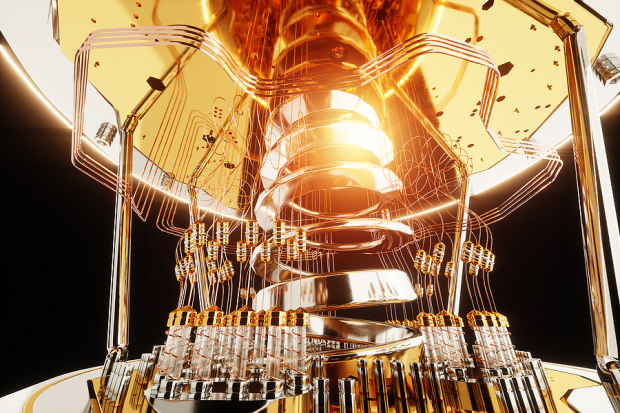

Analyzing The D-Wave Quantum (QBTS) Stock Price Crash On Monday

Table of Contents

Market Sentiment and Investor Reaction to Recent News

The QBTS stock price crash wasn't an isolated event; it reflects a broader shift in investor sentiment. Preceding the plunge, there was a palpable sense of uncertainty within the quantum computing sector. While no single catastrophic news event triggered the crash, a confluence of factors likely contributed to the negative market reaction.

- Specific negative news impacting QBTS: Although no major negative press release directly preceded the crash, a lack of significant positive announcements regarding new contracts or technological breakthroughs might have contributed to investor anxiety. Any perceived slowdown in development compared to competitors could have fueled selling pressure.

- Overall market trends affecting technology stocks: The broader technology sector experienced some volatility in the period leading up to the QBTS crash, with investors becoming more risk-averse. This general market downturn undoubtedly amplified the negative sentiment surrounding QBTS.

- Investor confidence levels before and after the crash: Prior to the crash, investor confidence in QBTS might have been relatively high, given the excitement surrounding the quantum computing field. However, the price plunge suggests a significant loss of confidence, possibly due to the aforementioned factors.

Social media and online forums played a crucial role in disseminating information (and misinformation) impacting investor behavior. Negative sentiment spread rapidly, influencing trading decisions and accelerating the sell-off.

Technical Analysis of the QBTS Stock Chart

A technical analysis of the QBTS stock chart reveals several bearish signals preceding the crash. The price had been consolidating near a key resistance level for several weeks, suggesting potential selling pressure.

- Key technical indicators showing bearish signals: Indicators like the Relative Strength Index (RSI) might have shown overbought conditions before the crash, indicating a potential reversal. Similarly, moving average convergence divergence (MACD) could have displayed bearish crossovers, further reinforcing the negative outlook.

- Support and resistance levels breached during the crash: The decisive break below key support levels confirmed the bearish trend, triggering further selling.

- Trading volume analysis before, during, and after the crash: High trading volume during the crash itself indicated a significant sell-off, suggesting many investors were actively participating in the price decline.

These technical factors, coupled with the negative market sentiment, created a perfect storm for the QBTS stock price to plummet. The implications for the future are uncertain; however, a sustained break below key support levels could signal further downward pressure.

Competition within the Quantum Computing Industry

The quantum computing industry is fiercely competitive, with several major players vying for market share. D-Wave Quantum, while a pioneer in the field, faces significant competition from companies developing different quantum computing technologies.

- Key competitors in the quantum computing industry: Companies like IBM, Google, and IonQ are all significant competitors, developing their own quantum computing hardware and software.

- D-Wave's competitive advantages and disadvantages: D-Wave's advantage lies in its early market entry and established technology. However, its annealing-based approach faces competition from gate-based quantum computing technologies, which are considered by some to have greater long-term potential.

- Recent advancements by competitors that may have negatively impacted QBTS: Any significant breakthroughs or announcements from competitors could shift investor sentiment away from D-Wave, contributing to the price decline.

