Analyzing The Long-Term Effects Of Trump's Trade Policies On US Finance

Table of Contents

The imposition of tariffs on imported steel and aluminum in 2018 sent shockwaves through the global economy, a stark reminder of the significant impact trade policies can have on national finances. This article delves into the enduring impact of Trump's trade policies on US finance, examining their long-term effects on various sectors of the American economy. We will analyze specific policies implemented during the Trump administration, assessing their overall impact – both positive and negative – and highlighting key areas affected.

H2: Impact on Manufacturing and the Trade Deficit

Trump's administration pursued a protectionist approach, significantly impacting US manufacturing and the trade deficit. Understanding these effects requires analyzing both the direct impact of tariffs and the indirect consequences of renegotiated trade agreements.

H3: Tariffs and Their Ripple Effects

The imposition of tariffs, particularly on steel, aluminum, and agricultural products, aimed to protect domestic industries. However, this strategy had several unintended consequences:

- Increased Prices: Tariffs led to a rise in the prices of imported goods, increasing costs for consumers and businesses alike. This inflationary pressure negatively impacted economic growth and reduced consumer purchasing power.

- Retaliatory Tariffs: Other countries retaliated with their own tariffs on US goods, creating a trade war that harmed US exporters and certain sectors of the American economy. The agricultural sector, for example, faced significant challenges due to retaliatory tariffs from China.

- Mixed Impact on Manufacturing Jobs: While some argue that tariffs saved or created jobs in specific sectors like steel, there's evidence suggesting that the overall impact on US manufacturing jobs was mixed, with job losses in export-oriented industries offsetting any gains in protected sectors. A comprehensive analysis requires examining job creation and job displacement in various sectors.

- Data and Statistics: To support the above claims, incorporating specific data on price increases, trade volumes, and job creation/loss across different manufacturing sectors during and after the tariff imposition is crucial. For example, analyzing the change in employment numbers within the steel industry both before and after the tariffs can support the claims made.

H3: Renegotiated Trade Agreements (USMCA)

The renegotiation of NAFTA into the USMCA (United States-Mexico-Canada Agreement) was another significant policy initiative. While presented as a more beneficial agreement for the US, the long-term economic consequences are complex and multifaceted:

- Changes from NAFTA: Analyzing the key changes in the USMCA compared to NAFTA, including provisions on labor, environmental standards, and intellectual property, is essential for evaluating its impact on trade flows.

- Industry-Specific Effects: The effects of the USMCA varied considerably across different industries and regions. Some sectors benefited from improved market access, while others faced challenges due to new regulations or increased competition.

- Short-term vs. Long-term: The short-term impacts of the USMCA might differ from its long-term effects. A thorough analysis should consider both the immediate and sustained economic consequences.

- Economic Comparison: A direct comparison of NAFTA and USMCA, quantifying their economic benefits and drawbacks using relevant economic indicators, is vital for reaching a well-supported conclusion.

H2: Effects on Global Supply Chains and Investment

Trump's trade policies significantly disrupted global supply chains and influenced foreign direct investment (FDI).

H3: Disruptions to Global Trade

The trade disputes and protectionist measures introduced considerable uncertainty and increased costs for businesses relying on global supply chains:

- Supply Chain Complexity: The disruptions to established global trade routes and increased unpredictability forced many companies to rethink their sourcing strategies.

- Increased Costs: Tariffs, trade disputes, and the increased complexity of navigating trade regulations led to significant increases in the costs of inputs and transportation.

- Manufacturing Relocation: Many companies relocated manufacturing operations outside the US to avoid tariffs and reduce costs. This shift in global manufacturing had considerable implications for job creation and economic growth.

- US Business Reliance: The consequences for US businesses heavily reliant on global supply chains were particularly severe, highlighting the interconnectedness of the global economy.

H3: Foreign Direct Investment (FDI)

Trade policy uncertainty had a significant impact on both inward and outward FDI:

- Inward FDI: Uncertainty surrounding trade policy likely discouraged foreign investment in the US, impacting job creation and economic growth.

- Outward FDI: US companies might have been hesitant to invest abroad due to retaliatory measures and an unstable global trade environment.

- Investment Decisions: Trade policy played a significant role in influencing investment decisions, as businesses considered potential risks and the long-term viability of their investments.

- Data on FDI: Analyzing data on FDI inflows and outflows during and after the Trump administration provides crucial evidence to support or refute various hypotheses about the impact of these policies.

H2: Long-Term Implications for the US Dollar and Financial Markets

Trump's trade policies also had significant implications for the US dollar and financial markets.

H3: Exchange Rate Volatility

Trade disputes and protectionist measures introduced volatility in the foreign exchange markets:

- US Dollar Value: The value of the US dollar fluctuated considerably in response to various trade policy announcements and developments.

