Analyzing Sasol's (SOL) New Strategic Direction: Implications For Investors

Table of Contents

Key Components of Sasol's (SOL) Revised Strategy

Sasol's new strategic direction is multifaceted, encompassing decarbonization initiatives, portfolio restructuring, and a focus on specific growth areas. Understanding these interconnected components is crucial for assessing the potential impact on the company's future performance.

Decarbonization Initiatives

Sasol is committed to reducing its environmental impact. This commitment translates into substantial investments in various decarbonization initiatives.

- Renewable Energy Investments: Sasol is actively exploring and investing in renewable energy sources to diversify its energy mix and reduce reliance on fossil fuels. This includes investments in solar and wind power projects.

- Carbon Capture, Utilization, and Storage (CCUS): The company is pursuing advanced CCUS technologies to capture and store CO2 emissions from its operations, mitigating its carbon footprint. Specific projects and their timelines are key details to watch.

- Operational Efficiency Improvements: Sasol is implementing various measures to improve the efficiency of its operations, reducing energy consumption and emissions. This includes process optimization and technological upgrades.

- Specific Targets and Timelines: Sasol has publicly announced targets for reducing its greenhouse gas emissions by a certain percentage by a specific year. These targets, along with the associated milestones, should be carefully reviewed by investors. The financial implications of achieving these ambitious targets are significant and require close monitoring.

The financial implications of these initiatives are considerable, involving substantial capital expenditures. However, the potential for generating carbon credits and attracting environmentally conscious investors could offset some of these costs.

Portfolio Restructuring and Asset Sales

A key element of Sasol's new strategy is the restructuring of its portfolio through asset sales. This involves divesting from non-core assets to focus resources on higher-growth, more profitable areas.

- Asset Identification: Specific assets slated for sale should be identified and their contribution to Sasol's overall financial picture evaluated.

- Rationale for Divestments: The reasoning behind each divestment should be scrutinized. Is it due to low profitability, strategic misalignment, or other factors?

- Impact on Financial Position: The net effect of these asset sales on Sasol's debt levels, liquidity, and overall financial strength needs to be carefully analyzed. Are the sales generating sufficient capital for reinvestment in core areas?

These divestments are designed to streamline operations, improve profitability, and strengthen the company's balance sheet. However, the timing and successful execution of these sales are critical factors influencing investor confidence.

Focus on Growth Areas

Sasol's revised strategy prioritizes growth in specific sectors, aiming to capitalize on emerging market opportunities.

- Chemicals Sector Expansion: Sasol is looking to expand its presence in the chemicals sector, targeting high-growth markets and leveraging its existing expertise. Specific projects and their anticipated returns should be investigated.

- Sustainable Fuels Development: The company is investing heavily in research and development of sustainable fuels, aligning with the global push towards cleaner energy sources. The success of these ventures will significantly affect future profitability.

- Planned Investments and Expansion Projects: Understanding the scale and scope of these investments, including the financial resources allocated, is crucial for assessing their potential impact on future growth. Realistic projections of returns on these investments are essential for a comprehensive evaluation.

The success of these growth initiatives will be a key determinant of Sasol's future performance and shareholder value. The competitive landscape and technological advancements in these sectors should also be considered.

Financial Implications for Investors

Sasol's new strategic direction will inevitably impact its financial performance and returns to investors.

Impact on Earnings and Dividends

The transition to a lower-carbon future and portfolio restructuring could affect Sasol's short-term and long-term earnings.

- Earnings Projections: Analyze the company's projected earnings considering the capital expenditures required for decarbonization initiatives and the potential impact of asset sales.

- Dividend Policy Changes: Assess any changes to Sasol's dividend payout policy, considering the potential trade-off between investment in growth and shareholder returns.

- Debt Levels and Financial Risk: Evaluate the impact of the strategy on Sasol's debt levels and overall financial risk profile. Are there potential risks of increased debt or lower credit ratings?

Investors should carefully analyze these factors to gauge the potential return on investment.

Valuation and Stock Price

The new strategic direction significantly influences Sasol's valuation and stock price.

- Analyst Opinions and Market Sentiment: Review analyst ratings, target prices, and market sentiment towards Sasol's new strategy. How do these sentiments align with your own assessment of the risks and opportunities?

- Risk and Reward Assessment: Assess the risks and rewards associated with investing in SOL, considering the potential for both significant upside and downside depending on the success of the strategic shift.

- Comparative Analysis: Compare Sasol's valuation to its peers in the energy and chemical sectors. Does its valuation reflect the changes in its strategic direction?

Risks and Uncertainties

Implementing Sasol's new strategy comes with several risks and uncertainties that investors must consider.

Execution Risk

The successful implementation of Sasol's plans is crucial, but several potential challenges exist.

- Project Delays and Cost Overruns: There's a risk of delays and cost overruns associated with large-scale investment projects in both renewable energy and sustainable fuels.

- Transition Management: The transition to a new strategic direction is complex and requires effective management of various stakeholders. The ability of Sasol's management team to successfully navigate this transition is a critical factor.

