Analyzing The Financial Implications Of Musk's X Debt Sale

Table of Contents

The Structure of Musk's X Debt

Initial Debt Burden

The acquisition of Twitter was heavily leveraged, resulting in a substantial initial debt burden. Reports estimate the initial debt load at over $13 billion, a mix of high-yield bonds and bank loans. These high-yield bonds, often referred to as "junk bonds," carry significantly higher interest rates than investment-grade debt, reflecting the perceived risk associated with the loan. The interest payments alone represent a considerable financial strain on X's operational cash flow.

- Breakdown of debt sources: A significant portion stemmed from high-yield bonds sold to institutional investors, complemented by bank loans from several major financial institutions.

- Maturity dates: These loans and bonds have varying maturity dates, creating a staggered repayment schedule over several years.

- Interest rate spreads: The interest rates on these high-yield bonds were significantly higher than comparable investment-grade corporate bonds, reflecting the substantial risk involved in lending to a company undergoing such a substantial leveraged buyout.

- Leveraged Buyouts (LBOs): Musk's acquisition of X is a classic example of a leveraged buyout (LBO), where a significant portion of the acquisition cost is financed through debt. LBOs, while potentially lucrative, carry substantial risk. A large debt load can make the company vulnerable to economic downturns, interest rate hikes, or unexpected operational challenges.

The Debt Sale

To alleviate some of this crippling debt, Musk pursued a debt sale. The specifics of this sale, including the exact amount of debt sold and the identities of the buyers, have not been fully disclosed. However, news reports suggest a substantial portion of the initial debt burden was addressed.

- Bonds sold at a discount: It is likely that these bonds were sold at a discount to their face value, reflecting the increased risk perception in the market. This means X received less money than the face value of the debt, resulting in a loss for the company.

- Impact on perceived risk: This sale impacts the perceived risk associated with X's debt. A successful sale suggests some degree of investor confidence, despite the inherent risks. The participation of private equity firms in the debt purchase would further contribute to this assessment.

Impact on X's Balance Sheet

The X debt sale significantly affects X's balance sheet. By reducing its debt load, X improves its debt-to-equity ratio, a key metric used to assess financial health. This improvement may also result in a better credit rating, potentially lowering the cost of future borrowing. However, the discount at which the bonds were sold will impact the net outcome.

- Before and after comparisons: A detailed comparison of X's key financial metrics – such as the debt-to-equity ratio, interest expense, and operating cash flow – before and after the debt sale is necessary to fully assess its impact. This analysis will reveal the true financial position of X post-sale.

The Implications for Elon Musk

Personal Financial Risk

Musk's personal finances were significantly intertwined with the X debt, raising concerns about his personal financial risk. Reports suggest that Musk may have provided personal guarantees for a portion of the debt.

- Personal guarantees: These guarantees would make Musk personally liable for the debt repayment if X failed to meet its obligations, jeopardizing his considerable personal wealth.

- Collateral: Any collateral pledged to secure the loans would also be at risk in case of default.

- Potential personal liability: The extent of Musk's personal liability and the potential impact on his net worth remains a critical area of ongoing analysis and speculation.

Future Investment Capacity

The X debt sale impacts Musk's future investment capacity. The reduced financial burden may free up resources for future investments. However, the overall impact on his ability to obtain credit for future projects will be largely dependent on the terms and conditions associated with the debt sale.

- Access to credit: The success or failure of the debt sale could affect his future access to credit for ventures beyond X. A successful sale could ease concerns and improve creditworthiness.

- Impact on other companies: His ability to invest in or support other companies he owns or controls could also be affected.

Broader Market Impacts

Impact on Credit Markets

The X debt sale has wider implications for the high-yield debt market and overall investor confidence. The success or failure of the sale serves as a benchmark for similar high-risk debt instruments.

- Impact on credit spreads: The sale might influence credit spreads on other high-yield bonds, potentially increasing or decreasing them depending on market sentiment and the perceived risk of similar debt securities.

- Potential contagion effects: Negative outcomes could potentially have contagion effects, impacting investor confidence in other companies with similar debt structures.

Regulatory Scrutiny

The acquisition of X and its subsequent debt management are subject to regulatory scrutiny, particularly from the Securities and Exchange Commission (SEC).

- SEC investigations: Any potential violations of securities laws or regulations could lead to investigations and potential penalties.

- Regulatory actions: Regulatory actions resulting from the acquisition or debt management could further complicate X's financial situation and negatively impact investor confidence.

Conclusion

This analysis of the financial implications of Musk's X debt sale reveals a complex interplay of factors influencing X's financial health, Musk's personal finances, and broader market dynamics. While the debt sale might alleviate some immediate pressures, it introduces new challenges and uncertainties. Understanding the nuances of high-yield debt and leveraged buyouts is crucial for assessing the long-term effects. Further analysis is needed to fully grasp the ultimate success or failure of this complex financial strategy. To stay informed about ongoing developments and the future implications of this significant financial event, continue following news and analysis related to Musk's X debt and its evolving financial situation.

