Analyzing Palantir Stock Before The May 5th Earnings Announcement

Table of Contents

Palantir's Recent Performance and Key Metrics

Understanding Palantir's recent performance is crucial for predicting its future trajectory. We'll analyze key financial metrics to gauge the company's health and growth potential.

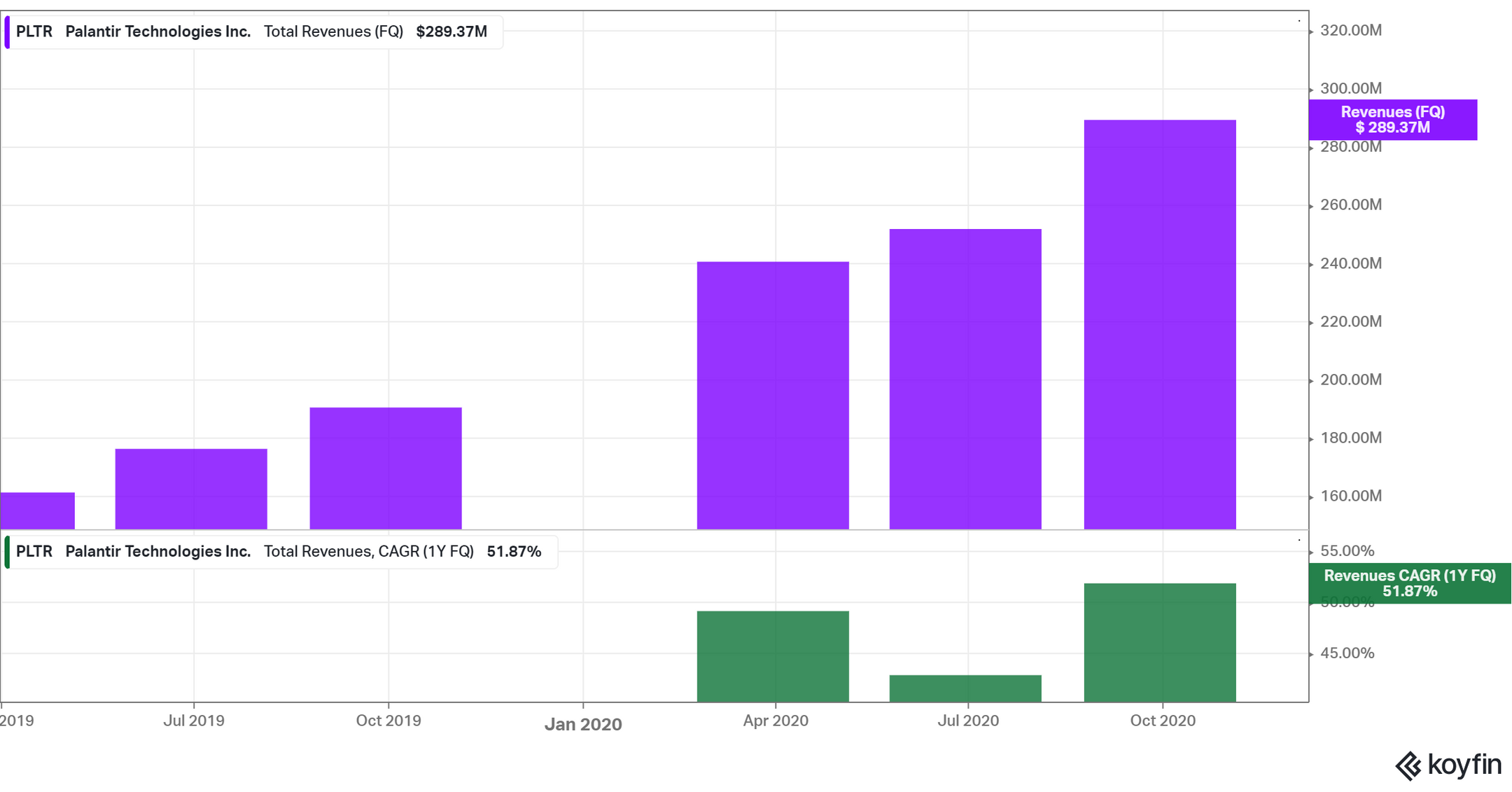

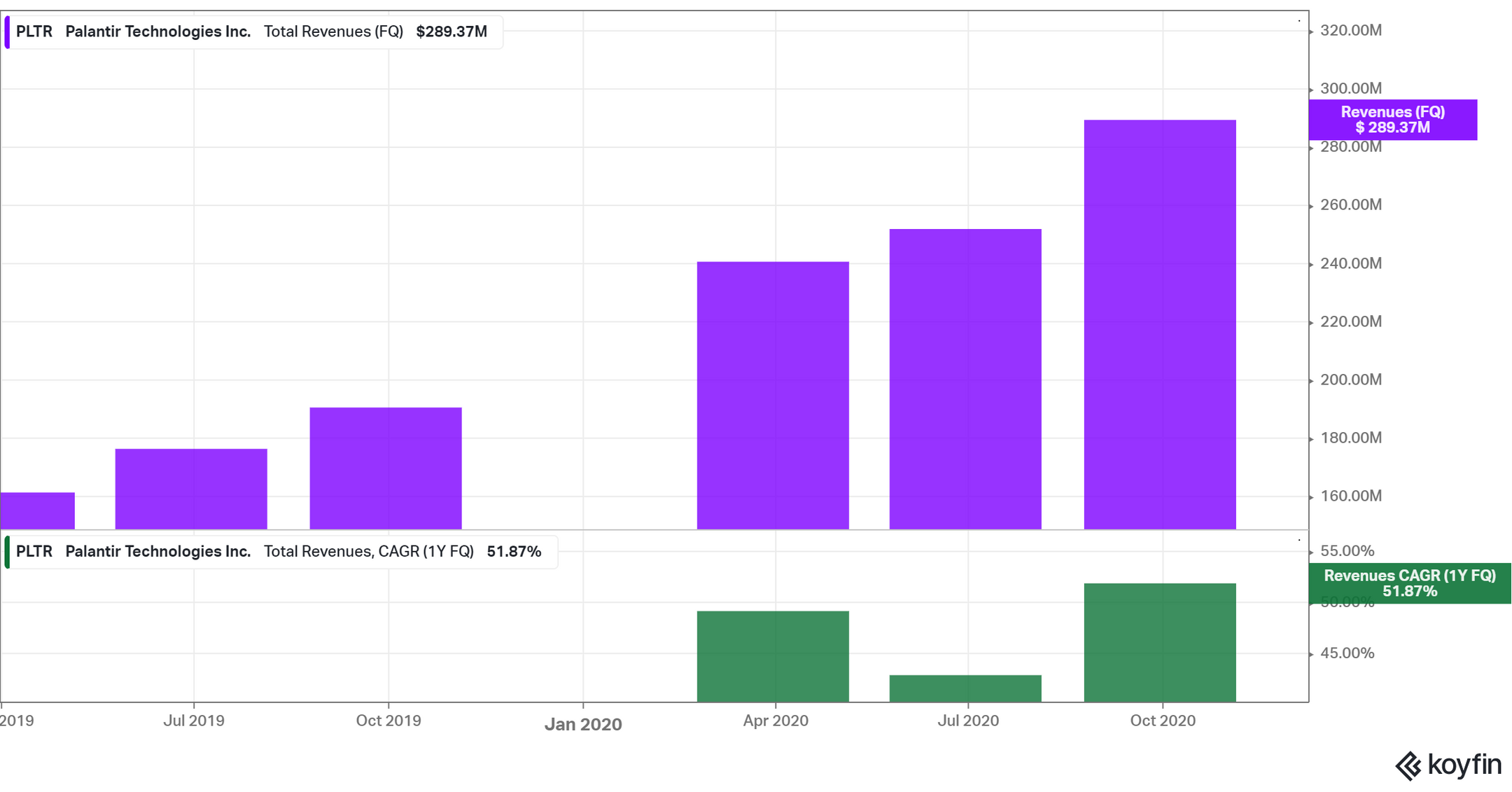

Revenue Growth and Profitability

Analyzing Palantir's revenue growth and profitability requires a close look at recent quarterly reports. Key metrics include year-over-year revenue growth, gross margins, operating income, and net income. Any significant changes or trends will indicate the company's financial strength.

- Government Contracts: Palantir's revenue significantly relies on government contracts. Analyzing the contribution of these contracts to overall revenue and the success in securing new government deals is vital. A decline in government contracts could negatively impact the company's revenue stream and future growth.

- Commercial Sector Growth: Palantir's expansion into the commercial sector is a key indicator of its long-term potential. Tracking the growth rate of its commercial revenue provides valuable insights into market penetration and the success of its sales strategies. Strong commercial growth suggests broader market adoption and reduced reliance on government contracts.

- Expense Management: Examining Palantir's expense management and operational efficiency is essential. A focus on profitability requires careful control over expenses. Analyzing the company's operating margin reveals how efficiently it converts revenue into profit. Improving efficiency can positively influence profit margins and investor sentiment.

Customer Acquisition and Retention

Palantir's ability to attract and retain clients is critical for sustainable growth, particularly in the competitive commercial sector. Analyzing customer acquisition and retention metrics reveals the company's ability to build a strong customer base.