- Technological Challenges: The success of some initiatives depends on advancements in technology. Any unforeseen technological hurdles could significantly delay or impede progress.

Market Volatility and External Factors

External factors can significantly influence Sasol's performance.

- Commodity Price Fluctuations: Sasol's business is sensitive to fluctuations in energy and chemical commodity prices. Any volatility in these markets can affect profitability.

- Geopolitical Events: Geopolitical instability and global events can disrupt supply chains, impact demand, and create uncertainty.

- Regulatory Changes: Changes in environmental regulations and government policies can create new challenges and affect the profitability of certain initiatives.

Conclusion

Sasol's (SOL) new strategic direction is a significant undertaking, emphasizing lower-carbon technologies and a more focused portfolio. While the transition presents significant challenges – including execution risk and market volatility – the potential for long-term growth in key sectors like sustainable fuels and specialized chemicals warrants careful consideration. The impact on SOL's stock price and dividend payouts remains uncertain, emphasizing the need for detailed analysis before investment decisions are made. Before investing in Sasol (SOL), thorough research into the detailed implications of this new strategic direction is crucial. Therefore, further due diligence is strongly recommended before making any investment decisions related to the Sasol (SOL) strategic direction.

Featured Posts

-

Ferrari And Leclerc A Statement Ahead Of The Imola Race

May 20, 2025

Ferrari And Leclerc A Statement Ahead Of The Imola Race

May 20, 2025 -

Agatha Christies Poirot A Study Of His Methods And Successes

May 20, 2025

Agatha Christies Poirot A Study Of His Methods And Successes

May 20, 2025 -

Experiencia Amazonica Festival Da Cunha Em Manaus Idealizado Por Isabelle Nogueira

May 20, 2025

Experiencia Amazonica Festival Da Cunha Em Manaus Idealizado Por Isabelle Nogueira

