Analyzing The Net Asset Value (NAV) Of The Amundi DJIA UCITS ETF (Distributing)

Table of Contents

What is the NAV of the Amundi DJIA UCITS ETF (Distributing) and how is it calculated?

The Net Asset Value (NAV) of the Amundi DJIA UCITS ETF (Distributing) represents the total value of all the assets held by the ETF, divided by the number of outstanding shares. Since this ETF tracks the DJIA, its NAV is directly tied to the performance of the 30 constituent companies within that index. The calculation involves a complex process considering several key factors:

-

Daily Calculation Process: The NAV is typically calculated daily at the close of the market, reflecting the closing prices of all the underlying DJIA components.

-

Impact of Currency Fluctuations: As the DJIA includes multinational corporations, currency fluctuations can influence the NAV, especially if the ETF is denominated in a currency different from the underlying assets' primary currency.

-

Role of Dividends and Distribution in NAV Calculation: Because this is a distributing ETF, dividend payments from the underlying companies are distributed to shareholders. This distribution reduces the NAV proportionally to the amount distributed.

-

Where to find the daily NAV: The daily NAV is usually published on the Amundi website, major financial news sources, and through your brokerage account. Always check official sources for the most accurate and up-to-date information. Looking for "Amundi DJIA UCITS ETF NAV" will yield the most relevant results.

Factors Affecting the NAV of the Amundi DJIA UCITS ETF (Distributing)

Several factors influence the NAV of the Amundi DJIA UCITS ETF (Distributing), impacting its overall value and return for investors. Understanding these factors is crucial for managing investment risk and expectations:

-

Market Volatility and its effect on NAV: General market fluctuations, both positive and negative, have a significant impact on the NAV, as the value of the underlying DJIA stocks rises and falls.

-

Influence of Economic News and Events: Major economic events, such as interest rate changes, inflation reports, and geopolitical developments, can significantly affect the DJIA and consequently the ETF's NAV.

-

Impact of changes in the DJIA index composition: When the composition of the DJIA changes (e.g., a company is added or removed), the ETF's underlying assets adjust accordingly, directly affecting its NAV.

-

Role of investor sentiment: Overall investor sentiment and market psychology can drive the prices of the underlying DJIA components, thus affecting the ETF's NAV. Positive sentiment generally leads to NAV increases, while negative sentiment has the opposite effect.

Using NAV to Analyze the Amundi DJIA UCITS ETF (Distributing) Performance

Tracking the NAV of the Amundi DJIA UCITS ETF (Distributing) is essential for analyzing its performance relative to its benchmark, the DJIA. By monitoring NAV changes over time, investors can gain insights into the ETF's growth trajectory:

-

Comparing NAV with ETF market price (Premium/Discount): The ETF's market price may sometimes deviate from its NAV, creating a premium or discount. Understanding this difference can offer opportunities for strategic trading.

-

Analyzing NAV trends to predict future performance (with cautionary note about not relying solely on NAV): Studying NAV trends can help gauge long-term performance, but it's vital to remember that past performance is not indicative of future results. Other factors should be considered.

-

Using NAV data for investment decision-making: NAV data, when used in conjunction with other market analysis, can inform investment decisions, such as buy, sell, or hold strategies.

Understanding the "Distributing" aspect and its influence on NAV

The "Distributing" designation in the Amundi DJIA UCITS ETF (Distributing) name indicates that the ETF distributes dividends received from its underlying holdings to shareholders. This has a direct impact on the NAV:

-

Ex-dividend date and its impact on NAV: On the ex-dividend date, the NAV typically drops by the amount of the dividend per share, reflecting the distribution to investors.

-

Frequency of dividend distributions: The frequency of dividend distributions varies depending on the dividend policies of the underlying DJIA companies.

-

Tax implications of dividend distributions: Remember that dividend distributions are often subject to taxes, which should be considered when assessing overall returns.

Conclusion: Making Informed Decisions with Amundi DJIA UCITS ETF (Distributing) NAV Analysis

Understanding the Net Asset Value (NAV) of the Amundi DJIA UCITS ETF (Distributing) is paramount for making informed investment decisions. By regularly monitoring NAV changes, comparing it to the market price, and considering the impact of dividends, investors can gain valuable insights into the ETF's performance and manage their investments more effectively. Remember to consult official sources for accurate NAV data and consider seeking professional financial advice before making any investment decisions. Regularly check the NAV of the Amundi DJIA UCITS ETF (Distributing) and leverage this information for smart investing. For further resources on Net Asset Value (NAV) and ETF investing, explore reputable financial websites and educational materials.

