Analyzing NCLH Stock: What Hedge Fund Activity Reveals

Table of Contents

Recent Hedge Fund Positions in NCLH

Analyzing NCLH stock requires understanding the movements of key players. Identifying which prominent hedge funds have recently bought, sold, or held NCLH stock offers valuable context. Let's examine the actions of some key players:

Identifying Key Players

Determining the specific hedge funds involved and their actions is paramount for a comprehensive NCLH analysis. Unfortunately, complete transparency isn't always available due to reporting lags and the private nature of some hedge fund activities. However, by monitoring SEC filings (13F forms) and reputable financial news sources, we can glean valuable insights.

-

Bullet Points: (Note: This section requires real-time data. The examples below are hypothetical and should be replaced with actual data from recent filings.)

- XYZ Capital increased its stake in NCLH by 15% in Q3 2024, according to their 13F filing. [Link to hypothetical SEC filing]

- ABC Investment Management reduced its NCLH holdings by 10% during the same period. [Link to hypothetical news article]

- DEF Partners maintained its existing NCLH position, suggesting a neutral outlook. [Link to hypothetical financial news source]

Explanation

The significance of these changes must be evaluated within the context of the overall market and NCLH’s performance. A large fund buying NCLH stock might signal bullish sentiment and expectation of future growth. Conversely, a significant sell-off could indicate concerns about the company's prospects or broader market anxieties. This detailed analysis is crucial for informed decision-making regarding NCLH investment.

Analyzing Hedge Fund Strategies and NCLH's Performance

Correlating hedge fund activity with NCLH's stock performance is key to understanding the predictive value of such activity. Did an increase in hedge fund buying precede a stock price surge? Or did the market move independently of hedge fund actions?

Correlation Between Hedge Fund Activity and Stock Price

Understanding this relationship is critical for any NCLH investment strategy.

-

Bullet Points:

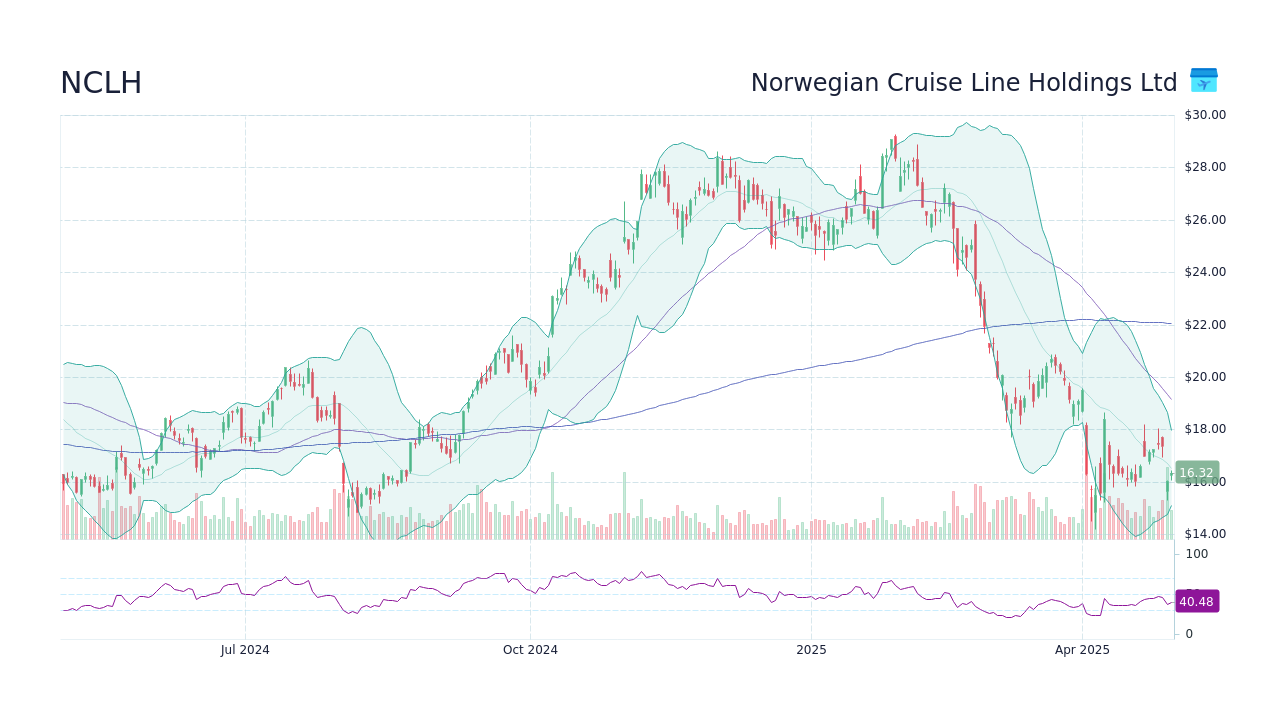

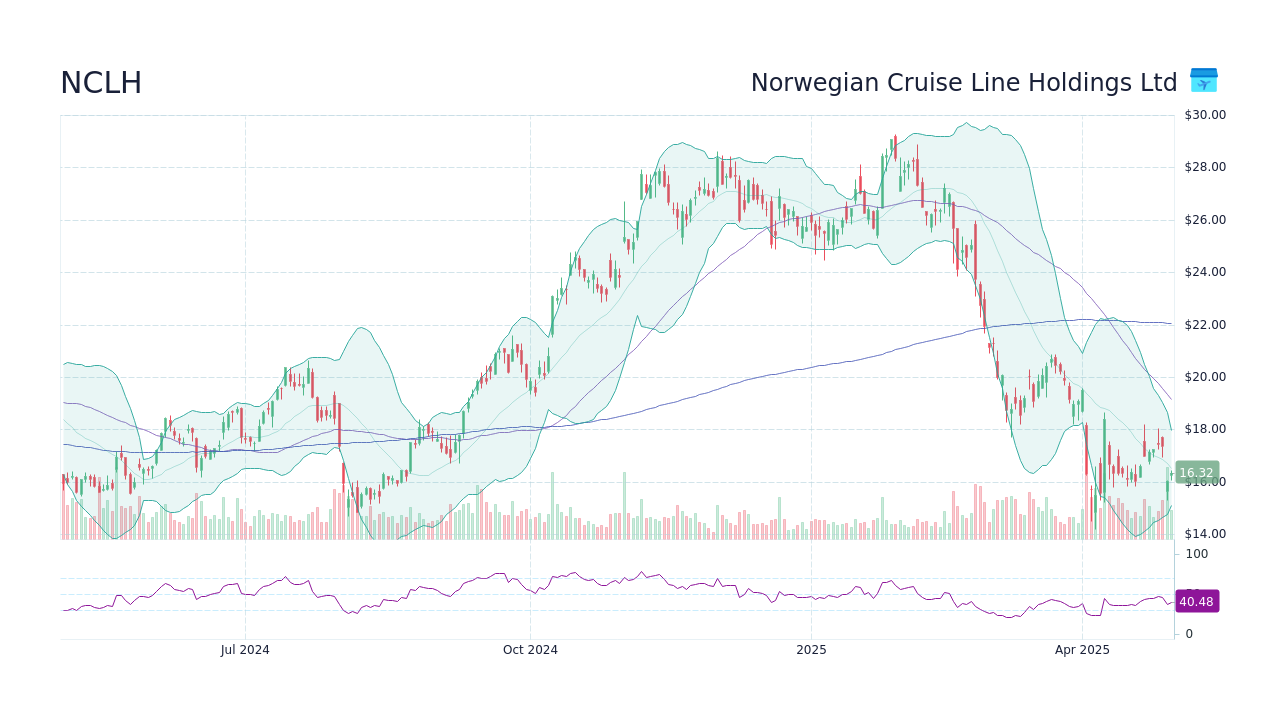

- (Insert chart or graph here illustrating the correlation, if any, between hedge fund activity and NCLH stock price. This would ideally show the percentage change in hedge fund holdings against the percentage change in NCLH's stock price over a specific period.)