May 20, 2025 -

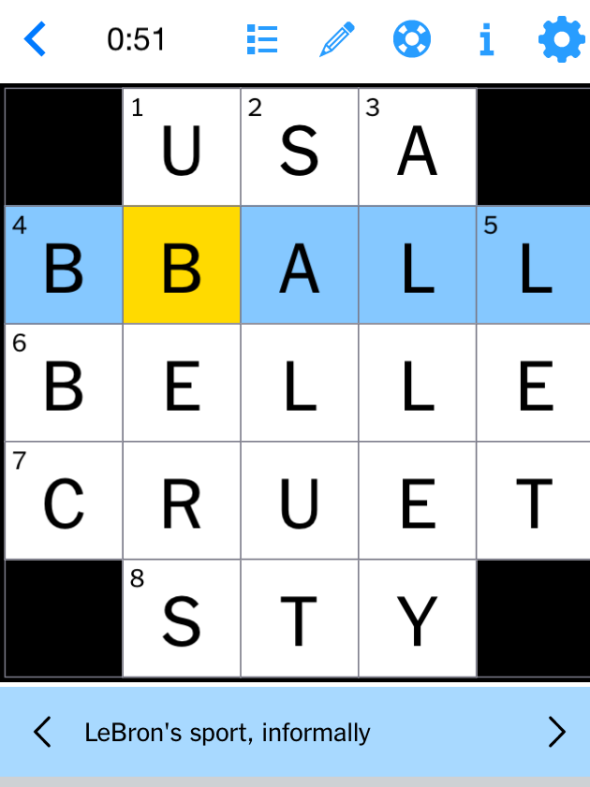

Nyt Mini Crossword Solutions March 31 2024

May 20, 2025

Nyt Mini Crossword Solutions March 31 2024

May 20, 2025 -

Jutarnji List Premijera Filma Zvijezde Na Crvenom Tepihu

May 20, 2025

Jutarnji List Premijera Filma Zvijezde Na Crvenom Tepihu

May 20, 2025

Latest Posts

-

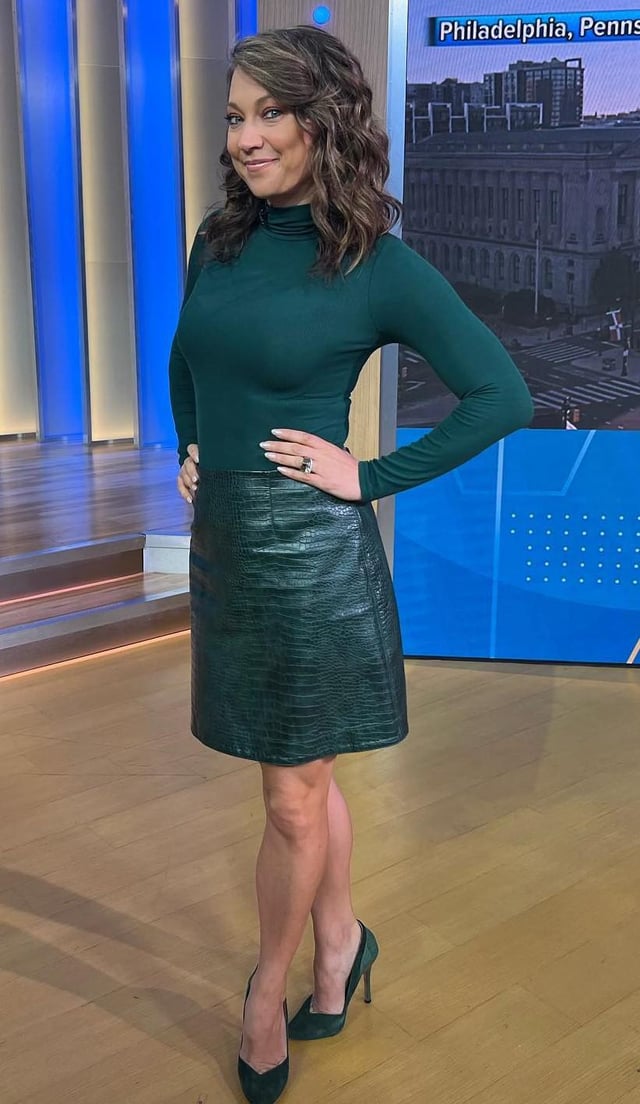

Asheville Rising Helene Special Gmas Ginger Zee Visits Wlos

May 20, 2025

Asheville Rising Helene Special Gmas Ginger Zee Visits Wlos

May 20, 2025 -

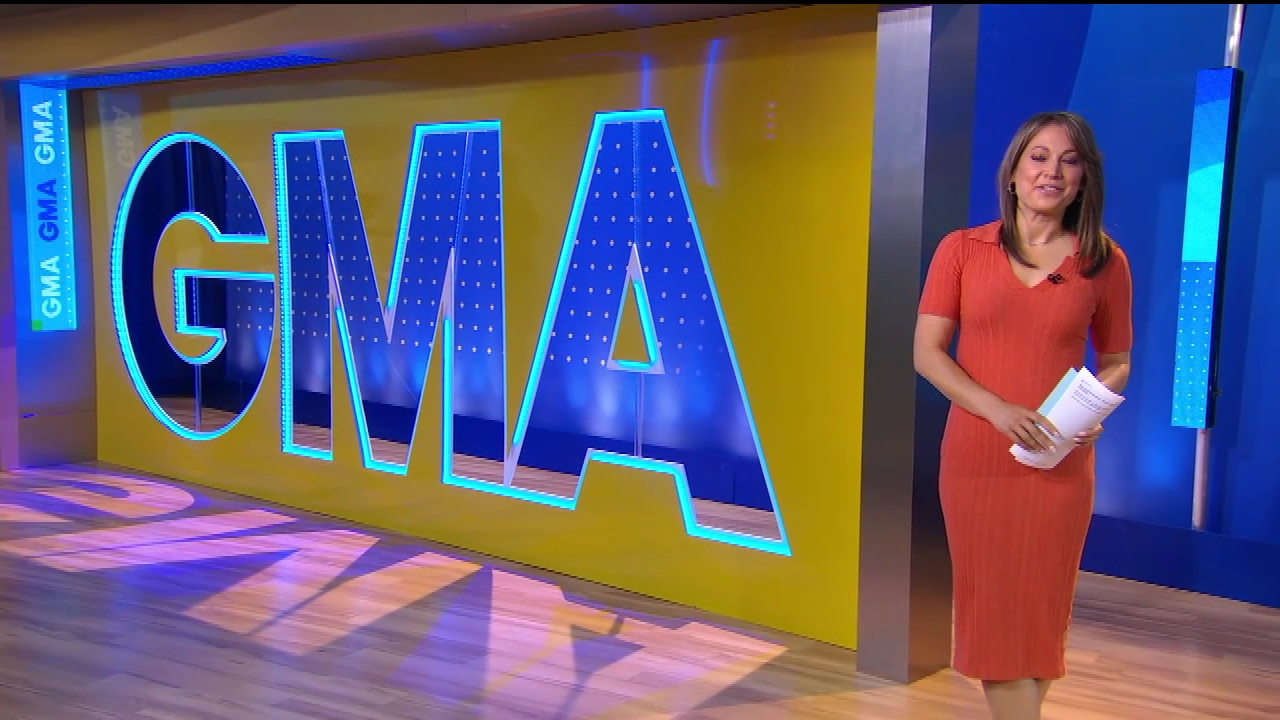

Michael Strahans Gma Departure The Real Reason He Left

May 20, 2025

Michael Strahans Gma Departure The Real Reason He Left

May 20, 2025 -

Ginger Zee Of Gma Visits Wlos To Promote Asheville Rising Helene Special

May 20, 2025

Ginger Zee Of Gma Visits Wlos To Promote Asheville Rising Helene Special

May 20, 2025 -

Good Morning Americas Ginger Zee Visits Wlos Ahead Of Asheville Rising Helene Special

May 20, 2025

Good Morning Americas Ginger Zee Visits Wlos Ahead Of Asheville Rising Helene Special

May 20, 2025 -

Behind The Scenes At Good Morning America Job Cuts And Staff Concerns

May 20, 2025

Behind The Scenes At Good Morning America Job Cuts And Staff Concerns

May 20, 2025