Analyzing The Treasury Market's Performance On April 8th

Table of Contents

Yield Curve Shifts and Their Implications

The yield curve, a graphical representation of Treasury yields across different maturities, is a crucial indicator of economic health. Its slope reflects investor expectations about future interest rates and economic growth. Analyzing the yield curve's shape on April 8th provides valuable insights into market sentiment.

Changes in Short-Term Yields

On April 8th, short-term Treasury yields, specifically the 2-year and 5-year notes, showed [insert specific percentage change, e.g., a slight increase].

- 2-year Treasury yield: Increased by [insert percentage], potentially reflecting [insert reason, e.g., anticipation of further Fed rate hikes].

- 5-year Treasury yield: Increased by [insert percentage], possibly driven by [insert reason, e.g., stronger-than-expected inflation data].

These shifts suggest [insert interpretation, e.g., a tightening monetary policy stance by the Federal Reserve].

Changes in Long-Term Yields

Long-term yields, represented by the 10-year and 30-year Treasury bonds, exhibited [insert specific percentage change, e.g., a more moderate increase].

- 10-year Treasury yield: Increased by [insert percentage], potentially influenced by [insert reason, e.g., concerns about persistent inflation].

- 30-year Treasury yield: Increased by [insert percentage], possibly reflecting [insert reason, e.g., uncertainty about the long-term economic outlook].

The movement in long-term yields indicates [insert interpretation, e.g., investors' assessment of long-term inflation risks and economic growth prospects].

Yield Curve Steepening/Flattening

The overall shape of the yield curve on April 8th [insert description, e.g., steepened slightly]. This suggests [insert interpretation, e.g., the market anticipates stronger economic growth in the future, with higher short-term rates reflecting tighter monetary policy and longer-term rates reflecting confidence in future growth]. A steeper curve often implies expectations of future economic expansion, while a flatter curve can signal economic uncertainty or a potential slowdown.

Trading Volume and Market Liquidity

Understanding trading volume and market liquidity is crucial for assessing the Treasury market's efficiency and stability.

Trading Volume Analysis

The total volume of Treasury securities traded on April 8th was [insert volume data, e.g., $XXX billion], [insert comparison, e.g., slightly higher than the average for the past month].

- Higher/Lower than average: [Insert reason, e.g., Increased volume could be attributed to heightened market volatility due to unexpected economic data releases, while lower volume might suggest reduced investor activity due to uncertainty.]

Market Liquidity Assessment

Market liquidity on April 8th appeared [insert assessment, e.g., relatively healthy], with bid-ask spreads remaining [insert description, e.g., within normal ranges]. However, [insert any caveats, e.g., certain segments of the market, such as longer-dated bonds, might have experienced lower liquidity]. This suggests [insert implication, e.g., the market was able to absorb the trading activity without significant price dislocations].

Impact of Economic News and Events

Economic data releases and geopolitical events significantly impact Treasury market performance.

Relevant Economic Data Releases

[Insert specific economic data release, e.g., The release of the April Consumer Price Index (CPI) report] on April 8th showed [insert data, e.g., a higher-than-expected inflation rate]. This [insert impact, e.g., fueled concerns about persistent inflationary pressures], leading to [insert market reaction, e.g., a rise in Treasury yields].

- Other relevant data: [List other data releases and their impact]

Geopolitical Events

[Insert specific geopolitical event, e.g., escalating tensions in Eastern Europe] on April 8th [insert impact, e.g., introduced uncertainty into the global economic outlook]. This [insert market reaction, e.g., increased demand for safe-haven assets like Treasuries], potentially [insert yield impact, e.g., putting downward pressure on yields, despite inflationary concerns].

- Other geopolitical factors: [List other events and their impact]

Influence of Federal Reserve Policy

The Federal Reserve's monetary policy decisions heavily influence Treasury market dynamics.

[Insert statement or action by the Federal Reserve, e.g., While the Fed did not announce any major policy changes on April 8th, comments from Fed officials regarding future rate hikes suggested a continued hawkish stance.] This [insert market reaction, e.g., led to increased expectations of further interest rate increases], causing [insert yield impact, e.g., Treasury yields to rise].

