Analyzing The Economic Impact Of Trump's Tariffs On China

Table of Contents

Trump's tariffs on China represent a significant turning point in the US-China economic relationship, triggering a period of heightened trade tensions with far-reaching consequences. This article delves into the complex economic fallout resulting from these tariffs, exploring their impact on both the United States and China. We will analyze key areas such as trade deficits, inflation rates, job creation and losses, and the disruption of global supply chains. Our central argument is that Trump's tariffs had a multifaceted impact, producing both intended and unintended consequences for both economies, ultimately leading to a more complex and uncertain global trade landscape.

2. Main Points:

H2: Impact on US Businesses and Consumers:

H3: Increased Prices for Consumers:

Trump's tariffs on Chinese goods directly increased the cost of imported products for American consumers. This price hike affected a wide range of goods, including electronics, furniture, clothing, and numerous other consumer staples. The impact was felt across all income levels, but lower-income households, who spend a larger proportion of their income on essential goods, were disproportionately affected.

- Statistics: Studies showed a noticeable increase in inflation rates during the period of tariff implementation, directly linked to increased import costs. For example, the consumer price index for certain categories showed a clear upward trend.

- Examples: The price of washing machines, solar panels, and certain types of steel saw significant increases, impacting both consumers and businesses reliant on these products.

- Impact on lower-income households: The increased cost of living placed a considerable strain on lower-income families, forcing them to make difficult choices between essential goods and services.

H3: Job Creation and Loss:

The impact of Trump's tariffs on US job creation and destruction remains a subject of debate. While proponents argued that tariffs protected American jobs by boosting domestic production, critics pointed to the negative effects on industries reliant on imported goods and the overall economic slowdown.

- Job losses in import-reliant sectors: Industries such as retail, manufacturing, and agriculture experienced job losses due to reduced consumer spending and increased input costs.

- Job creation in protected sectors: Some sectors, particularly those directly targeted by the tariffs, saw increased domestic production and employment. However, these gains were often offset by job losses in other sectors.

- Automation and other factors: It's crucial to acknowledge that job displacement due to automation and other economic factors were concurrent with the tariff impacts, making a direct causal link difficult to establish definitively.

H3: Shifting Supply Chains:

Facing higher tariffs, many US businesses actively sought to diversify their supply chains, moving sourcing away from China. This involved reshoring (bringing production back to the US) and nearshoring (moving production to nearby countries).

- Reshoring challenges: Reshoring proved costly, hampered by higher labor costs and infrastructure limitations in the US compared to China.

- Nearshoring alternatives: Companies increasingly looked towards countries like Mexico, Vietnam, and other Southeast Asian nations as alternative sourcing locations. This shift had implications for these countries' economies and labor markets.

- Long-term implications: The disruptions to global supply chains caused by Trump's tariffs had lasting consequences, increasing the complexity and vulnerability of international trade networks.

H2: Impact on the Chinese Economy:

H3: Reduced Exports and Economic Growth:

Trump's tariffs significantly impacted China's exports to the US, leading to a noticeable slowdown in economic growth. Specific industries, such as manufacturing and agriculture, suffered the most, resulting in job losses and reduced revenue.

- Decline in US-bound exports: Data clearly reveals a substantial decline in Chinese exports to the United States during the period of tariff implementation.

- Impact on GDP growth: The reduced export market contributed to a slowdown in China's overall GDP growth, though the extent of this impact remains debated among economists.

- Sector-specific analysis: The agricultural sector, notably soybean farmers, faced significant challenges due to retaliatory tariffs imposed by China.

H3: Retaliatory Tariffs and Trade Wars:

China responded to US tariffs with its own retaliatory measures, escalating the trade conflict into a full-blown trade war. This had ripple effects across the global economy, impacting businesses and consumers worldwide.

- Escalation of trade tensions: Both countries imposed tariffs on a wide range of goods, disrupting global trade flows and increasing uncertainty.

- Global economic consequences: The trade war slowed global economic growth, increased uncertainty in international markets, and contributed to increased volatility in currency exchange rates.

H3: Impact on Chinese Investment and Foreign Policy:

The trade tensions significantly influenced China's investment strategies both domestically and internationally. The experience may have led to a reassessment of its reliance on the US market and a greater focus on domestic consumption and diversification of trading partners.

- Increased focus on domestic markets: China invested more heavily in its domestic market to reduce its dependence on exports to the US.

