Analyzing The Reasons For D-Wave Quantum's (QBTS) Stock Drop On Monday

Table of Contents

Monday saw a significant drop in D-Wave Quantum's (QBTS) stock price, leaving investors scrambling to understand the reasons behind this sudden downturn. This article delves into the potential factors contributing to the D-Wave Quantum stock drop, examining market-wide trends, D-Wave's specific performance, and technical analysis of QBTS stock performance. We aim to provide a comprehensive overview to help investors navigate this volatility and understand the implications for the future of QBTS stock and the quantum computing sector as a whole.

Market Sentiment and Broader Economic Factors

Several macroeconomic factors and broader market sentiments could have contributed to the D-Wave Quantum stock drop.

General Market Downturn

Monday's market performance played a significant role. The overall market sentiment can heavily influence individual stock prices, especially in volatile sectors like quantum computing.

- Nasdaq Performance: The Nasdaq Composite, a tech-heavy index, experienced a [insert percentage]% decline on Monday. This broader market downturn likely negatively impacted technology stocks, including QBTS.

- Economic News: [Insert any significant economic news from that Monday, e.g., a concerning inflation report or interest rate hike announcement]. Such news often triggers a sell-off in riskier assets, such as growth stocks in the nascent quantum computing industry.

Sector-Specific Concerns

Beyond the general market downturn, the quantum computing sector itself might have faced headwinds.

- Competitor Developments: Announcements from competitors, like [mention specific competitors and any relevant negative news, e.g., delays in a competitor's product launch or a funding shortfall], could have dampened investor enthusiasm for the entire sector, leading to a decrease in QBTS stock price.

- Regulatory Uncertainty: Changes in government regulations or policies concerning quantum computing research and development can also create uncertainty, impacting investor confidence and potentially causing a QBTS stock drop.

D-Wave Quantum's (QBTS) Specific Performance and Announcements

Internal factors within D-Wave Quantum itself may also have contributed to the decline in QBTS stock.

Lack of Positive News or Earnings Reports

The absence of positive news or potentially disappointing earnings reports can trigger sell-offs.

- Recent Financials: A review of D-Wave Quantum's recent financial reports and press releases is crucial. [Analyze the company’s recent performance – were there any missed earnings expectations, lower-than-expected revenue, or delays in project timelines that might concern investors?]

- Competitive Landscape: Comparing QBTS performance to its competitors is vital. If competitors are showing stronger growth or more promising developments, it could negatively impact investor sentiment towards D-Wave.

Analyst Ratings and Recommendations

Changes in analyst ratings and recommendations can significantly impact a stock's price.

- Analyst Reports: [Mention any analyst downgrades or negative reports issued before or on Monday. Include specifics of the reports and their rationale if available]. Negative analyst sentiment can contribute to a sell-off.

- Investor Confidence: Negative ratings and recommendations erode investor confidence, prompting some to sell their shares of QBTS stock, putting downward pressure on the price.

Technical Analysis of QBTS Stock

Technical analysis can offer additional insights into the QBTS stock drop.

Chart Patterns and Trading Volume

Examining the QBTS stock chart on Monday reveals potentially important information.

- Chart Patterns: [Describe any relevant bearish chart patterns observed on Monday’s QBTS chart. E.g., "A bearish engulfing candle pattern was visible, suggesting a reversal of the prior uptrend."]. These patterns often indicate a shift in market sentiment.

- Trading Volume: Unusually high trading volume on Monday compared to previous days might indicate a significant sell-off driven by a large number of investors simultaneously exiting their positions in QBTS stock.

Short Selling and Market Manipulation

The possibility of short selling and market manipulation should also be considered.

- Short Interest: A high percentage of short interest in QBTS stock indicates a significant number of investors betting against the company. [State the percentage of short interest if available]. Increased short selling can amplify downward price pressure.