Featured Posts

-

France Revisits Dreyfus Affair Lawmakers Seek Posthumous Promotion

May 25, 2025

France Revisits Dreyfus Affair Lawmakers Seek Posthumous Promotion

May 25, 2025 -

Ecb Faiz Indirimi Avrupa Borsalarinda Karisik Bir Guen

May 25, 2025

Ecb Faiz Indirimi Avrupa Borsalarinda Karisik Bir Guen

May 25, 2025 -

Istoriya Lyubvi Ili Ilicha Publikatsiya V Gazete Trud

May 25, 2025

Istoriya Lyubvi Ili Ilicha Publikatsiya V Gazete Trud

May 25, 2025 -

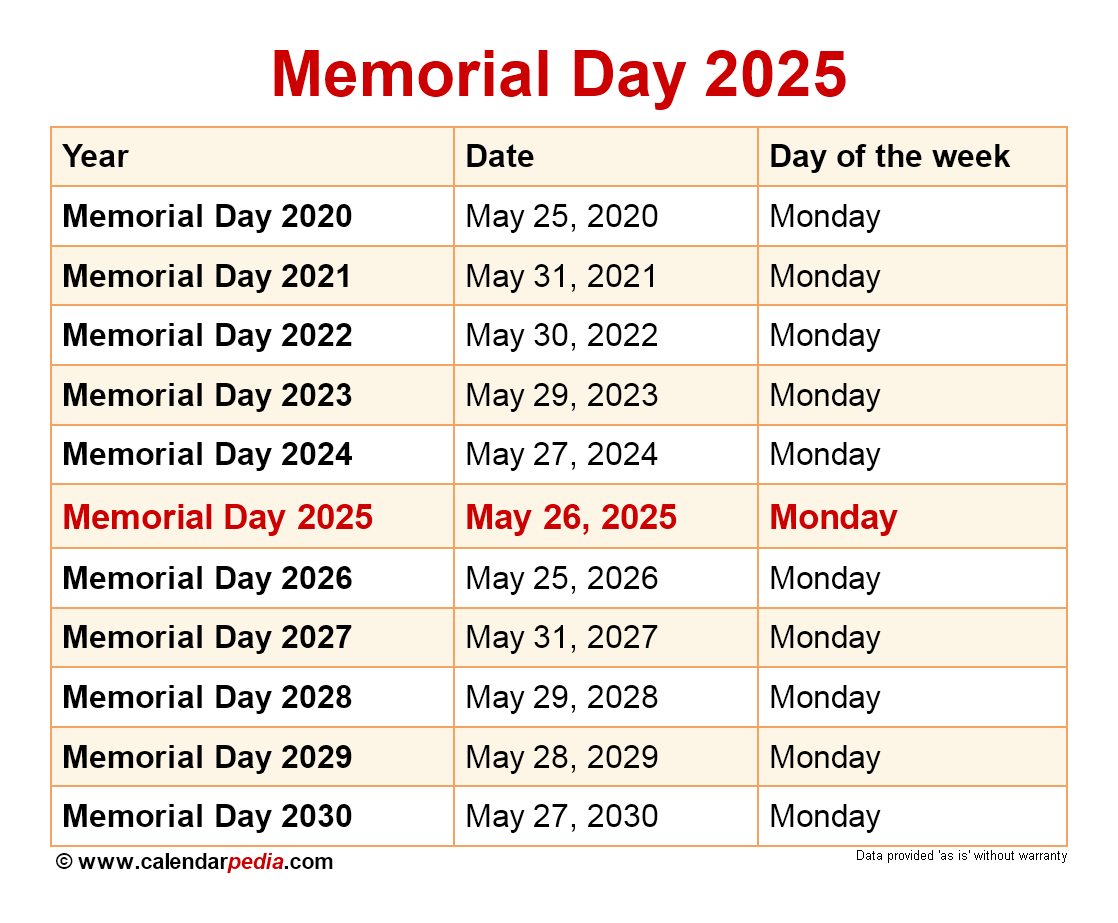

Memorial Day 2025 Air Travel When To Fly And When To Avoid

May 25, 2025

Memorial Day 2025 Air Travel When To Fly And When To Avoid

May 25, 2025 -

Flying During Memorial Day Weekend 2025 A Guide To Peak Travel Times

May 25, 2025

Flying During Memorial Day Weekend 2025 A Guide To Peak Travel Times

May 25, 2025

Latest Posts

-

Sean Penn Questions Dylan Farrows Accusation Against Woody Allen

May 25, 2025

Sean Penn Questions Dylan Farrows Accusation Against Woody Allen

May 25, 2025 -

The Sean Penn Woody Allen Relationship A Me Too Case Study

May 25, 2025

The Sean Penn Woody Allen Relationship A Me Too Case Study

May 25, 2025 -

Mia Farrow Michael Caine And A Surprise On Set The Untold Story

May 25, 2025

Mia Farrow Michael Caine And A Surprise On Set The Untold Story

May 25, 2025 -

Sean Penns Defense Of Woody Allen Understanding The Me Too Dissonance

May 25, 2025

Sean Penns Defense Of Woody Allen Understanding The Me Too Dissonance

May 25, 2025 -

The National Enquirer On Mia Farrow Ronan Farrows Involvement

May 25, 2025

The National Enquirer On Mia Farrow Ronan Farrows Involvement

May 25, 2025