- Inflation and Trade: Exchange rate fluctuations affected inflation and impacted US competitiveness in international trade.

- Currency Fluctuations: The role of currency fluctuations in shaping US competitiveness needs careful consideration when assessing the overall impact of trade policies.

H3: Market Uncertainty and Investor Sentiment

The uncertainty created by unpredictable trade policies impacted investor sentiment and financial markets:

- Investor Confidence: Frequent changes in trade policy eroded investor confidence, leading to market volatility and impacting investment decisions.

- Stock Markets and Bond Yields: Stock markets and bond yields reacted to trade policy developments, reflecting the overall impact on investor sentiment and economic expectations.

- Macroeconomic Stability: Trade policy contributed to overall macroeconomic uncertainty, potentially hindering long-term economic growth and stability.

- Financial Market Data: Incorporating data from financial markets, such as stock market indices and bond yields, during the period in question, strengthens the analysis and facilitates a better understanding of the market reactions.

Conclusion: Assessing the Lasting Legacy of Trump's Trade Policies on US Finance

The long-term effects of Trump's trade policies on US finance are complex and multifaceted. While some sectors experienced short-term gains from protectionist measures, the overall impact appears to have been largely negative, characterized by increased costs for consumers, disruptions to global supply chains, and uncertainty in financial markets. The renegotiation of NAFTA into the USMCA presented a mixed bag of consequences, with both potential benefits and drawbacks that require further long-term assessment. The lasting legacy of these policies is likely to be felt for years to come, impacting US competitiveness, manufacturing, and macroeconomic stability. Further research is needed to fully understand the ripple effects across different sectors and develop effective strategies to mitigate potential negative consequences. We encourage further discussion and analysis focusing on specific policy recommendations or in-depth studies of specific industries affected by Trump's trade policies on US finance, to ensure a more robust understanding of their lasting impact.