- Unusual Activity: [Mention any unusual trading activity observed on Monday that might point to manipulation. Examples include unusually large trades at specific price points or a sudden surge in trading volume without clear news.]

Conclusion

The D-Wave Quantum (QBTS) stock drop on Monday was likely a complex event with multiple contributing factors. While pinpointing a single definitive cause is challenging, a combination of negative market sentiment, concerns about D-Wave's specific performance, and potentially technical factors all likely played a role. To understand the full impact and long-term implications, continuous monitoring of financial news, analyst reports, and QBTS stock performance is crucial. To stay informed about future fluctuations in the D-Wave Quantum Stock Drop and the quantum computing market, continue to monitor financial news and analyst reports related to QBTS Stock and Quantum Computing Stock.

Featured Posts

-

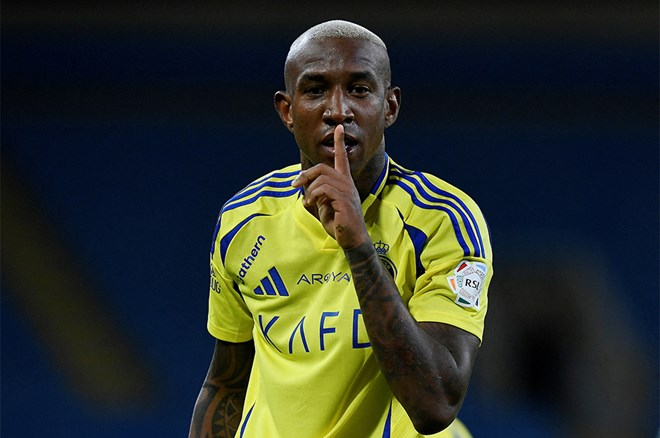

Fenerbahce Den Ajax A Transfer Son Nokta Mourinho Da

May 20, 2025

Fenerbahce Den Ajax A Transfer Son Nokta Mourinho Da

May 20, 2025 -

Talisca Ve Tadic Fenerbahce De Tartisma Ve Transfer Operasyonu

May 20, 2025

Talisca Ve Tadic Fenerbahce De Tartisma Ve Transfer Operasyonu

May 20, 2025 -

Novo Dijete Jennifer Lawrence Objava I Prve Fotografije

May 20, 2025

Novo Dijete Jennifer Lawrence Objava I Prve Fotografije

May 20, 2025 -

Le Nouveau Visage De La Gastronomie Biarrote Chefs Et Adresses

May 20, 2025

Le Nouveau Visage De La Gastronomie Biarrote Chefs Et Adresses

May 20, 2025 -

From Ragbrai To Daily Rides Scott Savilles Passion For Cycling

May 20, 2025

From Ragbrai To Daily Rides Scott Savilles Passion For Cycling

May 20, 2025

Latest Posts

-

Suomalaiset Jalkapalloilijat Kaellman Ja Hoskonen Jaettaevaet Puolalaisseuran

May 20, 2025

Suomalaiset Jalkapalloilijat Kaellman Ja Hoskonen Jaettaevaet Puolalaisseuran

May 20, 2025 -

Huuhkajat Kaellman Ja Hoskonen Siirtyvaet Pois Puolasta

May 20, 2025

Huuhkajat Kaellman Ja Hoskonen Siirtyvaet Pois Puolasta

May 20, 2025 -

Kaellmanin Vaikuttava Kehitys Mitae Se Tarkoittaa Huuhkajille

May 20, 2025

Kaellmanin Vaikuttava Kehitys Mitae Se Tarkoittaa Huuhkajille

May 20, 2025 -

Jalkapallo Kaellman Ja Hoskonen Palaavat Suomeen

May 20, 2025

Jalkapallo Kaellman Ja Hoskonen Palaavat Suomeen

May 20, 2025 -

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Maalinteko Ominaisuudet

May 20, 2025

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Maalinteko Ominaisuudet

May 20, 2025