- New Customer Acquisition: Tracking the number of new customers acquired each quarter reveals the success of Palantir's sales and marketing efforts. A steady increase in new customer acquisition indicates a healthy demand for its products and services.

- Customer Churn Rate: The customer churn rate indicates the rate at which clients discontinue using Palantir's services. A low churn rate suggests high customer satisfaction and loyalty, strengthening the long-term revenue outlook.

- Strategic Partnerships: New partnerships and significant contracts significantly influence revenue and demonstrate market confidence in Palantir's technology and services. These partnerships can lead to wider market access and revenue growth.

Analyzing Palantir's Future Projections and Guidance

Understanding Palantir's future projections and guidance is essential for assessing its potential for future growth.

Management's Outlook and Expectations

Closely scrutinize Palantir's official guidance for the upcoming quarter and fiscal year. Look for upward or downward revisions compared to previous guidance.

- Specific Targets: Management often sets specific targets, such as revenue growth percentages or operating margin improvements. These targets provide insight into their confidence levels and expectations for future performance.

- Confidence Levels: The tone and language used by management when discussing future projections convey their level of confidence in achieving their targets.

- Identified Risks: Understanding potential risks or challenges highlighted by management helps investors assess the likelihood of achieving the projected results and consider potential downside scenarios.

Industry Trends and Competitive Landscape

Analyzing industry trends and Palantir's competitive landscape provides context for evaluating its future prospects.

- Market Trends: The overall state of the data analytics and government technology sectors significantly impacts Palantir's performance. Key trends include AI adoption, cloud computing, and cybersecurity, all of which are relevant to Palantir's business.

- Competitive Analysis: Palantir faces competition from other data analytics companies. Analyzing the strategies and market positions of its competitors helps assess Palantir's competitive advantages and potential challenges.

- Competitive Advantages: Identifying Palantir's unique strengths and competitive advantages, such as its proprietary technology, strong government relationships, or expertise in specific market segments, helps determine its ability to maintain its market share and achieve its growth targets.

Potential Market Reactions and Investment Strategies

Predicting stock price movement is inherently uncertain, but analyzing potential scenarios helps prepare investors.

Predicting Stock Price Movement

While predicting stock price movements accurately is impossible, analyzing past performance and considering potential outcomes can provide valuable insights.

- Impact of Expectations: Exceeding or missing earnings expectations will likely influence the stock price significantly. Positive surprises usually lead to price increases, while negative surprises can result in price declines.

- Historical Analysis: Studying Palantir's historical stock price reaction to previous earnings announcements offers insight into potential future price reactions. Identifying patterns and trends can be helpful, but it's not a guarantee of future performance.

- Market Sentiment: The broader market sentiment and investor confidence greatly affect the stock price. A positive market outlook can boost stock prices even if earnings are slightly below expectations.

Risk Assessment and Investment Considerations

Investing in Palantir involves inherent risks that need careful consideration.

- Key Risks: Investors should be aware of the risks associated with Palantir, including its reliance on government contracts, competition in the data analytics market, and stock price volatility.

- Risk Management: Employing appropriate risk management strategies, such as diversification and setting stop-loss orders, mitigates potential losses.

- Investment Diversification: Diversifying your investment portfolio reduces overall risk by spreading your investment across various assets. Don't put all your eggs in one basket.

Conclusion

Analyzing Palantir stock before the May 5th earnings announcement demands a comprehensive understanding of its recent performance, future prospects, and the broader market environment. By considering the factors discussed above – revenue growth, customer acquisition, management guidance, and competitive landscape – investors can make more informed decisions. While predicting stock price movements is inherently challenging, thorough analysis helps mitigate risks and potentially capitalize on opportunities. Remember to conduct your own thorough research before making any investment decisions regarding Palantir stock. Don't miss out on understanding the key details before the May 5th announcement; continue your Palantir stock analysis to make the most of this crucial period.

Featured Posts

-

Pakistans 1 3 Billion Imf Bailout Review And Current Geopolitical Context

May 10, 2025

Pakistans 1 3 Billion Imf Bailout Review And Current Geopolitical Context

May 10, 2025 -

The 25m Financial Challenge Facing West Ham United

May 10, 2025

The 25m Financial Challenge Facing West Ham United

May 10, 2025 -

The Future Of Design Figmas Ai And The Competition

May 10, 2025

The Future Of Design Figmas Ai And The Competition

May 10, 2025 -

Young Thugs Loyalty To Mariah The Scientist A Song Snippet Analysis

May 10, 2025

Young Thugs Loyalty To Mariah The Scientist A Song Snippet Analysis

May 10, 2025 -

The Bangkok Post And The Push For Transgender Rights An Analysis

May 10, 2025

The Bangkok Post And The Push For Transgender Rights An Analysis

May 10, 2025