Analyzing NCLH Stock: What Are Hedge Funds Doing?

Table of Contents

The cruise industry, and particularly Norwegian Cruise Line Holdings (NCLH) stock, has experienced significant volatility in recent years. Understanding market sentiment and predicting future price movements is crucial for investors. One key indicator often used to gauge market sentiment is the activity of hedge funds—large institutional investors with sophisticated investment strategies. This article aims to analyze what hedge funds are doing with their NCLH holdings and what this might mean for you.

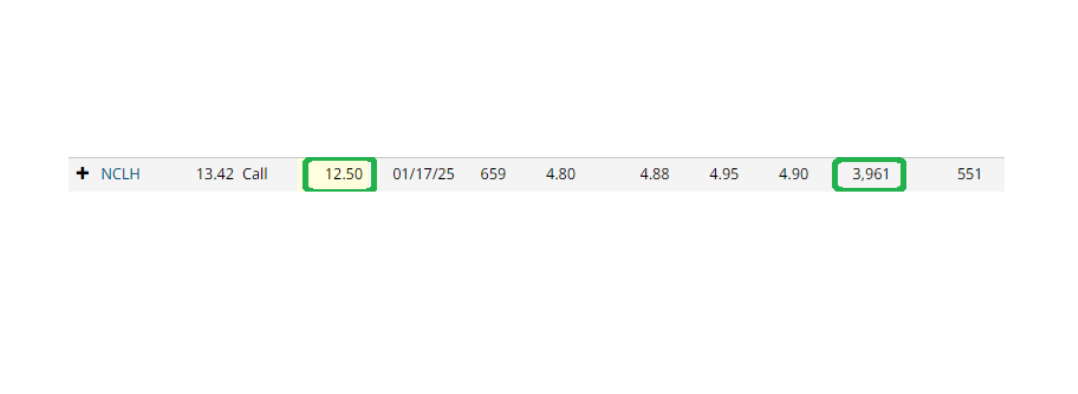

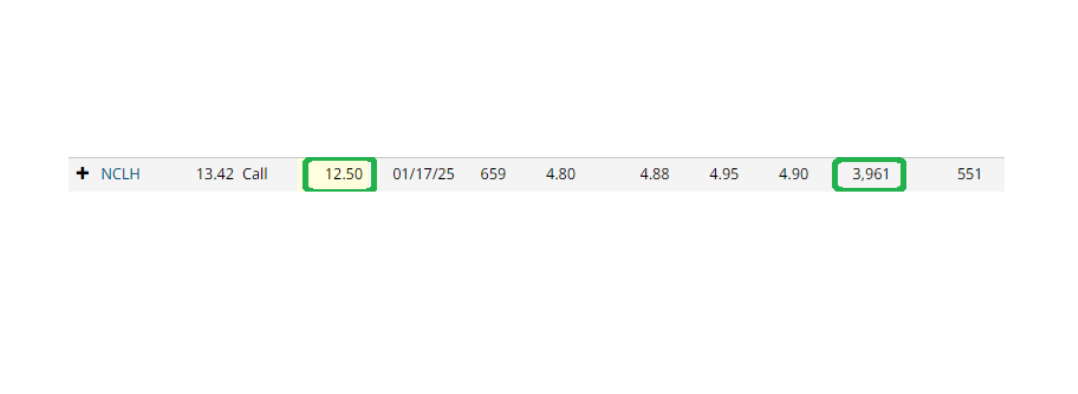

Recent Hedge Fund Positions in NCLH

Identifying Key Hedge Fund Investors

Pinpointing the exact hedge funds holding NCLH stock requires accessing proprietary databases. However, by regularly reviewing SEC filings like 13F forms, we can uncover some institutional investors' positions. Websites like [insert link to a reputable financial news source that tracks 13F filings] and [insert another link] provide data on institutional ownership. While complete transparency isn't always guaranteed, these sources offer valuable insights. Remember, this data is often delayed by several weeks.

Analyzing Recent 13F Filings

13F filings offer a snapshot of a hedge fund's equity holdings at the end of each quarter. Analyzing trends in these filings can reveal shifts in hedge fund sentiment towards NCLH.

- Increased holdings: A significant increase in NCLH shares held by multiple hedge funds could signal growing confidence in the company's recovery and future prospects. This might indicate a belief that the stock is undervalued.

- Decreased holdings: Conversely, a decrease in holdings might suggest profit-taking after a period of growth or concerns about the company's performance or the broader cruise industry outlook. This could stem from worries about increased competition, rising fuel costs, or geopolitical instability impacting travel.

- Unchanged positions: Maintaining a consistent position can indicate a "hold" strategy, suggesting a belief that the stock is fairly valued, and the fund expects no significant short-term price movement.

