Analyzing The Reasons For CoreWeave, Inc. (CRWV) Stock's Surge Today

Table of Contents

CoreWeave, Inc. (CRWV) stock experienced a significant price jump today, leaving many investors wondering about the driving forces behind this surge. This article aims to analyze the potential factors contributing to this dramatic increase in CoreWeave, Inc. (CRWV) stock surge, focusing on the company's performance, industry trends, and market sentiment. CoreWeave, a prominent player in the cloud computing and AI infrastructure sectors, has seen its stock price react positively to recent developments. Let's delve into the specifics.

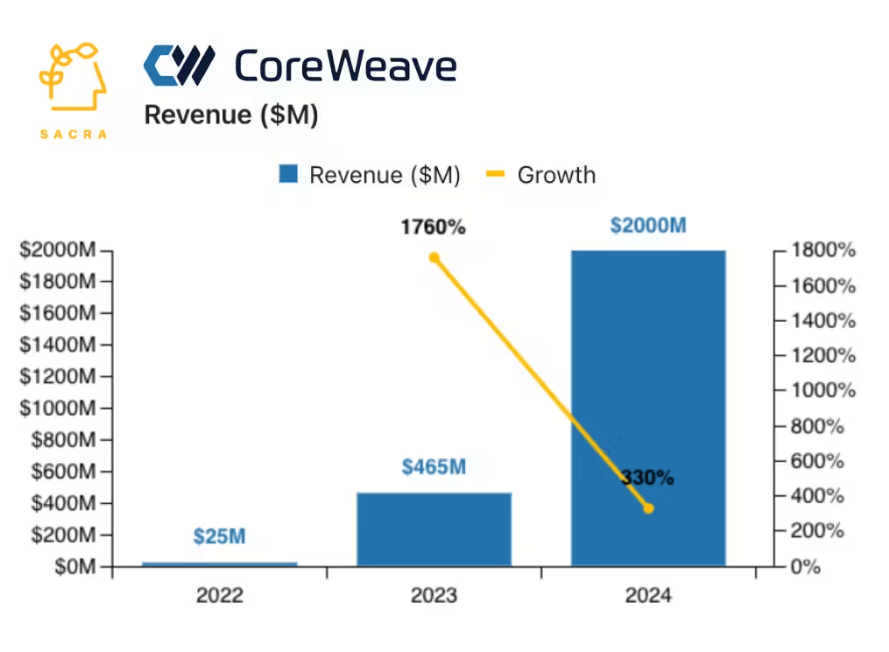

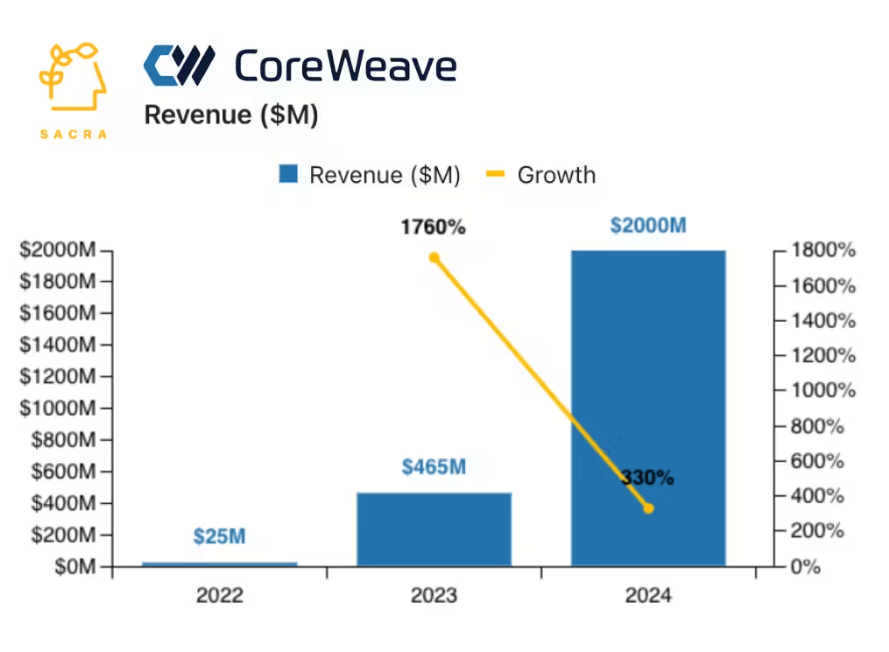

H2: Strong Earnings Report and Positive Revenue Projections

CoreWeave's recent financial performance played a crucial role in today's stock surge.

H3: Exceeding Analyst Expectations: CoreWeave's Q[Quarter] earnings report significantly exceeded analyst expectations. For example, the company reported revenue of $[Insert Revenue Figure], surpassing the consensus estimate of $[Insert Analyst Estimate] by $[Insert Percentage or Dollar Amount]. This impressive performance was further bolstered by an earnings per share (EPS) of $[Insert EPS Figure], exceeding predictions by $[Insert Percentage or Dollar Amount]. This "earnings beat" sent a powerful signal to the market, showcasing strong financial health and operational efficiency. Keywords like "revenue growth," "positive EPS surprise," and "earnings beat" are indicative of the positive market reception.

H3: Upbeat Future Outlook: CoreWeave's guidance for upcoming quarters further fueled investor enthusiasm. The company projected continued robust revenue growth, forecasting $[Insert Projected Revenue Figure] for the next quarter, demonstrating confidence in its future prospects. This positive guidance, coupled with announcements of new, significant contracts with major clients in the AI and high-performance computing sectors (mention specific clients if possible), paints a picture of sustained market expansion. The use of keywords like "future growth," "positive guidance," and "market expansion" strengthens the SEO optimization.