The intense competitive pressure within the quantum computing sector undoubtedly contributes to the volatility of QBTS stock and other similar stocks.

Macroeconomic Factors and their Influence

Broader macroeconomic conditions also played a role in the QBTS stock price crash. A general risk-off sentiment in the market, driven by various macroeconomic factors, likely amplified the negative impact of the company-specific and industry-related factors.

- Relevant macroeconomic indicators impacting the stock market: Factors like rising interest rates, high inflation, and fears of a potential recession generally impact the technology sector negatively. Investors often move to safer investments during times of economic uncertainty.

- Impact of general market sentiment on QBTS: A risk-averse market environment makes investors less willing to hold riskier assets, like stocks in a relatively nascent industry like quantum computing.

- Correlation between broader market trends and QBTS performance: The correlation between the overall market performance and QBTS performance likely shows a strong negative relationship during periods of economic uncertainty.

Conclusion: Understanding and Navigating the Future of D-Wave Quantum (QBTS)

The D-Wave Quantum (QBTS) stock price crash resulted from a complex interplay of market sentiment, technical indicators, intense competition, and unfavorable macroeconomic conditions. Understanding these factors is paramount for navigating the risks associated with investing in quantum computing stocks. While the future of D-Wave Quantum remains uncertain, investors must conduct thorough due diligence, carefully assess the risks, and stay informed about the company's progress and the broader quantum computing landscape. Monitor news from reputable sources, follow key technical indicators, and remain aware of competitive developments to make informed decisions regarding QBTS and other quantum computing stocks. Stay informed, stay vigilant, and make smart investment choices in the dynamic world of D-Wave Quantum and the future of quantum computing.

Featured Posts

-

Le Ministre Bruno Kone Et La Reussite Des Plans D Urbanisme En Cote D Ivoire Appel A La Collaboration Des Maires

May 20, 2025

Le Ministre Bruno Kone Et La Reussite Des Plans D Urbanisme En Cote D Ivoire Appel A La Collaboration Des Maires

