Analyzing Gibraltar Industries (ROCK) Q[Quarter] Earnings: Key Metrics And Projections

![Analyzing Gibraltar Industries (ROCK) Q[Quarter] Earnings: Key Metrics And Projections Analyzing Gibraltar Industries (ROCK) Q[Quarter] Earnings: Key Metrics And Projections](https://peoplelikeyourecords.de/image/analyzing-gibraltar-industries-rock-q-quarter-earnings-key-metrics-and-projections.jpeg)

Table of Contents

Revenue Analysis: Deconstructing Gibraltar Industries' Q3 Top Line

Revenue Growth and Breakdown:

Gibraltar Industries' Q3 revenue performance provides valuable insights into the company's overall health. Analyzing the numbers against previous quarters and the same period last year reveals important trends. Let's break it down:

- Total revenue figures for Q3: [Insert actual Q3 revenue figures here. For example: $XXX million].

- Year-over-year revenue growth percentage: [Insert percentage change. For example: +XX%]. This signifies [explain the reason for the growth or decline, e.g., strong demand in the residential market, successful new product launches, or challenges in a specific sector].

- Quarter-over-quarter revenue growth percentage: [Insert percentage change. For example: +XX% or -XX%]. This indicates [explain the reason for the growth or decline, e.g., seasonal fluctuations, successful marketing campaigns, or temporary market downturns].

- Breakdown of revenue by segment (e.g., residential, commercial, etc.): [Insert the breakdown of revenue across different segments if available in the report. For example: Residential - XX%, Commercial - YY%, Industrial - ZZ%]. This highlights the performance of each segment and identifies potential areas of strength or weakness.

- Key factors influencing revenue performance: [Explain factors affecting revenue, such as market demand shifts, successful new product introductions, pricing adjustments, supply chain issues, or economic conditions].

Analyzing Revenue Sources and Margins:

Examining the profitability of individual revenue streams is crucial for a comprehensive understanding of Gibraltar Industries' performance.

- Gross profit margin analysis: [Insert the gross profit margin for Q3 and compare it to previous quarters and the same period last year. Explain any significant changes and their underlying causes]. A higher gross margin suggests improved efficiency and pricing power.

- Operating profit margin analysis: [Insert the operating profit margin for Q3 and perform a similar comparative analysis as the gross profit margin. Discuss the factors affecting the operating margin]. This indicates the company's ability to control operating expenses.

- Comparison to industry benchmarks for profit margins: [Compare Gibraltar Industries' profit margins to those of its competitors. This provides context and reveals the company's relative profitability within the industry].

- Discussion of pricing strategies and their impact on margins: [Analyze the pricing strategies employed by Gibraltar Industries and their effect on profit margins. Discuss whether price increases were implemented and their impact on sales volume].

Profitability and Key Financial Metrics: A Deep Dive into Gibraltar Industries' Performance

Net Income and Earnings Per Share (EPS):

The net income and EPS figures provide a critical assessment of Gibraltar Industries' profitability.

- Net income for Q3: [Insert the net income figure for Q3].

- Earnings per share (EPS) for Q3: [Insert the EPS for Q3].

- Year-over-year and quarter-over-quarter changes in net income and EPS: [Compare the Q3 figures with previous periods and provide the percentage changes. Explain any significant deviations and their underlying reasons].

- Impact of one-time events (if any) on profitability: [If any one-time events impacted profitability, such as asset sales or restructuring charges, discuss their effect on net income and EPS. Highlight these events to allow for a more accurate comparison].

Key Financial Ratios and Indicators:

Analyzing key financial ratios provides a deeper insight into Gibraltar Industries' financial health and stability.

- Debt-to-equity ratio and its implications: [Insert the debt-to-equity ratio and analyze its implications for the company's financial risk. A higher ratio indicates higher leverage and potentially greater financial risk].

- Current ratio and liquidity position: [Insert the current ratio, which measures the company's ability to meet its short-term obligations. A higher ratio implies a stronger liquidity position].

- Return on equity (ROE) and profitability: [Insert the ROE and discuss its significance as a measure of profitability relative to shareholder equity. A higher ROE generally indicates better profitability and efficient use of equity].

- Comparison to industry averages and competitors: [Compare Gibraltar Industries' key financial ratios to industry averages and competitors' ratios. This will highlight its financial strength or weakness relative to its peers].

Future Projections and Outlook for Gibraltar Industries (ROCK) Stock:

Management Guidance and Future Expectations:

Understanding management's outlook is essential for projecting future performance.

- Management's commentary on future performance: [Summarize management's assessment of the company's future prospects, highlighting any key expectations or concerns].

- Guidance for future quarters (if provided): [If management provided guidance for future quarters, present the key projections for revenue, earnings, and other relevant metrics].

- Key assumptions underlying the projections: [Identify the key assumptions underlying management's projections, such as expected market conditions, pricing strategies, and operating efficiency].

- Potential risks and challenges identified by management: [Highlight any potential risks or challenges identified by management, such as economic downturns, competition, or supply chain disruptions].

Stock Price Implications and Investment Strategies:

Based on the Q3 earnings, investors should consider several factors.

- Potential short-term and long-term price movements: [Discuss the potential short-term and long-term impact of the Q3 earnings on the ROCK stock price based on the analysis].

