Analyzing The Potential Economic Fallout Of Restored Trump Tariffs On Europe

Table of Contents

Impact on Specific European Industries

The reintroduction of Trump-era tariffs would disproportionately affect several key European industries. The increased costs and reduced competitiveness would ripple through the economies of multiple European nations.

Automotive Sector

The automotive industry, a cornerstone of many European economies, would be particularly hard-hit by restored Trump tariffs. European car manufacturers, significant exporters to the US market, face a double whammy:

- Increased costs: Tariffs would directly increase the price of exporting vehicles to the US, reducing profit margins.

- Reduced competitiveness: Higher prices make European cars less competitive against domestically produced vehicles in the US market, leading to decreased sales.

- Potential job losses: Reduced sales and profitability could trigger job cuts across the European automotive supply chain, from manufacturing plants to dealerships.

- Retaliatory tariffs: The EU is likely to retaliate with its own tariffs on US car imports, further escalating the trade war and negatively impacting US carmakers. This tit-for-tat escalation highlights the interconnected nature of global trade and the potential for widespread economic damage from protectionist policies.

Agricultural Products

European agricultural exports, renowned for their quality and diverse offerings, would also face severe consequences from restored Trump tariffs. This includes:

- Reduced demand: Higher prices for European wine, cheese, and other agricultural products in the US would reduce consumer demand.

- Price increases for US consumers: The tariffs would be passed onto American consumers, increasing the cost of groceries and impacting household budgets.

- Supply chain disruptions: The imposition of tariffs can lead to logistical complications and disruptions within the already complex agricultural supply chains.

- Increased pressure on European farmers: Reduced sales and profitability would significantly pressure European farmers, potentially leading to farm closures and job losses in rural communities. This highlights the vulnerability of agricultural producers to external trade shocks.

Manufacturing and Other Sectors

The impact of restored Trump tariffs would not be limited to specific industries but would have broader economic consequences:

- Increased input costs: Many businesses rely on US imports for production inputs. Tariffs on these inputs would increase production costs across a range of sectors, from textiles to machinery.

- Reduced consumer spending: Higher prices for both imported and domestically produced goods due to the ripple effects of tariffs would reduce consumer spending, potentially leading to a decrease in economic growth.

- Potential for wider economic slowdown: The combined effects of reduced exports, increased prices, and decreased consumer spending could trigger a wider economic slowdown in Europe, negatively impacting overall economic performance and potentially leading to increased unemployment.

Geopolitical Implications of Restored Trump Tariffs

The re-imposition of Trump-era tariffs would have significant geopolitical consequences, extending far beyond the purely economic.

Transatlantic Relations

Restored tariffs would severely strain US-EU relations, potentially harming broader diplomatic cooperation on critical global issues:

- Increased trade tensions: The imposition of tariffs would inevitably lead to increased trade tensions, with the potential for further retaliatory measures from both sides.

- Undermining of international trade agreements and organizations: The renewed protectionist stance would undermine the progress made in establishing international trade agreements and the stability of international trade organizations, such as the WTO.

- Negative impact on global economic stability: Escalating trade tensions between the US and EU, two of the world's largest economies, would have a negative impact on global economic stability, potentially leading to uncertainty and decreased investment.

Shift in Global Trade Alliances

Europe might be forced to re-evaluate its trade relationships, potentially reducing its reliance on the US market:

- Increased focus on trade agreements with other regions: To mitigate the risks associated with relying heavily on the US market, Europe might accelerate its efforts to diversify its trade partnerships, exploring agreements with other regions such as Asia and Africa.

- Strengthening of alliances outside the transatlantic relationship: The restored Trump tariffs could hasten the formation of stronger alliances outside the transatlantic relationship, potentially leading to a reshaping of global trade dynamics and geopolitical power balances.