- Other Fed influences: [List other statements or actions and their impact.]

Conclusion

The Treasury Market Performance on April 8th was shaped by a confluence of factors. Yield curve shifts reflected changing expectations about future interest rates and economic growth. Trading volume and liquidity remained relatively stable, though specific segments may have experienced variations. Economic data releases, particularly inflation figures, and geopolitical uncertainties contributed to market volatility. Finally, the anticipated actions of the Federal Reserve played a significant role in shaping investor sentiment and yield movements. To stay updated on these crucial Treasury market trends, and for deeper analysis of future April 8th Treasury market analysis, subscribe to our newsletter or follow us on [social media platform]. Understanding these elements is key to navigating the complexities of the Treasury market.

Featured Posts

-

Starbucks And Union At Odds Over Proposed Pay Raise Guarantee

Apr 29, 2025

Starbucks And Union At Odds Over Proposed Pay Raise Guarantee

Apr 29, 2025 -

How To Secure Capital Summertime Ball 2025 Tickets

Apr 29, 2025

How To Secure Capital Summertime Ball 2025 Tickets

Apr 29, 2025 -

Parita Di Genere Sul Lavoro Situazione Attuale E Prospettive Future

Apr 29, 2025

Parita Di Genere Sul Lavoro Situazione Attuale E Prospettive Future

Apr 29, 2025 -

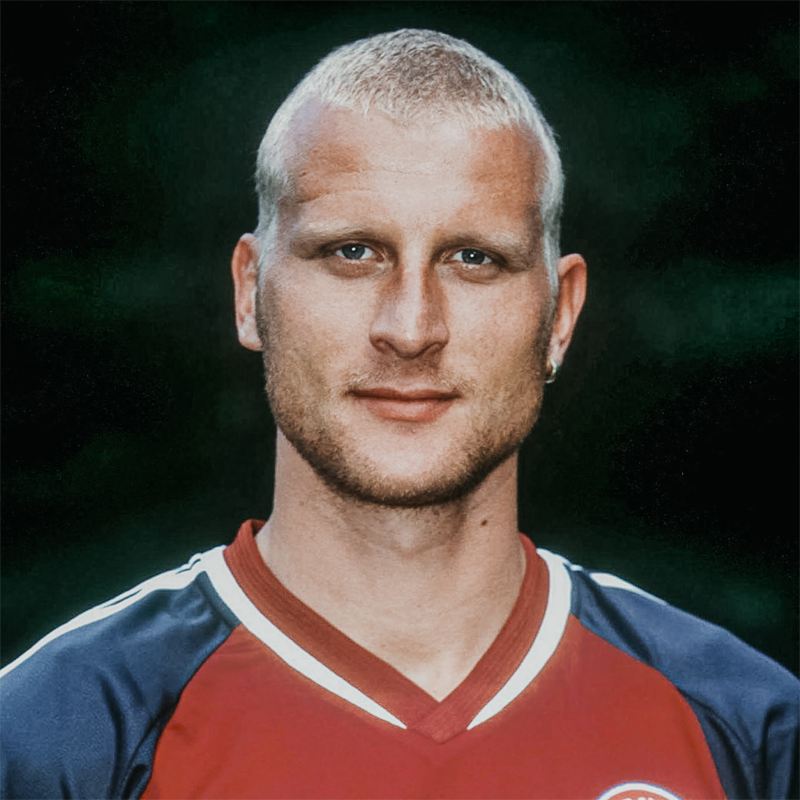

Carsten Jancker Wechsel Nach Seinem Engagement In Leoben

Apr 29, 2025

Carsten Jancker Wechsel Nach Seinem Engagement In Leoben

Apr 29, 2025 -

Wrong Way Crash On Minnesota North Dakota Border Kills Texas Resident

Apr 29, 2025

Wrong Way Crash On Minnesota North Dakota Border Kills Texas Resident

Apr 29, 2025