- Lagging indicators are possible. Hedge fund activity might reflect information already factored into the stock price. The price might have already moved before the public disclosure of hedge fund transactions.

- External factors, such as the ongoing impact of the COVID-19 pandemic on the travel industry, fuel price fluctuations, and global economic uncertainty, heavily influence both hedge fund decisions and NCLH's stock performance.

Explanation

While there may be some correlation, it's unlikely to be a perfect predictor. Hedge fund activity offers one piece of the puzzle, but it shouldn't be the sole basis for an investment decision in NCLH. A thorough NCLH analysis demands a broader perspective, considering fundamental company performance and macro-economic trends.

Interpreting the Implications for Investors

The observed hedge fund behavior provides valuable insights into the risk profile associated with investing in NCLH.

Risk Assessment Based on Hedge Fund Behavior

Based on the analysis of hedge fund activity, we can assess the inherent risk.

-

Bullet Points:

- The overall sentiment towards NCLH, as reflected by hedge fund actions, can range from bullish (net buying) to bearish (net selling).

- A significant concentration of NCLH holdings in a hedge fund's portfolio indicates a concentrated risk. Diversification across multiple holdings is generally considered a risk-mitigation strategy.

- Market conditions significantly impact NCLH's future prospects. Economic downturns or renewed travel restrictions can heavily influence the cruise industry.

Explanation

Investors should carefully consider their risk tolerance before investing in NCLH. The analysis of hedge fund activity offers valuable context but doesn't eliminate the inherent risks associated with this volatile sector.

Alternative Investment Strategies Considering NCLH and Hedge Fund Trends

Given the insights gleaned from hedge fund activity, diversification is crucial when considering an NCLH investment.

Diversification and Risk Management

Don't put all your eggs in one basket!

-

Bullet Points:

- Diversification is key. Investing in other sectors, such as technology or consumer staples, can help mitigate risk.

- Alternative investments within the travel industry, such as airlines or hotel chains, could provide some correlation with NCLH while also offering diversification.

- Understanding your personal risk tolerance is paramount. A more conservative investor might choose to allocate a smaller portion of their portfolio to NCLH.

Explanation

Incorporating NCLH into a well-diversified investment portfolio, with careful consideration of your individual risk profile and the broader market context, is a crucial element of a sound investment strategy.

Conclusion

Analyzing NCLH stock requires a multifaceted approach. While hedge fund activity provides valuable insights into market sentiment and potential investment opportunities, it's not a foolproof indicator of future performance. The correlation between hedge fund actions and NCLH's stock price is not guaranteed, and external factors significantly influence both.

By carefully analyzing NCLH stock and considering the insights revealed by hedge fund activity, alongside your own in-depth research, you can make more informed investment decisions. Remember to diversify your portfolio and understand your risk tolerance before investing in any single stock, especially one as volatile as NCLH. Conduct thorough due diligence before making any investment in NCLH stock or any other security.

