Analyzing The D-Wave Quantum (QBTS) Stock Decrease On Thursday

Table of Contents

Main Points: Deconstructing the QBTS Stock Dip

2.1. Market-Wide Factors Influencing QBTS Stock Performance

The overall market climate significantly impacts individual stock performance. Thursday's decline in QBTS may have been partly influenced by broader market trends. Analyzing the general market sentiment and the technology sector's performance on that day provides crucial context.

- Overall Market Sentiment: A general sense of negativity in the broader stock market can drag down even fundamentally sound companies. If Thursday saw a general downturn, QBTS would likely be affected, regardless of its specific circumstances.

- Technology Sector Performance: The technology sector, particularly sub-sectors like artificial intelligence (AI) and quantum computing, often moves in tandem. If other technology stocks, especially those involved in quantum computing or AI, experienced similar declines, this suggests a sector-specific headwind impacting QBTS.

- Economic Indicators: Macroeconomic factors play a significant role. Negative economic news, such as unexpected inflation reports or announcements of further interest rate hikes, could create a risk-averse environment, leading to selling pressure across various sectors, including QBTS.

- Bullet points: For instance, a higher-than-expected inflation report released on Thursday could have fueled investor anxiety, leading to a sell-off in growth stocks like QBTS. Similarly, any news regarding potential changes in Federal Reserve policy could have also impacted the market.

2.2. Company-Specific News and Developments Affecting QBTS

Internal factors specific to D-Wave Quantum can also contribute significantly to stock price fluctuations. Let's examine any news or developments that may have negatively impacted investor sentiment.

- Press Releases and Announcements: Any negative news releases from D-Wave itself, announcements of delays in projects, or setbacks in technological development could trigger immediate selling pressure.

- Analyst Ratings and Reports: Changes in analyst ratings or the release of negative reports from influential financial analysts can significantly influence investor perception and trading behavior. A downgrade from a major analyst firm could contribute to a stock price drop.

- Competitor Activity: Successes or breakthroughs by competitors in the quantum computing field could negatively affect D-Wave's perceived market share and future prospects, potentially leading to a decline in its stock price.

- Bullet points: For example, if a competitor announced a significant advancement in quantum computing technology on Thursday, it could have negatively impacted investor confidence in D-Wave's position in the market.

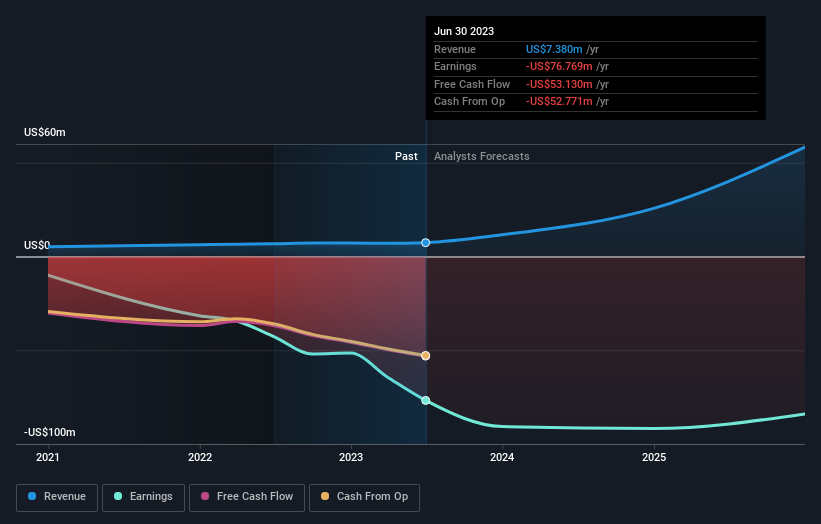

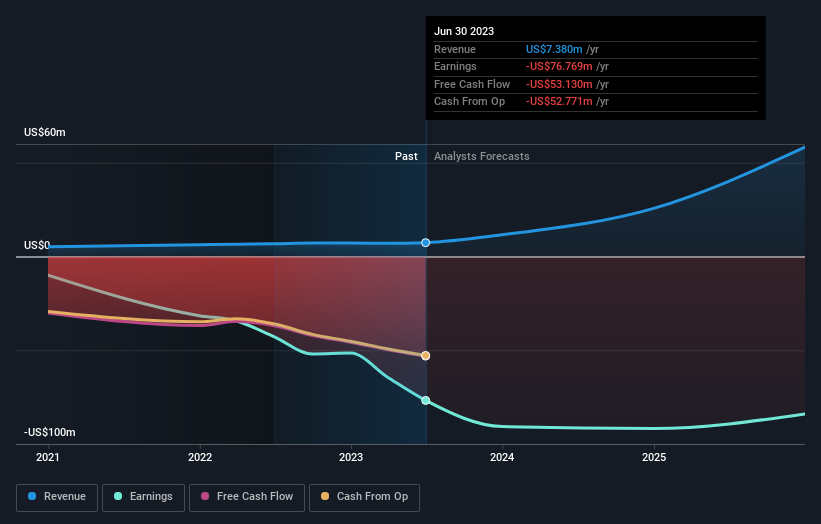

2.3. Technical Analysis of QBTS Stock Chart

Technical analysis offers valuable insights into stock price movements. Examining trading volume, support and resistance levels, and chart patterns can help explain the QBTS drop.