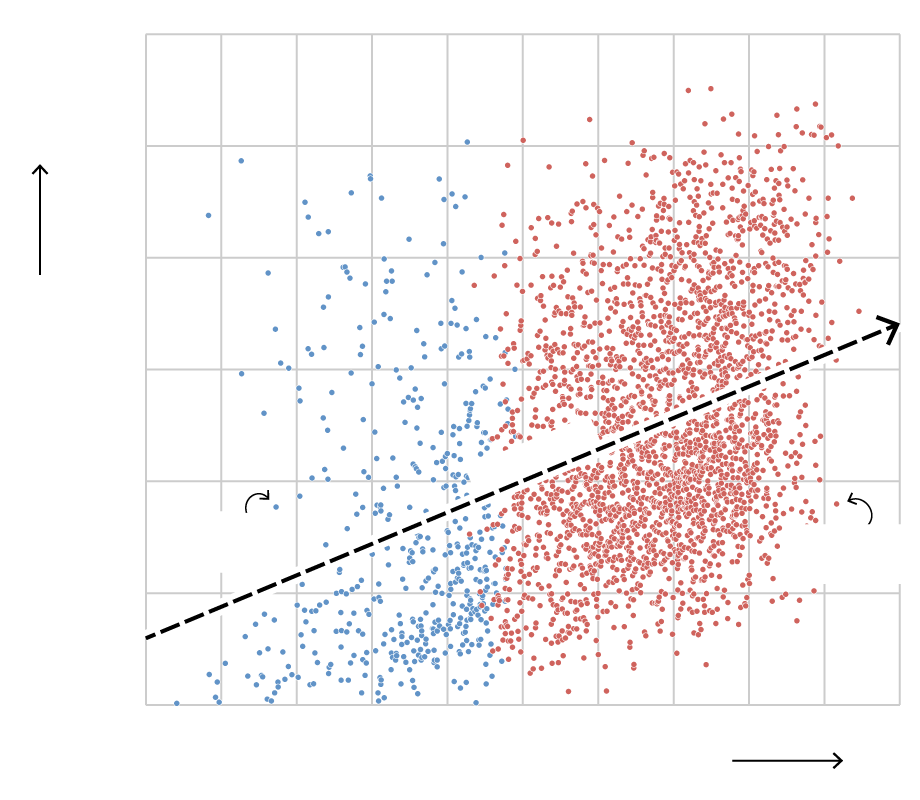

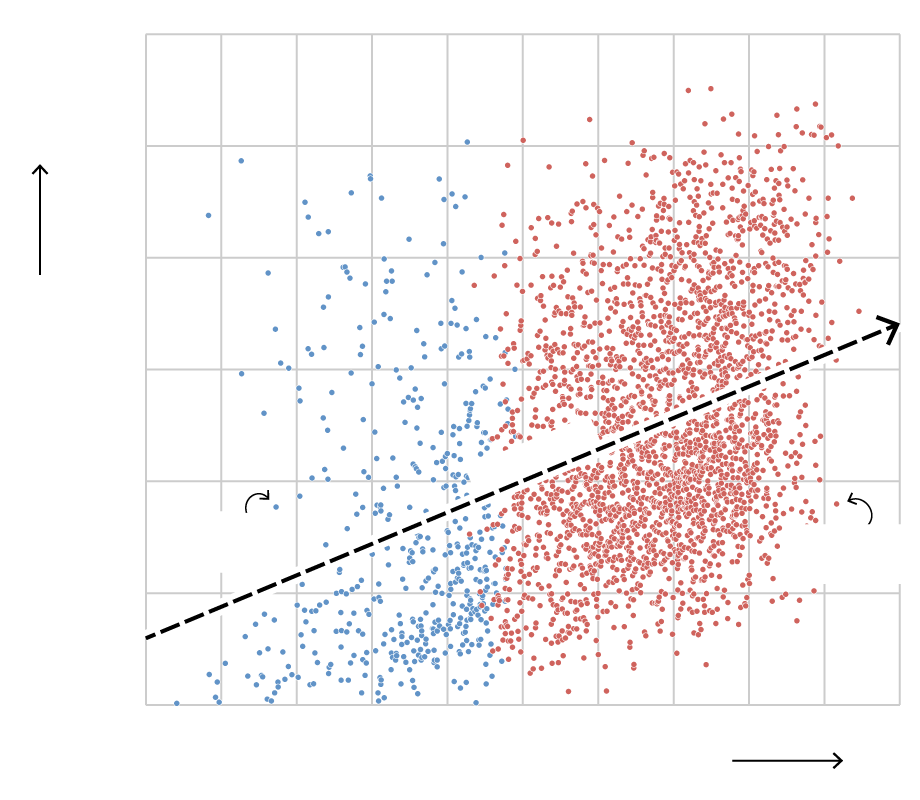

Modeling the Economic Fallout

Understanding the full economic fallout requires both quantitative and qualitative analyses.

Quantitative Analysis

Economists and modelers can employ econometric tools to forecast the potential impacts:

- GDP growth forecasts: Quantitative models can be used to predict the impact on GDP growth for both the EU and the US under various tariff scenarios.

- Analysis of trade flows: Econometric analysis can be used to quantify the changes in trade flows between the US and EU after the imposition of tariffs.

