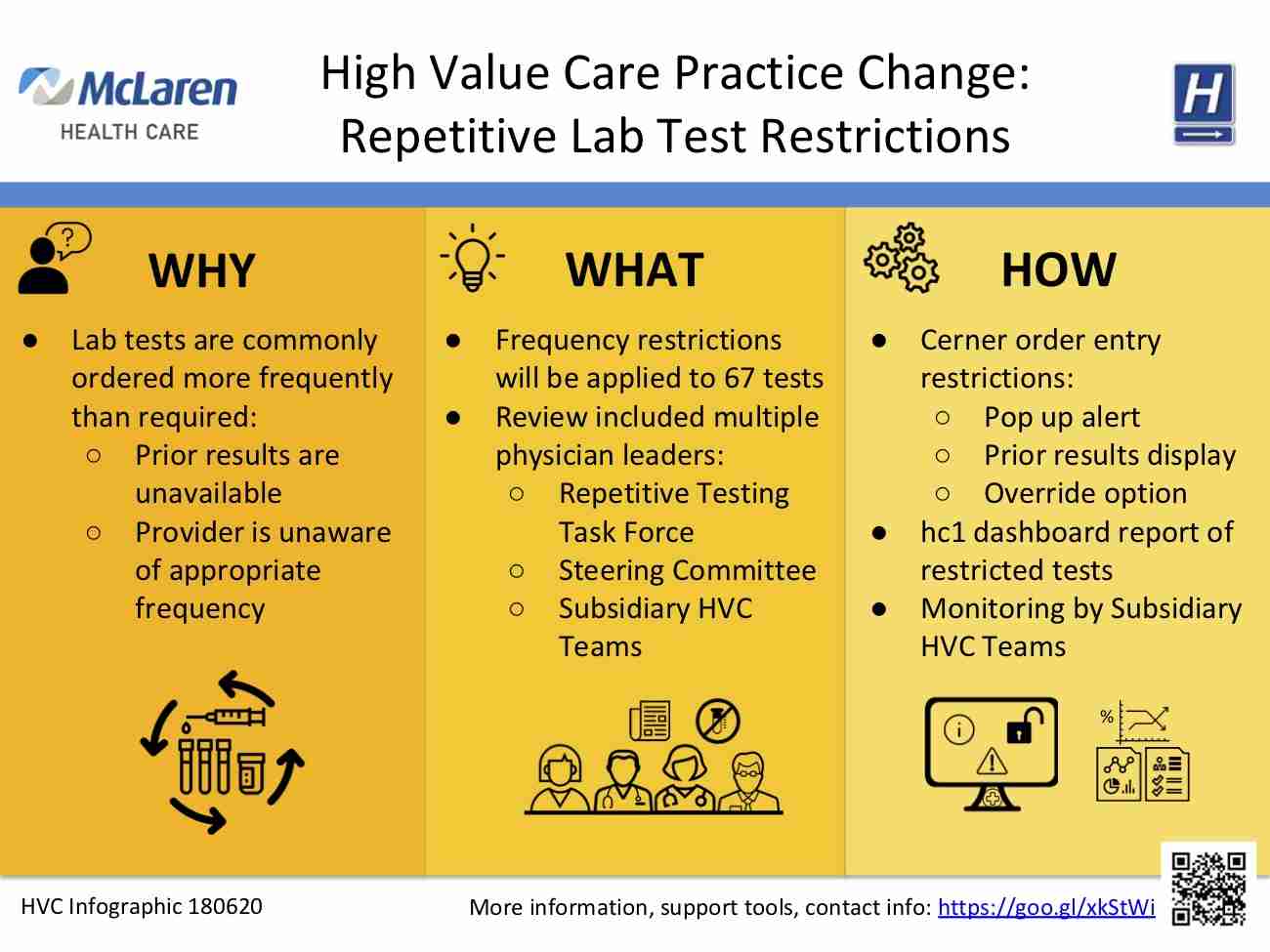

Evaluating ETF Performance and Risk

Analyzing historical performance data is crucial, but remember past performance is not indicative of future results. Charts and graphs illustrating the performance of relevant ETFs over various timeframes (e.g., 1-year, 3-year, 5-year) will give you a better understanding of their volatility and potential returns. However, understand that investing in autonomous driving technology is inherently risky.

- Technological Setbacks: Unexpected delays or failures in technology development can negatively impact ETF performance.

- Regulatory Changes: Shifts in government regulations can significantly alter the landscape for autonomous vehicles.

- Competition: The autonomous driving sector is highly competitive, with numerous players vying for market share.

Effective risk mitigation involves diversification. Don't put all your eggs in one basket. By spreading your investments across different ETFs and asset classes, you can reduce the overall volatility of your portfolio. Analyzing the correlation between ETF performance and broader market trends is also crucial for understanding systemic risk.

- Performance Visualization: Use charts and graphs to visualize historical ETF performance data.

- Risk Factors: Clearly outline key risk factors and consider mitigation strategies.

- Market Correlation: Analyze the correlation between ETF performance and overall market trends.

- Risk Comparison: Compare the risk profiles of different ETFs to make an informed decision.

Due Diligence and Diversification

Before investing in any ETF focused on autonomous driving technology, thorough research is paramount. Reviewing the ETF prospectus, understanding the underlying holdings, and assessing the fund manager's strategy are critical steps. Always remember that investing involves risk, and no investment is guaranteed to generate profit.

Diversification is key to mitigating risk. By spreading your investments across multiple ETFs and other asset classes, you can protect yourself from significant losses should one specific investment underperform. Consider consulting with a qualified financial advisor to create a personalized investment strategy aligned with your risk tolerance and financial goals.

- Prospectus Review: Thoroughly review the ETF prospectus to understand the investment strategy and associated risks.

- Underlying Holdings: Analyze the underlying holdings of each ETF to ensure alignment with your investment goals.

- Financial Advisor Consultation: Consult with a financial advisor to create a personalized investment strategy.

Conclusion

Investing in Uber's autonomous driving technology through ETFs presents both significant opportunities and considerable risks. Careful analysis of relevant ETFs, understanding Uber's strategic position within the autonomous vehicle market, and proper diversification are crucial for successful investment. The potential returns are high, but so is the risk.

Begin your research today on the best ETF Investments in Uber's Autonomous Driving Technology to find the right investment strategy that aligns with your risk tolerance and financial goals. Remember to always conduct thorough due diligence before investing in any ETF. Don't hesitate to seek professional financial advice to navigate this exciting yet complex investment landscape.

Featured Posts

-

High Value Low Cost Finding Exceptional Deals

May 17, 2025

High Value Low Cost Finding Exceptional Deals

May 17, 2025 -

Understanding Trumps Plans For The F 22 And Potential F 55 Aircraft

May 17, 2025

Understanding Trumps Plans For The F 22 And Potential F 55 Aircraft

May 17, 2025 -

Tom Thibodeaus High Praise For St Johns Success A New York Knicks Perspective

May 17, 2025

Tom Thibodeaus High Praise For St Johns Success A New York Knicks Perspective

May 17, 2025 -

Paige Bueckers City Honors Wnba Debut With Day Of Recognition

May 17, 2025

Paige Bueckers City Honors Wnba Debut With Day Of Recognition

May 17, 2025 -

Trump Supporter Ray Epps Defamation Suit Against Fox News Details On The January 6th Allegations

May 17, 2025

Trump Supporter Ray Epps Defamation Suit Against Fox News Details On The January 6th Allegations

May 17, 2025