Featured Posts

-

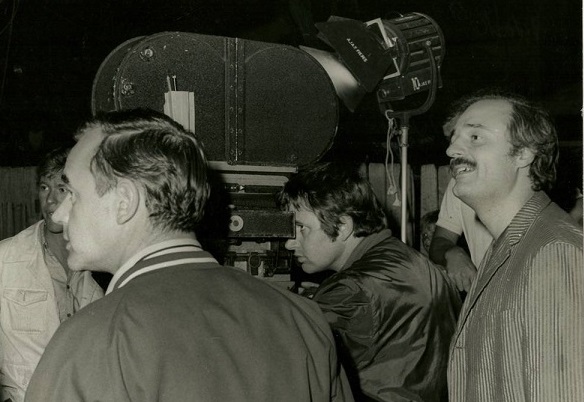

Ted Kotcheff Director Of Rambo First Blood Dies At 94

May 01, 2025

Ted Kotcheff Director Of Rambo First Blood Dies At 94

May 01, 2025 -

Cruise Line Complaints Will You Be Banned

May 01, 2025

Cruise Line Complaints Will You Be Banned

May 01, 2025 -

Michael Sheen And Channel 4 Face Backlash Over Controversial 1 Million Giveaway

May 01, 2025

Michael Sheen And Channel 4 Face Backlash Over Controversial 1 Million Giveaway

May 01, 2025 -

Actress Priscilla Pointer Passes Away Tributes Pour In

May 01, 2025

Actress Priscilla Pointer Passes Away Tributes Pour In

May 01, 2025 -

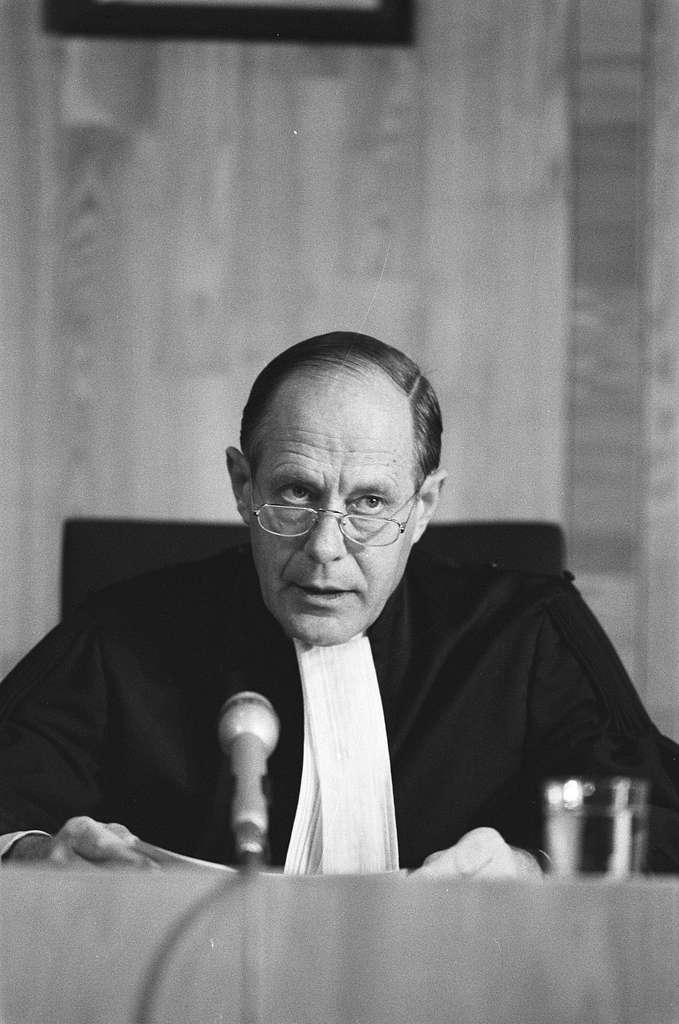

Stroomnetproblemen Kampen Kort Geding Tegen Enexis

May 01, 2025

Stroomnetproblemen Kampen Kort Geding Tegen Enexis

May 01, 2025

Latest Posts

-

Feltri Cristo In Croce E Il Venerdi Santo

May 01, 2025

Feltri Cristo In Croce E Il Venerdi Santo

May 01, 2025 -

Louisville Faces Triple Threat Snowstorm Tornadoes And Record Flooding In Early 2025

May 01, 2025

Louisville Faces Triple Threat Snowstorm Tornadoes And Record Flooding In Early 2025

May 01, 2025 -

Cardinal Trial Claims Of Prosecutorial Misconduct Based On New Evidence

May 01, 2025

Cardinal Trial Claims Of Prosecutorial Misconduct Based On New Evidence

May 01, 2025 -

Il Venerdi Santo Considerazioni Di Feltri

May 01, 2025

Il Venerdi Santo Considerazioni Di Feltri

May 01, 2025 -

New Revelations In Cardinal Case Allegedly Prove Prosecutorial Misconduct

May 01, 2025

New Revelations In Cardinal Case Allegedly Prove Prosecutorial Misconduct

May 01, 2025