Featured Posts

-

Assessing The Impact Of Trumps Trade Offensive On Us Financial Primacy

Apr 22, 2025

Assessing The Impact Of Trumps Trade Offensive On Us Financial Primacy

Apr 22, 2025 -

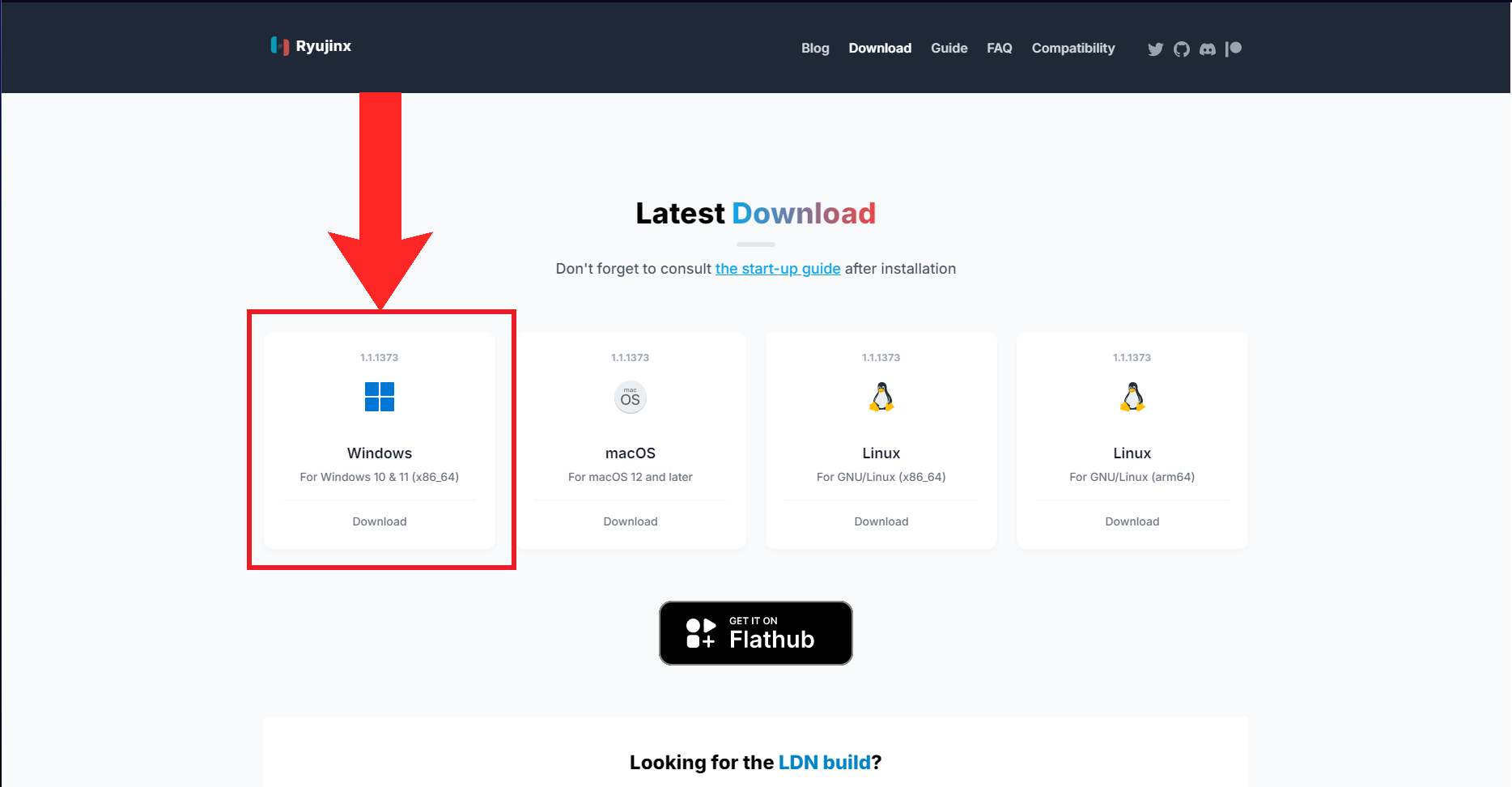

Ryujinx Emulator Development Halted Nintendos Involvement Confirmed

Apr 22, 2025

Ryujinx Emulator Development Halted Nintendos Involvement Confirmed

Apr 22, 2025 -

Razer Blade 16 2025 Review Balancing Ultra Thin Design With High End Gaming

Apr 22, 2025

Razer Blade 16 2025 Review Balancing Ultra Thin Design With High End Gaming

Apr 22, 2025 -

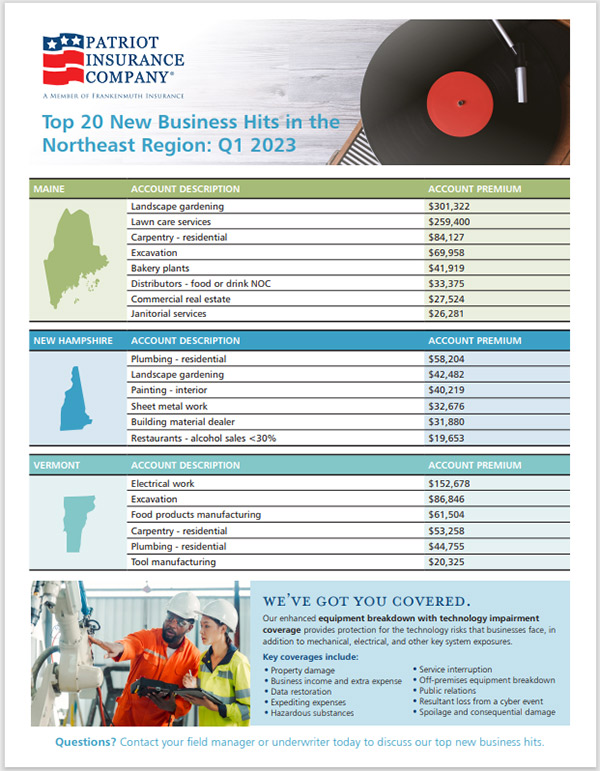

Where To Invest Mapping The Countrys Top New Business Locations

Apr 22, 2025

Where To Invest Mapping The Countrys Top New Business Locations

Apr 22, 2025 -

Stock Market Valuations Bof A Explains Why Investors Shouldnt Worry

Apr 22, 2025

Stock Market Valuations Bof A Explains Why Investors Shouldnt Worry

Apr 22, 2025

Latest Posts

-

Viral Video A Fan Made Henry Cavill Cyclops Trailer

May 12, 2025

Viral Video A Fan Made Henry Cavill Cyclops Trailer

May 12, 2025 -

Bayerns Triumph Championship Secured Muller Bids Farewell At Allianz Arena

May 12, 2025

Bayerns Triumph Championship Secured Muller Bids Farewell At Allianz Arena

May 12, 2025 -

Saisonende Bundesliga Abstieg Fuer Bochum Und Kiel Leipzig Enttaeuscht

May 12, 2025

Saisonende Bundesliga Abstieg Fuer Bochum Und Kiel Leipzig Enttaeuscht

May 12, 2025 -

Bayern Munichs Final Home Win Mullers Farewell And Championship Celebration

May 12, 2025

Bayern Munichs Final Home Win Mullers Farewell And Championship Celebration

May 12, 2025 -

Bundesliga Abstieg Bochum Und Holstein Kiel Leipzigs Cl Traum Geplatzt

May 12, 2025

Bundesliga Abstieg Bochum Und Holstein Kiel Leipzigs Cl Traum Geplatzt

May 12, 2025