- Diversification of trade partnerships: China actively sought to strengthen trade relationships with other countries to reduce its reliance on the US market.

- Shift in foreign policy: The trade war likely influenced China's foreign policy, particularly regarding its approach to international trade and economic cooperation.

H2: Long-Term Economic Consequences and Global Implications:

H3: Trade Relations and Geopolitical Shifts:

Trump's tariffs dramatically altered the US-China trade relationship, deepening mistrust and creating a more confrontational environment. This had wide-ranging geopolitical consequences, affecting global trade alliances and strategic partnerships.

- Increased protectionism: The tariffs fueled a broader trend towards protectionist trade policies globally, challenging the long-standing principles of free trade.

- Shifting global power dynamics: The trade war impacted the global power balance, influencing relations between the US, China, and other major economies.

H3: Sustainable Growth vs. Protectionism:

The experience with Trump's tariffs reignited the long-standing debate between proponents of free trade and those advocating for protectionist policies. The long-term economic sustainability of protectionism remains a key point of contention.

- Arguments for free trade: Free trade advocates emphasize the benefits of open markets, comparative advantage, and overall global economic growth.

- Arguments for protectionism: Protectionists argue for the importance of safeguarding domestic industries and jobs from foreign competition.

H3: Lessons Learned and Future Implications:

The experience with Trump's tariffs on China offers valuable lessons regarding the complexity of international trade and the potential pitfalls of protectionist policies. Understanding these implications is crucial for shaping future trade policies and managing international economic relationships.

- Need for multilateral cooperation: The trade war highlighted the importance of international cooperation and multilateral frameworks for resolving trade disputes.

- Importance of diversified supply chains: Businesses need to develop more robust and diversified supply chains to mitigate risks associated with trade disputes.

- Long-term impact on global trade: The consequences of Trump's tariffs will continue to shape global trade patterns and economic relationships for years to come.

3. Conclusion: Assessing the Legacy of Trump's Tariffs on China

Trump's tariffs on China had a profound and multifaceted impact on both the US and Chinese economies. Increased consumer prices, job displacement in some sectors, disruptions to global supply chains, and heightened geopolitical tensions are all lasting legacies. The strategy's success in achieving its stated goals remains highly debated, with evidence suggesting both intended and significant unintended consequences. While some domestic industries may have benefited temporarily, the overall economic effects were complex and far-reaching. To fully grasp the ongoing ramifications of this policy, further research is essential. We encourage you to explore additional resources and critically analyze the broader implications of protectionist trade policies and the continuing impact of Trump's tariffs on China on the global stage. Understanding this complex issue is critical for navigating the future of international trade.