May 20, 2025 -

Bbc Deepfake Agatha Christie Fact Or Fiction

May 20, 2025

Bbc Deepfake Agatha Christie Fact Or Fiction

May 20, 2025 -

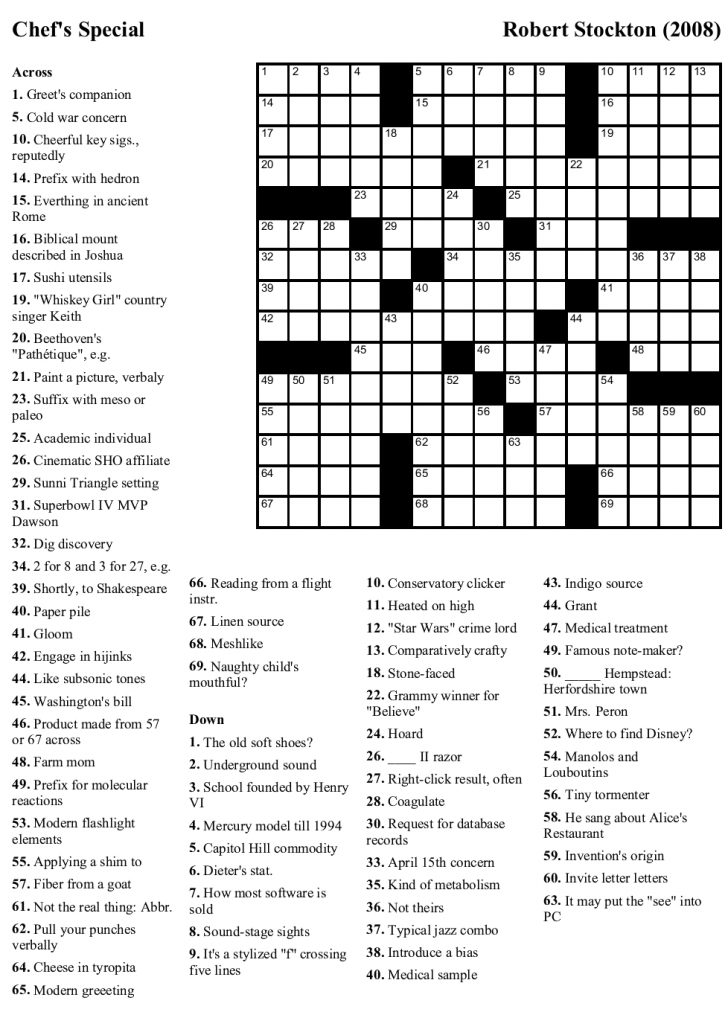

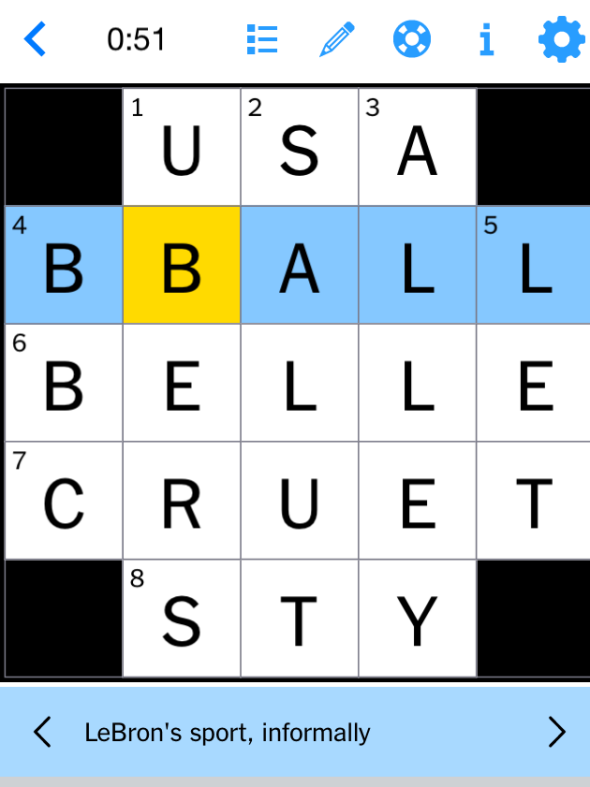

Todays Nyt Mini Crossword Puzzle May 9 Answers

May 20, 2025

Todays Nyt Mini Crossword Puzzle May 9 Answers

May 20, 2025 -

College Town Economic Crisis The Impact Of Shrinking Enrollment

May 20, 2025

College Town Economic Crisis The Impact Of Shrinking Enrollment

May 20, 2025 -

Find The Answers Nyt Mini Crossword March 16 2025

May 20, 2025

Find The Answers Nyt Mini Crossword March 16 2025

May 20, 2025

Latest Posts

-

Suomalaiset Jalkapalloilijat Kaellman Ja Hoskonen Jaettaevaet Puolalaisseuran

May 20, 2025

Suomalaiset Jalkapalloilijat Kaellman Ja Hoskonen Jaettaevaet Puolalaisseuran

May 20, 2025 -

Huuhkajat Kaellman Ja Hoskonen Siirtyvaet Pois Puolasta

May 20, 2025

Huuhkajat Kaellman Ja Hoskonen Siirtyvaet Pois Puolasta

May 20, 2025 -

Kaellmanin Vaikuttava Kehitys Mitae Se Tarkoittaa Huuhkajille

May 20, 2025

Kaellmanin Vaikuttava Kehitys Mitae Se Tarkoittaa Huuhkajille

May 20, 2025 -

Jalkapallo Kaellman Ja Hoskonen Palaavat Suomeen

May 20, 2025

Jalkapallo Kaellman Ja Hoskonen Palaavat Suomeen

May 20, 2025 -

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Maalinteko Ominaisuudet

May 20, 2025

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Maalinteko Ominaisuudet

May 20, 2025