- Trading Volume: Unusually high trading volume on Thursday, significantly exceeding the average daily volume, would indicate strong selling pressure and potentially amplify the price drop.

- Support and Resistance Levels: If the QBTS stock price broke through a crucial support level—a price point where buying pressure historically outweighs selling pressure—this could trigger further declines as investors react to the breach.

- Chart Patterns: Recognizable chart patterns, such as a "head and shoulders" or "double top," can sometimes predict price reversals. The presence of such patterns before Thursday's drop might offer insight into the price movement.

- Bullet points: Analysis of Relative Strength Index (RSI), Moving Averages (MA), and other technical indicators would provide a more granular understanding of the price action. (Note: Inclusion of relevant chart screenshots would enhance this section).

2.4. Investor Sentiment and Speculation

Investor sentiment and speculation play a vital role in stock price movements. Understanding the prevailing sentiment can shed light on Thursday's QBTS decline.

- Social Media Sentiment: Analyzing social media conversations (Twitter, Reddit, StockTwits, etc.) about D-Wave Quantum can reveal the prevailing sentiment among individual investors. A surge in negative sentiment before or during the drop could be a contributing factor.

- Investor Confidence: A general decline in investor confidence in the quantum computing sector or in D-Wave specifically could lead to selling pressure, amplifying the price drop.

- Short-Selling Activity: An increase in short-selling—betting against the stock—can exacerbate downward pressure, particularly if short sellers act in concert.

- Bullet points: A clear shift in social media sentiment towards negativity, coupled with a reported increase in short-selling activity, might provide a compelling narrative for the QBTS stock decline.

Conclusion: Interpreting the D-Wave Quantum (QBTS) Stock Decrease and Future Outlook

Thursday's QBTS stock price decrease was likely a result of a confluence of factors. Broader market weakness, company-specific news (or lack thereof), technical indicators suggesting selling pressure, and possibly negative investor sentiment all contributed to the decline. While the drop is concerning, it's crucial to maintain a balanced perspective. D-Wave's position in the rapidly growing quantum computing market remains strategically significant.

The future outlook for QBTS requires careful monitoring. Continued analysis of market trends, company developments, and technical indicators is necessary. Investors should remain vigilant and adapt their investment strategies based on emerging information. Understanding the future of QBTS necessitates a continuous evaluation of these factors. By analyzing QBTS performance and closely monitoring D-Wave Quantum stock trends, investors can make more informed decisions regarding their investment in this potentially transformative technology. Therefore, continue researching D-Wave Quantum and its progress in the quantum computing field.

Featured Posts

-

Love Monster For Children And Adults

May 21, 2025

Love Monster For Children And Adults

May 21, 2025 -

I Ypothesi Giakoymaki To Bullying Oi Basanismoi Kai I Apoysia Prostasias

May 21, 2025

I Ypothesi Giakoymaki To Bullying Oi Basanismoi Kai I Apoysia Prostasias

May 21, 2025 -

Tikkie In Nederland Alles Wat Je Moet Weten Over Betalen Via Je Bankrekening

May 21, 2025

Tikkie In Nederland Alles Wat Je Moet Weten Over Betalen Via Je Bankrekening

May 21, 2025 -

Minkulturi Viznalo Kanali Kritichno Vazhlivimi 1 1 Inter Stb Ta Inshi

May 21, 2025

Minkulturi Viznalo Kanali Kritichno Vazhlivimi 1 1 Inter Stb Ta Inshi

May 21, 2025 -

Best Ea Fc 24 Fut Birthday Cards Tier List And Ratings

May 21, 2025

Best Ea Fc 24 Fut Birthday Cards Tier List And Ratings

May 21, 2025

Latest Posts

-

Southport Stabbing Mums Tweet Costs Her Freedom And Housing

May 22, 2025

Southport Stabbing Mums Tweet Costs Her Freedom And Housing

May 22, 2025 -

Connolly Loses Appeal Over Racially Abusive Post

May 22, 2025

Connolly Loses Appeal Over Racially Abusive Post

May 22, 2025 -

Mum Jailed For Tweet After Southport Stabbing Homelessness Sentence

May 22, 2025

Mum Jailed For Tweet After Southport Stabbing Homelessness Sentence

May 22, 2025 -

Decision Delayed Ex Tory Councillors Wifes Appeal Over Racial Hatred Tweet

May 22, 2025

Decision Delayed Ex Tory Councillors Wifes Appeal Over Racial Hatred Tweet

May 22, 2025 -

Wife Of Jailed Tory Councillor Says Fire Rant Against Migrant Hotels Wasnt Intended To Incite Violence

May 22, 2025

Wife Of Jailed Tory Councillor Says Fire Rant Against Migrant Hotels Wasnt Intended To Incite Violence

May 22, 2025