Featured Posts

-

Examining The Broader Impact Of Trumps Higher Education Policies

Apr 28, 2025

Examining The Broader Impact Of Trumps Higher Education Policies

Apr 28, 2025 -

Mike Breen Names Marv Albert The Greatest Basketball Announcer

Apr 28, 2025

Mike Breen Names Marv Albert The Greatest Basketball Announcer

Apr 28, 2025 -

Can We Curb Americas Excessive Truck Use Exploring Solutions

Apr 28, 2025

Can We Curb Americas Excessive Truck Use Exploring Solutions

Apr 28, 2025 -

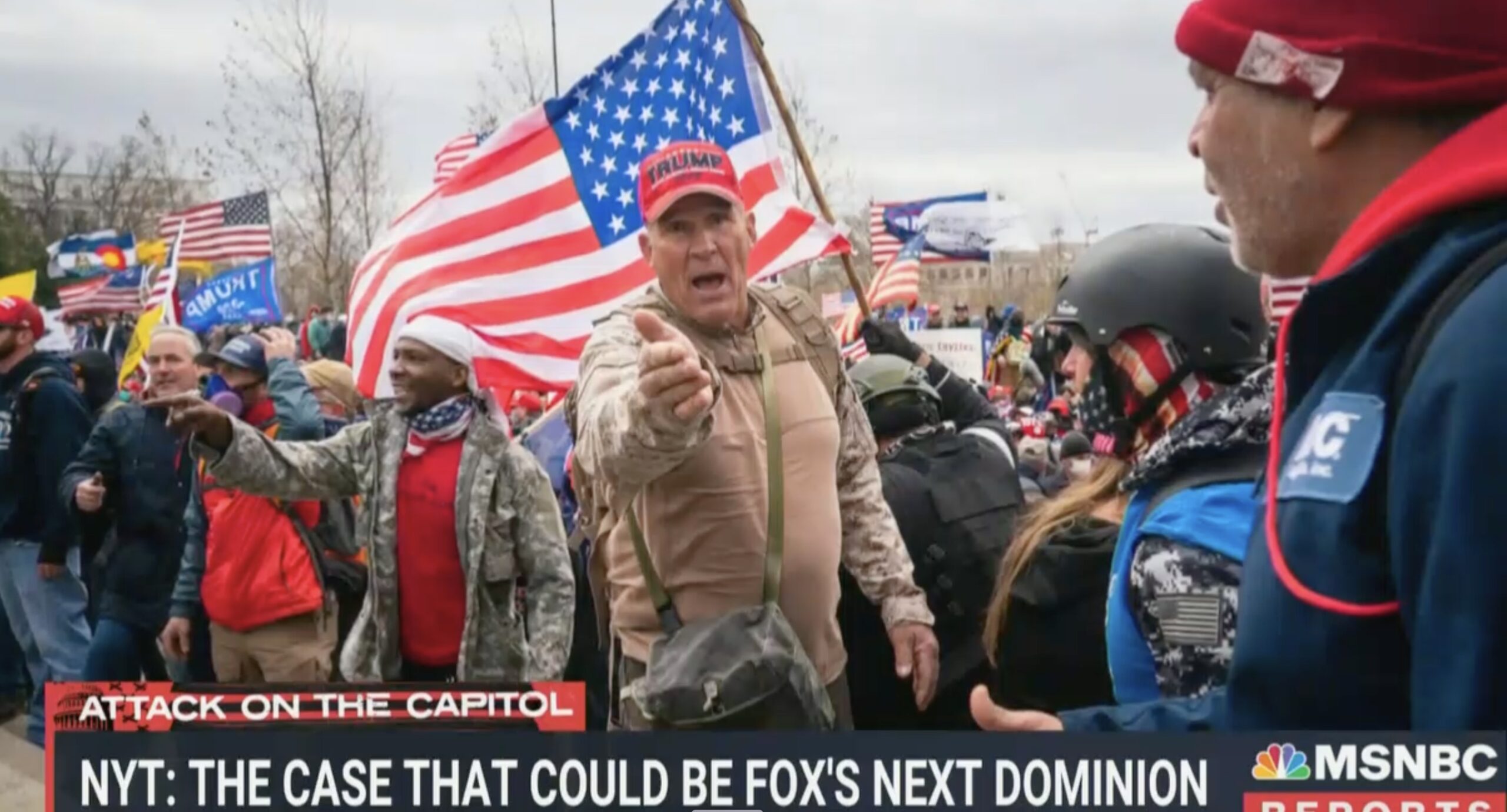

Ray Epps Vs Fox News A Deep Dive Into The Jan 6th Defamation Case

Apr 28, 2025

Ray Epps Vs Fox News A Deep Dive Into The Jan 6th Defamation Case

Apr 28, 2025 -

Luigi Mangione A Look At His Supporters And Their Views

Apr 28, 2025

Luigi Mangione A Look At His Supporters And Their Views

Apr 28, 2025