Understanding Hedge Fund Investment Strategies

Hedge funds employ diverse strategies when investing in NCLH stock. These may include:

- Long-term growth potential: Some funds may view NCLH as a long-term investment, betting on the cruise industry's overall recovery and NCLH's ability to capture market share.

- Short-term trading opportunities: Other funds may engage in short-term trading, attempting to profit from short-term price fluctuations based on news events or market sentiment.

- Macroeconomic factors: Global economic conditions, fuel prices, and interest rates significantly influence the cruise industry's profitability, affecting hedge fund decisions.

- Specific catalysts: New ship launches, expansion into new markets, or successful cost-cutting measures can also drive hedge fund interest in NCLH.

Analyzing the Cruise Industry Landscape and its Impact on NCLH

Competition and Market Share

The cruise industry is competitive, with major players like Carnival Corporation & plc and Royal Caribbean Cruises Ltd. Analyzing NCLH's market share, brand strength, and pricing strategies is essential. Factors like the quality of onboard experiences and the target customer demographic play critical roles in market competition.

Industry Trends and Growth Potential

Several trends shape the cruise industry's future:

- Sustainability initiatives: Growing environmental concerns are pushing cruise lines towards more eco-friendly practices, influencing investor sentiment. NCLH's commitment to sustainability will likely impact its long-term prospects.

- Technological advancements: Digitalization, AI, and automation are changing the customer experience and cruise line operations. NCLH's adoption of new technologies is a key factor for investors.

- Changing consumer preferences: Understanding shifting travel patterns and preferences is essential. NCLH's ability to adapt to evolving consumer demands will directly affect its success.

Economic Factors Affecting the Cruise Industry

External economic factors significantly impact NCLH's performance:

- Fuel prices: Fluctuations in fuel prices directly affect operating costs and profitability.

- Global economic conditions: Recessions or economic slowdowns reduce discretionary spending on leisure travel, impacting demand for cruises.

- Travel restrictions: Geopolitical events or health crises can lead to travel restrictions, severely impacting the cruise industry.

Evaluating NCLH's Financial Performance and Future Outlook

Key Financial Metrics

Investors should analyze key NCLH financial metrics:

- Revenue growth: Examining year-over-year revenue growth reveals the company's ability to increase sales and market share.

- Profitability: Profit margins indicate efficiency and pricing power. Analyzing net income and operating income is crucial.

- Debt levels: High debt levels can increase financial risk. Evaluating the debt-to-equity ratio is important.

- Cash flow: Positive cash flow demonstrates the company's ability to generate funds for investment and debt repayment.

Risk Assessment

Investing in NCLH involves risks:

- Economic downturns: Recessions significantly impact the cruise industry's demand.

- Geopolitical events: Global instability and terrorism can disrupt travel and hurt the cruise business.

- Health crises: Pandemics or outbreaks of infectious diseases can lead to travel restrictions and operational disruptions.

- Regulatory changes: Changes in environmental regulations or safety standards can impact NCLH's operations and costs.

Valuation Analysis

Various valuation methods (e.g., discounted cash flow analysis) can help determine whether NCLH's stock is undervalued or overvalued. However, these methods require detailed financial projections and assumptions which can vary widely among analysts.

Conclusion

Analyzing NCLH stock requires a multifaceted approach, considering hedge fund activity, the cruise industry's dynamics, and NCLH's financial health. While increased hedge fund holdings might suggest optimism, it's crucial to understand the underlying reasons and consider various risks. The data presented should not be considered investment advice. Remember to conduct thorough due diligence and consider consulting a financial advisor before making any investment decisions. Continue your own in-depth analysis of NCLH stock and make informed decisions based on your own risk tolerance and investment strategy. Further research into cruise industry reports and hedge fund investment strategies can enhance your understanding of NCLH's future potential.

Featured Posts

-

Is Blue Ivy Carter The Brow Guru Behind Tina Knowles Look

Apr 30, 2025

Is Blue Ivy Carter The Brow Guru Behind Tina Knowles Look

Apr 30, 2025 -

Black And Asian Police Officer Faces Inquiry After Controversial Tweet

Apr 30, 2025

Black And Asian Police Officer Faces Inquiry After Controversial Tweet

Apr 30, 2025 -

Watch Ru Pauls Drag Race Season 17 Episode 6 Online Free And Cable Free

Apr 30, 2025

Watch Ru Pauls Drag Race Season 17 Episode 6 Online Free And Cable Free

Apr 30, 2025 -

Solo 3 Dias Para Tu Clase De Boxeo En El Edomex

Apr 30, 2025

Solo 3 Dias Para Tu Clase De Boxeo En El Edomex

Apr 30, 2025 -

Ubisoft Entertainment Informations Cles Du Document Amf Cp 2025 E1029768

Apr 30, 2025

Ubisoft Entertainment Informations Cles Du Document Amf Cp 2025 E1029768

Apr 30, 2025