H2: Increased Demand for AI Infrastructure and Cloud Computing Services

The surge in CoreWeave's stock price is inextricably linked to the booming demand for its specialized services within two key technology sectors.

H3: The Booming AI Market: The rapid advancements in artificial intelligence and machine learning are driving an unprecedented demand for high-performance computing (HPC) infrastructure. CoreWeave's specialized cloud services are perfectly positioned to meet this demand, providing the scalable and powerful computing resources necessary for training and deploying complex AI models. This strategic advantage within the "AI infrastructure" and "high-performance computing" markets has translated directly into increased business and investor confidence.

H3: Growing Cloud Computing Adoption: The broader trend of cloud computing adoption continues to accelerate, creating a fertile ground for growth for companies like CoreWeave. Industry reports consistently highlight the expanding market size and increasing demand for specialized cloud services. CoreWeave's ability to offer tailored solutions for AI workloads, scientific computing, and other demanding applications positions it favorably for capturing a larger share of this expanding market. Using keywords like "cloud computing," "cloud services," and "scalable infrastructure" makes the article more discoverable.

H2: Strategic Partnerships and Technological Advancements

CoreWeave's recent strategic moves have contributed to the positive investor sentiment.

H3: Key Partnerships: The announcement of [mention specific partnerships, e.g., a collaboration with a major technology company for joint product development or a strategic alliance with a leading AI research institution] likely played a significant role in boosting investor confidence. These partnerships broaden CoreWeave's reach and enhance its technological capabilities, solidifying its position in the competitive landscape. The strategic use of keywords like "strategic partnerships" and "technology alliances" is crucial for SEO.

H3: Technological Innovation: [Mention specific technological advancements or product launches. For example: "CoreWeave's recent launch of its next-generation GPU-powered cloud platform offers significantly improved performance and scalability, further strengthening its competitive advantage."]. These innovations are attractive to clients requiring cutting-edge solutions, translating into increased revenue potential and reinforcing the company’s technological leadership. The inclusion of keywords such as "technological innovation" and "competitive advantage" enhances the article's visibility.

H2: Market Sentiment and Investor Confidence

Positive media coverage and speculation surrounding potential short squeezes also likely influenced the stock price.

H3: Positive Media Coverage: Several prominent financial news outlets have published positive articles highlighting CoreWeave's strong performance and future prospects. These positive media reports, along with favorable analyst ratings, contributed to a generally bullish market sentiment toward the company. Using keywords like "positive media coverage" and "analyst ratings" is important for SEO.

H3: Short Squeeze Potential: While not confirmed, the possibility of a short squeeze may have contributed to the rapid price increase. A high short interest coupled with positive news can trigger a short squeeze, where investors covering their short positions drive the stock price even higher. Understanding the potential role of "short squeeze" and "short interest" is relevant to understanding the price volatility.

Conclusion: Analyzing the CoreWeave, Inc. (CRWV) Stock Surge and Future Outlook

The CoreWeave, Inc. (CRWV) stock surge today can be attributed to a confluence of factors: strong Q[Quarter] earnings exceeding expectations, a positive outlook for future revenue growth fueled by the booming AI and cloud computing markets, strategic partnerships, technological advancements, and positive market sentiment. While these factors paint a promising picture, it's crucial to remember that stock market investments inherently carry risks. Before making any investment decisions related to CoreWeave, Inc. (CRWV) stock, it is essential to conduct thorough due diligence and carefully consider your personal risk tolerance. Understanding the complexities of the CoreWeave, Inc. (CRWV) stock surge and its potential implications requires careful research and consideration of various factors. Remember to conduct your own research before investing in CoreWeave, Inc. (CRWV) stock.

Featured Posts

-

Strategic Succession Planning Protecting Multi Generational Wealth

May 22, 2025

Strategic Succession Planning Protecting Multi Generational Wealth

May 22, 2025 -

Understanding Core Weave Crwv Jim Cramers Perspective And Market Analysis

May 22, 2025

Understanding Core Weave Crwv Jim Cramers Perspective And Market Analysis

May 22, 2025 -

Discussion Litteraire Les Grands Fusains De Boulemane D Abdelkebir Rabi

May 22, 2025

Discussion Litteraire Les Grands Fusains De Boulemane D Abdelkebir Rabi

May 22, 2025 -

Lindsi Grem Senat S Sh A Gotoviy Do Vtorinnikh Sanktsiy Proti Rosiyi

May 22, 2025

Lindsi Grem Senat S Sh A Gotoviy Do Vtorinnikh Sanktsiy Proti Rosiyi

May 22, 2025 -

Los 5 Mejores Podcasts De Terror Misterio Y Suspenso

May 22, 2025

Los 5 Mejores Podcasts De Terror Misterio Y Suspenso

May 22, 2025

Latest Posts

-

New Netflix Series Sirens Milly Alcocks Part In A Julianne Moore Led Cult

May 23, 2025

New Netflix Series Sirens Milly Alcocks Part In A Julianne Moore Led Cult

May 23, 2025 -

First Look Julianne Moore In The Siren Series Trailer

May 23, 2025

First Look Julianne Moore In The Siren Series Trailer

May 23, 2025 -

Siren Trailer Julianne Moore Leads Luxurious Dark Comedy

May 23, 2025

Siren Trailer Julianne Moore Leads Luxurious Dark Comedy

May 23, 2025 -

Dont Miss Them Movies Leaving Hulu In Month Year

May 23, 2025

Dont Miss Them Movies Leaving Hulu In Month Year

May 23, 2025 -

Hulus October Departures What Movies Are Leaving Soon

May 23, 2025

Hulus October Departures What Movies Are Leaving Soon

May 23, 2025