- Suitable investment strategies based on the analysis (buy, hold, sell): [Provide recommendations based on the analysis, considering different investor risk profiles and investment goals. This section should not constitute financial advice].

- Consideration of risk tolerance and investment goals: [Emphasize the importance of aligning investment decisions with individual risk tolerance and investment objectives].

Conclusion:

This analysis of Gibraltar Industries (ROCK) Q3 earnings reveals [summarize key findings – e.g., strong revenue growth, improved profitability, positive outlook or alternatively, weaker than expected performance and areas needing improvement]. While [mention potential risks or uncertainties, e.g., economic headwinds or competitive pressures], the overall performance suggests [positive or negative conclusion based on the analysis]. Investors interested in ROCK stock should carefully consider this information alongside their own risk tolerance and investment strategy before making any decisions. Conduct further research and consult with a financial advisor before investing in Gibraltar Industries (ROCK) or any other stock. Remember to carefully analyze future earnings reports for continued monitoring of Gibraltar Industries' performance and to inform your investment strategies in ROCK.

![Analyzing Gibraltar Industries (ROCK) Q[Quarter] Earnings: Key Metrics And Projections Analyzing Gibraltar Industries (ROCK) Q[Quarter] Earnings: Key Metrics And Projections](https://peoplelikeyourecords.de/image/analyzing-gibraltar-industries-rock-q-quarter-earnings-key-metrics-and-projections.jpeg)

Featured Posts

-

Chris Evans Praises Co Star Scarlett Johansson Their Professional And Personal Relationship

May 13, 2025

Chris Evans Praises Co Star Scarlett Johansson Their Professional And Personal Relationship

May 13, 2025 -

Nhl Draft Lottery A New In Studio Twist

May 13, 2025

Nhl Draft Lottery A New In Studio Twist

May 13, 2025 -

Extensive Search Underway For Missing Elderly Hiker In Peninsula Hills

May 13, 2025

Extensive Search Underway For Missing Elderly Hiker In Peninsula Hills

May 13, 2025 -

Ademola Lookman Liverpool And Chelsea In Transfer Battle

May 13, 2025

Ademola Lookman Liverpool And Chelsea In Transfer Battle

May 13, 2025 -

Ali Larter Returns As Landman In New Season 2 Images

May 13, 2025

Ali Larter Returns As Landman In New Season 2 Images

May 13, 2025

Latest Posts

-

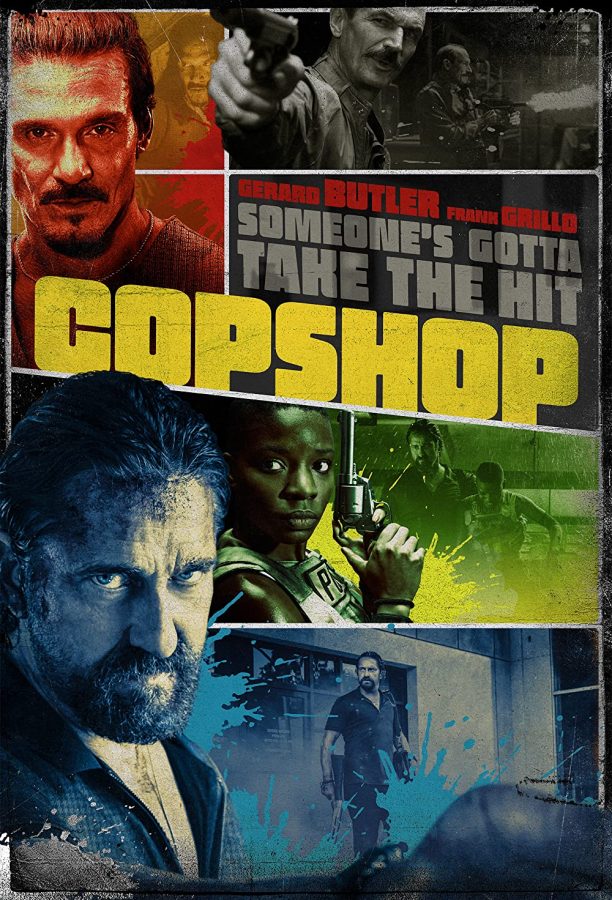

Gerard Butlers Box Office Flop Finds New Life As Netflix Hit

May 13, 2025

Gerard Butlers Box Office Flop Finds New Life As Netflix Hit

May 13, 2025 -

Btlr Trognat Ot Blgariya Vizhte Snimkata Koyato Razchuvstva Mrezhata

May 13, 2025

Btlr Trognat Ot Blgariya Vizhte Snimkata Koyato Razchuvstva Mrezhata

May 13, 2025 -

Blgarskiyat Spomen Na Dzherard Btlr Vizhte Kakvo Go E Trognalo

May 13, 2025

Blgarskiyat Spomen Na Dzherard Btlr Vizhte Kakvo Go E Trognalo

May 13, 2025 -

Blgarska Snimka Razplaka Dzherard Btlr Vizhte Ya

May 13, 2025

Blgarska Snimka Razplaka Dzherard Btlr Vizhte Ya

May 13, 2025 -

Dzherard Btlr Nay Miliyat Mu Spomen Ot Blgariya Razchupva Mrezhata

May 13, 2025

Dzherard Btlr Nay Miliyat Mu Spomen Ot Blgariya Razchupva Mrezhata

May 13, 2025