Featured Posts

-

Sudny Proces V Pripade Unosu Studentky Sone Rozhodovanie V Stredu

Apr 29, 2025

Sudny Proces V Pripade Unosu Studentky Sone Rozhodovanie V Stredu

Apr 29, 2025 -

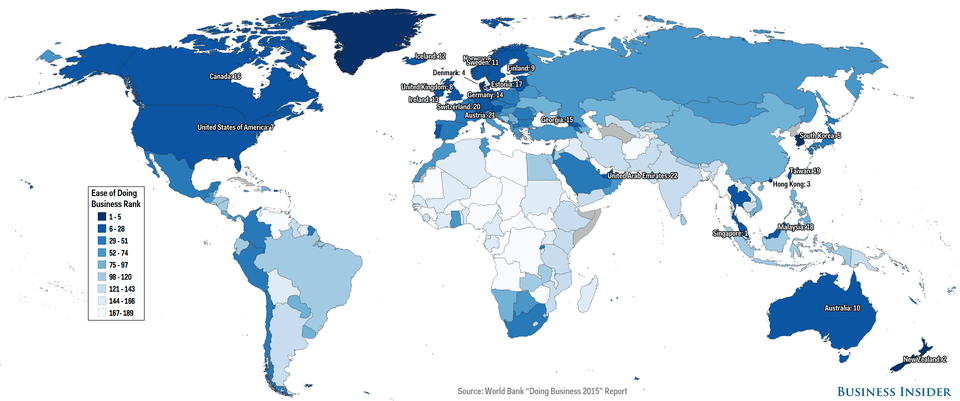

Mapping The Countrys Emerging Business Hubs

Apr 29, 2025

Mapping The Countrys Emerging Business Hubs

Apr 29, 2025 -

German And Austrian Ministers Respond To Threat Cancel Syria Plans

Apr 29, 2025

German And Austrian Ministers Respond To Threat Cancel Syria Plans

Apr 29, 2025 -

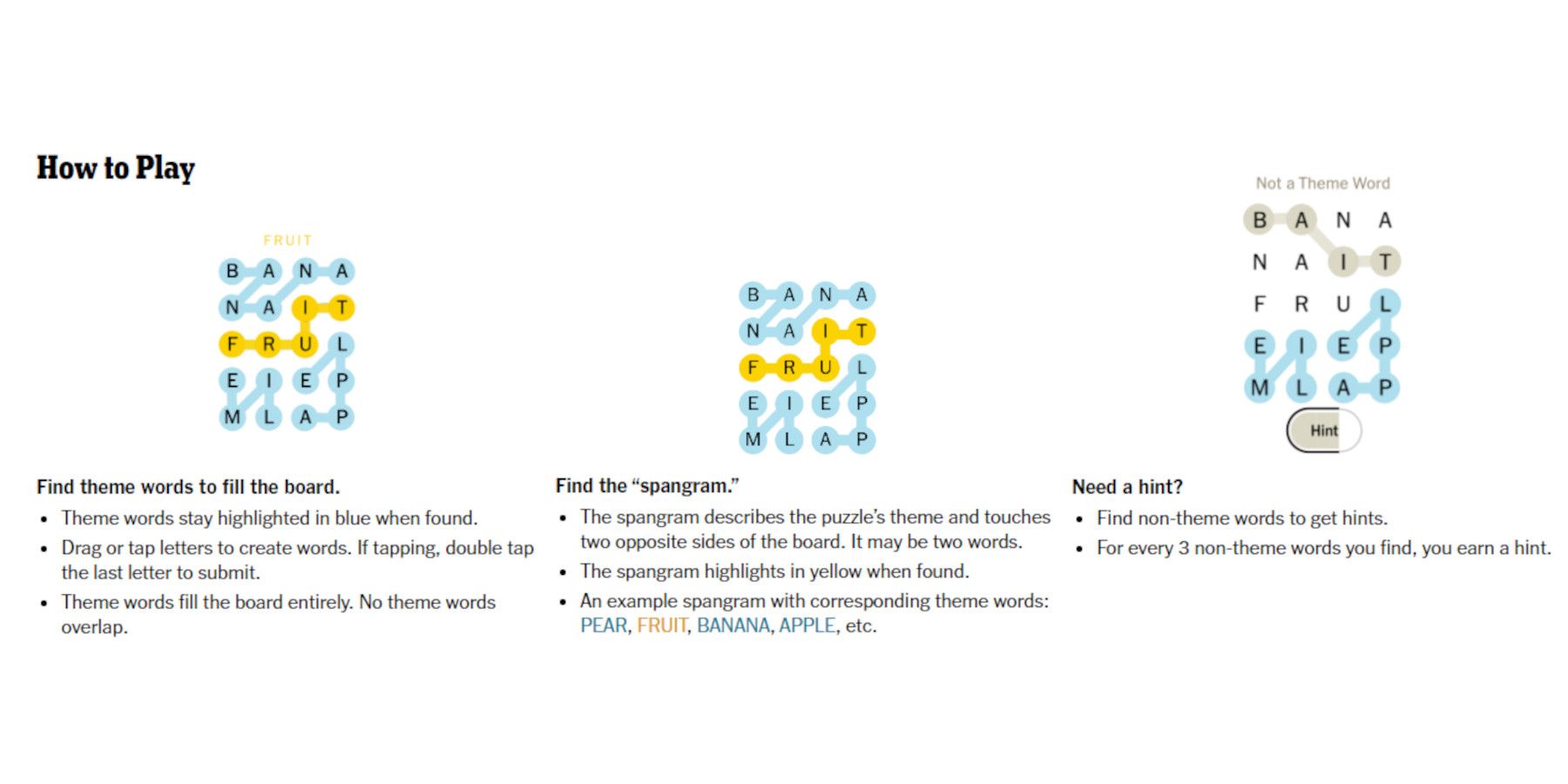

Complete Guide To Solving Nyt Strands Puzzle April 3 2025

Apr 29, 2025

Complete Guide To Solving Nyt Strands Puzzle April 3 2025

Apr 29, 2025 -

Public Sector Pensions Examining The Financial Gamble

Apr 29, 2025

Public Sector Pensions Examining The Financial Gamble

Apr 29, 2025