- Impact assessment on employment levels: Models can be used to estimate the potential job losses across various sectors in both the US and Europe.

Qualitative Assessment

Beyond numerical predictions, it's crucial to consider qualitative factors:

- Uncertainty and investment decisions: The threat of tariffs creates uncertainty, impacting business confidence and investment decisions. Businesses may postpone investments or reduce hiring, further hindering economic growth.

- Consumer sentiment: The uncertainty and potential price increases resulting from tariffs negatively affect consumer sentiment, potentially leading to reduced consumer spending.

Conclusion

The potential re-imposition of Trump-era tariffs on Europe poses a considerable risk to the global economy. The impact on specific industries, such as automotive and agriculture, will be substantial, leading to job losses, higher prices, and reduced competitiveness. Moreover, the geopolitical implications are significant, potentially straining transatlantic relations and reshaping global trade alliances. A thorough understanding of the potential economic fallout of restored Trump tariffs is crucial for policymakers and businesses to mitigate the negative impacts and adapt to the new trade landscape. We urge further research and careful consideration of the potential consequences before any such tariffs are reinstated. Understanding the ramifications of restored Trump tariffs is critical for navigating the future of transatlantic trade.

Featured Posts

-

A Look Inside Eva Longorias Miami Birthday Celebration

May 13, 2025

A Look Inside Eva Longorias Miami Birthday Celebration

May 13, 2025 -

Competition Heats Up In Brazil Byds Ev Push Against Fords Waning Influence

May 13, 2025

Competition Heats Up In Brazil Byds Ev Push Against Fords Waning Influence

May 13, 2025 -

Bar Roma On Blog To Torontos Italian Gem A Comprehensive Look

May 13, 2025

Bar Roma On Blog To Torontos Italian Gem A Comprehensive Look

May 13, 2025 -

Brexit Fallout Economic Crisis Looms Over Spanish Border Towns

May 13, 2025

Brexit Fallout Economic Crisis Looms Over Spanish Border Towns

May 13, 2025 -

Pl Retro On Sky Sports Premier League Hd A Nostalgia Trip For Football Fans

May 13, 2025

Pl Retro On Sky Sports Premier League Hd A Nostalgia Trip For Football Fans

May 13, 2025

Latest Posts

-

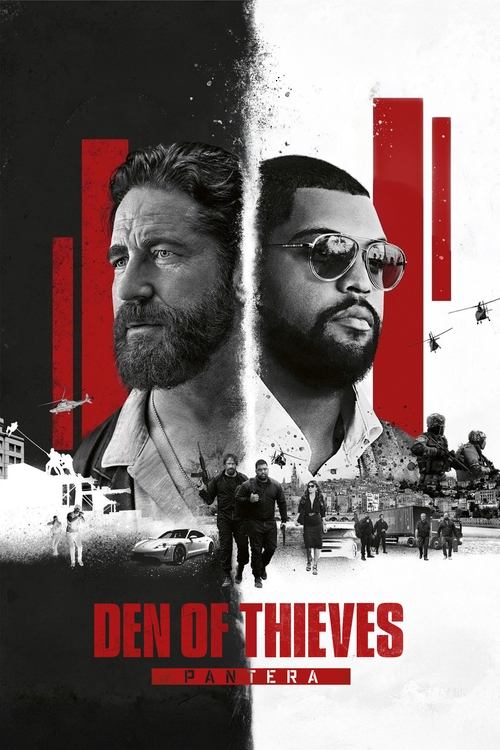

Den Of Thieves 2 Netflix Release Date And Streaming Information

May 13, 2025

Den Of Thieves 2 Netflix Release Date And Streaming Information

May 13, 2025 -

Realni Geroi 10 Aktori Spasili Khora V Realniya Zhivot

May 13, 2025

Realni Geroi 10 Aktori Spasili Khora V Realniya Zhivot

May 13, 2025 -

Vybor Luchshikh Filmov S Dzherardom Batlerom

May 13, 2025

Vybor Luchshikh Filmov S Dzherardom Batlerom

May 13, 2025 -

Where To Stream Den Of Thieves 2 Netflix And Other Options

May 13, 2025

Where To Stream Den Of Thieves 2 Netflix And Other Options

May 13, 2025 -

10 Aktori Koito Sa Spasili Zhivoti Geroi Ot Golemiya Ekran

May 13, 2025

10 Aktori Koito Sa Spasili Zhivoti Geroi Ot Golemiya Ekran

May 13, 2025